Answered step by step

Verified Expert Solution

Question

1 Approved Answer

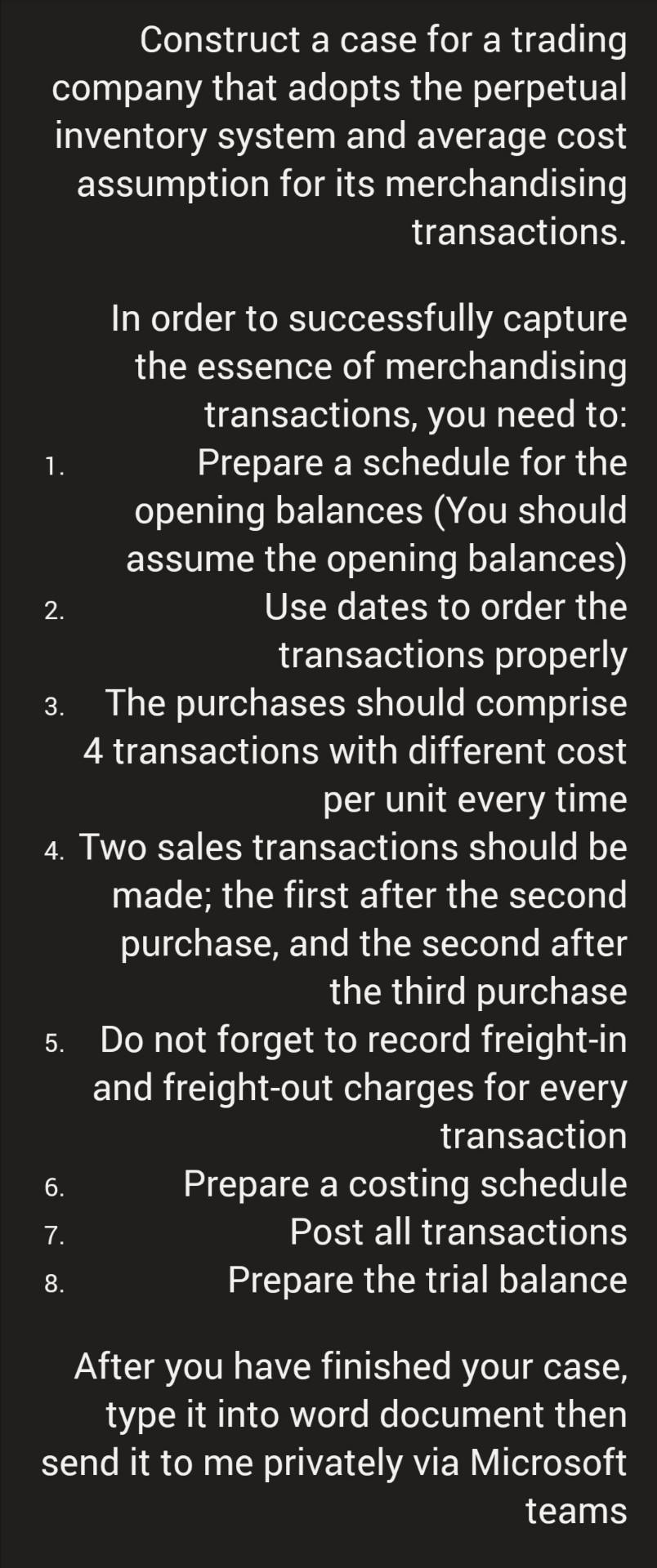

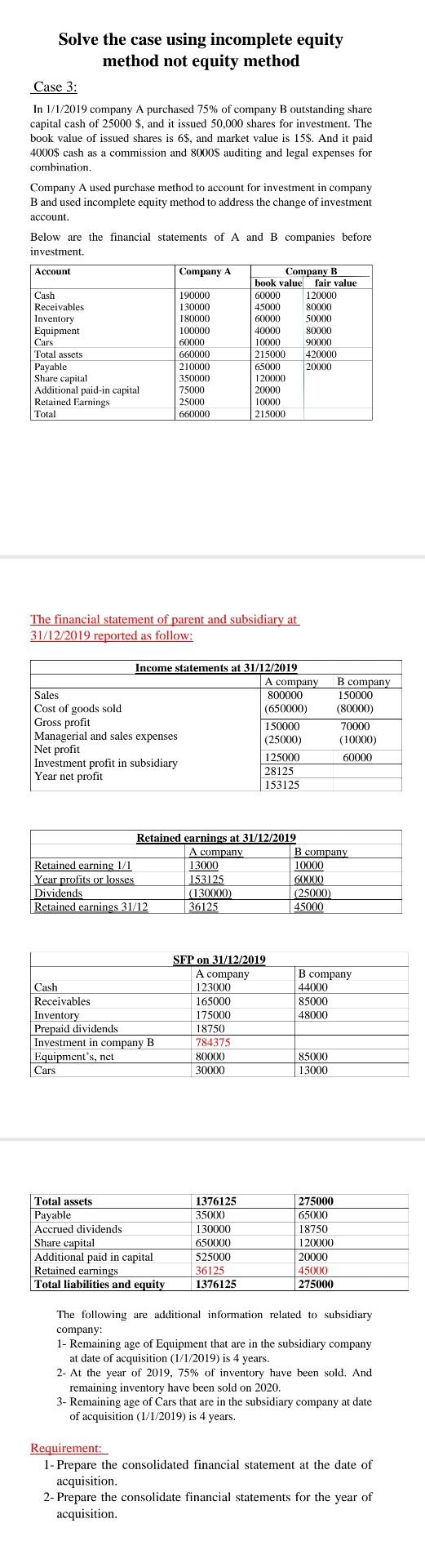

What's the solution? Please solve the white paper And the black paper came down by mistake. Don't solve the black paper. Construct a case for

What's the solution?

Please solve the white paper And the black paper came down by mistake. Don't solve the black paper.

Construct a case for a trading company that adopts the perpetual inventory system and average cost assumption for its merchandising transactions. 1. 2. 3. In order to successfully capture the essence of merchandising transactions, you need to: Prepare a schedule for the opening balances (You should assume the opening balances) Use dates to order the transactions properly The purchases should comprise 4 transactions with different cost per unit every time 4. Two sales transactions should be made; the first after the second purchase, and the second after the third purchase 5. Do not forget to record freight-in and freight-out charges for every transaction 6. Prepare a costing schedule Post all transactions Prepare the trial balance 7. 8. After you have finished your case, type it into word document then send it to me privately via Microsoft teams Solve the case using incomplete equity method not equity method Case 3: In 1/1/2019 company A purchased 75% of company B outstanding share capital cash of 25000 $, and it issued 50,000 shares for investment. The book value of issued shares is 6$, and market value is 158. And it paid 4000$ cash as a commission and 8000$ auditing and legal expenses for combination. Company A used purchase method to account for investment in company B and used incomplete equity method to address the change of investment account. Below are the financial statements of A and B companies before investment. Account Company A Company B book value fair value Cash 190000 60000 120000 Receivables 130000 45000 80000 Inventory 180000 60000 50000 Equipment 100000 40000 80000 Cars 60000 10000 90000 Total assets 660000 215000 420000 Payable 210000 65000 20000 Share capital 35000 20004 Additional paid-in capital 75000 20000 Retained Earnings 25000 10000 Total 660000 215000 The financial statement of parent and subsidiary at 31/12/2019 reported as follow: Income statements at 31/12/2019 A company Sales 800000 Cost of goods sold (650000) Gross profit 150000 Managerial and sales expenses (25000) Net profit 125000 Investment profit in subsidiary 28125 Year net profit 153125 B company 150000 (80000) 70000 (10000) 60000 Retained earnings at 31/12/2019 A company B company Retained earning 1/1 13000 10000 Year profits or losses 153125 60000 Dividends (130000) (25000) Retained earnings 31/12 36125 45000 SFP on 31/12/2019 A company 123000 165000 175000 18750 784375 80000 30000 B company 44000 85000 48000 Cash Receivables Inventory Prepaid dividends Investment in company B Equipment's, nct Cars 85000 13000 1376125 35000 130000 Total assets Payable Accrued dividends Share capital Additional paid in capital Retained earnings Total liabilities and equity 650000 275000 65000 18750 120000 20000 45000 275000 525000 36125 1376125 The following are additional information related to subsidiary company: 1- Remaining age of Equipment that are in the subsidiary company at date of acquisition (1/1/2019) is 4 years. 2- At the year of 2019, 75% of inventory have been sold. And remaining inventory have been sold on 2020. 3- Remaining age of Cars that are in the subsidiary company at date of acquisition (1/1/2019) is 4 years. Requirement: 1- Prepare the consolidated financial statement at the date of acquisition. 2- Prepare the consolidate financial statements for the year of acquisition Construct a case for a trading company that adopts the perpetual inventory system and average cost assumption for its merchandising transactions. 1. 2. 3. In order to successfully capture the essence of merchandising transactions, you need to: Prepare a schedule for the opening balances (You should assume the opening balances) Use dates to order the transactions properly The purchases should comprise 4 transactions with different cost per unit every time 4. Two sales transactions should be made; the first after the second purchase, and the second after the third purchase 5. Do not forget to record freight-in and freight-out charges for every transaction 6. Prepare a costing schedule Post all transactions Prepare the trial balance 7. 8. After you have finished your case, type it into word document then send it to me privately via Microsoft teams Solve the case using incomplete equity method not equity method Case 3: In 1/1/2019 company A purchased 75% of company B outstanding share capital cash of 25000 $, and it issued 50,000 shares for investment. The book value of issued shares is 6$, and market value is 158. And it paid 4000$ cash as a commission and 8000$ auditing and legal expenses for combination. Company A used purchase method to account for investment in company B and used incomplete equity method to address the change of investment account. Below are the financial statements of A and B companies before investment. Account Company A Company B book value fair value Cash 190000 60000 120000 Receivables 130000 45000 80000 Inventory 180000 60000 50000 Equipment 100000 40000 80000 Cars 60000 10000 90000 Total assets 660000 215000 420000 Payable 210000 65000 20000 Share capital 35000 20004 Additional paid-in capital 75000 20000 Retained Earnings 25000 10000 Total 660000 215000 The financial statement of parent and subsidiary at 31/12/2019 reported as follow: Income statements at 31/12/2019 A company Sales 800000 Cost of goods sold (650000) Gross profit 150000 Managerial and sales expenses (25000) Net profit 125000 Investment profit in subsidiary 28125 Year net profit 153125 B company 150000 (80000) 70000 (10000) 60000 Retained earnings at 31/12/2019 A company B company Retained earning 1/1 13000 10000 Year profits or losses 153125 60000 Dividends (130000) (25000) Retained earnings 31/12 36125 45000 SFP on 31/12/2019 A company 123000 165000 175000 18750 784375 80000 30000 B company 44000 85000 48000 Cash Receivables Inventory Prepaid dividends Investment in company B Equipment's, nct Cars 85000 13000 1376125 35000 130000 Total assets Payable Accrued dividends Share capital Additional paid in capital Retained earnings Total liabilities and equity 650000 275000 65000 18750 120000 20000 45000 275000 525000 36125 1376125 The following are additional information related to subsidiary company: 1- Remaining age of Equipment that are in the subsidiary company at date of acquisition (1/1/2019) is 4 years. 2- At the year of 2019, 75% of inventory have been sold. And remaining inventory have been sold on 2020. 3- Remaining age of Cars that are in the subsidiary company at date of acquisition (1/1/2019) is 4 years. Requirement: 1- Prepare the consolidated financial statement at the date of acquisition. 2- Prepare the consolidate financial statements for the year of acquisitionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started