Answered step by step

Verified Expert Solution

Question

1 Approved Answer

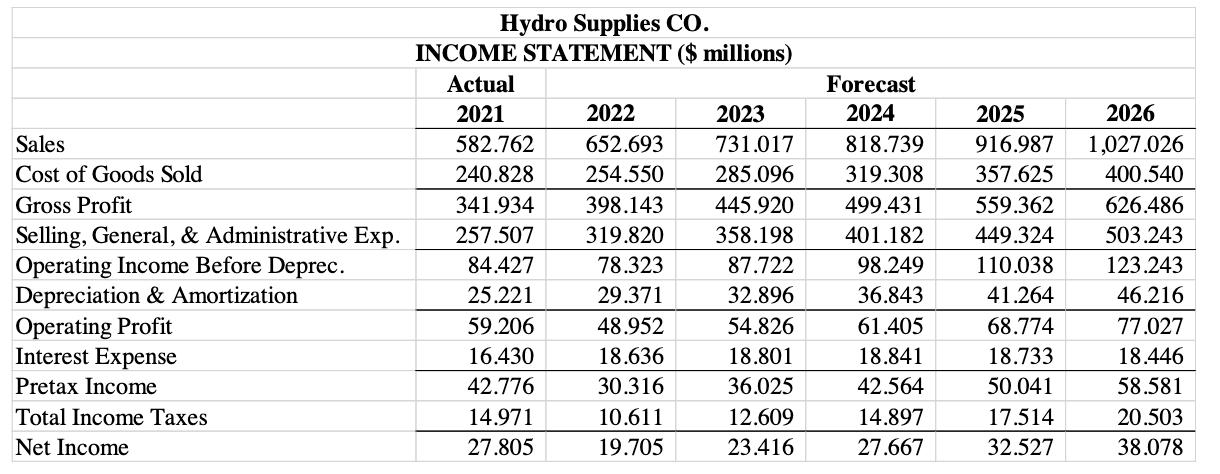

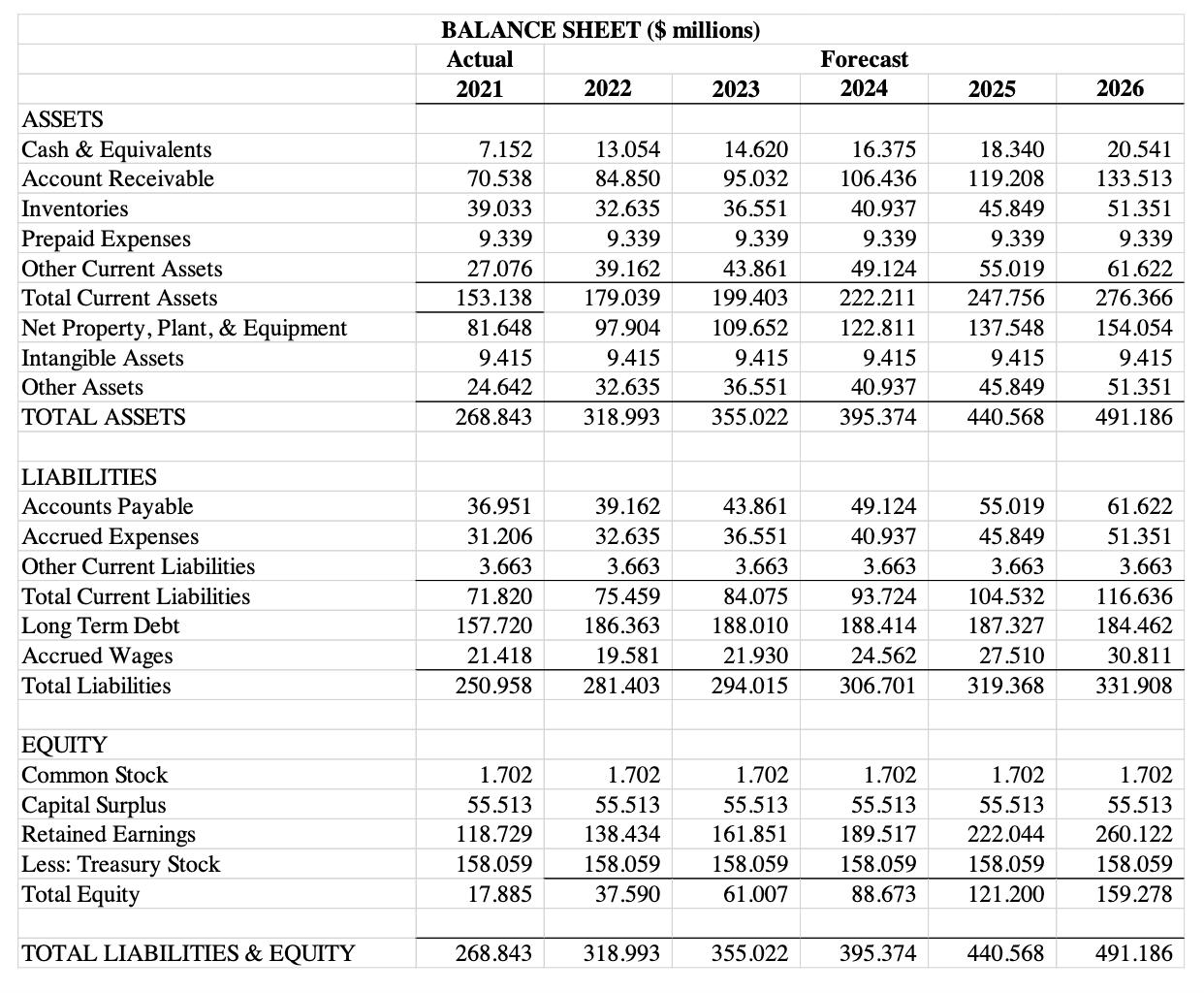

When consulting a bond table (in text or online), what bond rating would Hydro Supplies have in 2021 was the rating based solely on the

When consulting a bond table (in text or online), what bond rating would Hydro Supplies have in 2021 was the rating based solely on the firm's interest coverage ratio?

Sales Cost of Goods Sold Gross Profit Selling, General, & Administrative Exp. Operating Income Before Deprec. Depreciation & Amortization Operating Profit Interest Expense Pretax Income Total Income Taxes Net Income Hydro Supplies CO. INCOME STATEMENT ($ millions) Actual 2021 2022 582.762 652.693 240.828 254.550 341.934 398.143 257.507 319.820 84.427 78.323 25.221 29.371 59.206 48.952 16.430 18.636 42.776 30.316 14.971 10.611 27.805 19.705 Forecast 2024 2023 731.017 818.739 285.096 319.308 445.920 358.198 87.722 32.896 54.826 18.801 36.025 12.609 23.416 499.431 401.182 98.249 36.843 61.405 18.841 42.564 14.897 27.667 2025 916.987 357.625 559.362 449.324 110.038 41.264 68.774 18.733 50.041 17.514 32.527 2026 1,027.026 400.540 626.486 503.243 123.243 46.216 77.027 18.446 58.581 20.503 38.078

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the bond rating based solely on Hydro Supplies interest coverage ratio we need to calculate the interest coverage ratio for the company T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started