Answered step by step

Verified Expert Solution

Question

1 Approved Answer

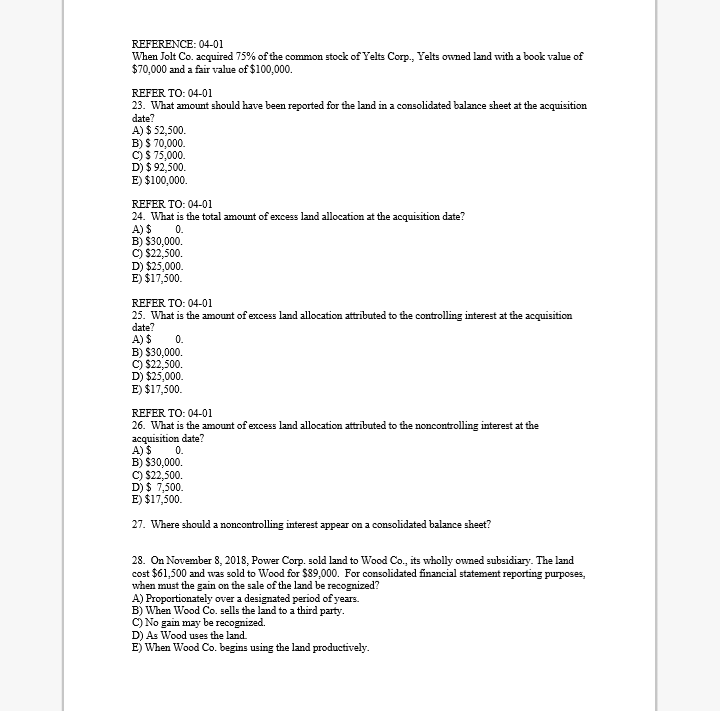

When Jolt Co. acquired 75% of the common stock of Yelts Corp., Yelts owned land with a book value of $70, 000 and a fair

When Jolt Co. acquired 75% of the common stock of Yelts Corp., Yelts owned land with a book value of $70, 000 and a fair value of $100, 000. What amount should have been reported for the land in a consolidated balance sheet at the acquisition date? A) $ 52, 500. B) $ 70, 000. C) $ 75, 000. D) $ 92, 500. E) $ 100, 000. What is the total amount of excess land allocation at the acquisition date? A) $0. B) $3 0, 000. C) $22, 500. D) $25, 000. E) $17, 500. What is the amount of excess land allocation attributed to the controlling interest at the acquisition date? A) $0. B) $30, 000. C) $22, 500. D) $25, 000. E) $17, 500. What is the amount of excess land allocation attributed to the noncontrolling interest at the acquisition date? A) $0. B) $30, 000. C) $22, 500. D) $7.500. E) $17, 500. Where should a noncontrolling interest appear on a consolidated balance sheet? On November 8, 2018, Power Corp. sold land to Wood Co., its wholly owned subsidiary. The land cost $61, 500 and was sold to Wood for $89.000. For consolidated financial statement reporting purposes, when must the gain on the sale of the land be recognized? A) Proportionately over a designated period of years. B) When Wood Co. sells the land to a third party. C) No gain may be recognized. D) As Wood uses the land E) When Wood Co. begins using the land productively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started