Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When Microsoft went public, the company sold 4 million new shares (the primary issue). In addition, existing shareholders sold 0.7 million shares (the secondary issue)

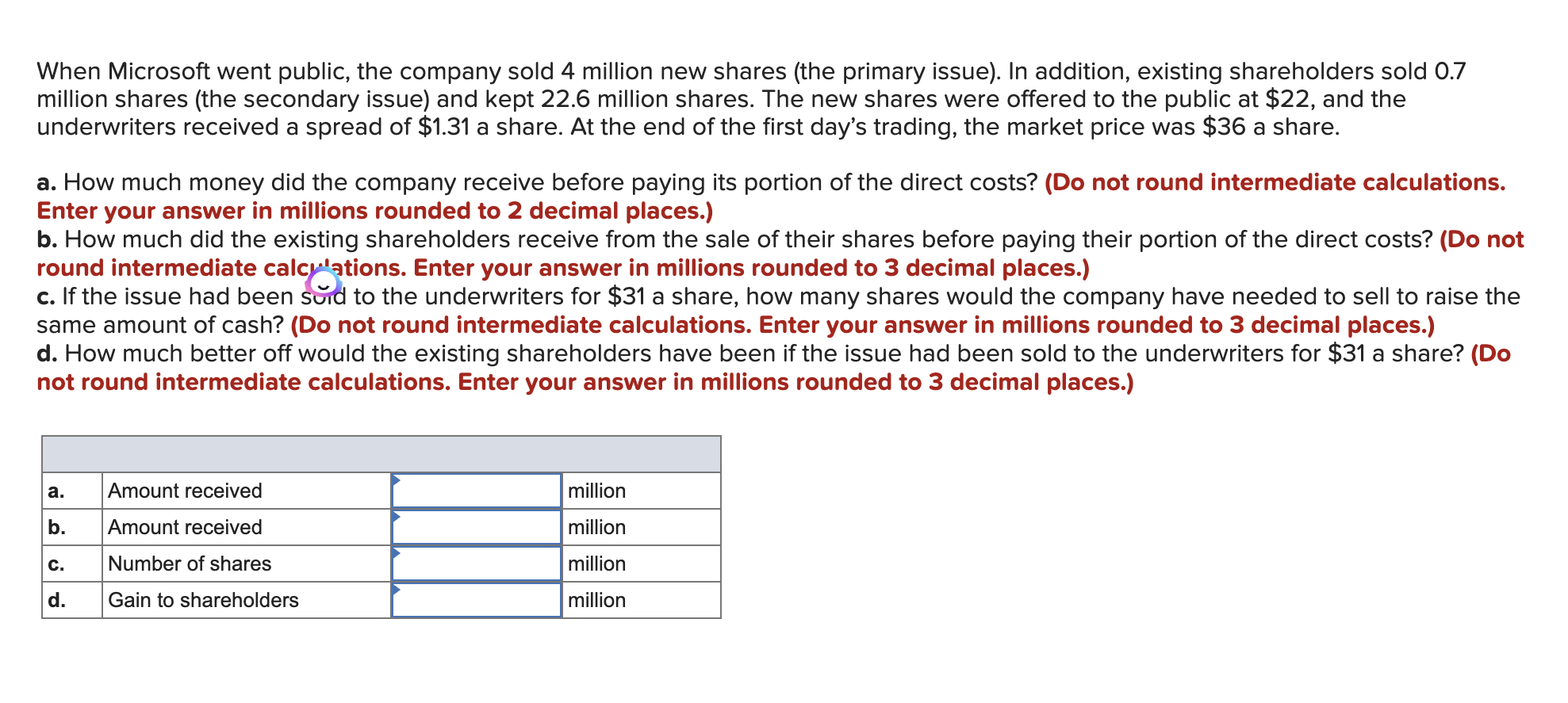

When Microsoft went public, the company sold 4 million new shares (the primary issue). In addition, existing shareholders sold 0.7 million shares (the secondary issue) and kept 22.6 million shares. The new shares were offered to the public at $22, and the underwriters received a spread of $1.31 a share. At the end of the first day's trading, the market price was $36 a share. a. How much money did the company receive before paying its portion of the direct costs? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. How much did the existing shareholders receive from the sale of their shares before paying their portion of the direct costs? (Do not round intermediate calcy 3 tions. Enter your answer in millions rounded to 3 decimal places.) c. If the issue had been sdd to the underwriters for $31 a share, how many shares would the company have needed to sell to raise the same amount of cash? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) d. How much better off would the existing shareholders have been if the issue had been sold to the underwriters for $31 a share? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.)

When Microsoft went public, the company sold 4 million new shares (the primary issue). In addition, existing shareholders sold 0.7 million shares (the secondary issue) and kept 22.6 million shares. The new shares were offered to the public at $22, and the underwriters received a spread of $1.31 a share. At the end of the first day's trading, the market price was $36 a share. a. How much money did the company receive before paying its portion of the direct costs? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. How much did the existing shareholders receive from the sale of their shares before paying their portion of the direct costs? (Do not round intermediate calcy 3 tions. Enter your answer in millions rounded to 3 decimal places.) c. If the issue had been sdd to the underwriters for $31 a share, how many shares would the company have needed to sell to raise the same amount of cash? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) d. How much better off would the existing shareholders have been if the issue had been sold to the underwriters for $31 a share? (Do not round intermediate calculations. Enter your answer in millions rounded to 3 decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started