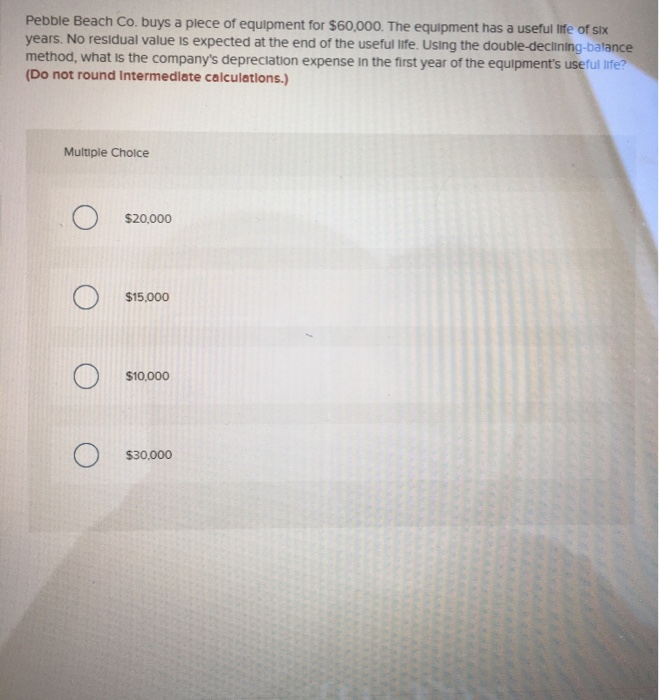

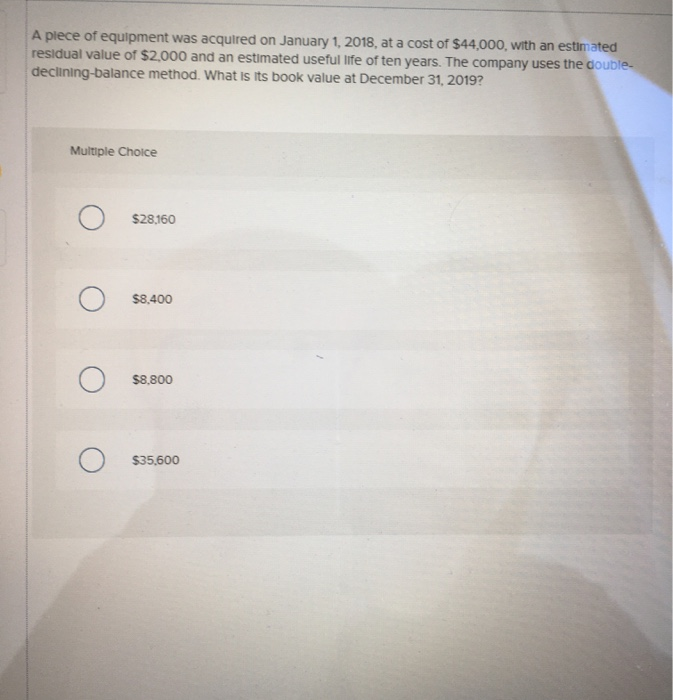

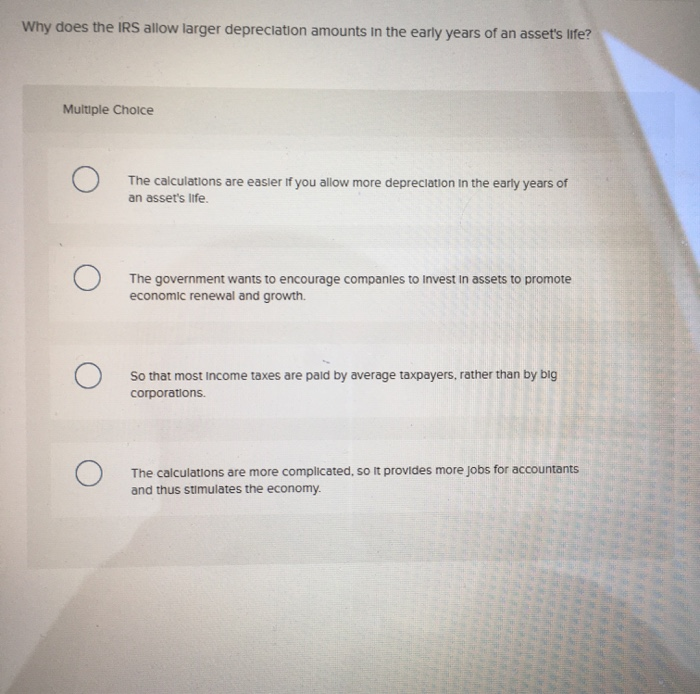

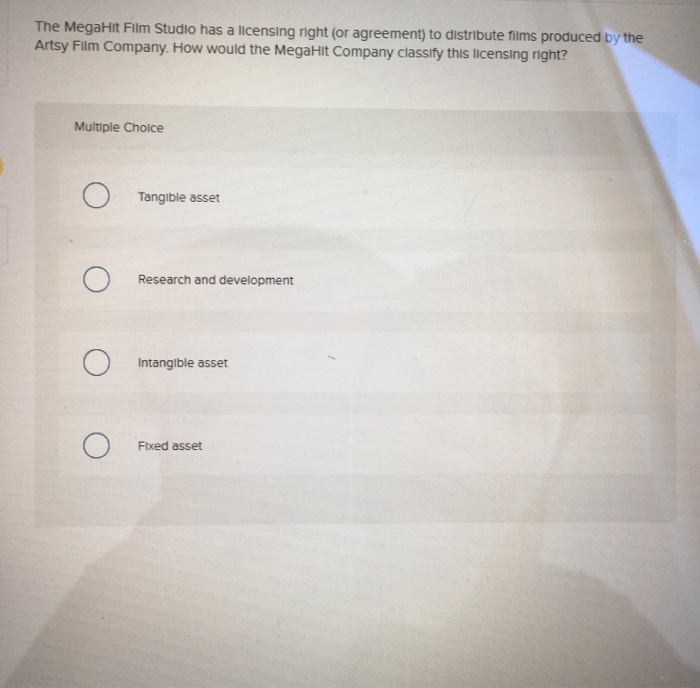

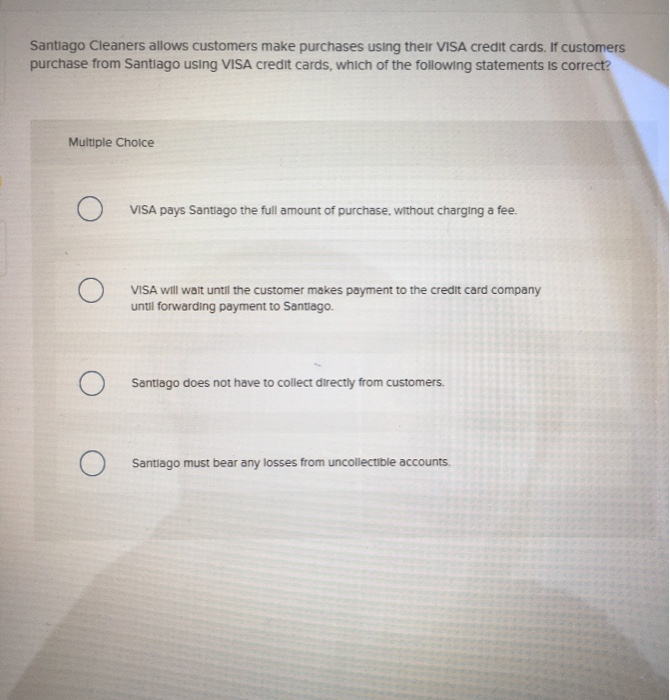

When the direct write-off method is used: Multiple Choice 0 the estimated amount of bad debts is debited to Bad Debt Expense. 0 the estimated amount of bad debts is debited to Allowance for Doubtful Accounts the estimated amount of bad debts is debited to which account Accounts Receivable. 0 bad debts are not estimated 0 A company bought land and a building for $128,000. The building has a useful life of 20 years. Why should the company split the $128,000 cost between the land and the building? Multiple Choice O Land is not depreciated, while the building will be depreciated over its 20-year useful life. O The cost should not be split between the land and building O The land will be depreciated over 40 years and the building will be depreciated over 20 years. O Both the land and the building will be depreciated over 20 years. Superior, Inc. Just bought a new machine to be used on its production line. Which of these costs should not be capitalized? 1 Multiple Choice 0 The $600,000 Invoice price of the machine. 0 O The $18,000 freight bill to deliver the machine to Superior's factory 0 The $9,600 cost of tearing down Superior's factory wall to get the machine Inside 0 The $520 Increase in annual Insurance costs for the machine A plece of equipment was acquired on January 1, 2018, at a cost of $44,000, with an estimated residual value of $2,000 and an estimated useful life of ten years. The company uses the double declining-balance method. What is its book value at December 31, 2019? Multiple Choice S28160 $8,400 8,800 S35,600 Why does the IRS allow larger depreciation amounts in the early years of an asset's life? 1 Multiple Choice The calculations are easier if you allow more depreciation in the early years of an asset's life. The government wants to encourage companies to invest in assets to promote economic renewal and growth. o So that most Income taxes are paid by average taxpayers, rather than by big corporations. o The calculations are more complicated, so it provides more jobs for accountants and thus stimulates the economy. CAS The MegaHit Film Studio has a licensing right (or agreement) to distribute films produced by the Artsy Film Company. How would the MegaHit Company classify this licensing right? Multiple Choice Tangible asset Research and development Intangible asset mange mine oo Fixed asset Santiago Cleaners allows customers make purchases using their VISA credit cards. If customers purchase from Santiago using VISA credit cards, which of the following statements is correct? Multiple Choice VISA pays Santiago the full amount of purchase, without charging a fee. O VISA will wait until the customer makes payment to the credit card company until forwarding payment to Santiago Santiago does not have to collect directly from customers. O Santiago must bear any losses from uncollectible accounts O