Answered step by step

Verified Expert Solution

Question

1 Approved Answer

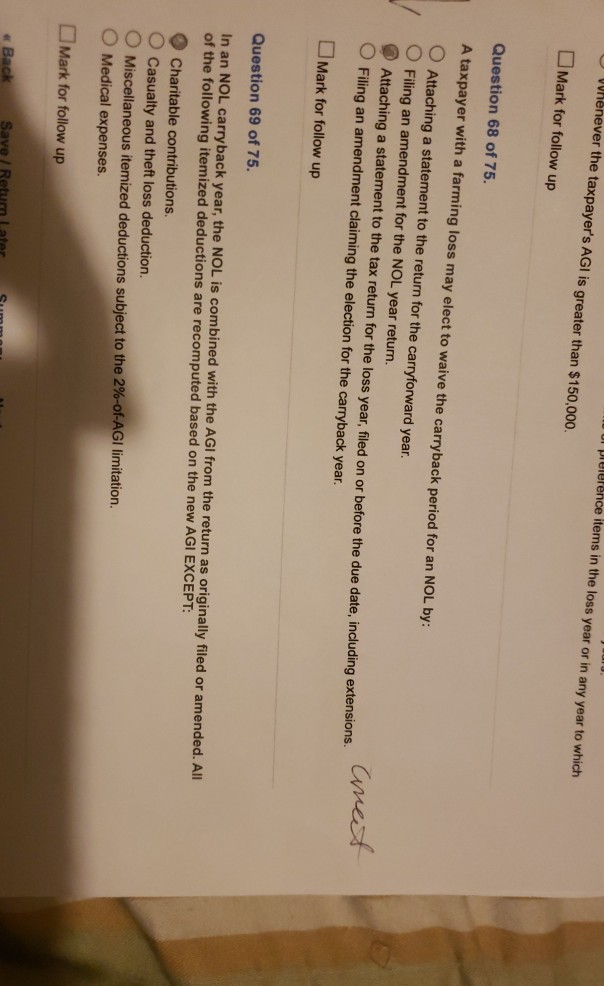

Whenever the taxpayer's AGI is greater than $150,000. i ul pleierence items in the loss year or in any year to which Mark for follow

Whenever the taxpayer's AGI is greater than $150,000. i ul pleierence items in the loss year or in any year to which Mark for follow up Question 68 of 75. A taxpayer with a farming loss may elect to waive the carryback period for an NOL by: O Attaching a statement to the return for the carryforward year. Filing an amendment for the NOL year return. Attaching a statement to the tax return for the loss year, filed on or before the due date, including extensions Filing an amendment claiming the election for the carryback year. ore the due date, including extensione m e t Mark for follow up Question 69 of 75. In an NOL carryback year, the NOL is combined with the AGI from the return as originally filed or amended. All of the following itemized deductions are recomputed based on the new AGI EXCEPT: Charitable contributions. Casualty and theft loss deduction. O Miscellaneous itemized deductions subject to the 2%-of-AGI limitation. Medical expenses. Mark for follow up Back Save / Return Later Summoni

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started