Answered step by step

Verified Expert Solution

Question

1 Approved Answer

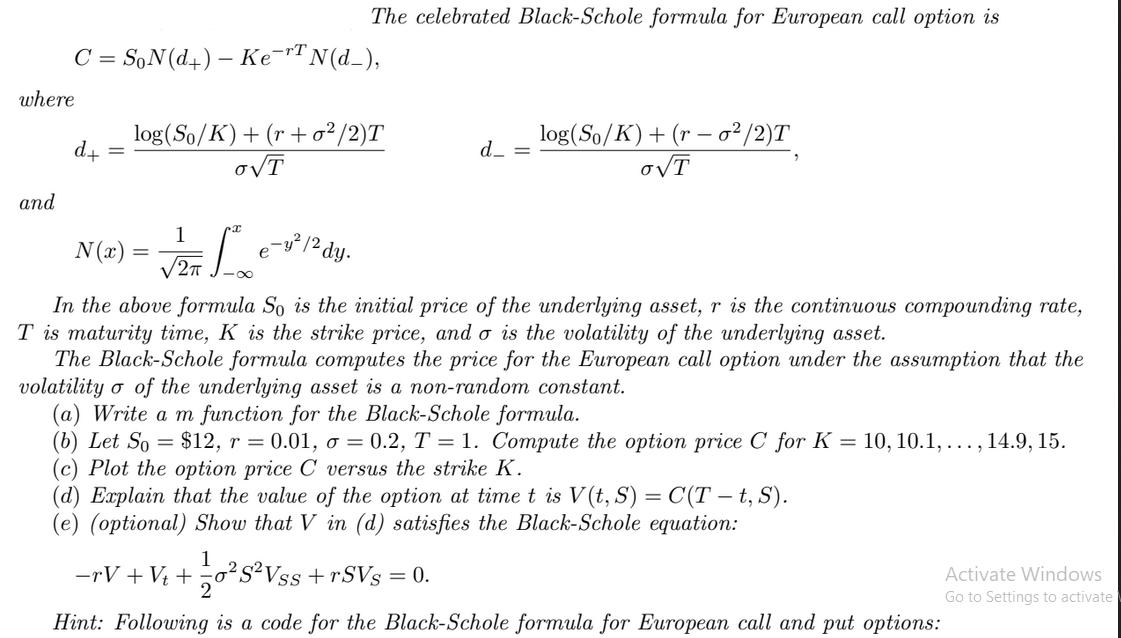

where and C = SoN(d+) - Ke-T N(d_), d+ = The celebrated Black-Schole formula for European call option is N (x) log (So/K) +

where and C = SoN(d+) - Ke-T N(d_), d+ = The celebrated Black-Schole formula for European call option is N (x) log (So/K) + (r +o/2)T ovT = d_ = 1 e-y/2 dy. 2 J- In the above formula So is the initial price of the underlying asset, r is the continuous compounding rate, T is maturity time, K is the strike price, and o is the volatility of the underlying asset. The Black-Schole formula computes the price for the European call option under the assumption that the volatility o of the underlying asset is a non-random constant. log(So/K) + (r o/2)T oT (a) Write a m function for the Black-Schole formula. (b) Let So = $12, r = 0.01, o = 0.2, T = 1. Compute the option price C for K = 10, 10.1,..., 14.9, 15. (c) Plot the option price C versus the strike K. (d) Explain that the value of the option at time t is V(t, S) = C(T-t, S). (e) (optional) Show that V in (d) satisfies the Black-Schole equation: 1 -rV+Vt+ SVss+rSVs = 0. 2 Hint: Following is a code for the Black-Schole formula for European call and put options: Activate Windows Go to Settings to activate

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Here is a MATLAB function for the BlackScholes formula for European call options matlab function C ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started