Answered step by step

Verified Expert Solution

Question

1 Approved Answer

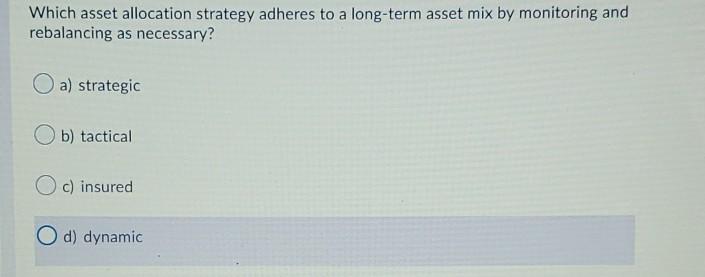

Which asset allocation strategy adheres to a long-term asset mix by monitoring and rebalancing as necessary? a) strategic b) tactical Oc) insured d) dynamic Select

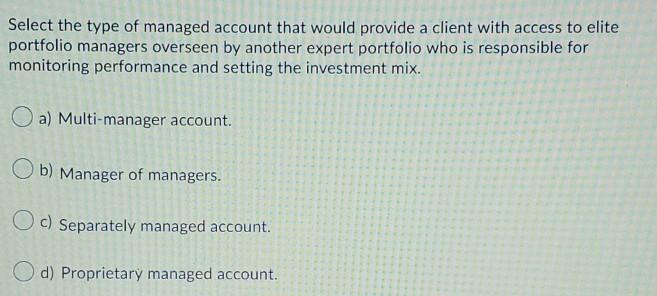

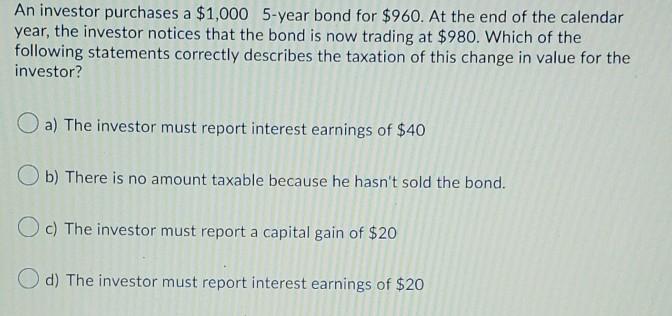

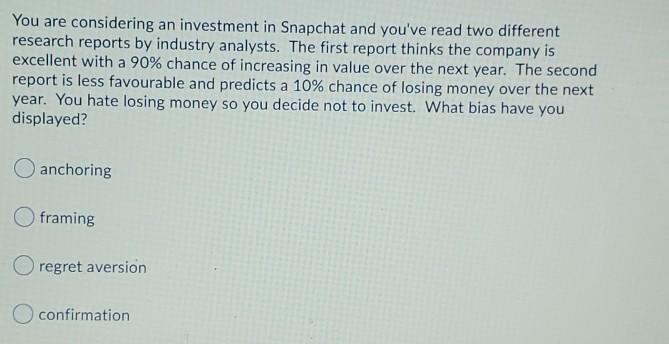

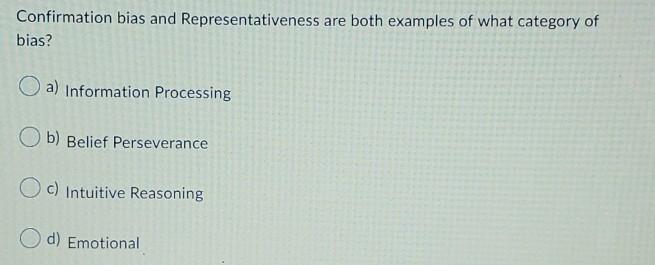

Which asset allocation strategy adheres to a long-term asset mix by monitoring and rebalancing as necessary? a) strategic b) tactical Oc) insured d) dynamic Select the type of managed account that would provide a client with access to elite portfolio managers overseen by another expert portfolio who is responsible for monitoring performance and setting the investment mix. O a) Multi-manager account. Ob) Manager of managers. Oc) Separately managed account. d) Proprietary managed account. An investor purchases a $1,000 5-year bond for $960. At the end of the calendar year, the investor notices that the bond is now trading at $980. Which of the following statements correctly describes the taxation of this change in value for the investor? a) The investor must report interest earnings of $40 Ob) There is no amount taxable because he hasn't sold the bond. Oc) The investor must report a capital gain of $20 d) The investor must report interest earnings of $20 You are considering an investment in Snapchat and you've read two different research reports by industry analysts. The first report thinks the company is excellent with a 90% chance of increasing in value over the next year. The second report is less favourable and predicts a 10% chance of losing money over the next year. You hate losing money so you decide not to invest. What bias have you displayed? anchoring framing regret aversion confirmation Confirmation bias and Representativeness are both examples of what category of bias? a) Information Processing b) Belief Perseverance c) Intuitive Reasoning d) Emotional Which asset allocation strategy adheres to a long-term asset mix by monitoring and rebalancing as necessary? a) strategic b) tactical Oc) insured d) dynamic Select the type of managed account that would provide a client with access to elite portfolio managers overseen by another expert portfolio who is responsible for monitoring performance and setting the investment mix. O a) Multi-manager account. Ob) Manager of managers. Oc) Separately managed account. d) Proprietary managed account. An investor purchases a $1,000 5-year bond for $960. At the end of the calendar year, the investor notices that the bond is now trading at $980. Which of the following statements correctly describes the taxation of this change in value for the investor? a) The investor must report interest earnings of $40 Ob) There is no amount taxable because he hasn't sold the bond. Oc) The investor must report a capital gain of $20 d) The investor must report interest earnings of $20 You are considering an investment in Snapchat and you've read two different research reports by industry analysts. The first report thinks the company is excellent with a 90% chance of increasing in value over the next year. The second report is less favourable and predicts a 10% chance of losing money over the next year. You hate losing money so you decide not to invest. What bias have you displayed? anchoring framing regret aversion confirmation Confirmation bias and Representativeness are both examples of what category of bias? a) Information Processing b) Belief Perseverance c) Intuitive Reasoning d) Emotional

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started