Question

Which of the following distributions is nontaxable? Dividend on an insurance policy in the amount of $1,000 (as of the date of this dividend

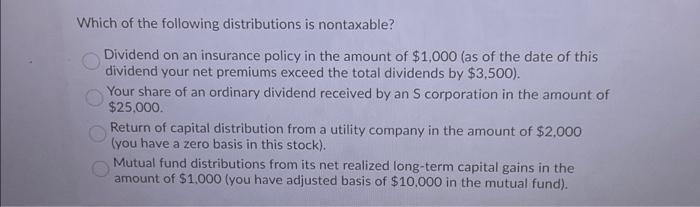

Which of the following distributions is nontaxable? Dividend on an insurance policy in the amount of $1,000 (as of the date of this dividend your net premiums exceed the total dividends by $3,500). Your share of an ordinary dividend received by an S corporation in the amount of $25,000. Return of capital distribution from a utility company in the amount of $2,000 (you have a zero basis in this stock). Mutual fund distributions from its net realized long-term capital gains in the amount of $1.000 (you have adjusted basis of $10.000 in the mutual fund).

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution The correct answer is a Dividend on insurance policy in the amount of 1000 As of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

The Practice Of Statistics

Authors: Daren S. Starnes, Josh Tabor

6th Edition

978-1319113339

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App