Answered step by step

Verified Expert Solution

Question

1 Approved Answer

which of the following is considered a partnership termination? Tor $12 a share on September 10, 2018. On August 29, 2019, the might decline further,

which of the following is considered a partnership termination?

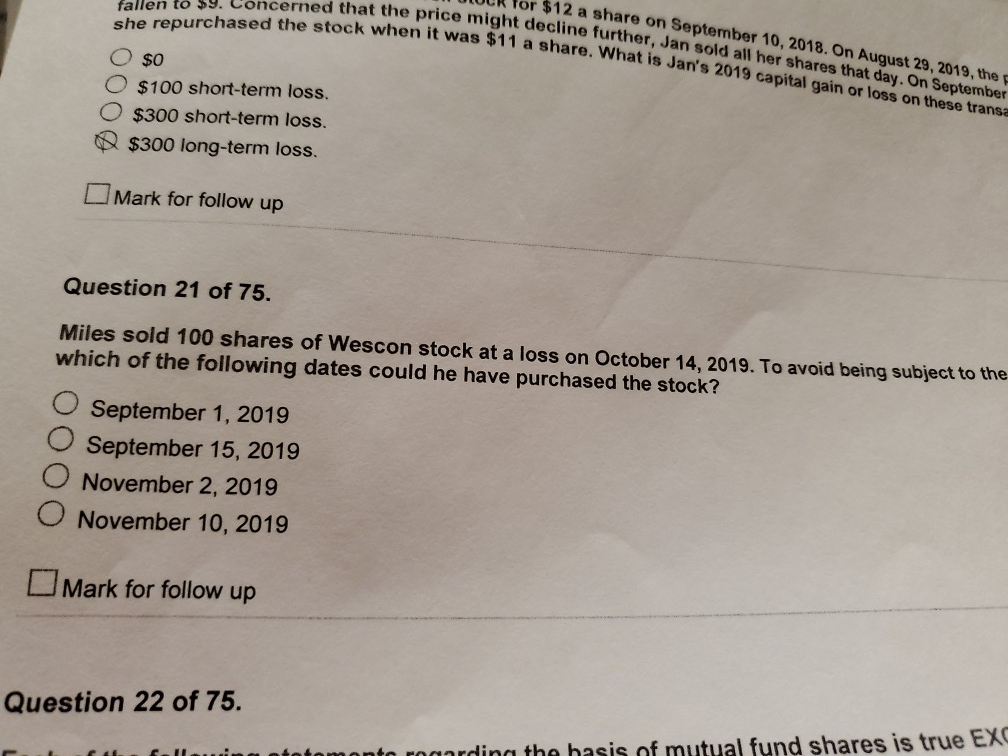

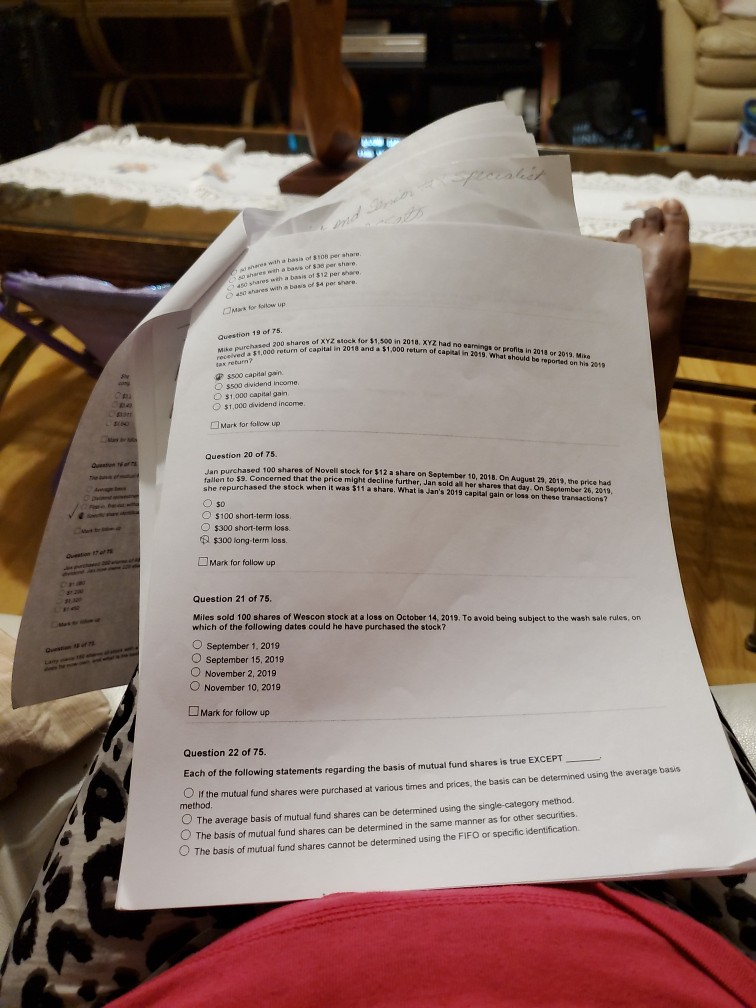

Tor $12 a share on September 10, 2018. On August 29, 2019, the might decline further, Jan sold all her shares that day. On September it was $11 a share. What is Jan's 2019 capital gain or loss on these transi fallen to 3y. concerned that the she repurchased the stock when it was 544 O $0 O $100 short-term loss. O $300 short-term loss. Q$300 long-term loss. Mark for follow up Question 21 of 75. Miles sold 100 shares of Wescon stock at a loss on October 14, 2019. To avoid being subject to the which of the following dates could he have purchased the stock? O September 1, 2019 O September 15, 2019 November 2, 2019 November 10, 2019 Mark for follow up Question 22 of 75. ordip the basis of mutual fund shares is true Ey whesis of $100 perahu with a basso per share w a basis of $12 per where shares with a bans of $4 per share for follow up Question 19 of 75. 200 shares och for $1.500 in 2018. XYZ had nevarnings or profits in 2018 or 2019, Mike in 2018 and a $1.000 return of capital in 2019. What should be reported on his Mike purch received a $1,000 return of capital in 2 O 500 capitalgan $500 dividend income. $1.000 capital gain $1.000 dividend income Mark for follow up Question 20 of 75 based 100 shares of Novell stock for $12 a share on September 10, 2018. On August 23, 2013, the price had te 59. Concerned that the price might decline further, Jan sold all her shares that day. On September 25, 2013 her purchased the stock when it was $11 a share. What is Jan's 2019 capital gain or loss on these ar e 2 O O $0 $100 short-term loss $300 short-term loss $300 long-term loss. Mark for follow up Question 21 of 75. Miles sold 100 shares of Woscon stock at a loss on October 14, 2019. To avoid being subject to the wash sale rules, on which of the following dates could he have purchased the stock? O September 1. 2019 O September 15, 2019 O November 2, 2019 O November 10, 2019 Mark for follow up Question 22 of 75. Each of the following statements regarding the basis of mutual fund shares is true EXCEPT If the mutual fund shares were purchased at various times and prices the basis can be determined using the average aus method. The average basis of mutual fund shares can be determined using the single-category method. The basis of mutual fund shares can be determined in the same manner as for other securities The basis of mutual fund shares cannot be determined using the FIFO or specific identification Tor $12 a share on September 10, 2018. On August 29, 2019, the might decline further, Jan sold all her shares that day. On September it was $11 a share. What is Jan's 2019 capital gain or loss on these transi fallen to 3y. concerned that the she repurchased the stock when it was 544 O $0 O $100 short-term loss. O $300 short-term loss. Q$300 long-term loss. Mark for follow up Question 21 of 75. Miles sold 100 shares of Wescon stock at a loss on October 14, 2019. To avoid being subject to the which of the following dates could he have purchased the stock? O September 1, 2019 O September 15, 2019 November 2, 2019 November 10, 2019 Mark for follow up Question 22 of 75. ordip the basis of mutual fund shares is true Ey whesis of $100 perahu with a basso per share w a basis of $12 per where shares with a bans of $4 per share for follow up Question 19 of 75. 200 shares och for $1.500 in 2018. XYZ had nevarnings or profits in 2018 or 2019, Mike in 2018 and a $1.000 return of capital in 2019. What should be reported on his Mike purch received a $1,000 return of capital in 2 O 500 capitalgan $500 dividend income. $1.000 capital gain $1.000 dividend income Mark for follow up Question 20 of 75 based 100 shares of Novell stock for $12 a share on September 10, 2018. On August 23, 2013, the price had te 59. Concerned that the price might decline further, Jan sold all her shares that day. On September 25, 2013 her purchased the stock when it was $11 a share. What is Jan's 2019 capital gain or loss on these ar e 2 O O $0 $100 short-term loss $300 short-term loss $300 long-term loss. Mark for follow up Question 21 of 75. Miles sold 100 shares of Woscon stock at a loss on October 14, 2019. To avoid being subject to the wash sale rules, on which of the following dates could he have purchased the stock? O September 1. 2019 O September 15, 2019 O November 2, 2019 O November 10, 2019 Mark for follow up Question 22 of 75. Each of the following statements regarding the basis of mutual fund shares is true EXCEPT If the mutual fund shares were purchased at various times and prices the basis can be determined using the average aus method. The average basis of mutual fund shares can be determined using the single-category method. The basis of mutual fund shares can be determined in the same manner as for other securities The basis of mutual fund shares cannot be determined using the FIFO or specific identificationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started