Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following is FALSE? Select one: a . The cost of equity for Tangshan Mining would be roughly 1 0 percent if the

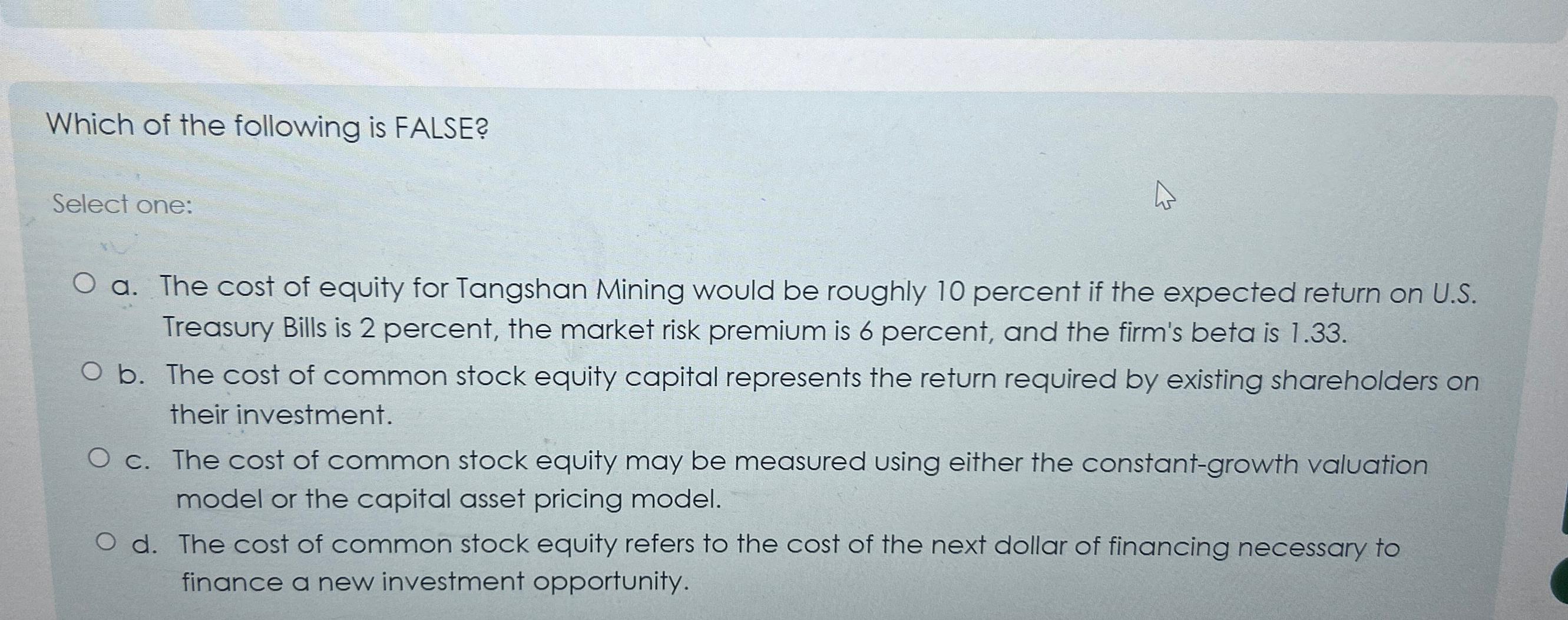

Which of the following is FALSE?

Select one:

a The cost of equity for Tangshan Mining would be roughly percent if the expected return on US Treasury Bills is percent, the market risk premium is percent, and the firm's beta is

b The cost of common stock equity capital represents the return required by existing shareholders on their investment.

c The cost of common stock equity may be measured using either the constantgrowth valuation model or the capital asset pricing model.

d The cost of common stock equity refers to the cost of the next dollar of financing necessary to finance a new investment opportunity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started