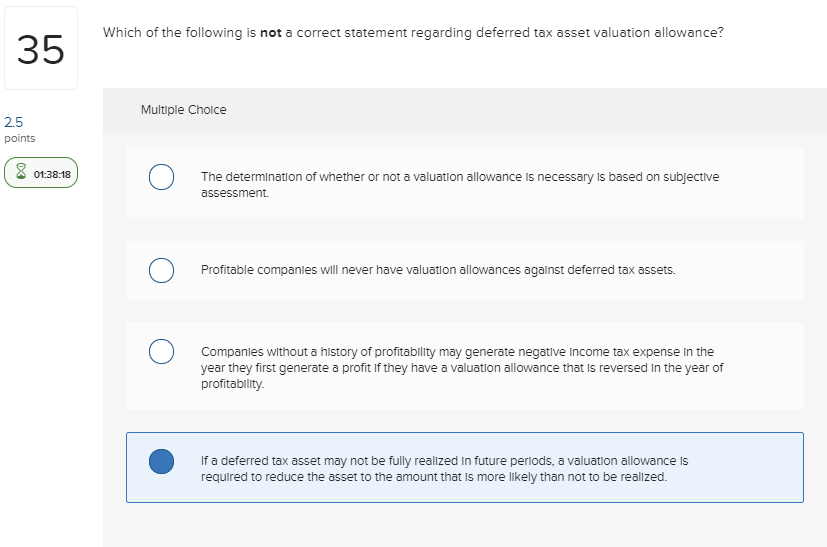

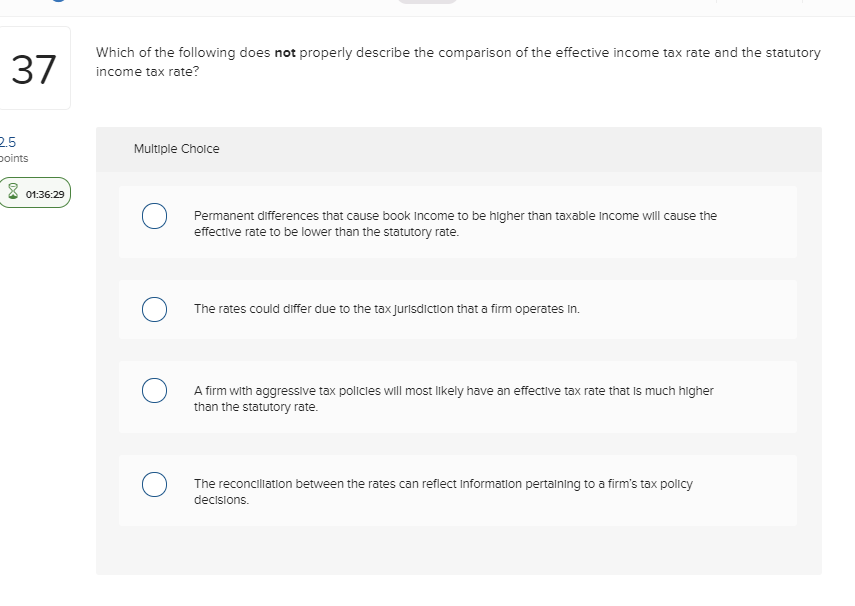

Which of the following is not a correct statement regarding deferred tax asset valuation allowance? 35 Multiple Cholce 2.5 points 01:38:18 The determination of whether or not a valuation allowance is necessary Is based on subjective assessment. Profitable companles will never have valuatlon allowances agalnst deferred tax assets. Companles without a history of profitablity may generate negative Income tax expense In the year they first generate a profit If they have a valuation allowance that Is reversed In the year of profitability If a deferred tax asset may not be fully reallzed in future periods, a valuation allowance Is required to reduce the asset to the amount that Is more likely than not to be realized. Which of the following does not properly describe the comparison of the effective income tax rate and the statutory 37 income tax rate? 25 Multiple Cholce oints 01:36:29 Permanent differences that cause book Income to be higher than taxable Income will cause the effective rate to be lower than the statutory rate The rates could differ due to the tax Jurlsdiction that a firm operates In. A firm with aggressive tax policies will most likely have an effective tax rate that Is much higher than the statutory rate. The reconciliation between the rates can reflect Information pertalning to a firm's tax policy declslons. Which of the following is not a correct statement regarding deferred tax asset valuation allowance? 35 Multiple Cholce 2.5 points 01:38:18 The determination of whether or not a valuation allowance is necessary Is based on subjective assessment. Profitable companles will never have valuatlon allowances agalnst deferred tax assets. Companles without a history of profitablity may generate negative Income tax expense In the year they first generate a profit If they have a valuation allowance that Is reversed In the year of profitability If a deferred tax asset may not be fully reallzed in future periods, a valuation allowance Is required to reduce the asset to the amount that Is more likely than not to be realized. Which of the following does not properly describe the comparison of the effective income tax rate and the statutory 37 income tax rate? 25 Multiple Cholce oints 01:36:29 Permanent differences that cause book Income to be higher than taxable Income will cause the effective rate to be lower than the statutory rate The rates could differ due to the tax Jurlsdiction that a firm operates In. A firm with aggressive tax policies will most likely have an effective tax rate that Is much higher than the statutory rate. The reconciliation between the rates can reflect Information pertalning to a firm's tax policy declslons