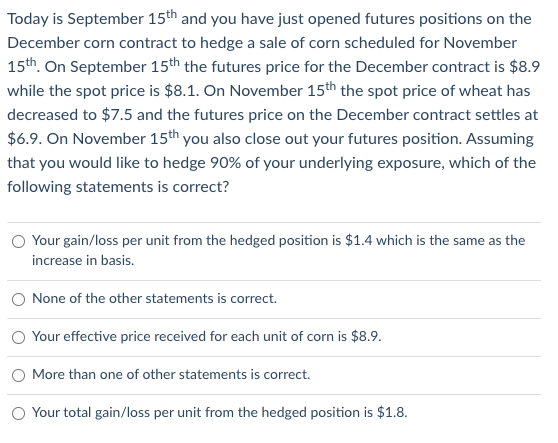

Which of the following is true: Reducing the beta of an equity portfolio to zero through the appropriate short position in stock index futures does not guarantee the risk-free rate of return on the hedged portfolio More than one of the other statements is true. According to the Hedging Pressure hypothesis, when speculators are net short on futures the futures price is expected to fall. In April 2020 the long maturity WTI futures prices went negative for the first time in history. None of the other statements is true. Today is September 15th and you have just opened futures positions on the December corn contract to hedge a sale of corn scheduled for November 15th. On September 15th the futures price for the December contract is $8.9 while the spot price is $8.1. On November 15th the spot price of wheat has decreased to $7.5 and the futures price on the December contract settles at $6.9. On November 15th you also close out your futures position. Assuming that you would like to hedge 90% of your underlying exposure, which of the following statements is correct? Your gain/loss per unit from the hedged position is $1.4 which is the same as the increase in basis. None of the other statements is correct. Your effective price received for each unit of corn is $8.9. O More than one of other statements is correct. Your total gain/loss per unit from the hedged position is $1.8. Which of the following is true: Reducing the beta of an equity portfolio to zero through the appropriate short position in stock index futures does not guarantee the risk-free rate of return on the hedged portfolio More than one of the other statements is true. According to the Hedging Pressure hypothesis, when speculators are net short on futures the futures price is expected to fall. In April 2020 the long maturity WTI futures prices went negative for the first time in history. None of the other statements is true. Today is September 15th and you have just opened futures positions on the December corn contract to hedge a sale of corn scheduled for November 15th. On September 15th the futures price for the December contract is $8.9 while the spot price is $8.1. On November 15th the spot price of wheat has decreased to $7.5 and the futures price on the December contract settles at $6.9. On November 15th you also close out your futures position. Assuming that you would like to hedge 90% of your underlying exposure, which of the following statements is correct? Your gain/loss per unit from the hedged position is $1.4 which is the same as the increase in basis. None of the other statements is correct. Your effective price received for each unit of corn is $8.9. O More than one of other statements is correct. Your total gain/loss per unit from the hedged position is $1.8