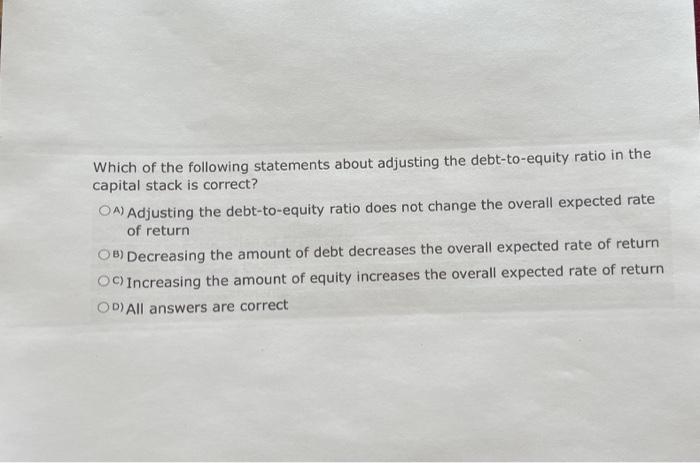

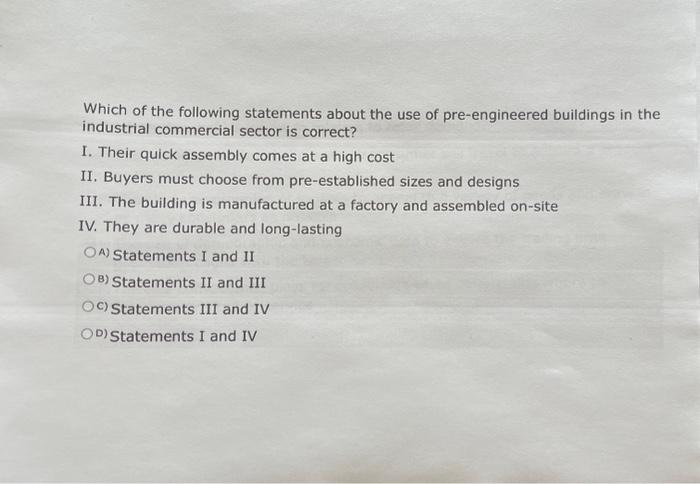

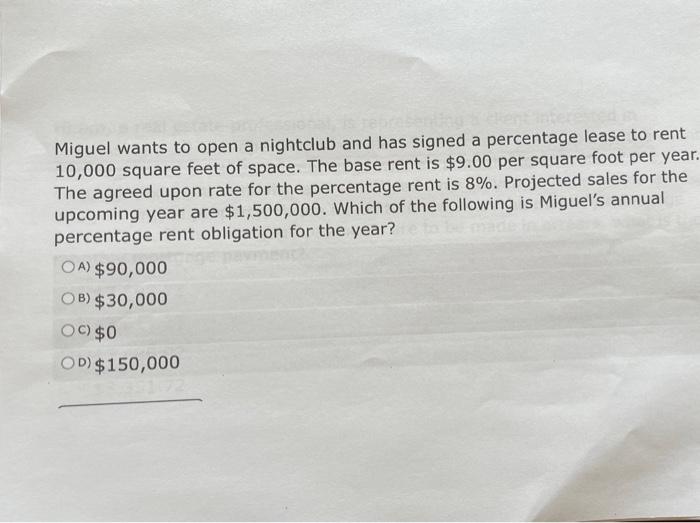

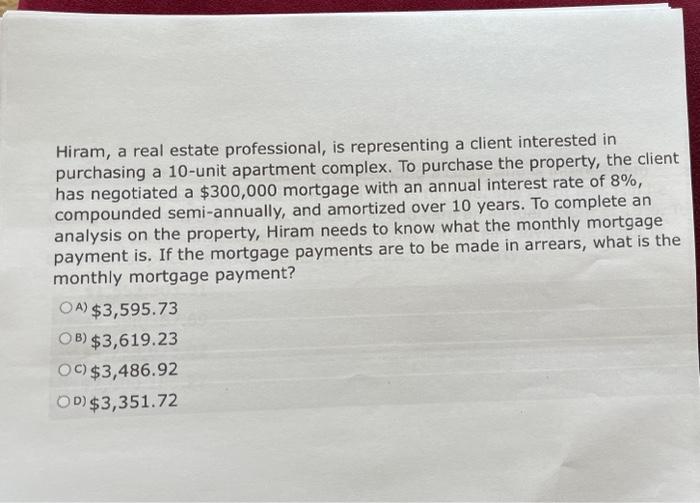

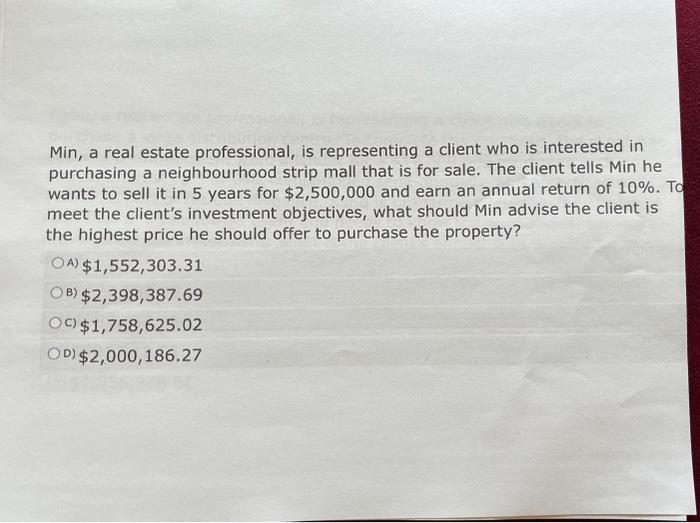

Which of the following statements about adjusting the debt-to-equity ratio in the capital stack is correct? A) Adjusting the debt-to-equity ratio does not change the overall expected rate of return B) Decreasing the amount of debt decreases the overall expected rate of return C) Increasing the amount of equity increases the overall expected rate of return D) All answers are correct: Which of the following statements about the use of pre-engineered buildings in the industrial commercial sector is correct? I. Their quick assembly comes at a high cost II. Buyers must choose from pre-established sizes and designs III. The building is manufactured at a factory and assembled on-site IV. They are durable and long-lasting A) Statements I and II B) Statements II and III C) Statements III and IV b) Statements I and IV Miguel wants to open a nightclub and has signed a percentage lease to rent 10,000 square feet of space. The base rent is $9.00 per square foot per year The agreed upon rate for the percentage rent is 8%. Projected sales for the upcoming year are $1,500,000. Which of the following is Miguel's annual percentage rent obligation for the year? A) $90,000 B) $30,000 c) $0 D) $150,000 Hiram, a real estate professional, is representing a client interested in purchasing a 10-unit apartment complex. To purchase the property, the client has negotiated a $300,000 mortgage with an annual interest rate of 8%, compounded semi-annually, and amortized over 10 years. To complete an analysis on the property, Hiram needs to know what the monthly mortgage payment is. If the mortgage payments are to be made in arrears, what is the monthly mortgage payment? A) $3,595.73 B) $3,619.23 C) $3,486.92 D) $3,351.72 Min, a real estate professional, is representing a client who is interested in purchasing a neighbourhood strip mall that is for sale. The client tells Min he wants to sell it in 5 years for $2,500,000 and earn an annual return of 10%. T meet the client's investment objectives, what should Min advise the client is the highest price he should offer to purchase the property? A) $1,552,303.31 B) $2,398,387.69 c) $1,758,625.02 D) $2,000,186.27