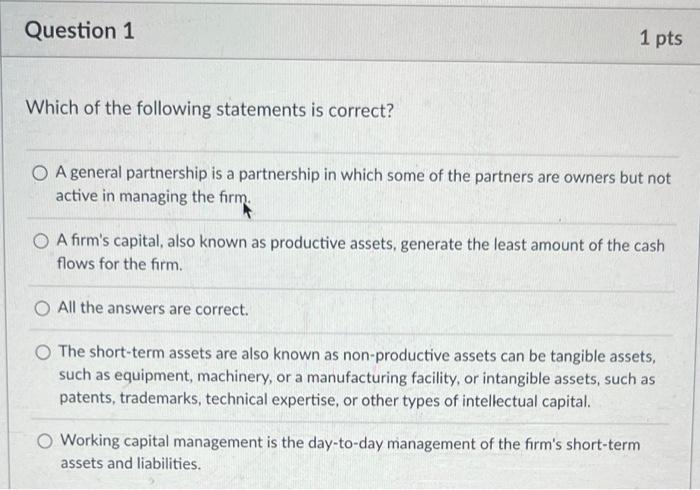

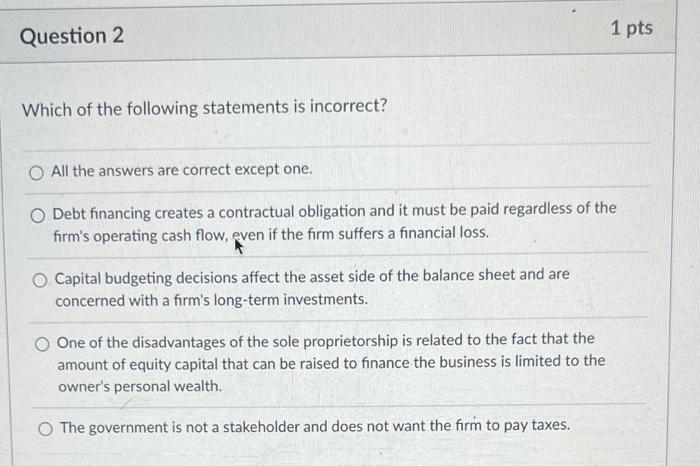

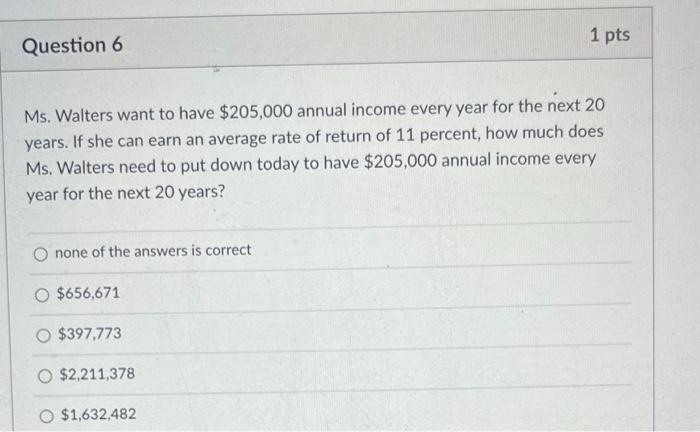

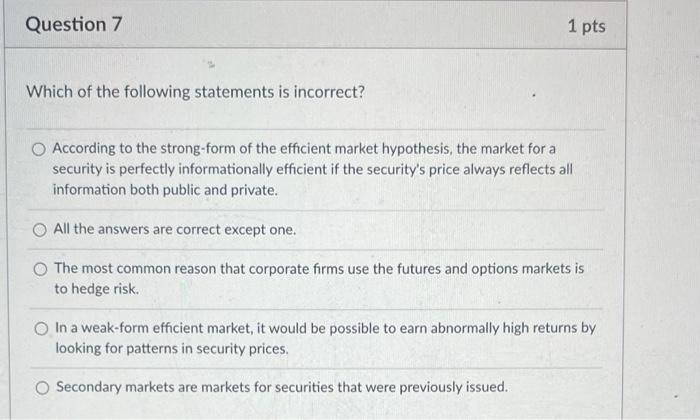

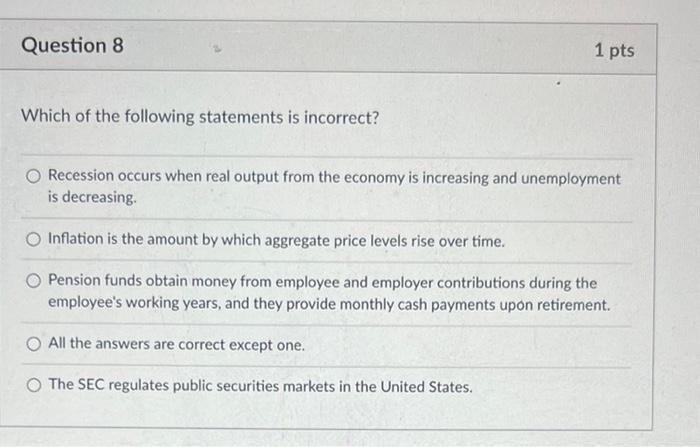

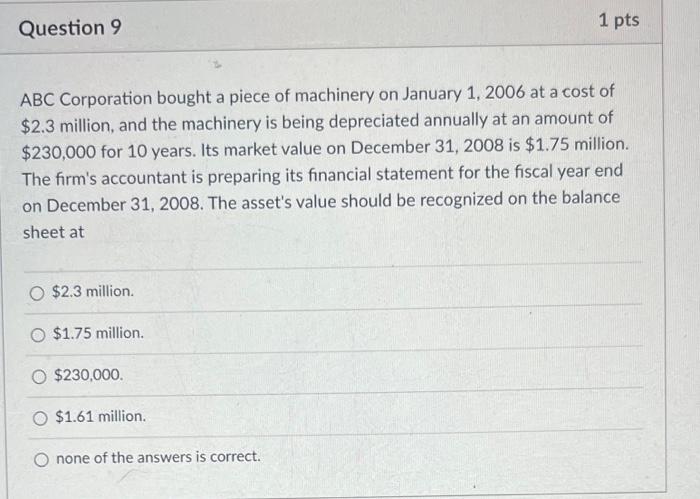

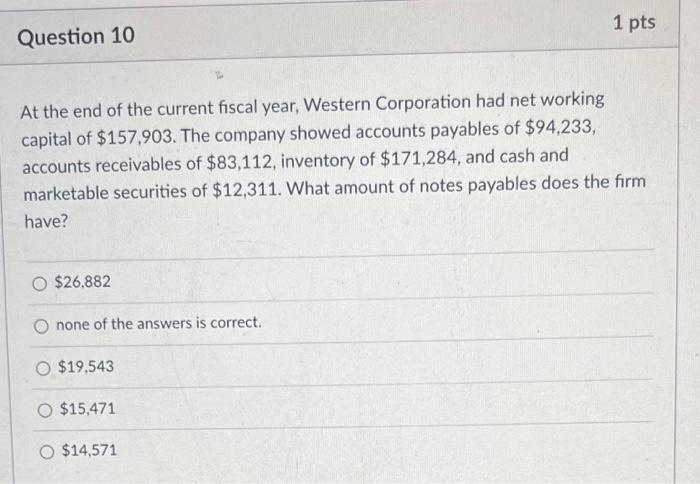

Which of the following statements is correct? A general partnership is a partnership in which some of the partners are owners but not active in managing the firm. A firm's capital, also known as productive assets, generate the least amount of the cash flows for the firm. All the answers are correct. The short-term assets are also known as non-productive assets can be tangible assets, such as equipment, machinery, or a manufacturing facility, or intangible assets, such as patents, trademarks, technical expertise, or other types of intellectual capital. Working capital management is the day-to-day management of the firm's short-term assets and liabilities. Which of the following statements is incorrect? All the answers are correct except one. Debt financing creates a contractual obligation and it must be paid regardless of the firm's operating cash flow, even if the firm suffers a financial loss. Capital budgeting decisions affect the asset side of the balance sheet and are concerned with a firm's long-term investments. One of the disadvantages of the sole proprietorship is related to the fact that the amount of equity capital that can be raised to finance the business is limited to the owner's personal wealth. The government is not a stakeholder and does not want the firm to pay taxes. (TRUE or FALSE?) A firm is profitable when it fails to generate sufficient cash inflows to pay operating expenses, creditors, and taxes. True False (TRUE or FALSE?) Financing or capital structure decisions affect the asset side of the balance sheet but not the liability side and are concerned with a firm's longterm investments. True False Ms. Walters want to have $205,000 annual income every year for the next 20 years. If she can earn an average rate of return 11 percent, how much does Ms. Walters need to put down today to have $205,000 annual income every year for the next 20 years? none of the answers is correct $656,671 $397,773 $2,211,378 $1,632,482 Which of the following statements is incorrect? According to the strong-form of the efficient market hypothesis, the market for a security is perfectly informationally efficient if the security's price always reflects all information both public and private. All the answers are correct except one. The most common reason that corporate firms use the futures and options markets is to hedge risk. In a weak-form efficient market, it would be possible to earn abnormally high returns by looking for patterns in security prices. Secondary markets are markets for securities that were previously issued. Which of the following statements is incorrect? Recession occurs when real output from the economy is increasing and unemployment is decreasing. Inflation is the amount by which aggregate price levels rise over time. Pension funds obtain money from employee and employer contributions during the employee's working years, and they provide monthly cash payments upon retirement. All the answers are correct except one. The SEC regulates public securities markets in the United States. ABC Corporation bought a piece of machinery on January 1, 2006 at a cost of $2.3 million, and the machinery is being depreciated annually at an amount of $230,000 for 10 years. Its market value on December 31,2008 is $1.75 million. The firm's accountant is preparing its financial statement for the fiscal year end on December 31,2008 . The asset's value should be recognized on the balance sheet at $2.3 million. $1.75 million. $230,000. \$1.61 million. none of the answers is correct. At the end of the current fiscal year, Western Corporation had net working capital of $157,903. The company showed accounts payables of $94,233, accounts receivables of $83,112, inventory of $171,284, and cash and marketable securities of $12,311. What amount of notes payables does the firm have? $26,882 none of the answers is correct. $19,543 $15,471 $14,571