Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements is MOST CORRECT? Select one a A CEO who is about to exercise a million dollars in stock options and

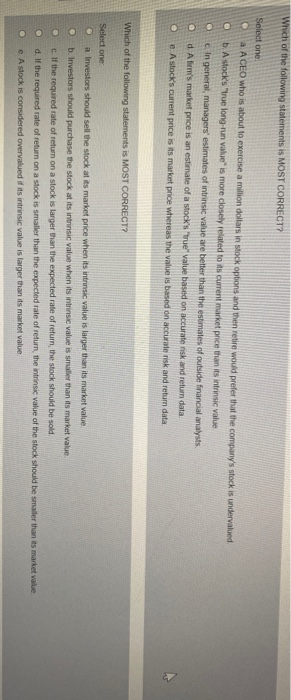

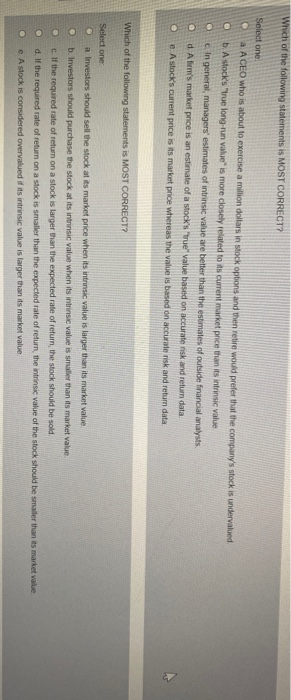

Which of the following statements is MOST CORRECT? Select one a A CEO who is about to exercise a million dollars in stock options and then retire would prefer that the company's stock is undervalued b. A stock's "True long-run value is more closely related to its current market price than its intrinsic value c. In general managers' estimates of intrinsic value are better than the estimates of outside financial analysts d Afirm's market price is an estimate of a stock's "true" value based on accurate risk and return data e. A stock's current price is its market price whereas the value is based on accurate risk and return data Which of the following statements is MOST CORRECT? @ Select one a Investors should sell the stock at its market price when its intrinsic value is larger than its market value b. Investors should purchase the stock at its intrinsic value when its intrinsic value is smaller than its market value c. If the required rate of return on a stock is larger than the expected rate of return, the stock should be sold d. If the required rate of return on a stock is smaller than the expected rate of return the intrinsic value of the stock should be smaller than its market value e Astock is considered overvalued if its intrinsic value is larger than its market value

Which of the following statements is MOST CORRECT? Select one a A CEO who is about to exercise a million dollars in stock options and then retire would prefer that the company's stock is undervalued b. A stock's "True long-run value is more closely related to its current market price than its intrinsic value c. In general managers' estimates of intrinsic value are better than the estimates of outside financial analysts d Afirm's market price is an estimate of a stock's "true" value based on accurate risk and return data e. A stock's current price is its market price whereas the value is based on accurate risk and return data Which of the following statements is MOST CORRECT? @ Select one a Investors should sell the stock at its market price when its intrinsic value is larger than its market value b. Investors should purchase the stock at its intrinsic value when its intrinsic value is smaller than its market value c. If the required rate of return on a stock is larger than the expected rate of return, the stock should be sold d. If the required rate of return on a stock is smaller than the expected rate of return the intrinsic value of the stock should be smaller than its market value e Astock is considered overvalued if its intrinsic value is larger than its market value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started