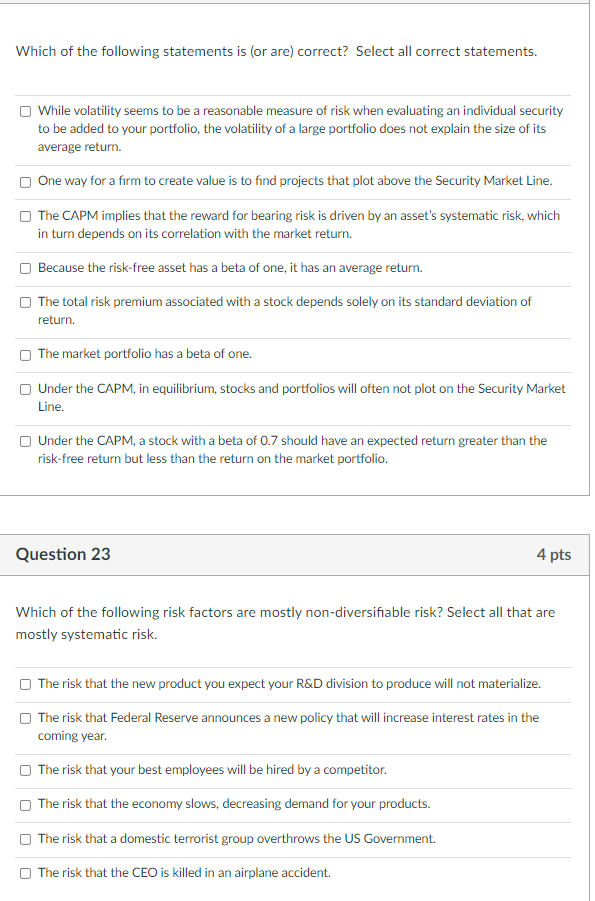

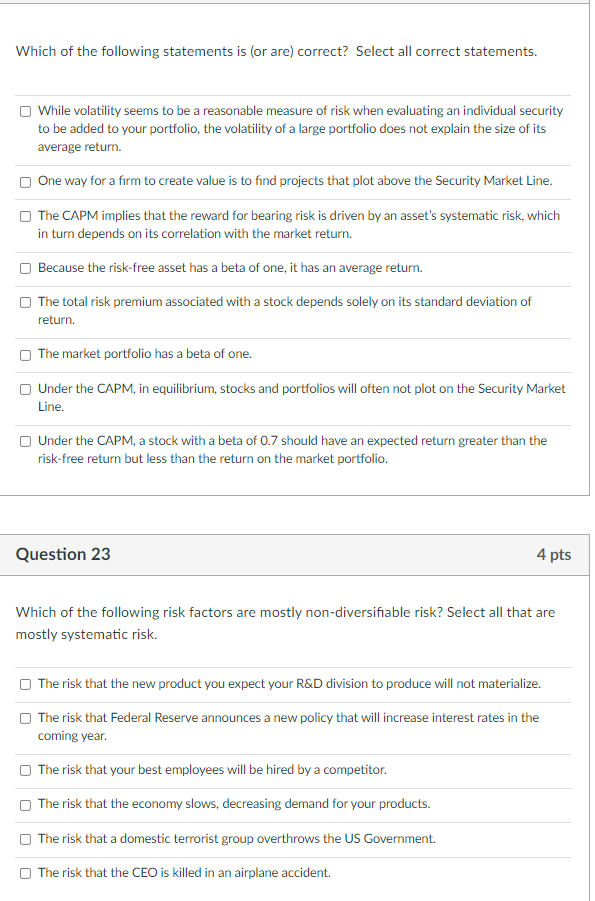

Which of the following statements is (or are) correct? Select all correct statements. While volatility seems to be a reasonable measure of risk when evaluating an individual security to be added to your portfolio, the volatility of a large portfolio does not explain the size of its average return One way for a firm to create value is to find projects that plot above the Security Market Line. The CAPM implies that the reward for bearing risk is driven by an asset's systematic risk, which in turn depends on its correlation with the market return. Because the risk-free asset has a beta of one, it has an average return. The total risk premium associated with a stock depends solely on its standard deviation of return. The market portfolio has a beta of one. Under the CAPM, in equilibrium, stocks and portfolios will often not plot on the Security Market Line. Under the CAPM, a stock with a beta of 0.7 should have an expected return greater than the risk-free return but less than the return on the market portfolio. Question 23 4 pts Which of the following risk factors are mostly non-diversifiable risk? Select all that are mostly systematic risk. The risk that the new product you expect your R&D division to produce will not materialize. The risk that Federal Reserve announces a new policy that will increase interest rates in the coming year. The risk that your best employees will be hired by a competitor. The risk that the economy slows, decreasing demand for your products. The risk that a domestic terrorist group overthrows the US Government. The risk that the CEO is killed in an airplane accident. Which of the following statements is (or are) correct? Select all correct statements. While volatility seems to be a reasonable measure of risk when evaluating an individual security to be added to your portfolio, the volatility of a large portfolio does not explain the size of its average return One way for a firm to create value is to find projects that plot above the Security Market Line. The CAPM implies that the reward for bearing risk is driven by an asset's systematic risk, which in turn depends on its correlation with the market return. Because the risk-free asset has a beta of one, it has an average return. The total risk premium associated with a stock depends solely on its standard deviation of return. The market portfolio has a beta of one. Under the CAPM, in equilibrium, stocks and portfolios will often not plot on the Security Market Line. Under the CAPM, a stock with a beta of 0.7 should have an expected return greater than the risk-free return but less than the return on the market portfolio. Question 23 4 pts Which of the following risk factors are mostly non-diversifiable risk? Select all that are mostly systematic risk. The risk that the new product you expect your R&D division to produce will not materialize. The risk that Federal Reserve announces a new policy that will increase interest rates in the coming year. The risk that your best employees will be hired by a competitor. The risk that the economy slows, decreasing demand for your products. The risk that a domestic terrorist group overthrows the US Government. The risk that the CEO is killed in an airplane accident