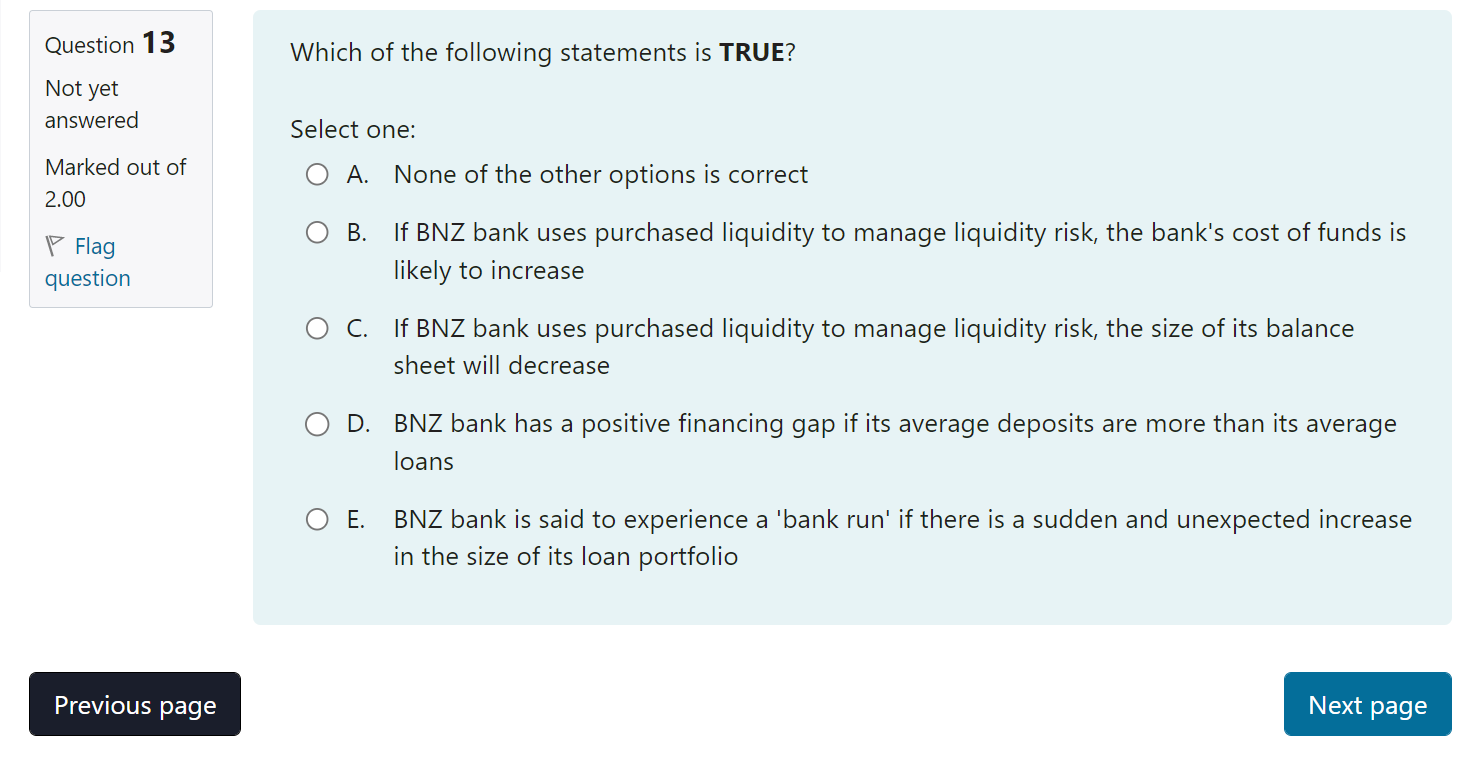

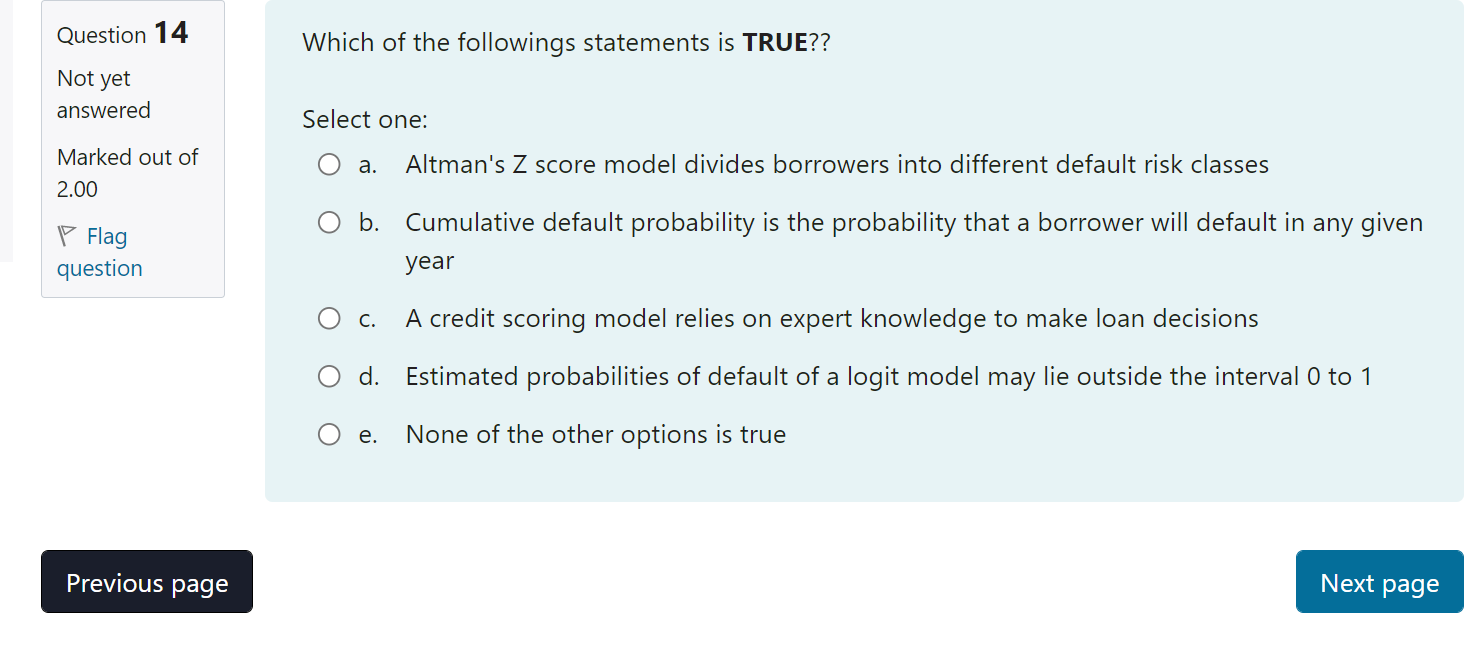

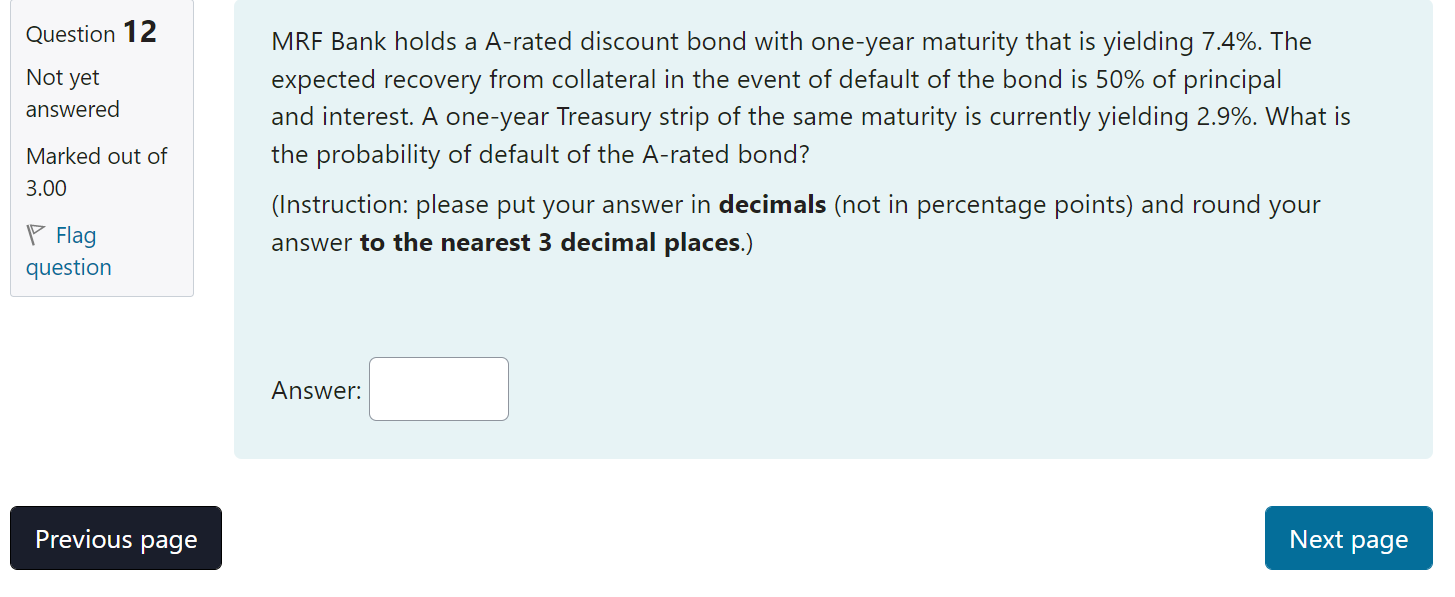

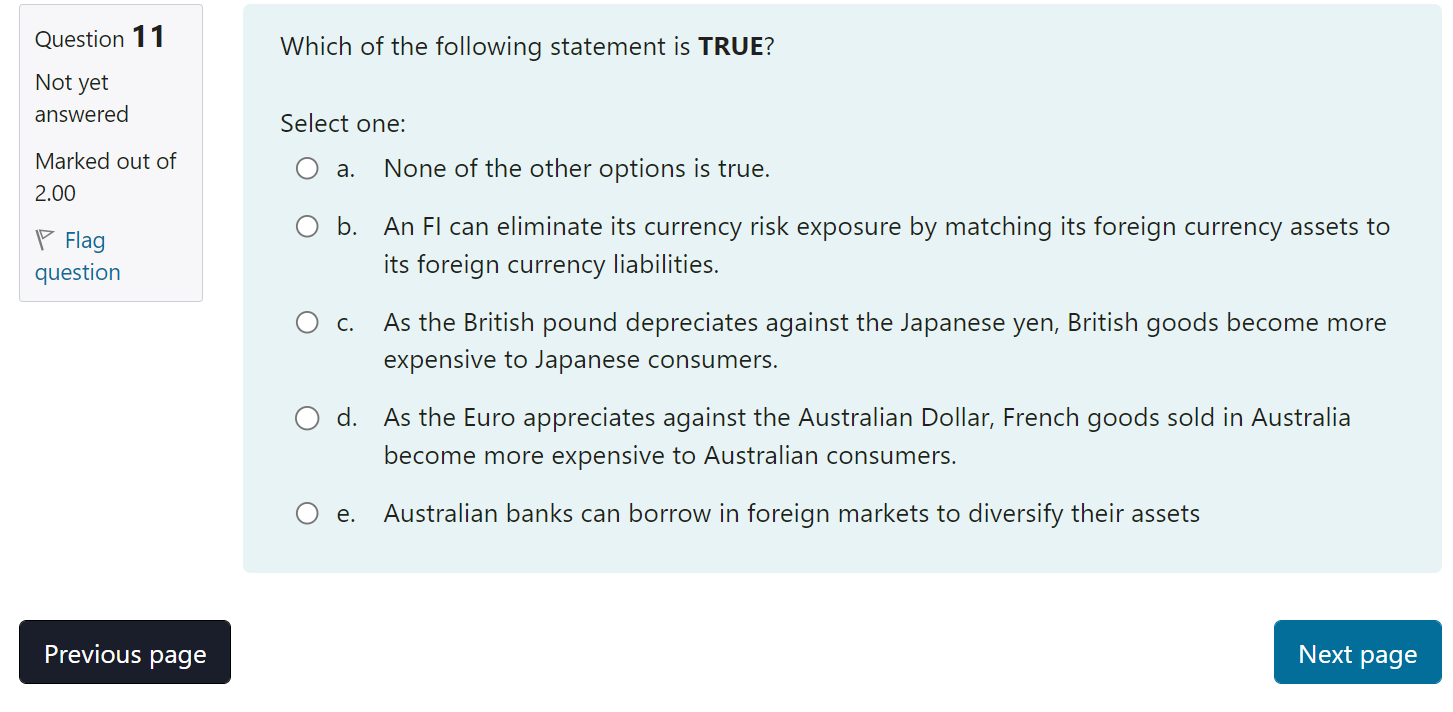

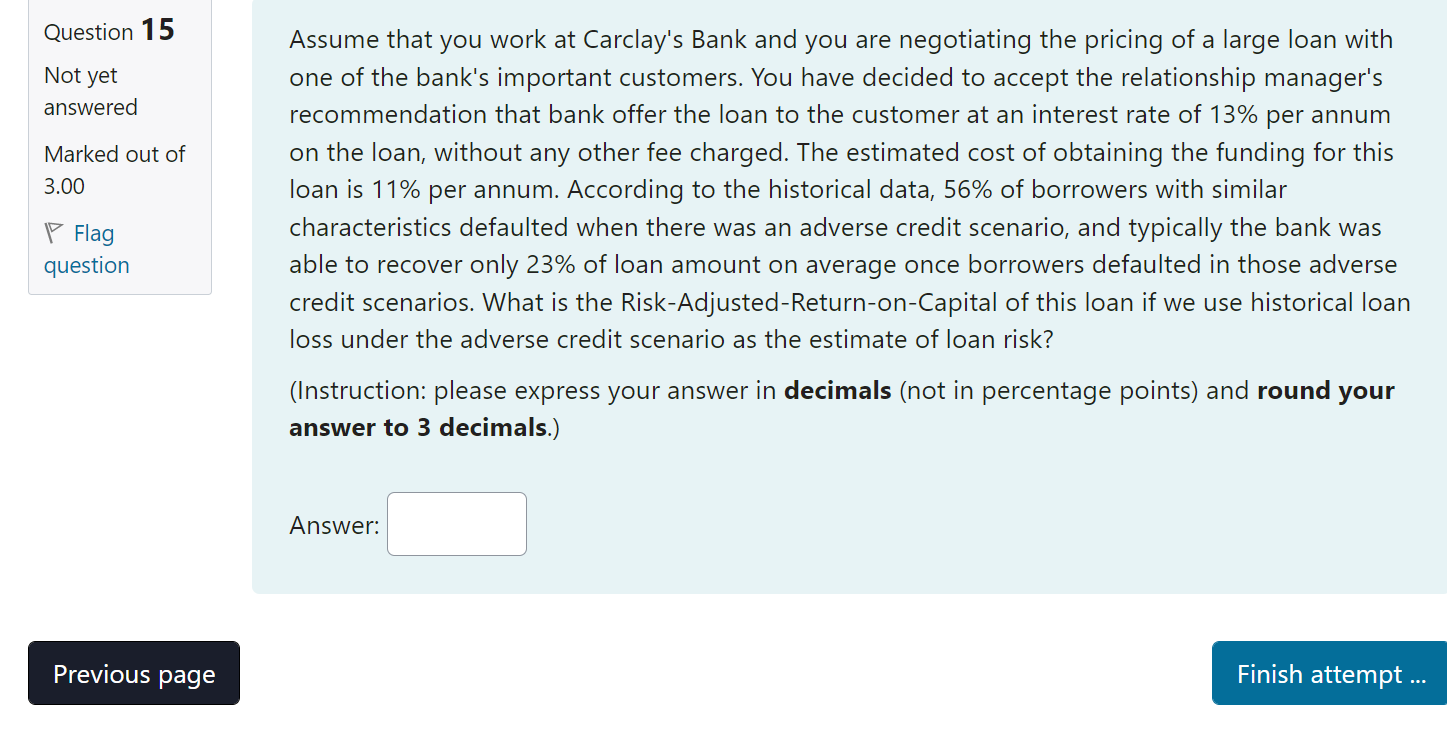

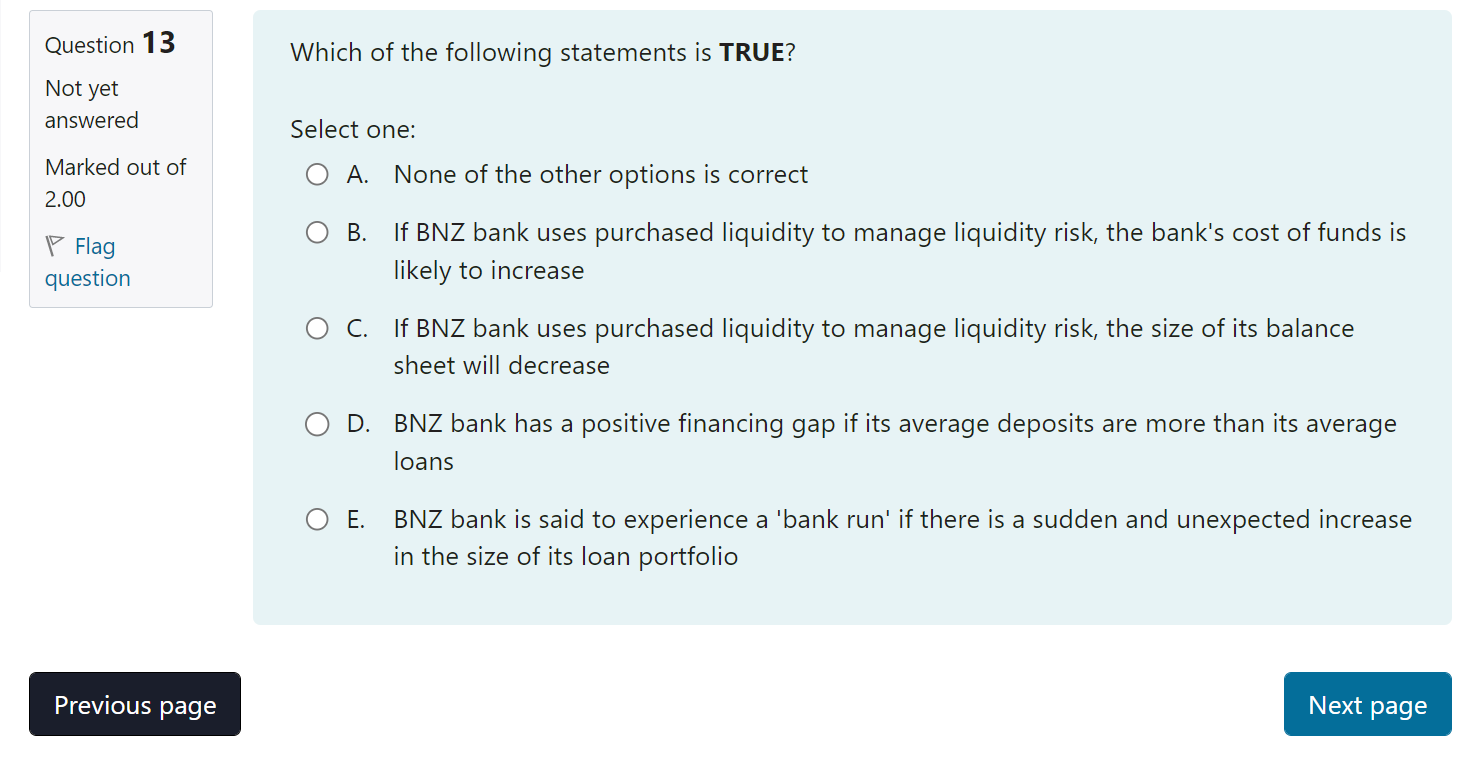

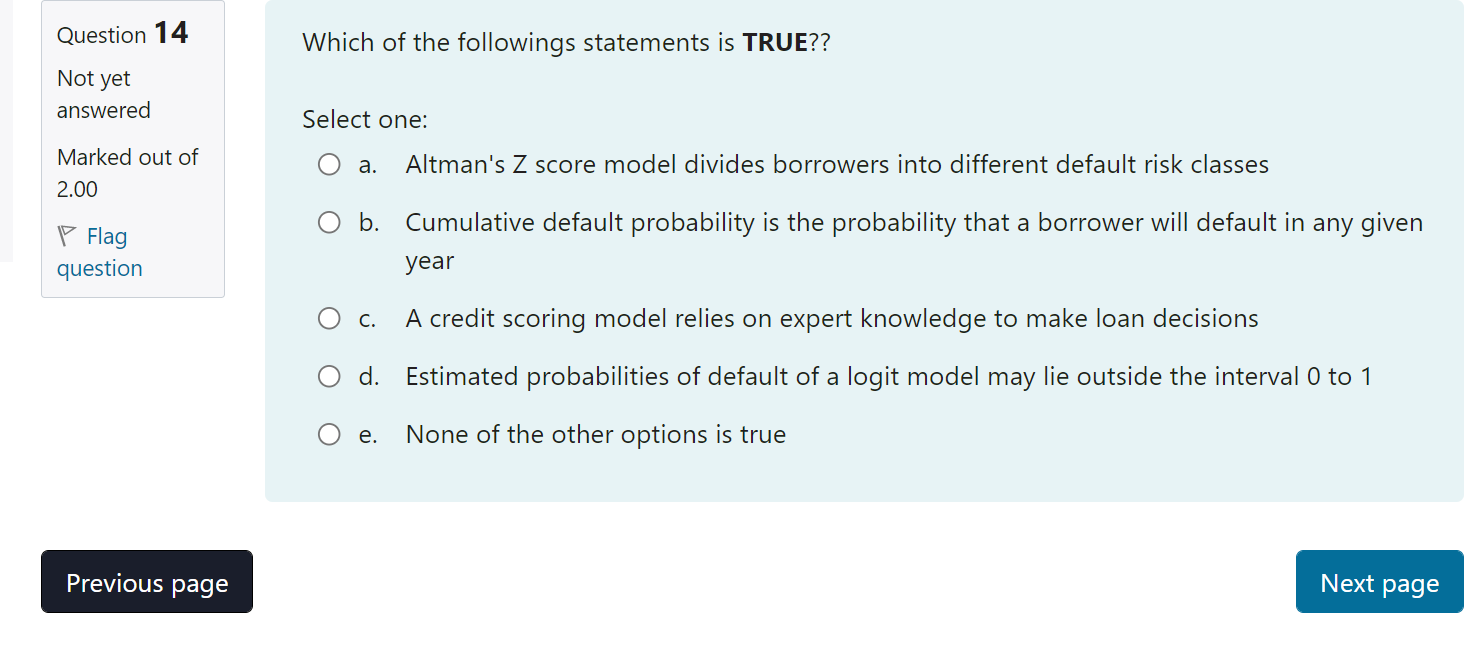

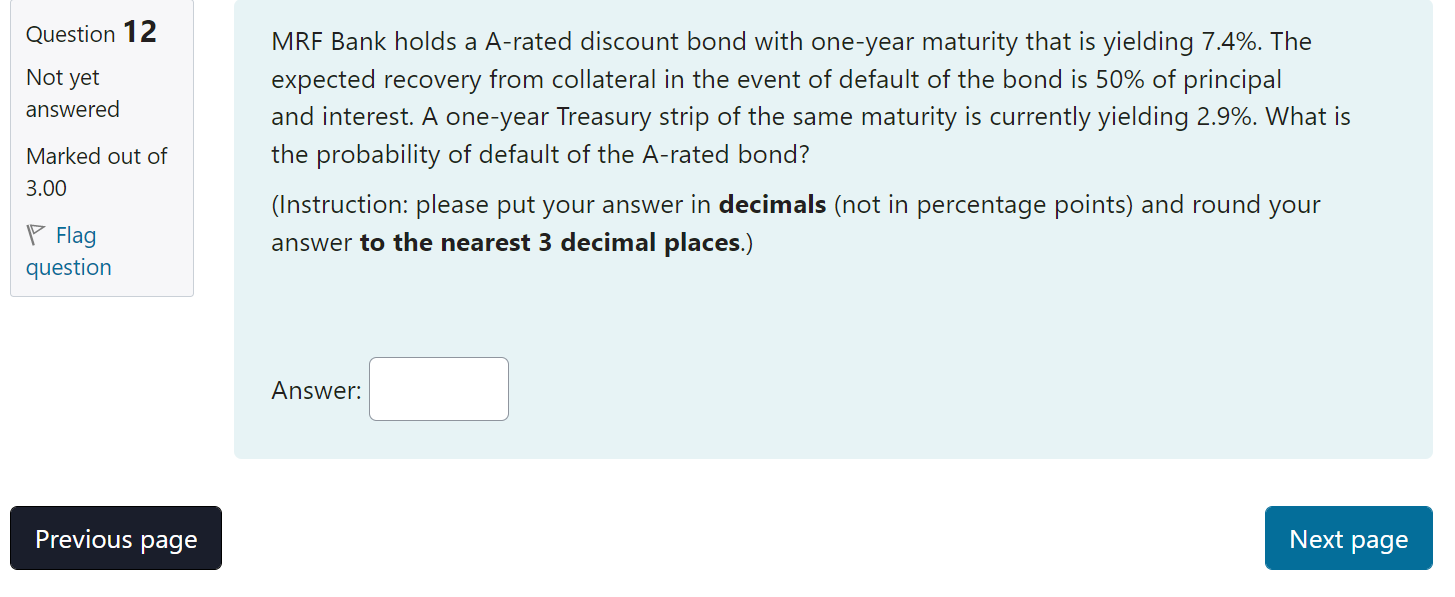

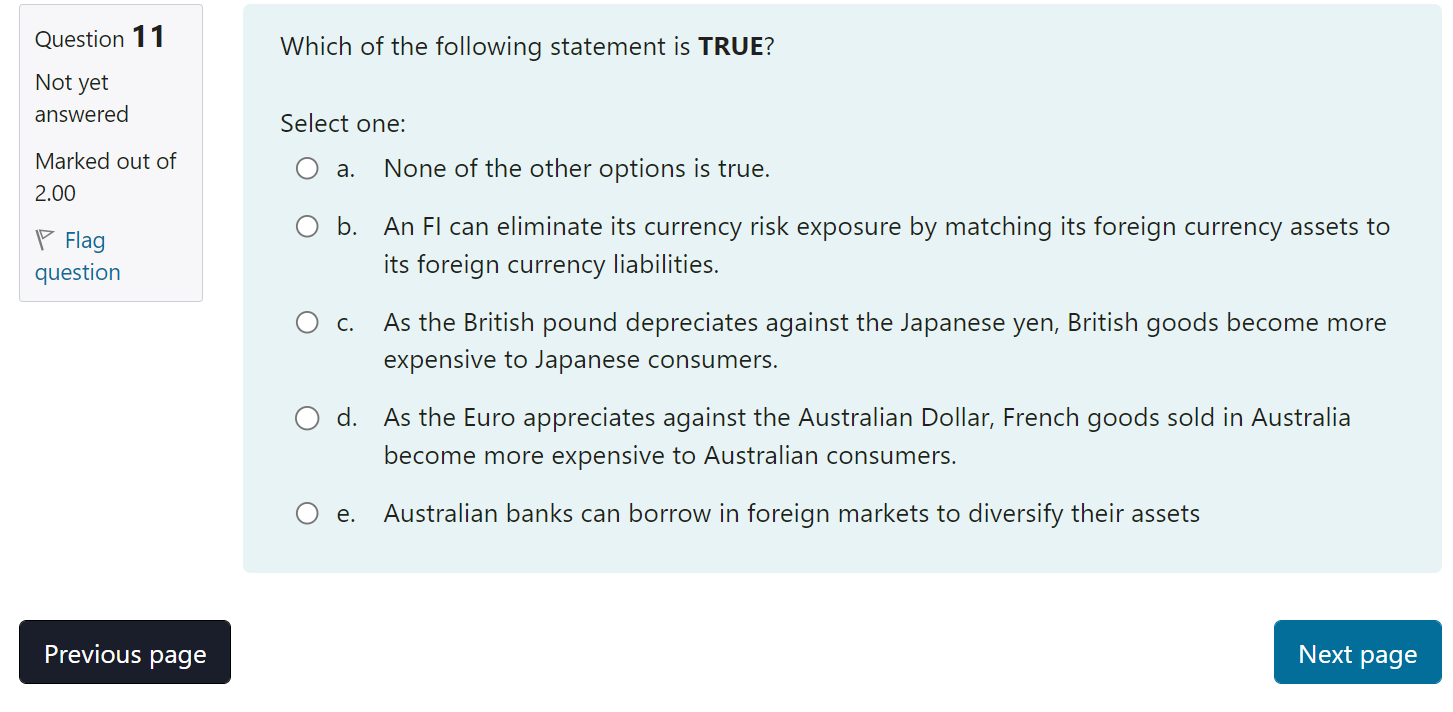

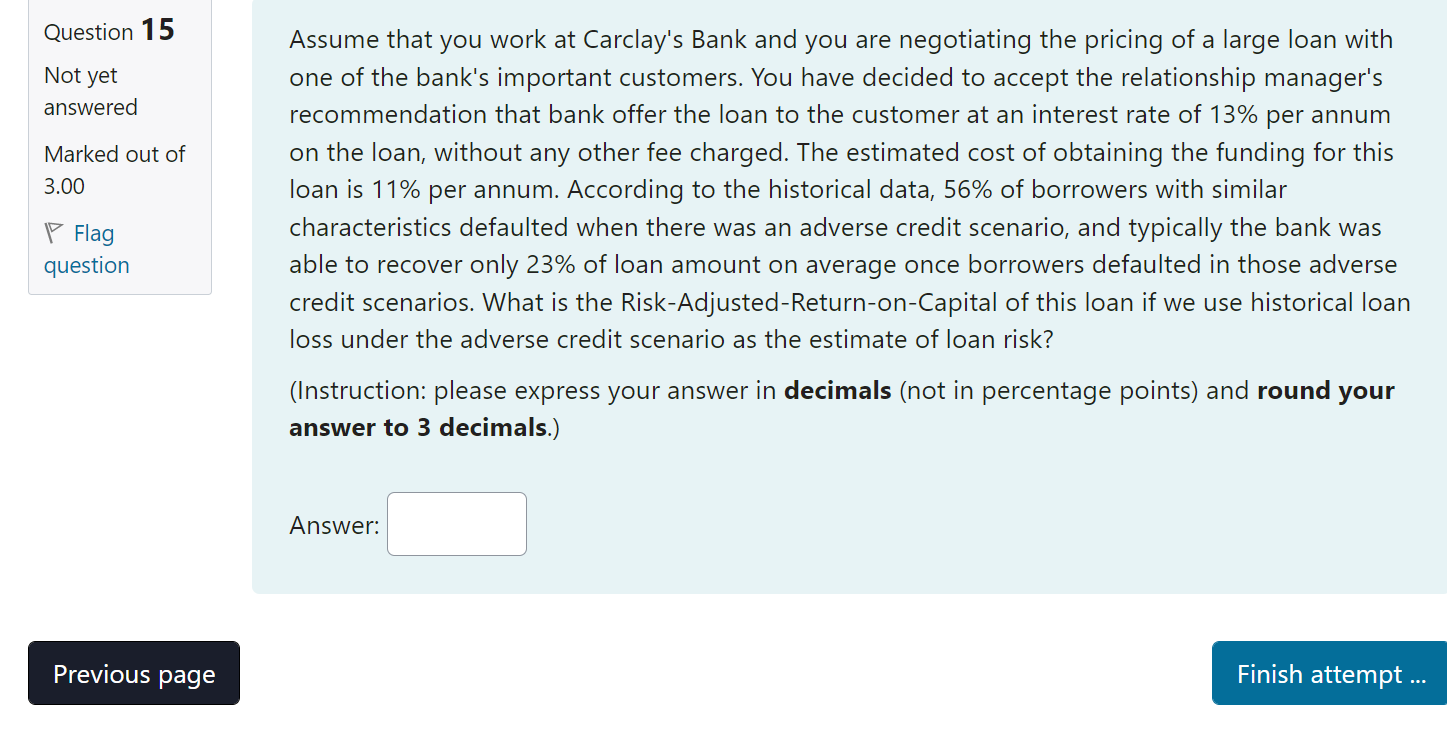

Which of the following statements is TRUE? Select one: A. None of the other options is correct B. If BNZ bank uses purchased liquidity to manage liquidity risk, the bank's cost of funds is likely to increase C. If BNZ bank uses purchased liquidity to manage liquidity risk, the size of its balance sheet will decrease D. BNZ bank has a positive financing gap if its average deposits are more than its average loans E. BNZ bank is said to experience a 'bank run' if there is a sudden and unexpected increase in the size of its loan portfolio Question 14 Which of the followings statements is TRUE?? Not yet Select one: Marked out of a. Altman's Z score model divides borrowers into different default risk classes 2.00 b. Cumulative default probability is the probability that a borrower will default in any given P Flag year c. A credit scoring model relies on expert knowledge to make loan decisions d. Estimated probabilities of default of a logit model may lie outside the interval 0 to 1 e. None of the other options is true \begin{tabular}{l|l} Question 12 & MRF Bank holds a A-rated discount bond with one-year maturity that is yielding 7.4%. The \\ Not yet & expected recovery from collateral in the event of default of the bond is 50% of principal \\ answered & and interest. A one-year Treasury strip of the same maturity is currently yielding 2.9%. What is \\ Marked out of & the probability of default of the A-rated bond? \\ 3.00 & (Instruction: please put your answer in decimals (not in percentage points) and round your \\ \hline Flag & answer to the nearest 3 decimal places.) \\ question & \end{tabular} Answer: Which of the following statement is TRUE? Select one: a. None of the other options is true. b. An FI can eliminate its currency risk exposure by matching its foreign currency assets to its foreign currency liabilities. c. As the British pound depreciates against the Japanese yen, British goods become more expensive to Japanese consumers. d. As the Euro appreciates against the Australian Dollar, French goods sold in Australia become more expensive to Australian consumers. e. Australian banks can borrow in foreign markets to diversify their assets Question 15 Assume that you work at Carclay's Bank and you are negotiating the pricing of a large loan with Not yet one of the bank's important customers. You have decided to accept the relationship manager's answered recommendation that bank offer the loan to the customer at an interest rate of 13% per annum Marked out of 3.00 on the loan, without any other fee charged. The estimated cost of obtaining the funding for this loan is 11% per annum. According to the historical data, 56% of borrowers with similar characteristics defaulted when there was an adverse credit scenario, and typically the bank was able to recover only 23% of loan amount on average once borrowers defaulted in those adverse credit scenarios. What is the Risk-Adjusted-Return-on-Capital of this loan if we use historical loan loss under the adverse credit scenario as the estimate of loan risk? (Instruction: please express your answer in decimals (not in percentage points) and round your answer to 3 decimals.) Answer: Which of the following statements is TRUE? Select one: A. None of the other options is correct B. If BNZ bank uses purchased liquidity to manage liquidity risk, the bank's cost of funds is likely to increase C. If BNZ bank uses purchased liquidity to manage liquidity risk, the size of its balance sheet will decrease D. BNZ bank has a positive financing gap if its average deposits are more than its average loans E. BNZ bank is said to experience a 'bank run' if there is a sudden and unexpected increase in the size of its loan portfolio Question 14 Which of the followings statements is TRUE?? Not yet Select one: Marked out of a. Altman's Z score model divides borrowers into different default risk classes 2.00 b. Cumulative default probability is the probability that a borrower will default in any given P Flag year c. A credit scoring model relies on expert knowledge to make loan decisions d. Estimated probabilities of default of a logit model may lie outside the interval 0 to 1 e. None of the other options is true \begin{tabular}{l|l} Question 12 & MRF Bank holds a A-rated discount bond with one-year maturity that is yielding 7.4%. The \\ Not yet & expected recovery from collateral in the event of default of the bond is 50% of principal \\ answered & and interest. A one-year Treasury strip of the same maturity is currently yielding 2.9%. What is \\ Marked out of & the probability of default of the A-rated bond? \\ 3.00 & (Instruction: please put your answer in decimals (not in percentage points) and round your \\ \hline Flag & answer to the nearest 3 decimal places.) \\ question & \end{tabular} Answer: Which of the following statement is TRUE? Select one: a. None of the other options is true. b. An FI can eliminate its currency risk exposure by matching its foreign currency assets to its foreign currency liabilities. c. As the British pound depreciates against the Japanese yen, British goods become more expensive to Japanese consumers. d. As the Euro appreciates against the Australian Dollar, French goods sold in Australia become more expensive to Australian consumers. e. Australian banks can borrow in foreign markets to diversify their assets Question 15 Assume that you work at Carclay's Bank and you are negotiating the pricing of a large loan with Not yet one of the bank's important customers. You have decided to accept the relationship manager's answered recommendation that bank offer the loan to the customer at an interest rate of 13% per annum Marked out of 3.00 on the loan, without any other fee charged. The estimated cost of obtaining the funding for this loan is 11% per annum. According to the historical data, 56% of borrowers with similar characteristics defaulted when there was an adverse credit scenario, and typically the bank was able to recover only 23% of loan amount on average once borrowers defaulted in those adverse credit scenarios. What is the Risk-Adjusted-Return-on-Capital of this loan if we use historical loan loss under the adverse credit scenario as the estimate of loan risk? (Instruction: please express your answer in decimals (not in percentage points) and round your answer to 3 decimals.)