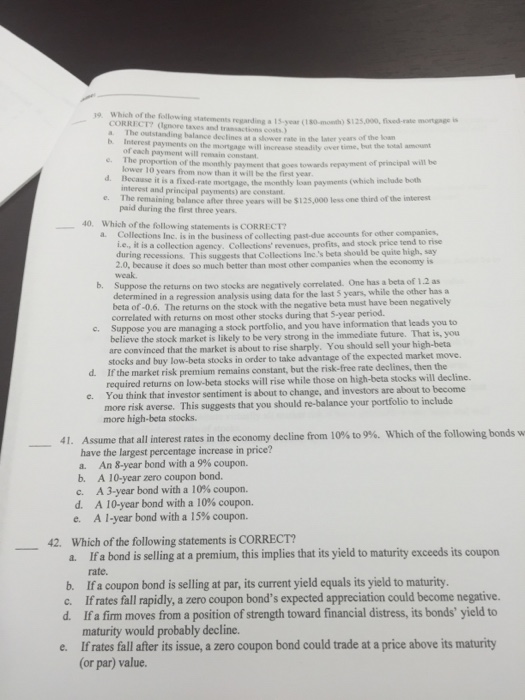

Which of the following statements regarding a 15-year (180-month) $125,000, fixed-rate mortgage is CORRECT? (Ignore taxes and transactions costs.) The outstanding balance declines at a slower rate in the later years of the loan. Interest payments on the mortgage will increase steadily over time, but the total amount of each payment will remain constant. The preparation of the monthly payment that goes towards repayment of principal will be lower 10 years from now than it will be the first year. Because it is a fixed-rate mortgage, the monthly loan payments (which include both interest and principal payments) are constant. The remaining balance after three years will be $125, 000 less one third of the interest paid during the first three years. Which of the following statements is CORRECT? Collection Inc, is in the business of collecting past-due accounts for other companies, i.e., it is a collection agency. Collection revenues, profits, and stock price tend to rise during recessions. This suggests that Collections Inc.'s beta should be quite high, say 2.0, because it does so much better than most other companies when the economy is weak. Suppose the returns on two stocks are negatively correlated. One has a beta of 1.2 as determined in a regression analysis using data for the last 5 years, while the other has a beta of -0.6. The returns on the stock with the negative beta must have been negatively correlated with returns on most other stocks during that 5-year period. Suppose you are managing a stock portfolio, and you have information that leads you to believe the stock market is likely to be very strong in the immediate future. That is, you are convinced that the market is about to rise sharply. You should sell your high-beta stocks and buy low-beta stocks in order to take advantage of the expected market move. If the market risk premium remains constant, but the risk-free rate declines, then the required returns on low-beta stocks will rise while those on high-beta stocks will decline. You think that investor sentiment is about to change, and investors are about to become more risk averse. This suggests that you should re-balance your portfolio to include more high-beta stocks. Assume that all interest rates in the economy decline from 10% to 9%. Which of the following bonds would have the largest percentage increase in price? An 8-year bend with a 9% coupon. A 10-year zero coupon bond. A 3-year bond with a 10% coupon. A 10-year bond with a 10% coupon. A 1-year bond with a 15% coupon. Which of the following statements is CORRECT? If a bond is selling at a premium, this implies that its yield to maturity exceeds its coupon rate. If a coupon bond is selling at par, its current yield equals its yield to maturity. If rates fall rapidly, a zero coupon bond's expected appreciation could become negative. If a firm moves from a position of strength toward financial distress, its bonds' yield to maturity would probably decline. If rates fall after its issue, a zero coupon bond could trade at a price above its maturity (or par) value