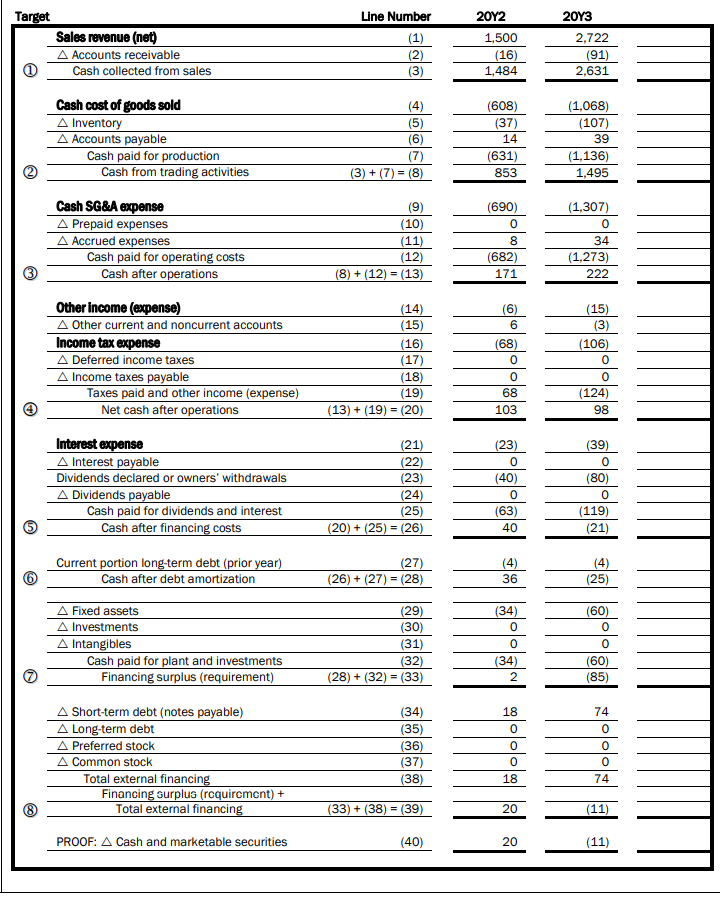

Which of the following statements regarding Muebles Mexicanos 20Y3 borrowing needs is correct?

Dividend payments were not a significant borrowing cause. There were no dividend payments. Dividend payments were a significant borrowing cause. There is not enough information to determine the impact of dividend payments.

(Note: expected for right answer with justification)

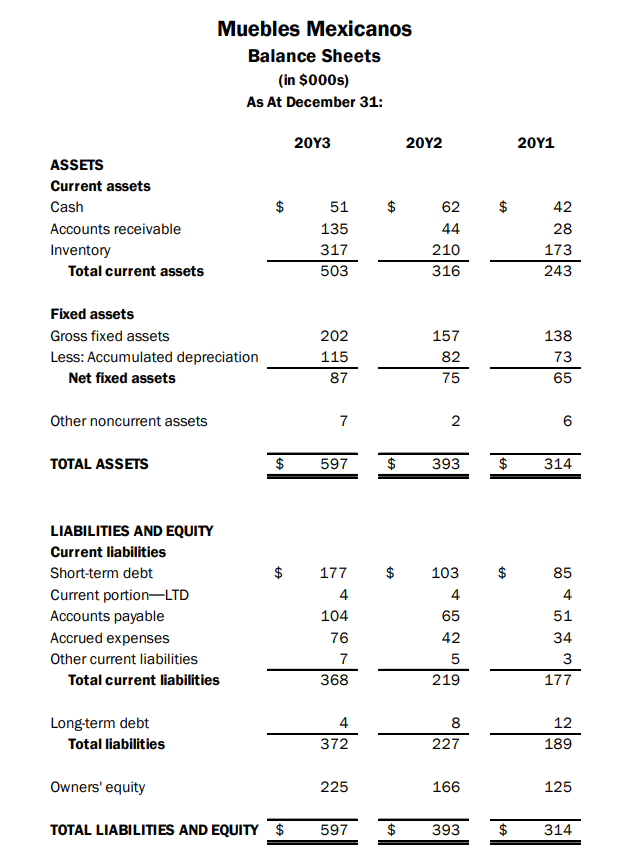

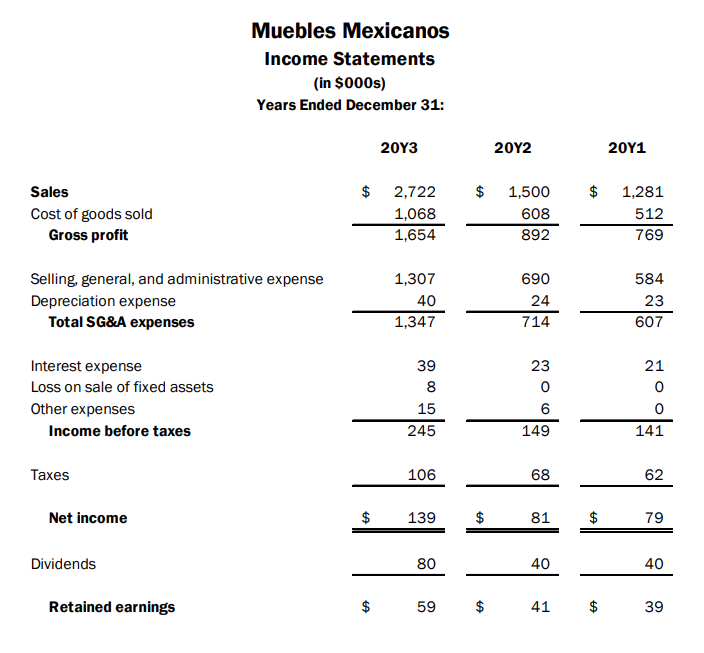

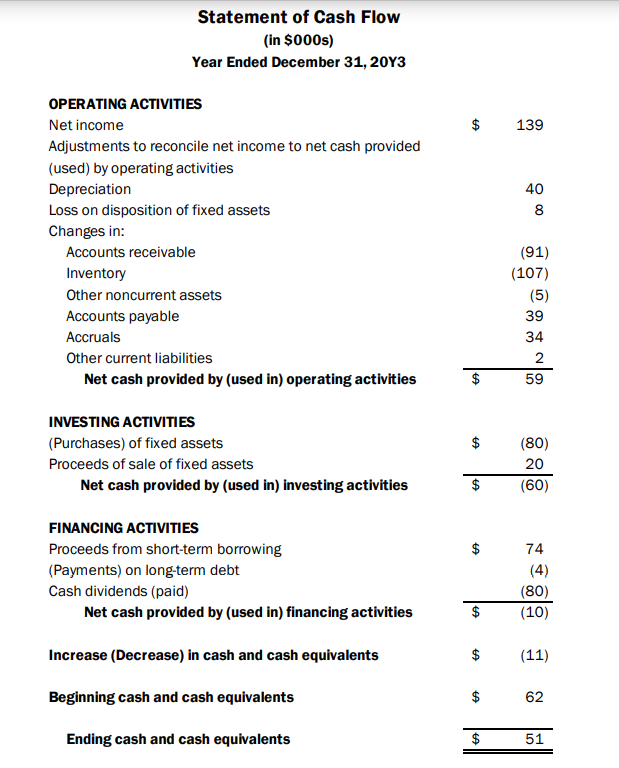

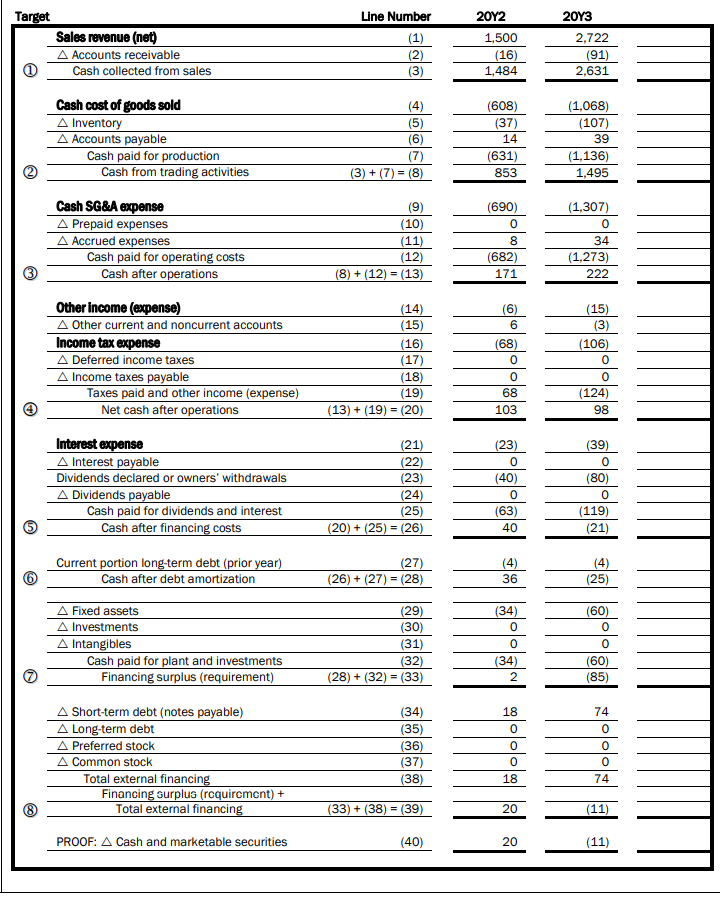

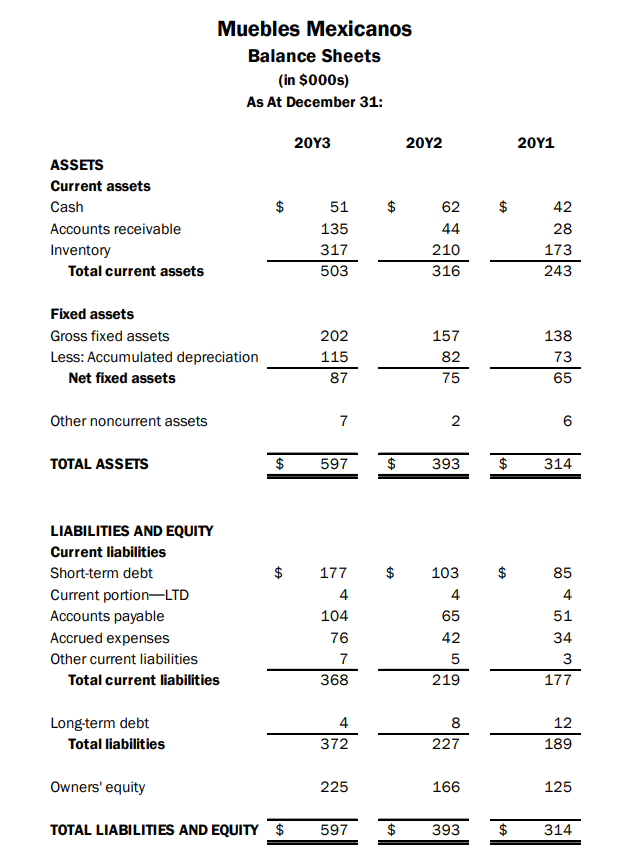

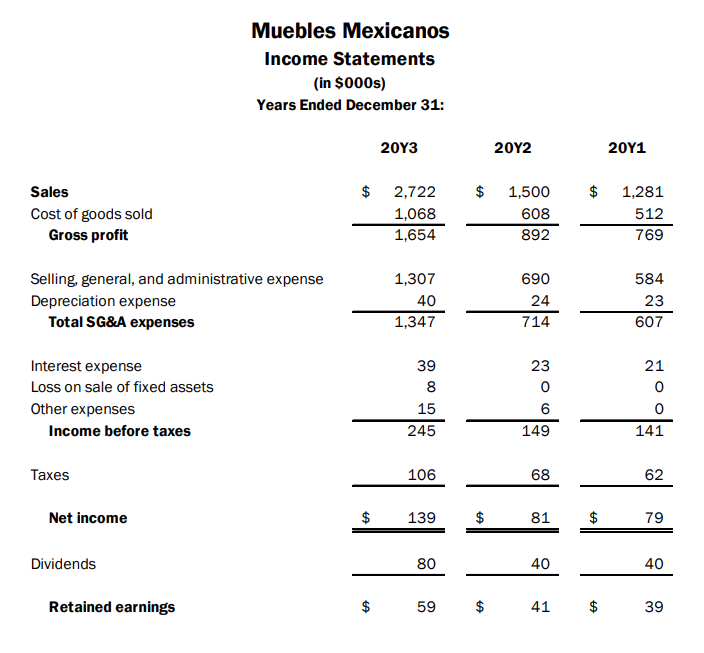

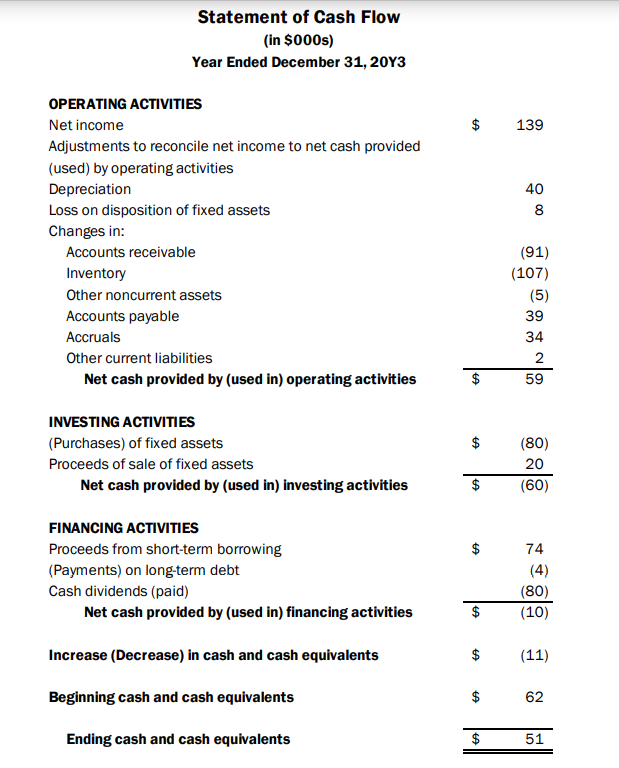

Muebles Mexicanos Balance Sheets (in $000s) As At December 31: 2093 20Y2 20Y1 $ ASSETS Current assets Cash Accounts receivable Inventory Total current assets 51 135 317 503 62 44 210 316 42 28 173 243 Fixed assets Gross fixed assets Less: Accumulated depreciation Net fixed assets 202 115 87 157 82 75 138 73 65 Other noncurrent assets 7 2 0) TOTAL ASSETS $ 597 $ 393 $ 314 $ $ $ 103 4 LIABILITIES AND EQUITY Current liabilities Short-term debt Current portionLTD Accounts payable Accrued expenses Other current liabilities Total current liabilities 65 177 4 104 76 7 368 85 4 51 34 3 177 42 5 219 12 Long-term debt Total liabilities 4 372 8 227 189 Owners' equity 225 166 125 TOTAL LIABILITIES AND EQUITY $ 597 $ 393 $ 314 Muebles Mexicanos Income Statements (in $000s) Years Ended December 31: 2013 20Y2 20Y1 $ $ $ Sales Cost of goods sold Gross profit 2,722 1,068 1,654 1,500 608 892 1,281 512 769 Selling, general, and administrative expense Depreciation expense Total SG&A expenses 1,307 40 1,347 690 24 714 584 23 607 39 Interest expense Loss on sale of fixed assets Other expenses Income before taxes 8 15 245 23 0 6 149 21 0 0 141 Taxes 106 68 62 Net income $ $ 139 $ $ 81 $ 79 Dividends 80 40 40 Retained earnings $ $ 59 $ 41 $ 39 Statement of Cash Flow (in $000s) Year Ended December 31, 20Y3 $ 139 40 8 OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided (used) by operating activities Depreciation Loss on disposition of fixed assets Changes in: Accounts receivable Inventory Other noncurrent assets Accounts payable Accruals Other current liabilities Net cash provided by (used in) operating activities (91) (107) (5) 39 34 2 59 $ INVESTING ACTIVITIES (Purchases) of fixed assets Proceeds of sale of fixed assets Net cash provided by (used in) investing activities (80) 20 (60) FINANCING ACTIVITIES Proceeds from short-term borrowing (Payments) on long-term debt Cash dividends (paid) Net cash provided by (used in) financing activities 74 (4) (80) (10) Increase (Decrease) in cash and cash equivalents $ (11) Beginning cash and cash equivalents $ 62 Ending cash and cash equivalents $ 51 Target Sales revenue (net) A Accounts receivable Cash collected from sales Line Number (1) (2) (3) 2012 1,500 (16) 1,484 20Y3 2,722 (91) 2,631 Cash cost of goods sold A Inventory A Accounts payable Cash paid for production Cash from trading activities (4) (5) (6) (7) (3) + (7) = (8) (608) (37) 14 (631) 853 (1,068) (107) 39 (1,136) 1,495 Cash SG&A expense A Prepaid expenses A Accrued expenses Cash paid for operating costs Cash after operations (10) (11) (12) (8) + (12) = (13) (690) 0 8 (682) 171 (1,307) 0 34 (1,273) 222 Other Income (expense) A Other current and noncurrent accounts Income tax expense A Deferred income taxes A Income taxes payable Taxes paid and other income (expense) Net cash after operations (14) (15) (16) (17) (18) (19) (13) + (19) = (20) (6) 6 (68 0 0 68 103 (15) (3) (106) 0 0 (124) 98 Interest expense A Interest payable Dividends declared or owners' withdrawals A Dividends payable Cash paid for dividends and interest Cash after financing costs (21) (22) (23) (24) (25) (20) + (25) = (26) (23) 0 (40) 0 (63) 40 (39) 0 (80) 0 (119) (21) Current portion long-term debt (prior year) Cash after debt amortization (27) (26) + (27) = (28) (4) 36 (4) (25) A Fixed assets A Investments A Intangibles Cash paid for plant and investments Financing surplus (requirement) (29) (30) (31) (32) (28) + (32) = (33) (34) 0 0 (34) 2 (60) 0 0 (60) (85) A Short-term debt (notes payable) A Long-term debt A Preferred stock A Common stock Total external financing Financing surplus (rcquircmcnt) + Total external financing (34) (35) (36) (37) (38) 18 0 0 0 18 74 0 0 0 74 (33) + (38) = (39) 20 (11) PROOF: A Cash and marketable securities (40) 20 (11)