Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following sub-area of finance can help facilitate the capital flows between investors and companies? 1. Investments 2. Financial management 3. Treasury management

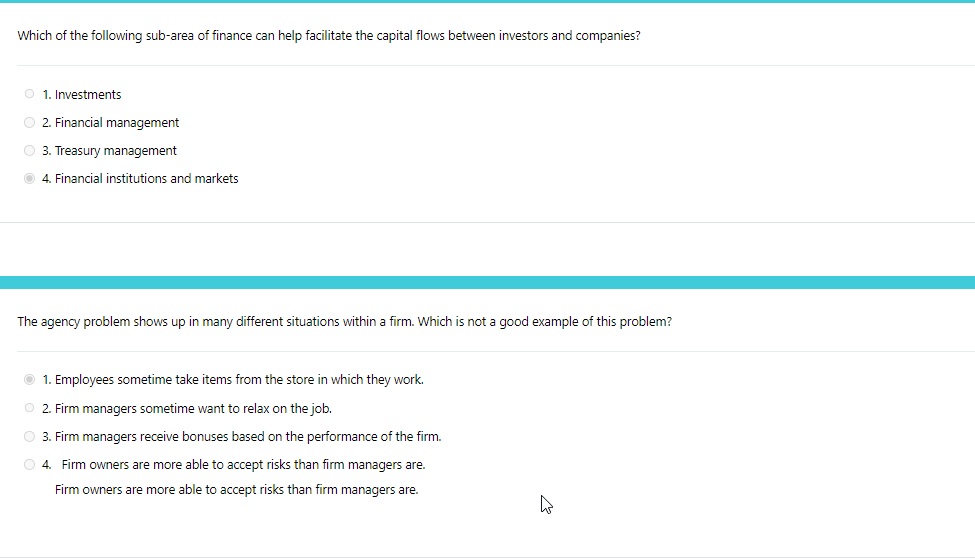

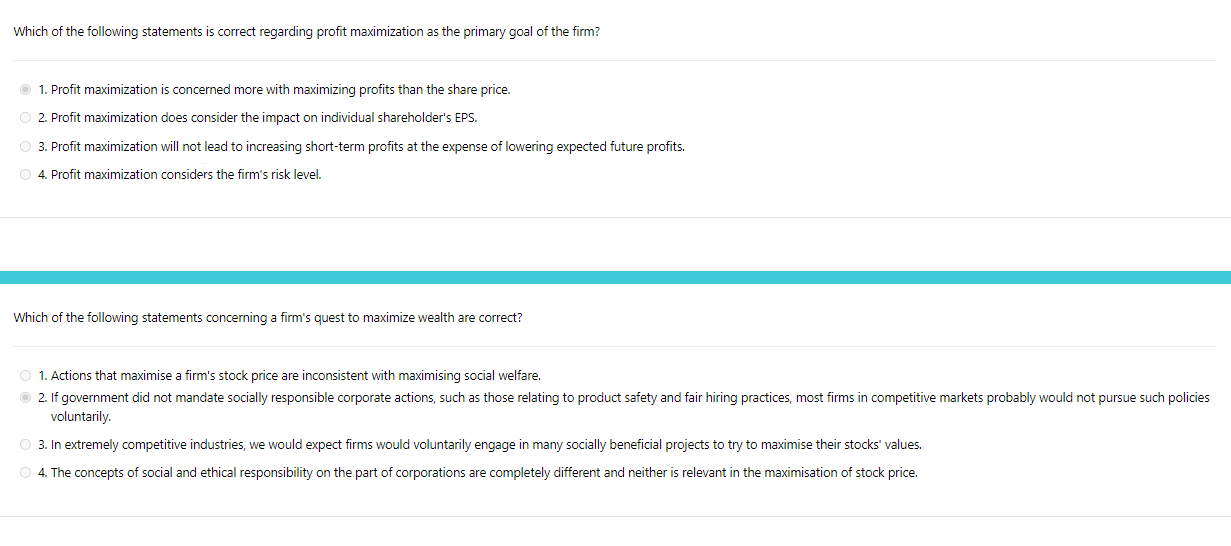

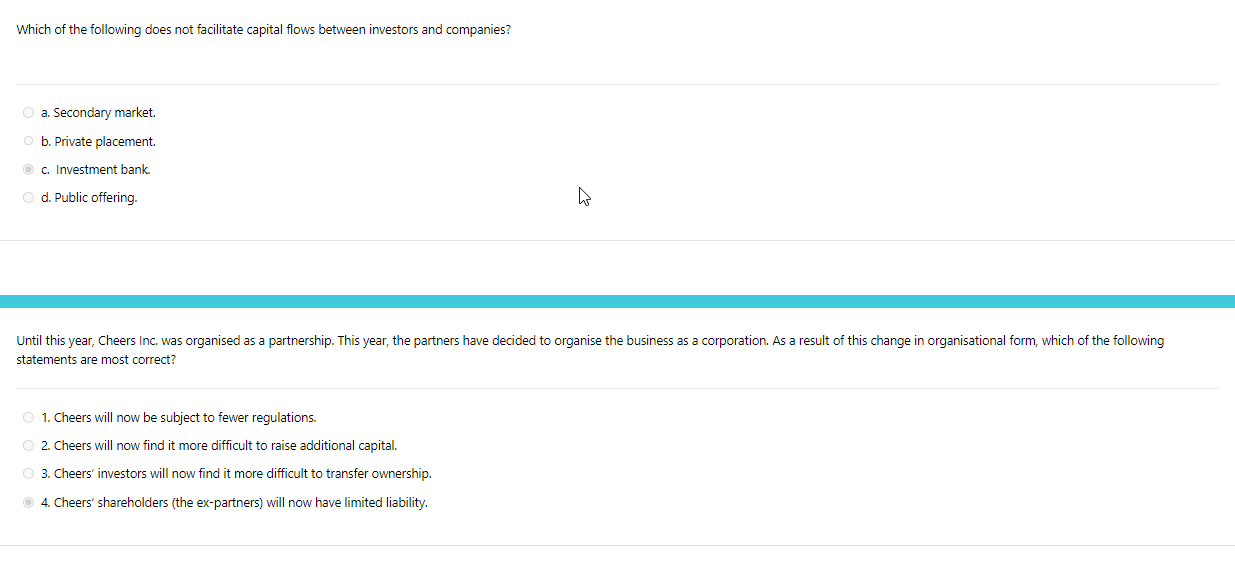

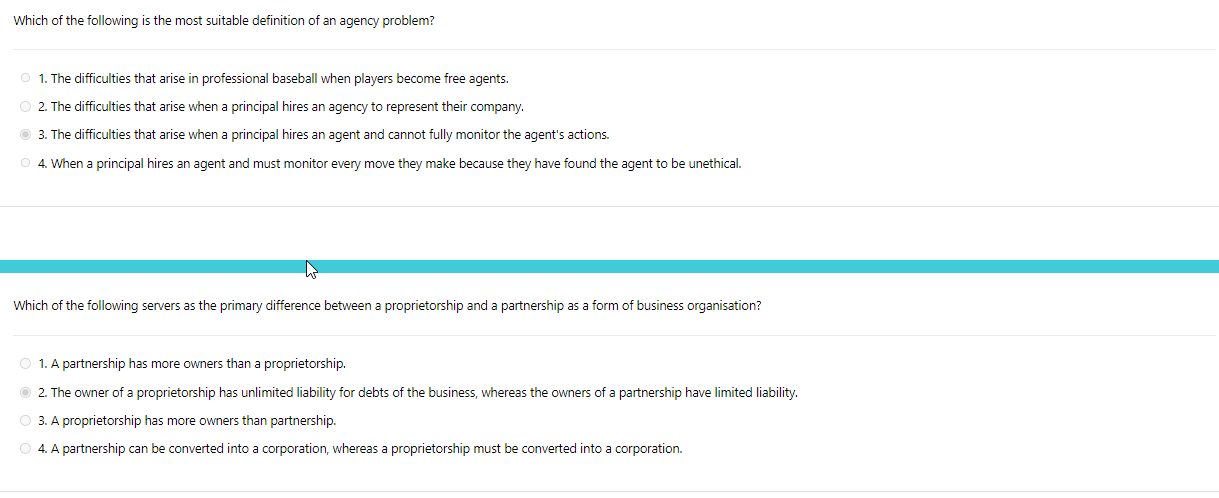

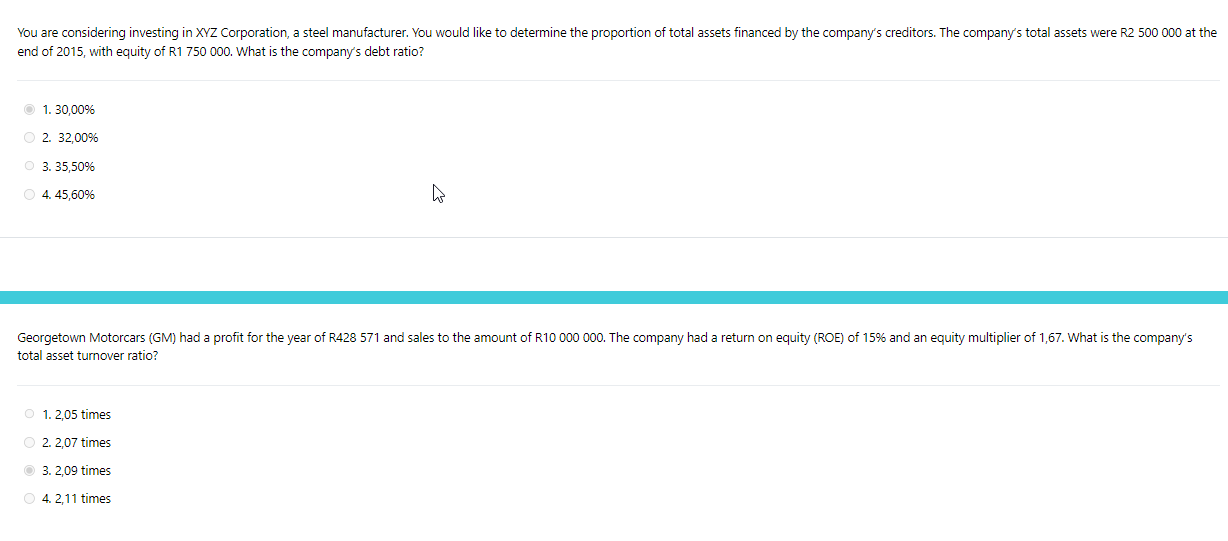

Which of the following sub-area of finance can help facilitate the capital flows between investors and companies? 1. Investments 2. Financial management 3. Treasury management 4. Financial institutions and markets The agency problem shows up in many different situations within a firm. Which is not a good example of this problem? 1. Employees sometime take items from the store in which they work. 2. Firm managers sometime want to relax on the job. 3. Firm managers receive bonuses based on the performance of the firm. 4. Firm owners are more able to accept risks than firm managers are. Firm owners are more able to accept risks than firm managers are. Which of the following statements is correct regarding profit maximization as the primary goal of the firm? 1. Profit maximization is concerned more with maximizing profits than the share price. 2. Profit maximization does consider the impact on individual shareholder's EPS. 3. Profit maximization will not lead to increasing short-term profits at the expense of lowering expected future profits. 4. Profit maximization considers the firm's risk level. Which of the following statements concerning a firm's quest to maximize wealth are correct? 1. Actions that maximise a firm's stock price are inconsistent with maximising social welfare. voluntarily. 3. In extremely competitive industries, we would expect firms would voluntarily engage in many socially beneficial projects to try to maximise their stocks" values. 4. The concepts of social and ethical responsibility on the part of corporations are completely different and neither is relevant in the maximisation of stock price. Which of the following does not facilitate capital flows between investors and companies? a. Secondary market. b. Private placement. c. Investment bank. d. Public offering. statements are most correct? 1. Cheers will now be subject to fewer regulations. 2. Cheers will now find it more difficult to raise additional capital. 3. Cheers' investors will now find it more difficult to transfer ownership. 4. Cheers' shareholders (the ex-partners) will now have limited liability. Which of the following is the most suitable definition of an agency problem? 1. The difficulties that arise in professional baseball when players become free agents. 2. The difficulties that arise when a principal hires an agency to represent their company. 3. The difficulties that arise when a principal hires an agent and cannot fully monitor the agent's actions. 4. When a principal hires an agent and must monitor every move they make because they have found the agent to be unethical. Which of the following servers as the primary difference between a proprietorship and a partnership as a form of business organisation? 1. A partnership has more owners than a proprietorship. 2. The owner of a proprietorship has unlimited liability for debts of the business, whereas the owners of a partnership have limited liability. 3. A proprietorship has more owners than partnership. 4. A partnership can be converted into a corporation, whereas a proprietorship must be converted into a corporation. end of 2015 , with equity of R1 750000 . What is the company's debt ratio? 1. 30,00% 2. 32,00% 3. 35,50% 4. 45,60% total asset turnover ratio? 1. 2,05 times 2. 2,07 times 3. 2,09 times 4. 2,11 times

Which of the following sub-area of finance can help facilitate the capital flows between investors and companies? 1. Investments 2. Financial management 3. Treasury management 4. Financial institutions and markets The agency problem shows up in many different situations within a firm. Which is not a good example of this problem? 1. Employees sometime take items from the store in which they work. 2. Firm managers sometime want to relax on the job. 3. Firm managers receive bonuses based on the performance of the firm. 4. Firm owners are more able to accept risks than firm managers are. Firm owners are more able to accept risks than firm managers are. Which of the following statements is correct regarding profit maximization as the primary goal of the firm? 1. Profit maximization is concerned more with maximizing profits than the share price. 2. Profit maximization does consider the impact on individual shareholder's EPS. 3. Profit maximization will not lead to increasing short-term profits at the expense of lowering expected future profits. 4. Profit maximization considers the firm's risk level. Which of the following statements concerning a firm's quest to maximize wealth are correct? 1. Actions that maximise a firm's stock price are inconsistent with maximising social welfare. voluntarily. 3. In extremely competitive industries, we would expect firms would voluntarily engage in many socially beneficial projects to try to maximise their stocks" values. 4. The concepts of social and ethical responsibility on the part of corporations are completely different and neither is relevant in the maximisation of stock price. Which of the following does not facilitate capital flows between investors and companies? a. Secondary market. b. Private placement. c. Investment bank. d. Public offering. statements are most correct? 1. Cheers will now be subject to fewer regulations. 2. Cheers will now find it more difficult to raise additional capital. 3. Cheers' investors will now find it more difficult to transfer ownership. 4. Cheers' shareholders (the ex-partners) will now have limited liability. Which of the following is the most suitable definition of an agency problem? 1. The difficulties that arise in professional baseball when players become free agents. 2. The difficulties that arise when a principal hires an agency to represent their company. 3. The difficulties that arise when a principal hires an agent and cannot fully monitor the agent's actions. 4. When a principal hires an agent and must monitor every move they make because they have found the agent to be unethical. Which of the following servers as the primary difference between a proprietorship and a partnership as a form of business organisation? 1. A partnership has more owners than a proprietorship. 2. The owner of a proprietorship has unlimited liability for debts of the business, whereas the owners of a partnership have limited liability. 3. A proprietorship has more owners than partnership. 4. A partnership can be converted into a corporation, whereas a proprietorship must be converted into a corporation. end of 2015 , with equity of R1 750000 . What is the company's debt ratio? 1. 30,00% 2. 32,00% 3. 35,50% 4. 45,60% total asset turnover ratio? 1. 2,05 times 2. 2,07 times 3. 2,09 times 4. 2,11 times Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started