Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following taxpayers has only nontaxable income? A)Dale received workers' compensation, a cash gift from his father, and a rebate from an office

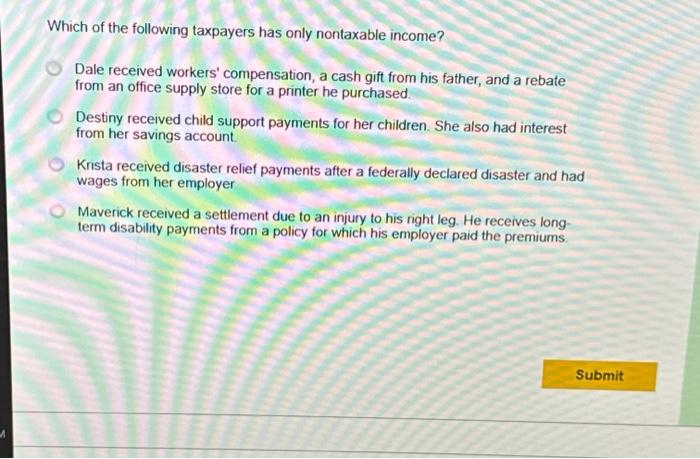

Which of the following taxpayers has only nontaxable income?

A)Dale received workers' compensation, a cash gift from his father, and a rebate from an office supply store for a printer he purchased.

B) Destiny received child support payments for her children. She also had interest from her savings account.

C)Krista received disaster relief payments after a federally declared disaster and had wages from her employer.

D)Maverick received a settlement due to an injury to his right leg. He receives long- term disability payments from a policy for which his employer paid the premiums. Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started