Answered step by step

Verified Expert Solution

Question

1 Approved Answer

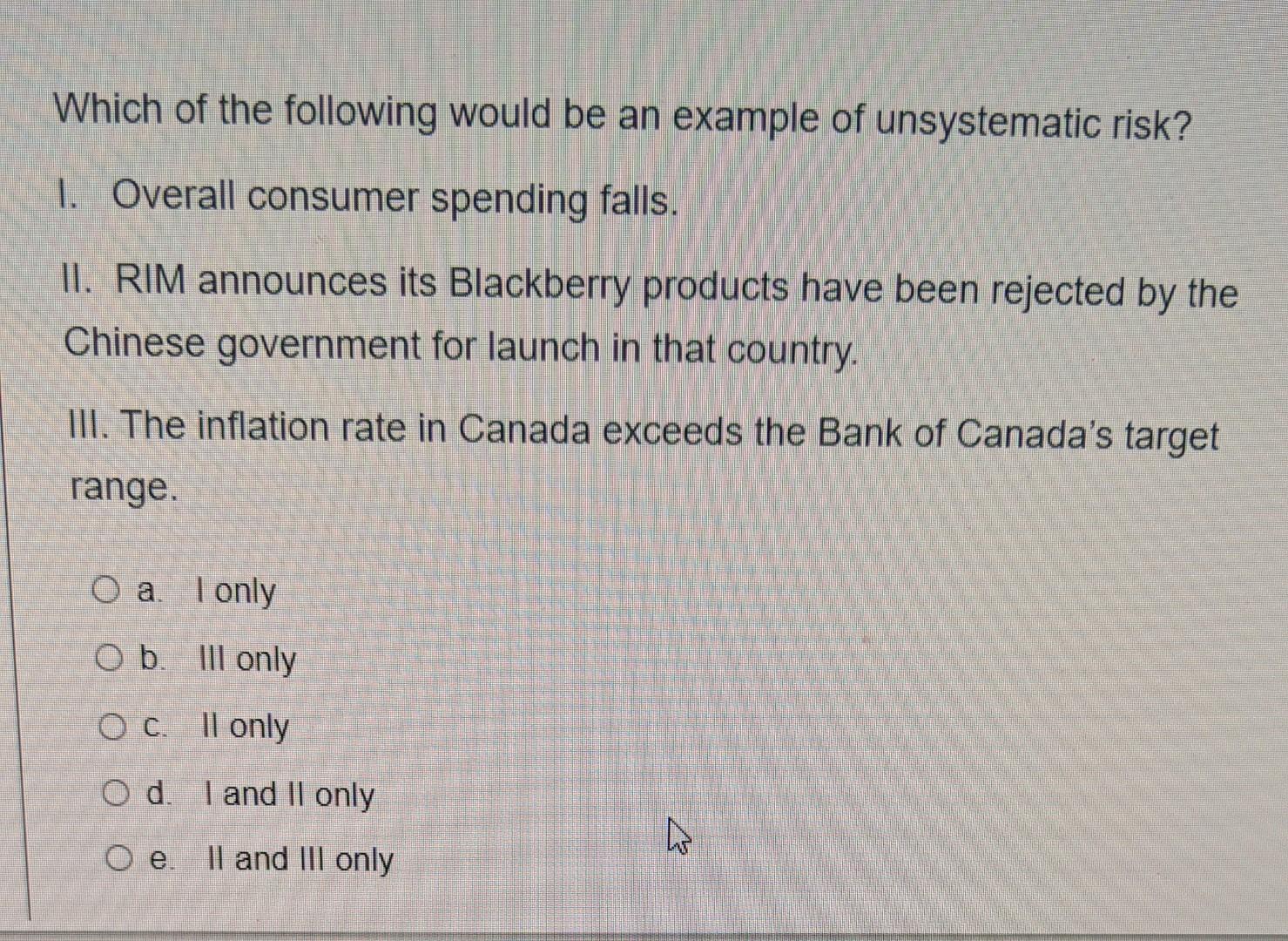

Which of the following would be an example of unsystematic risk? 1. Overall consumer spending falls. II. RIM announces its Blackberry products have been rejected

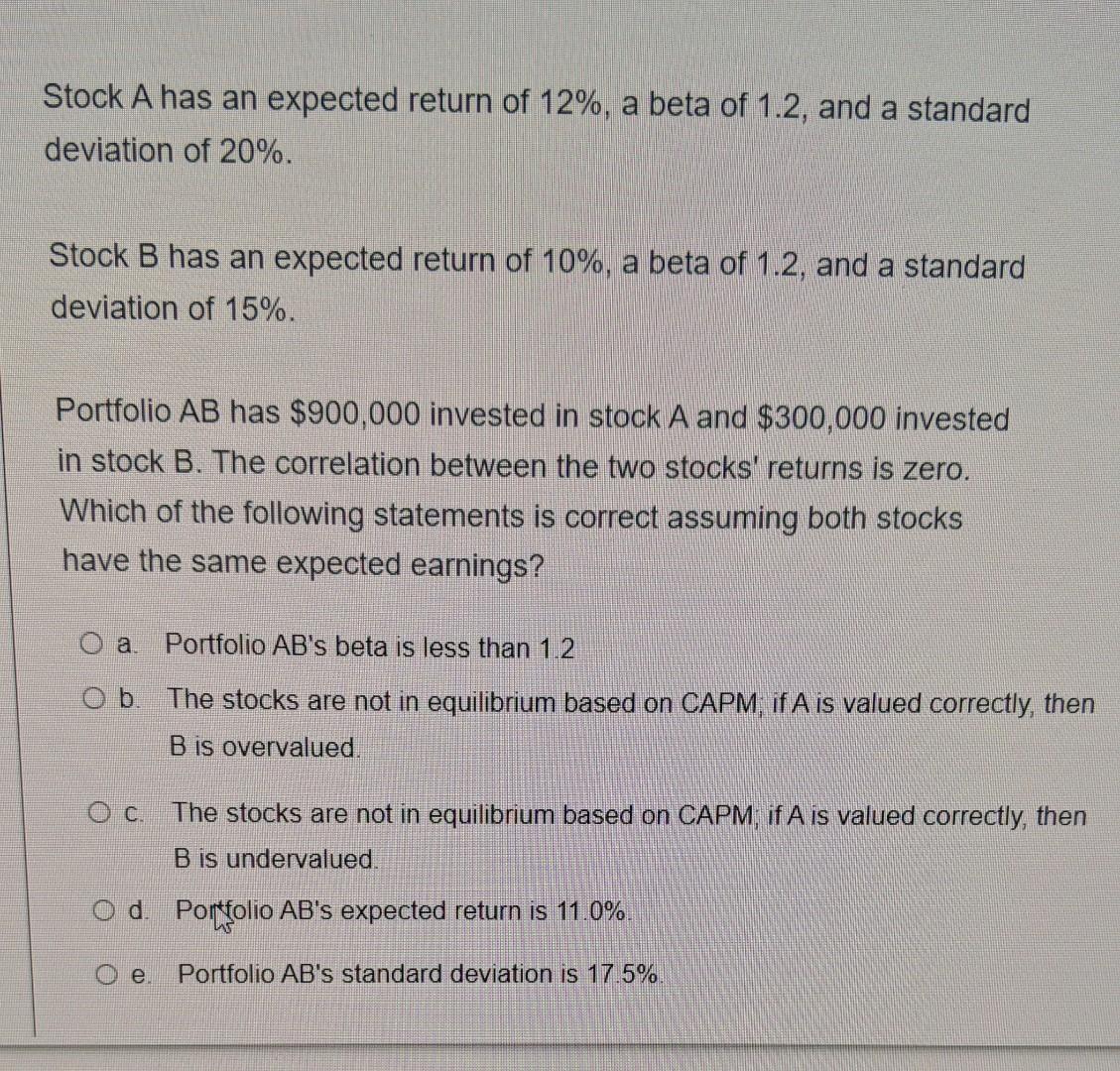

Which of the following would be an example of unsystematic risk? 1. Overall consumer spending falls. II. RIM announces its Blackberry products have been rejected by the Chinese government for launch in that country. III. The inflation rate in Canada exceeds the Bank of Canada's target range O a. I only O b. III only O c. ll only O d. I and II only w O e II and III only Stock A has an expected return of 12%, a beta of 1.2, and a standard deviation of 20%. Stock B has an expected return of 10%, a beta of 1.2, and a standard deviation of 15%. Portfolio AB has $900,000 invested in stock A and $300,000 invested in stock B. The correlation between the two stocks' returns is zero. Which of the following statements is correct assuming both stocks have the same expected earnings? O a Portfolio AB's beta is less than 1.2 O b. The stocks are not in equilibrium based on CAPMif A is valued correctly, then B is overvalued OC. The stocks are not in equilibrium based on CAPM; if A is valued correctly, then B is undervalued. O d. Portfolio AB's expected return is 11.0%. O. Portfolio AB's standard deviation is 17.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started