Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which one of the following would tend to favor a low - dividend payout? Elimination of the tax deferral on capital gains Higher tax rates

Which one of the following would tend to favor a lowdividend payout?

Elimination of the tax deferral on capital gains

Higher tax rates on capital gains than on dividend income

Endowment fund investors who cannot spend principal

High flotation cost for equity issues

Investors' desire for a highdividend yield

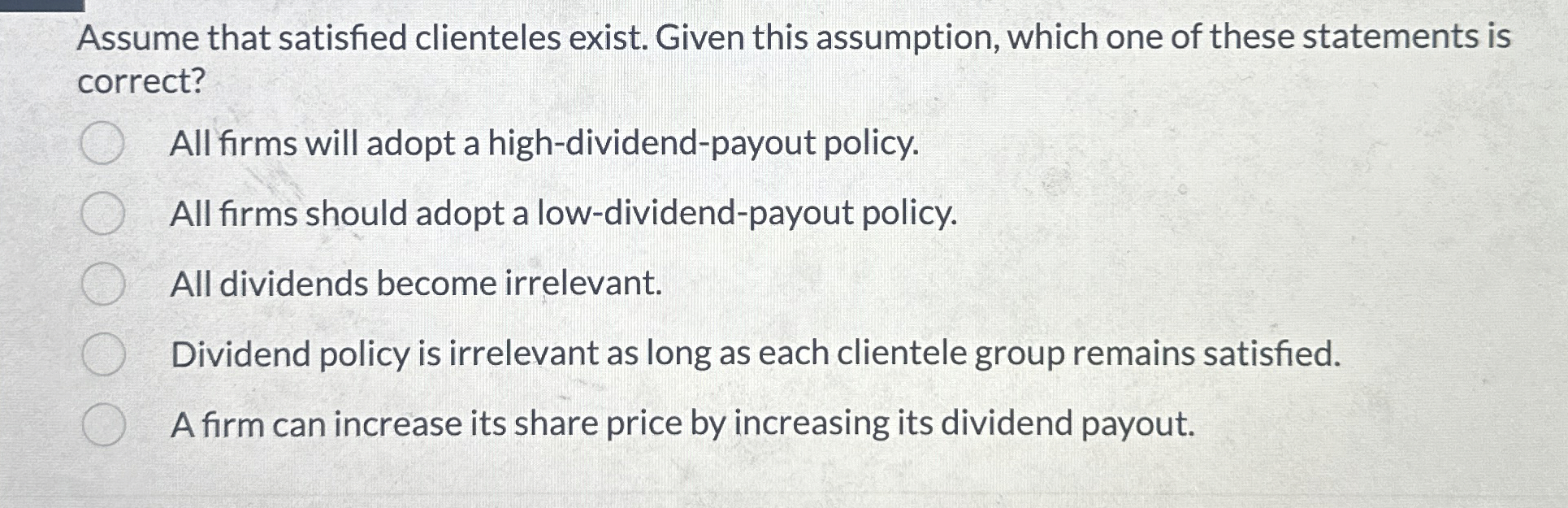

Assume that satisfied clienteles exist. Given this assumption, which one of these statements is

correct?

All firms will adopt a highdividendpayout policy.

All firms should adopt a lowdividendpayout policy.

All dividends become irrelevant.

Dividend policy is irrelevant as long as each clientele group remains satisfied.

A firm can increase its share price by increasing its dividend payout.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started