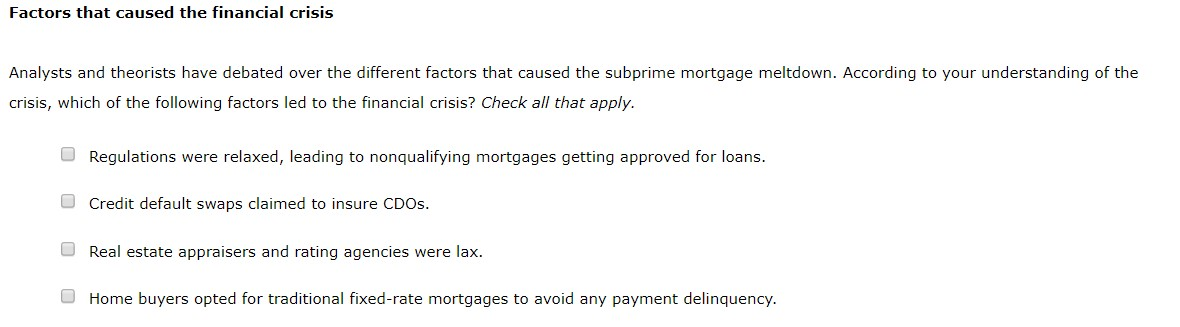

Which statements belong in the summary? Check all that apply. Borrowers who met certain requirements for mortgages, such as minimum income level relative to the total mortgage amount, could obtain mortgages that were qualified to be securitized. Such mortgages were called subprime, or Alt-A, mortgages. Mortgage payments based on short-term interest rates-called adjustable-rate mortgages (ARMS)-were preferred by subprime borrowers. Investors across the globe were buying mortgage-backed securities for the rate of return that these securities were generating. Most of these investors chose to be ignorant of the risks involved in such investments. In the 2000s, specialized mortgage brokers were allowed to originate mortgage loans. Earlier mortgage loan originators were Savings & Loan associations (S&Ls) or banks Factors that caused the financial crisis Analysts and theorists have debated over the different factors that caused the subprime mortgage meltdown. According to your understanding of the crisis, which of the following factors led to the financial crisis? Check all that apply. Regulations were relaxed, leading to nonqualifying mortgages getting approved for loans Credit default swaps claimed to insure CDOS. Real estate appraisers and rating agencies were lax. Home buyers opted for traditional fixed-rate mortgages to avoid any payment delinquency Which statements belong in the summary? Check all that apply. Borrowers who met certain requirements for mortgages, such as minimum income level relative to the total mortgage amount, could obtain mortgages that were qualified to be securitized. Such mortgages were called subprime, or Alt-A, mortgages. Mortgage payments based on short-term interest rates-called adjustable-rate mortgages (ARMS)-were preferred by subprime borrowers. Investors across the globe were buying mortgage-backed securities for the rate of return that these securities were generating. Most of these investors chose to be ignorant of the risks involved in such investments. In the 2000s, specialized mortgage brokers were allowed to originate mortgage loans. Earlier mortgage loan originators were Savings & Loan associations (S&Ls) or banks Factors that caused the financial crisis Analysts and theorists have debated over the different factors that caused the subprime mortgage meltdown. According to your understanding of the crisis, which of the following factors led to the financial crisis? Check all that apply. Regulations were relaxed, leading to nonqualifying mortgages getting approved for loans Credit default swaps claimed to insure CDOS. Real estate appraisers and rating agencies were lax. Home buyers opted for traditional fixed-rate mortgages to avoid any payment delinquency