Question

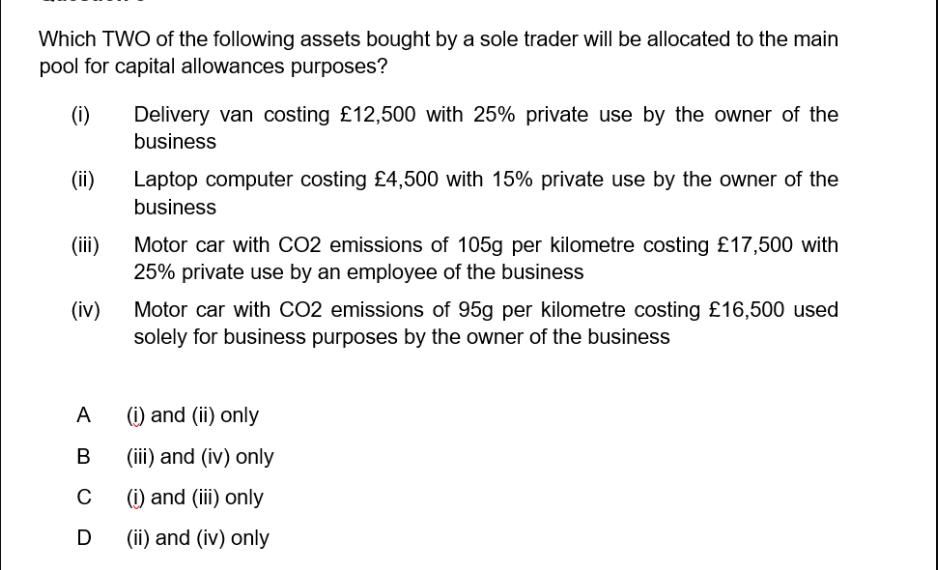

Which TWO of the following assets bought by a sole trader will be allocated to the main pool for capital allowances purposes? (i) (ii)

Which TWO of the following assets bought by a sole trader will be allocated to the main pool for capital allowances purposes? (i) (ii) (iii) (iv) A B C D Delivery van costing 12,500 with 25% private use by the owner of the business Laptop computer costing 4,500 with 15% private use by the owner of the business Motor car with CO2 emissions of 105g per kilometre costing 17,500 with 25% private use by an employee of the business Motor car with CO2 emissions of 95g per kilometre costing 16,500 used solely for business purposes by the owner of the business (i) and (ii) only (iii) and (iv) only (i) and (iii) only (ii) and (iv) only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting for Governmental and Nonprofit Entities

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely

18th edition

1260190080, 1260190083, 978-1259917059

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App