Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The short rate at time t is given by The yield curve is given by r = F + e-kt (ro-7). (1 +

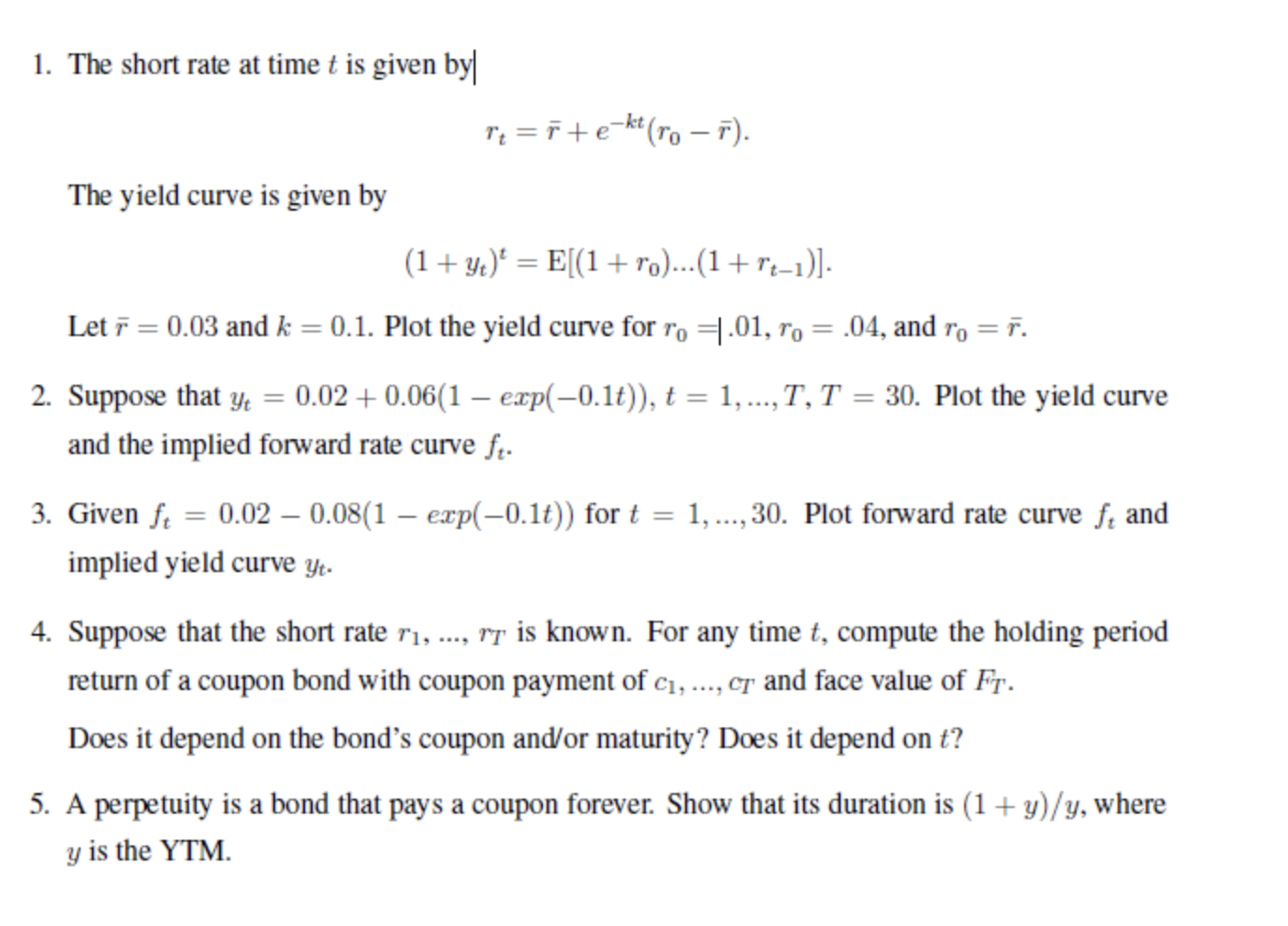

1. The short rate at time t is given by The yield curve is given by r = F + e-kt (ro-7). (1 + y) = E[(1 + ro)...(1 + Tt-1)]. Let F = 0.03 and k = 0.1. Plot the yield curve for ro=1.01, ro= .04, and To = F. 2. Suppose that y = 0.02 +0.06(1 exp(-0.1t)), t = 1,..., T, T = 30. Plot the yield curve and the implied forward rate curve ft. 3. Given ft = 0.02 -0.08(1 - exp(-0.1t)) for t = 1,..., 30. Plot forward rate curve and implied yield curve yt. 4. Suppose that the short rate r, ..., r7 is known. For any time t, compute the holding period return of a coupon bond with coupon payment of c, ..., cr and face value of Fr. Does it depend on the bond's coupon and/or maturity? Does it depend on t? 5. A perpetuity is a bond that pays a coupon forever. Show that its duration is (1 + y)/y, where y is the YTM.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 To plot the yield curve for different values of ro we can use the given formulas Yield at time t Ye E1ro1rt Given ro 101 ro 004 and ro r we can calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started