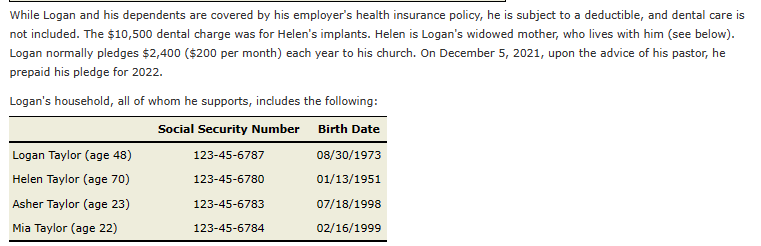

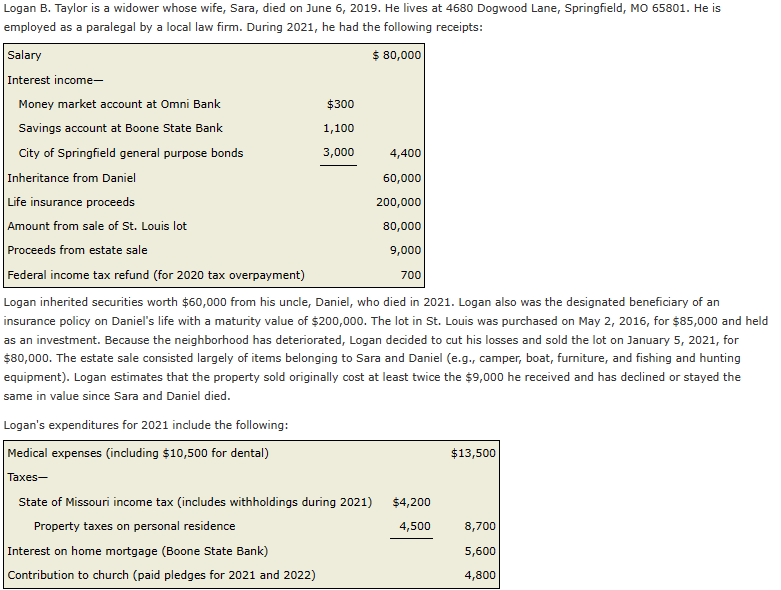

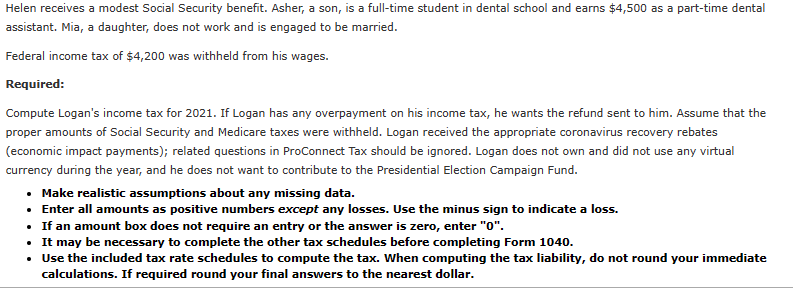

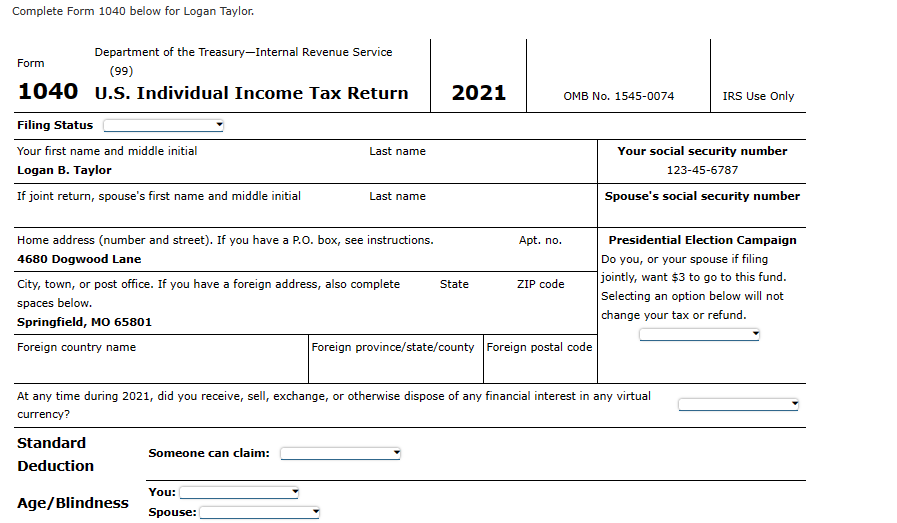

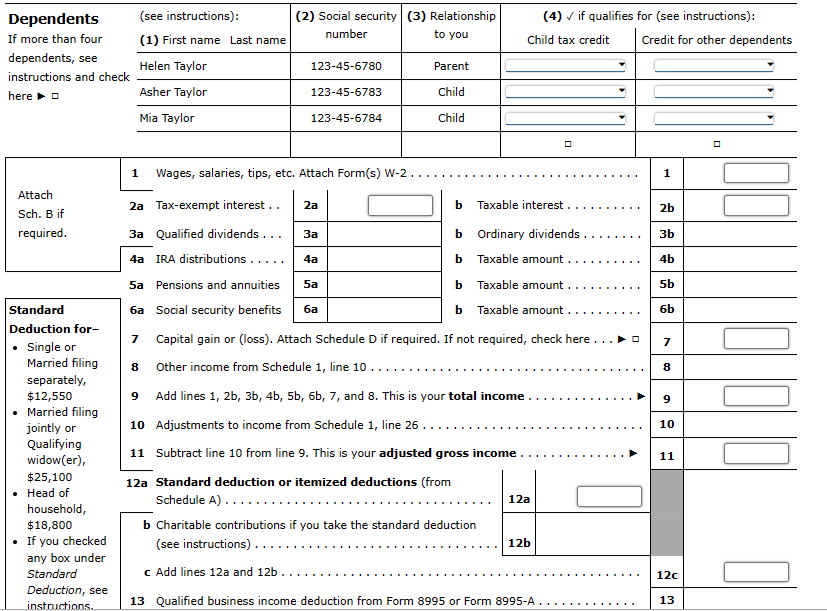

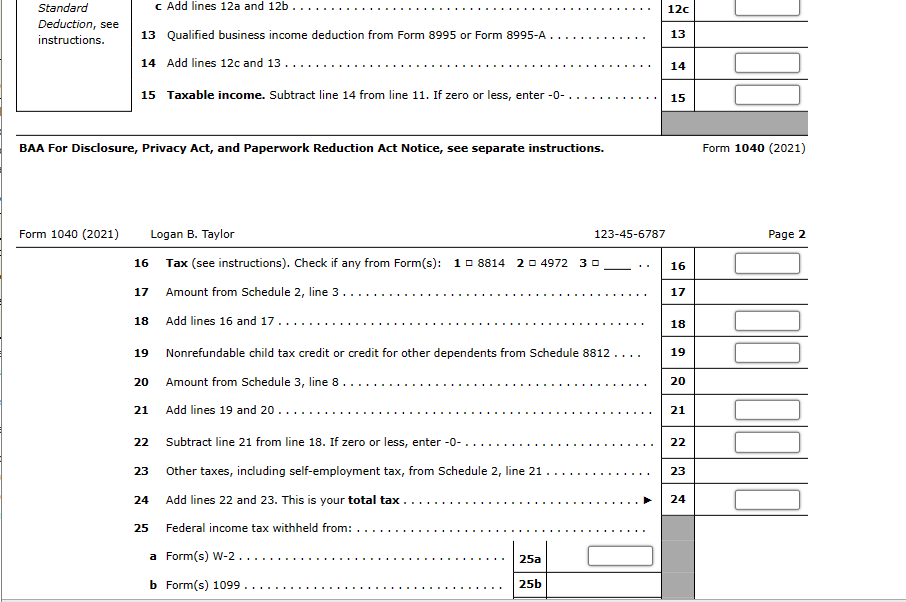

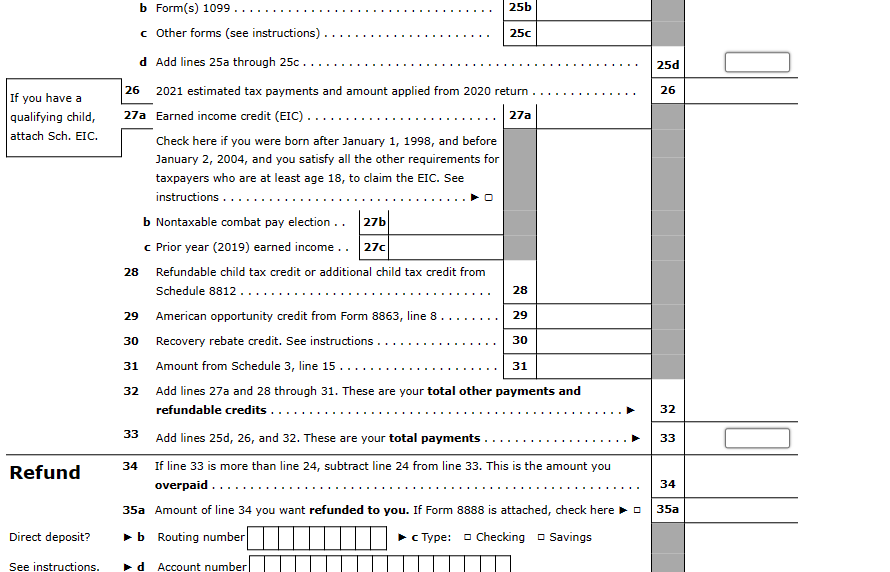

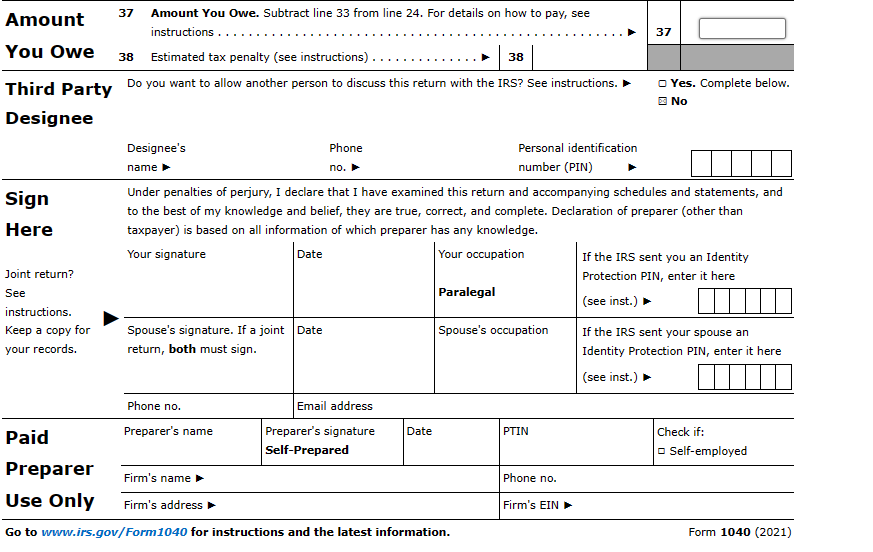

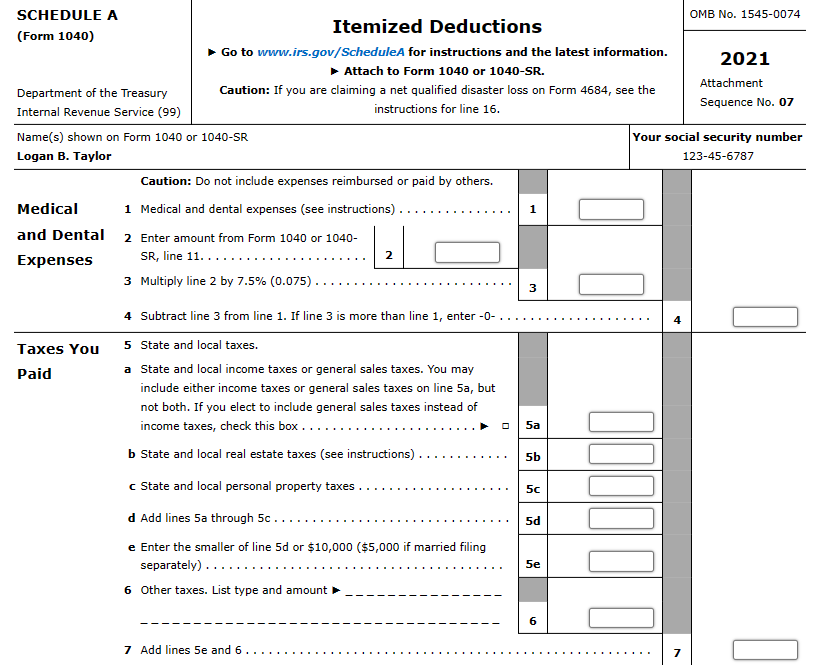

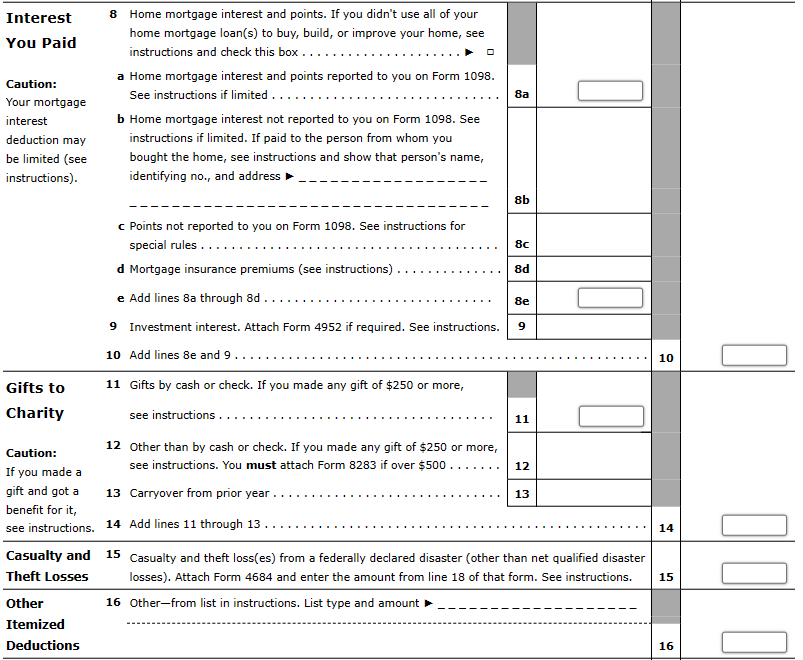

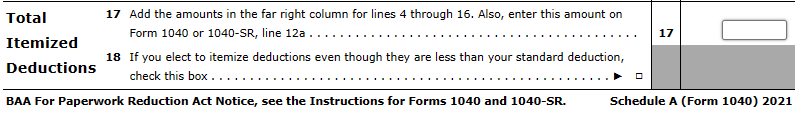

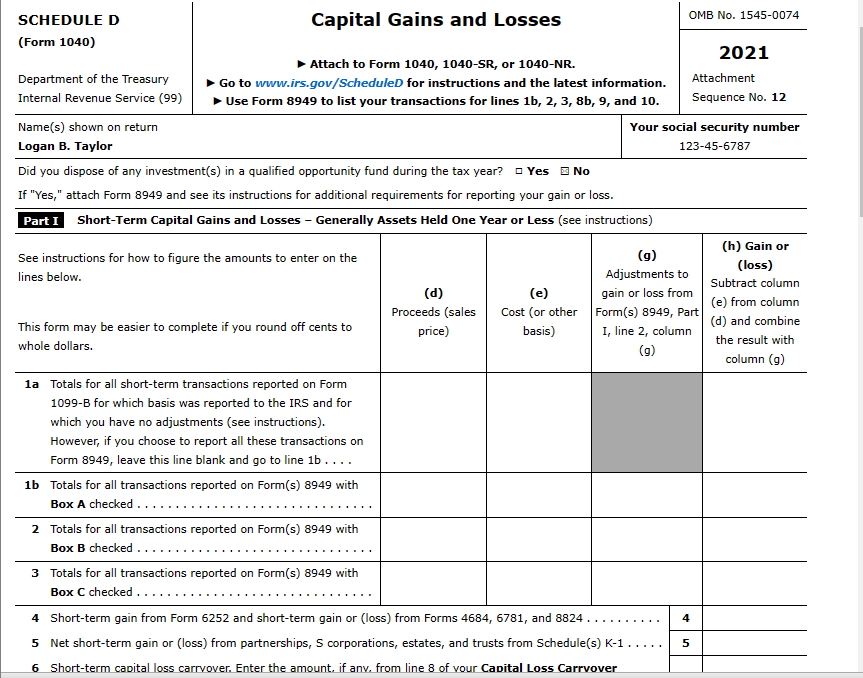

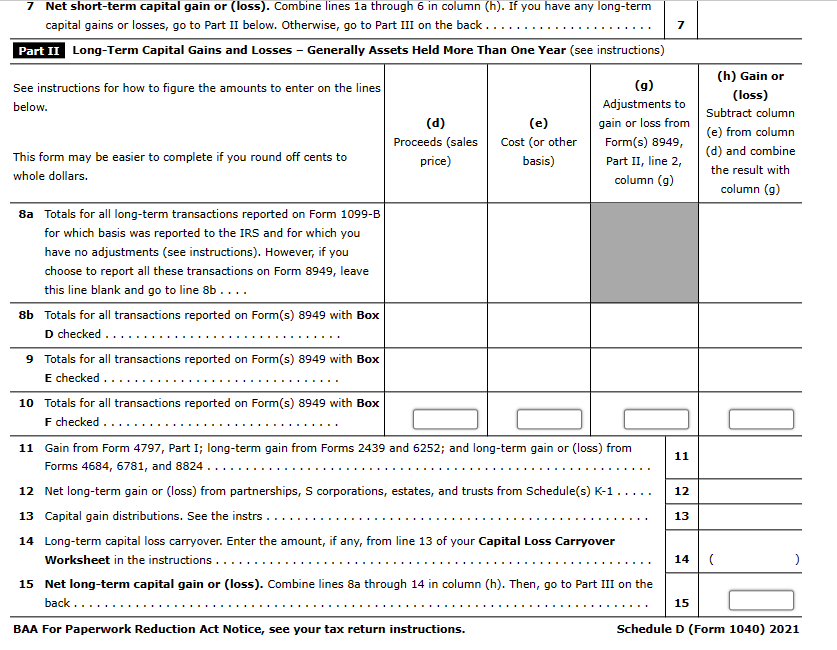

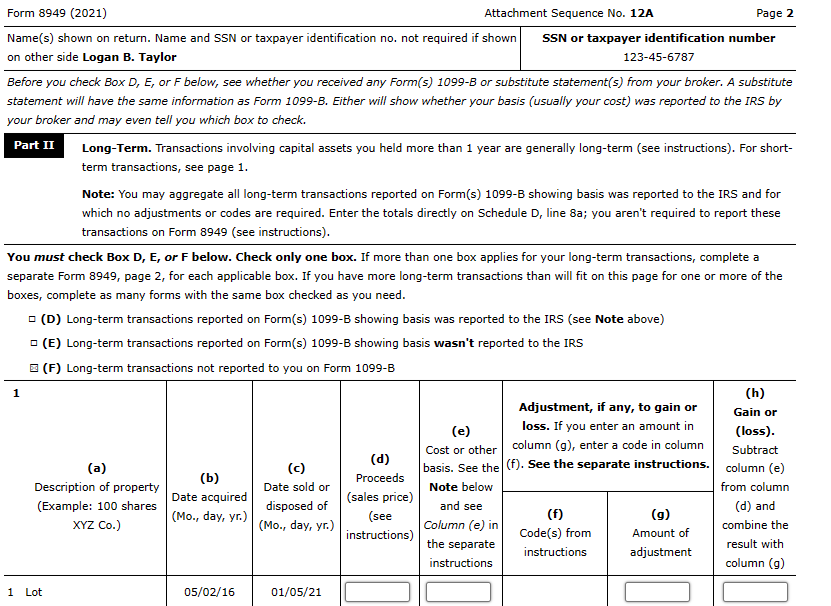

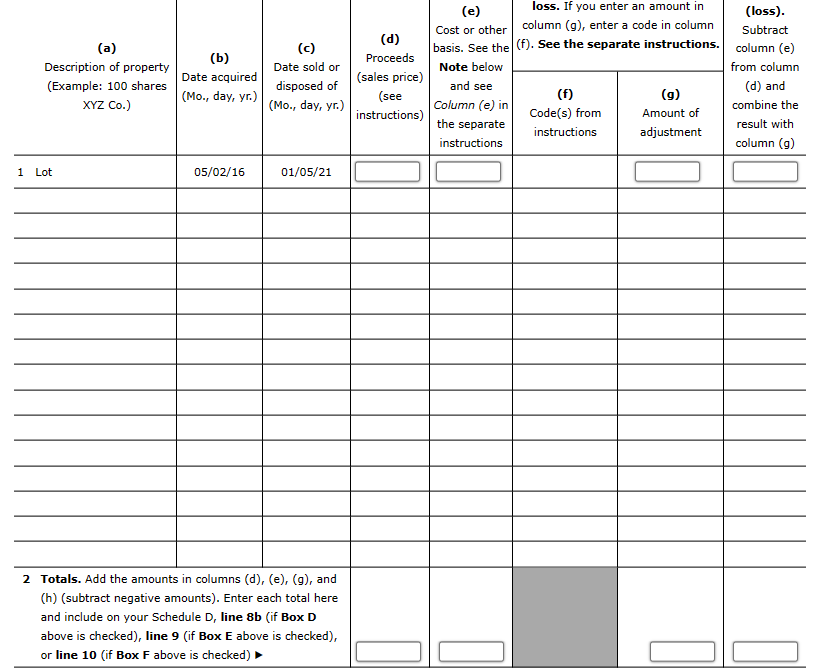

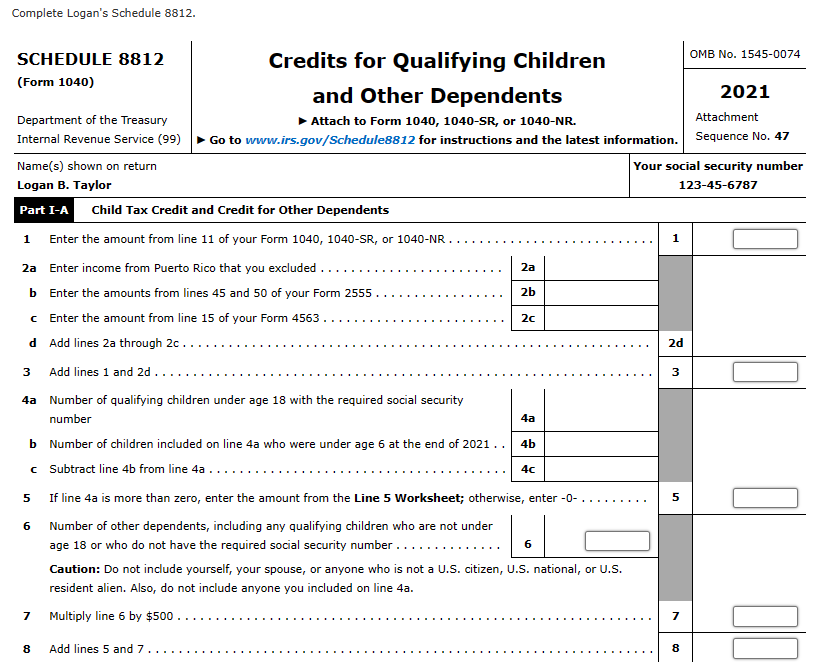

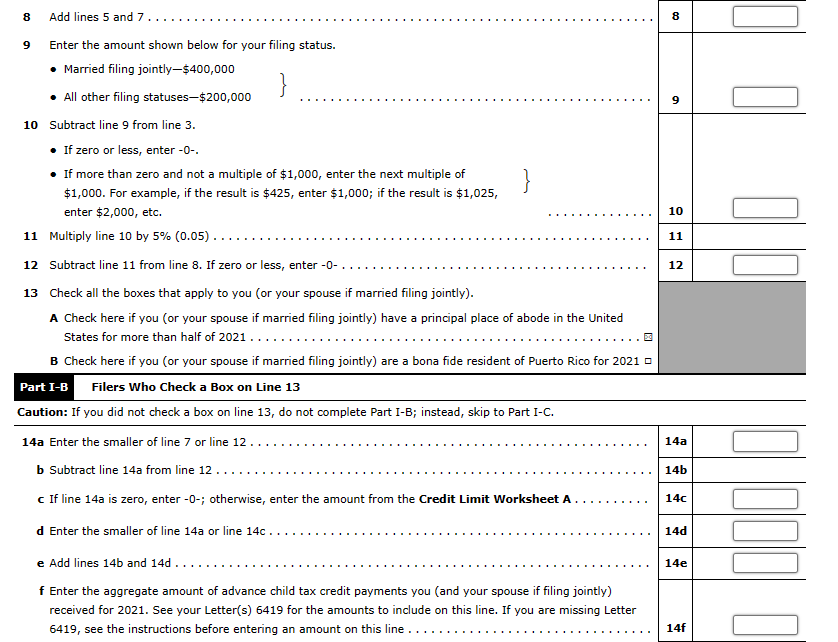

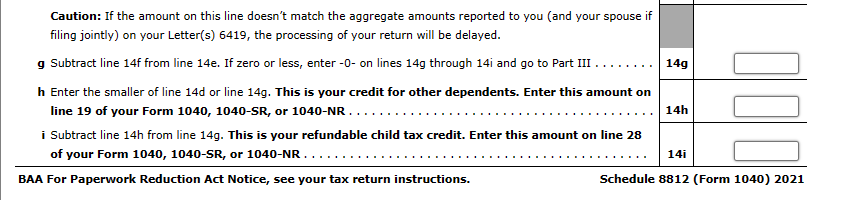

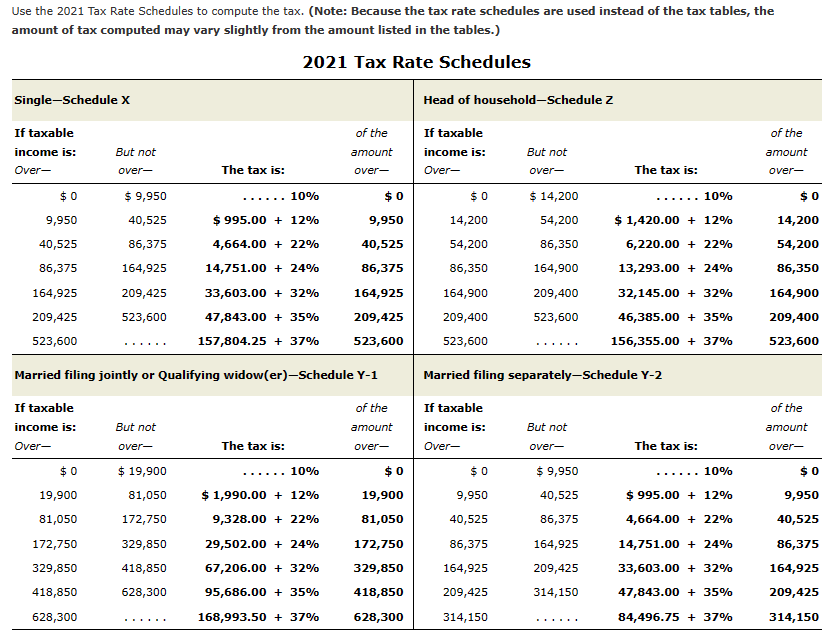

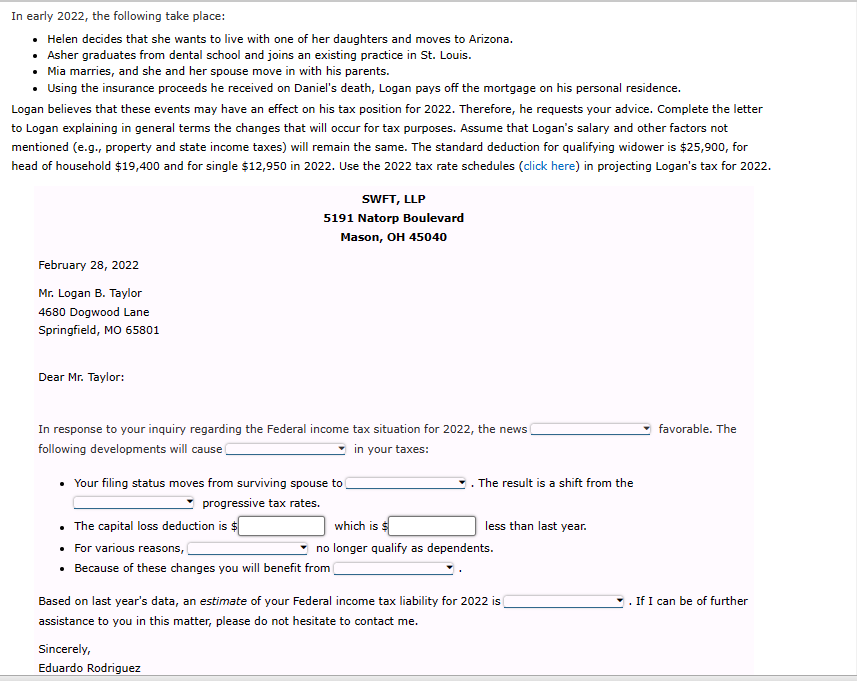

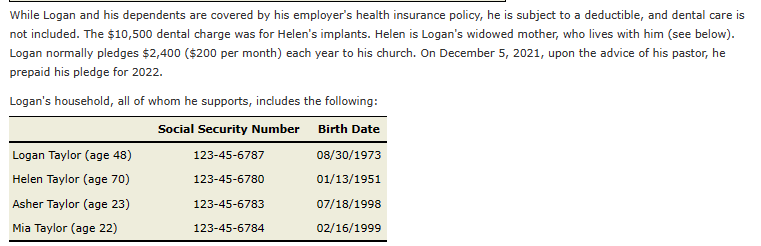

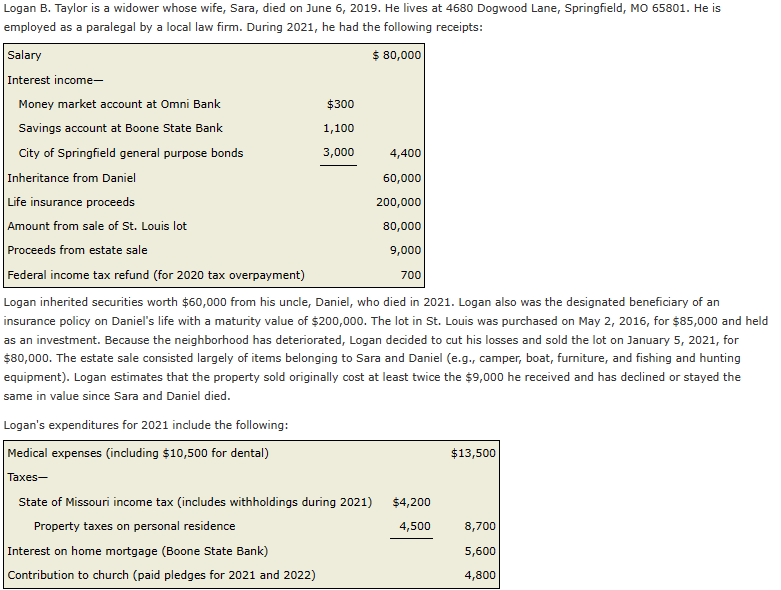

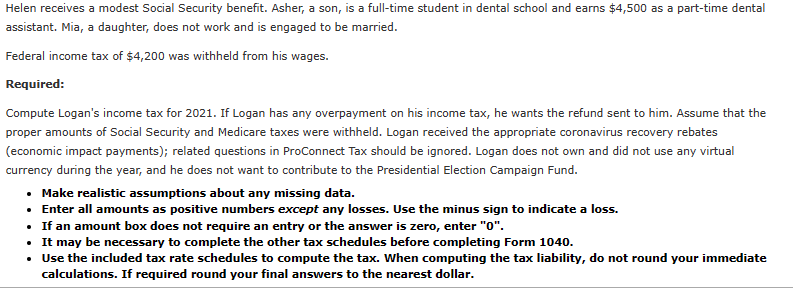

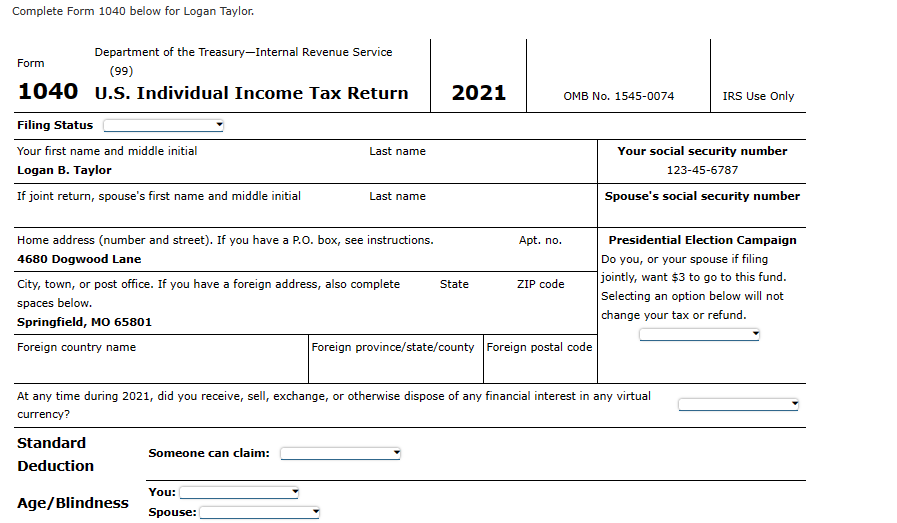

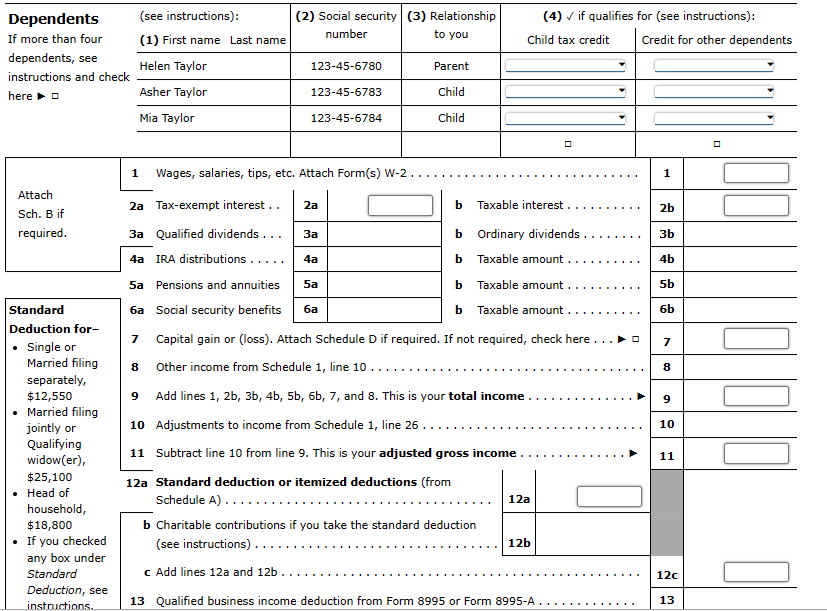

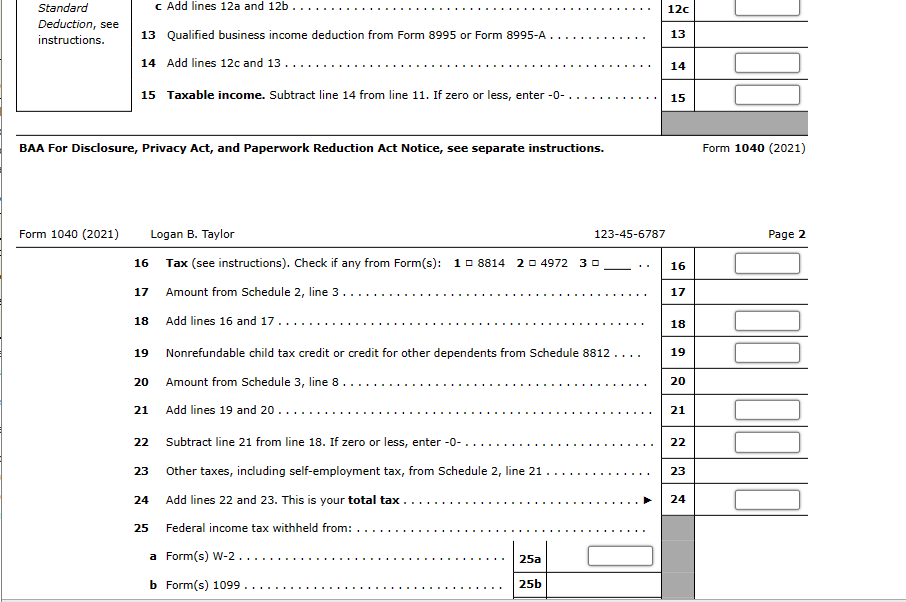

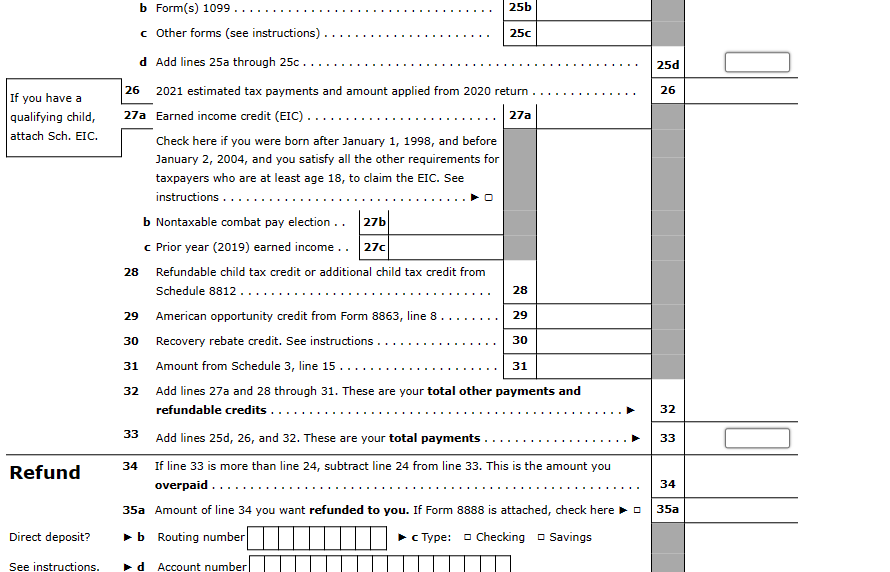

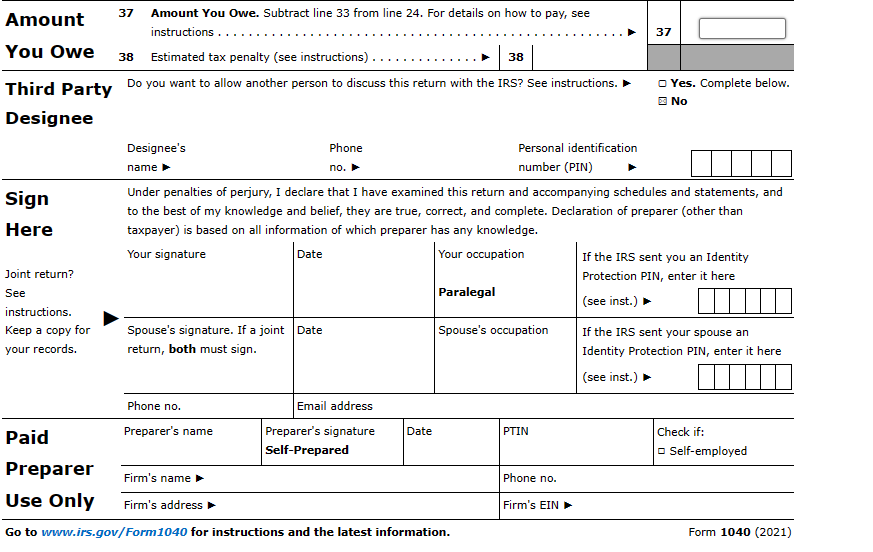

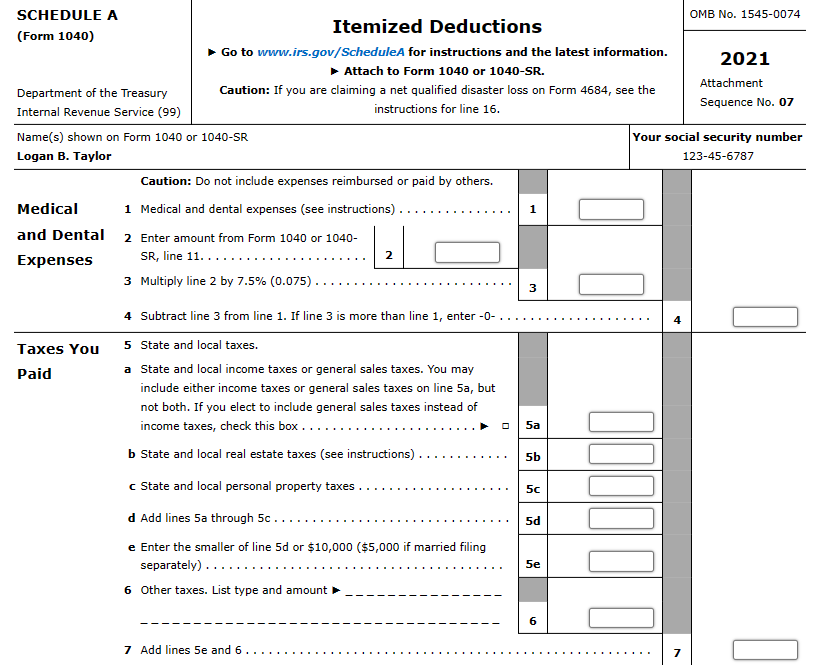

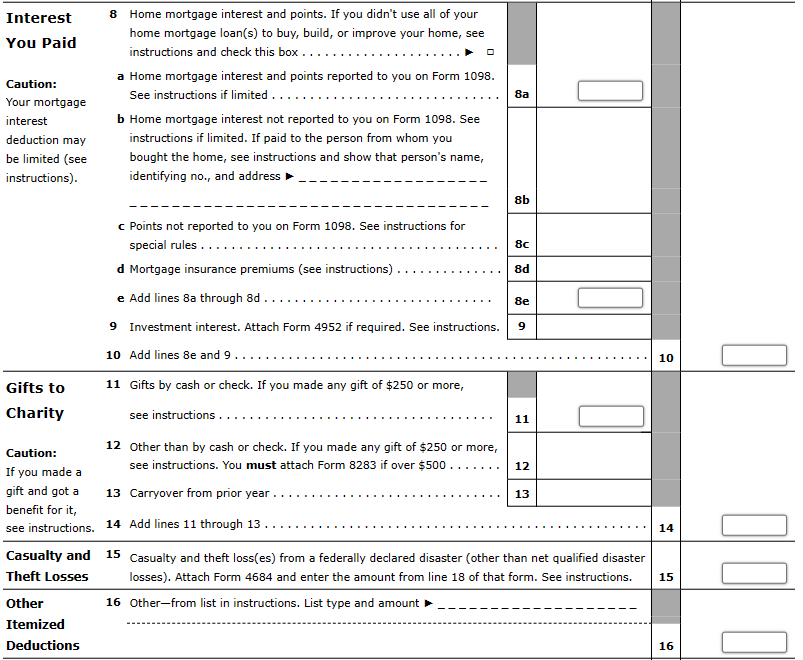

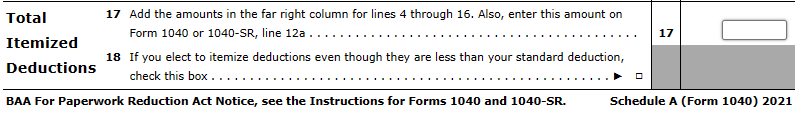

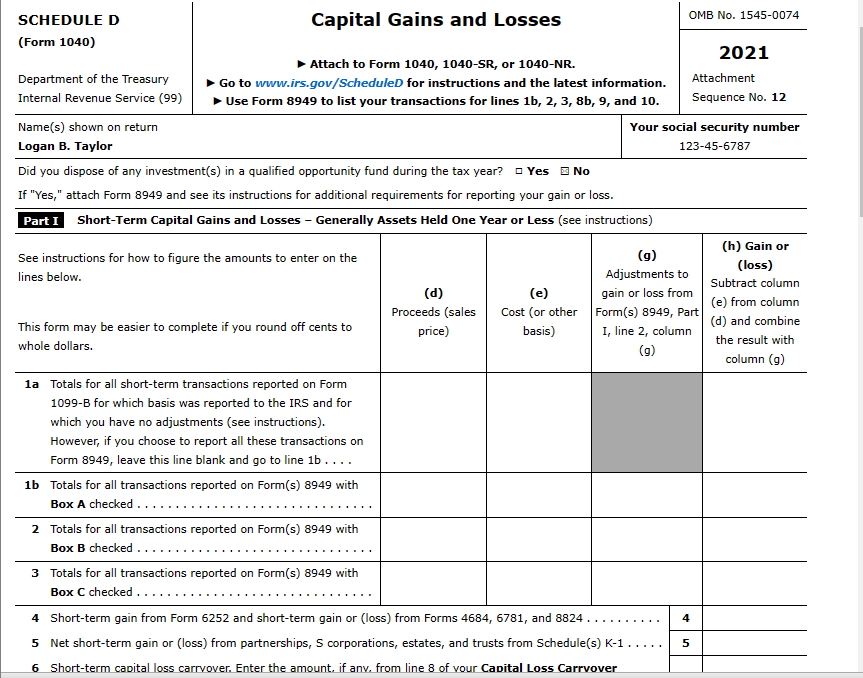

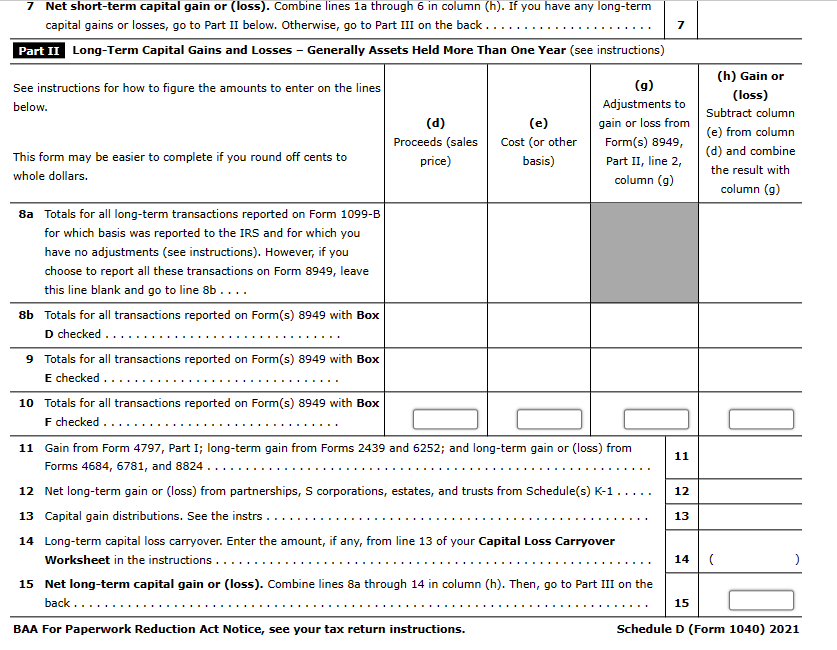

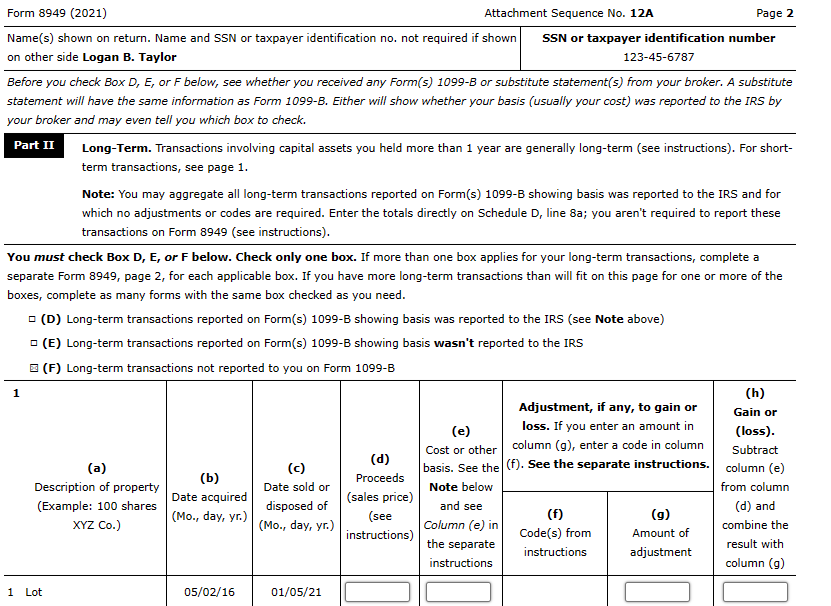

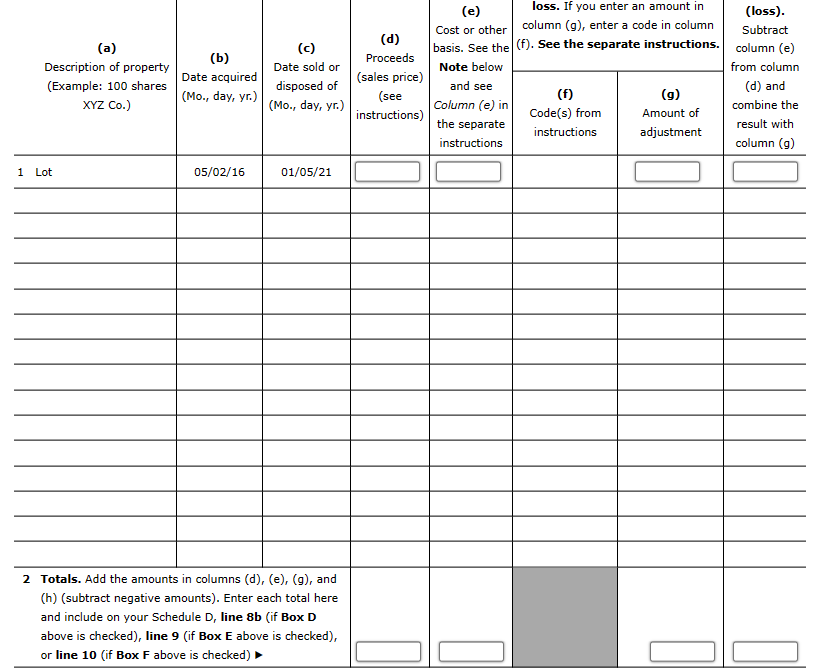

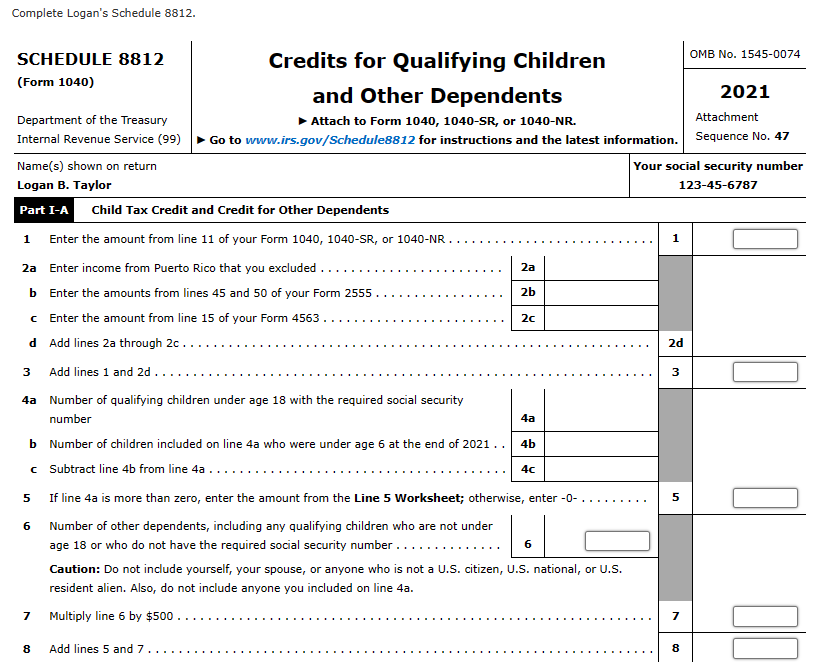

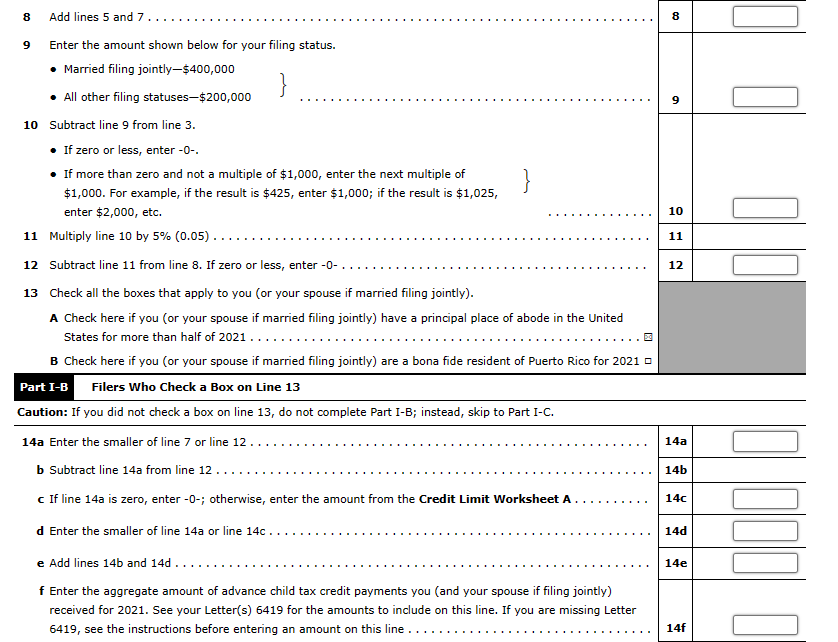

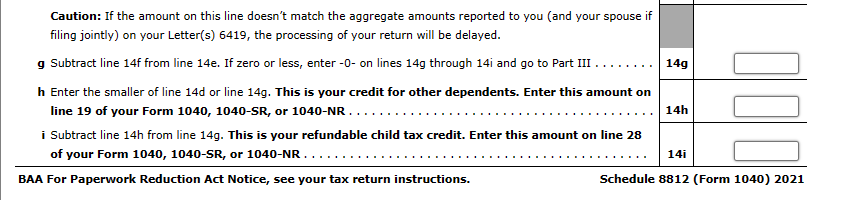

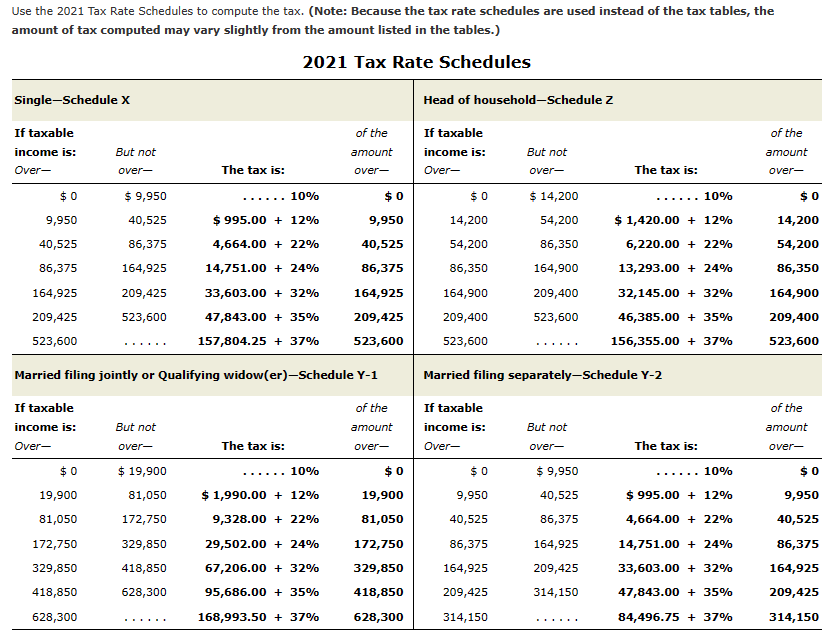

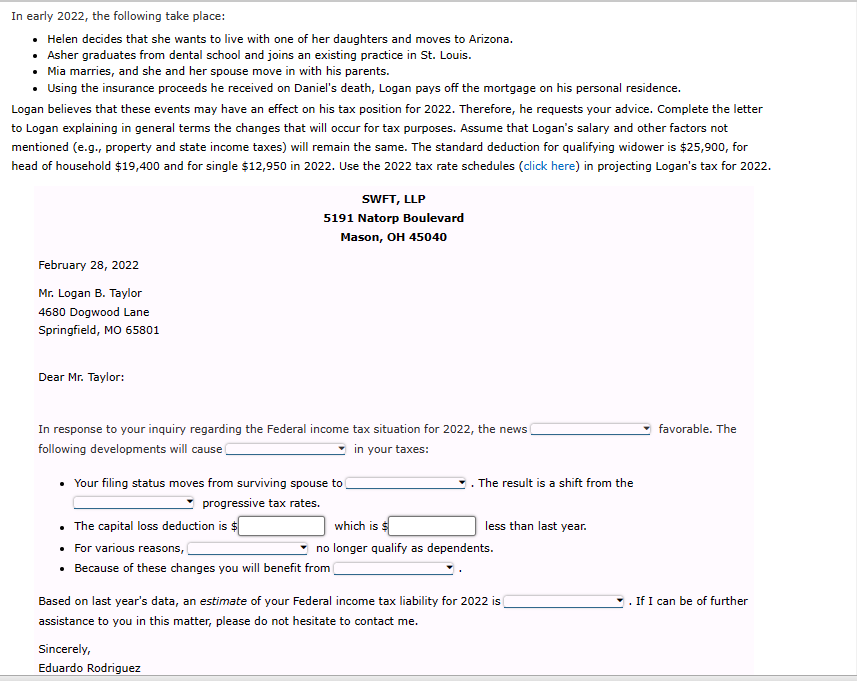

While Logan and his dependents are covered by his employer's health insurance policy, he is subject to a deductible, and dental care is not included. The $10,500 dental charge was for Helen's implants. Helen is Logan's widowed mother, who lives with him (see below). Logan normally pledges $2,400 ( $200 per month) each year to his church. On December 5, 2021, upon the advice of his pastor, he prepaid his pledge for 2022. Logan's household, all of whom he supports, includes the following: Logan B. Taylor is a widower whose wife, Sara, died on June 6,2019 . He lives at 4680 Dogwood Lane, Springfield, MO 65801 . He is employed as a paralegal by a local law firm. During 2021, he had the following receipts: Logan inherited securities worth $60,000 from his uncle, Daniel, who died in 2021. Logan also was the designated beneficiary of an insurance policy on Daniel's life with a maturity value of $200,000. The lot in St. Louis was purchased on May 2, 2016, for $85,000 and held as an investment. Because the neighborhood has deteriorated, Logan decided to cut his losses and sold the lot on January 5, 2021, for $80,000. The estate sale consisted largely of items belonging to Sara and Daniel (e.g., camper, boat, furniture, and fishing and hunting equipment). Logan estimates that the property sold originally cost at least twice the $9,000 he received and has declined or stayed the same in value since Sara and Daniel died. Helen receives a modest Social Security benefit. Asher, a son, is a full-time student in dental school and earns $4,500 as a part-time dental assistant. Mia, a daughter, does not work and is engaged to be married. Federal income tax of $4,200 was withheld from his wages. Required: Compute Logan's income tax for 2021. If Logan has any overpayment on his income tax, he wants the refund sent to him. Assume that the proper amounts of Social Security and Medicare taxes were withheld. Logan received the appropriate coronavirus recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored. Logan does not own and did not use any virtual currency during the year, and he does not want to contribute to the Presidential Election Campaign Fund. - Make realistic assumptions about any missing data. - Enter all amounts as positive numbers except any losses. Use the minus sign to indicate a loss. - If an amount box does not require an entry or the answer is zero, enter "0". - It may be necessary to complete the other tax schedules before completing Form 1040. - Use the included tax rate schedules to compute the tax. When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar. Complete Form 1040 below for Logan Taylor. Standard Deduction, see instructions. c Add lines 12a and 12b. 12c 13 Qualified business income deduction from Form 8995 or Form 8995-A 14 Add lines 12c and 13 15 Taxable . Subt line 14 from line 11. If zero or less, enter 0 BAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040(2021) Form 1040(2021) Logan B. Taylor 123456787 Page 2 16 Tax (see instructions). Check if any from Form(s): 1 q 88142 q 49723 16 17 19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 22 Subtract line 21 from line 18. If zero or less, enter -0- 23 Other taxes, including self-employment tax, from Schedule 2 , line 21... 24 Add lines 22 and 23 . This is your total tax 25 Federal income tax withheld from: . ........................... a Form(s) W-2 b Form(s) 1099 c Other forms (see instructions) .................. 25c d Add lines 25a through 25c Designee Go to www.irs.gov/Form1040 for instructions and the latest information. Form 1040(2021) If "Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. 7 Net short-term capital gain or (loss). Combine lines 1 a through 6 in column (h). If you have any long-term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back................. 7 Part II Long-Term Capital Gains and Losses - Generally Assets Held More Than One Year (see instructions) BAA For Paperwork Reduction Act Notice, see your tax return instructions. Schedule D (Form 1040) 2021 term transactions, see page 1 . Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box D, E, or F below. Check only one box. If more than one box applies for your long-term transactions, complete a separate Form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (D) Long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (F) Long-term transactions not reported to you on Form 1099-B Complete Logan's Schedule 8812 . 9 Enter the amount shown below for your filing status. - Married filing jointly-\$400,000 - All other filing statuses- $200,000} 10 Subtract line 9 from line 3. - If zero or less, enter-0-. -Ifmorethanzeroandnotamultipleof$1,000,enterthenextmultipleof$1,000.Forexample,iftheresultis$425,enter$1,000;iftheresultis$1,025,} enter $2,000, etc. A Check here if you (or your spouse if married filing jointly) have a principal place of abode in the United B Check here if you (or your spouse if married filing jointly) are a bona fide resident of Puerto Rico for 2021 a Part I-B Filers Who Check a Box on Line 13 Caution: If you did not check a box on line 13 , do not complete Part I-B; instead, skip to Part I-C. Caution: If the amount on this line doesn't match the aggregate amounts reported to you (and your spouse if filing jointly) on your Letter(s) 6419, the processing of your return will be delayed. g Subtract line 14f from line 14e. If zero or less, enter -0 - on lines 14g through 14i and go to Part III ........ h Enter the smaller of line 14d or line 14g. This is your credit for other dependents. Enter this amount on line 19 of your Form 1040, 1040-SR, or 1040-NR i Subtract line 14h from line 14g. This is your refundable child tax credit. Enter this amount on line 28 of your Form 1040, 1040-SR, or 1040-NR . . .............................. 14i. BAA For Paperwork Reduction Act Notice, see your tax return instructions. Schedule 8812 (Form 1040) 2021 Use the 2021 Tax Rate Schedules to compute the tax. (Note: Because the tax rate schedules are used instead of the tax tables, the In early 2022 , the following take place: - Helen decides that she wants to live with one of her daughters and moves to Arizona. - Asher graduates from dental school and joins an existing practice in St. Louis. - Mia marries, and she and her spouse move in with his parents. - Using the insurance proceeds he received on Daniel's death, Logan pays off the mortgage on his personal residence. Logan believes that these events may have an effect on his tax position for 2022. Therefore, he requests your advice. Complete the letter to Logan explaining in general terms the changes that will occur for tax purposes. Assume that Logan's salary and other factors not mentioned (e.g., property and state income taxes) will remain the same. The standard deduction for qualifying widower is $25,900, for head of household $19,400 and for single $12,950 in 2022. Use the 2022 tax rate schedules (click here) in projecting Logan's tax for 2022. Dear Mr. Taylor: In response to your inquiry regarding the Federal income tax situation for 2022, the news favorable. The following developments will cause in your taxes: - Your filing status moves from surviving spouse to . The result is a shift from the progressive tax rates. - The capital loss deduction is \$ which is $ less than last year. - For various reasons, no longer qualify as dependents. - Because of these changes you will benefit from Based on last year's data, an estimate of your Federal income tax liability for 2022 is . If I can be of further assistance to you in this matter, please do not hesitate to contact me. Sincerely, Eduardo Rodriauez