Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Whinn Ltd is planning to merge with All Ltd. Under the merger one share in Whinn Ltd will be exchanged for every 2 shares

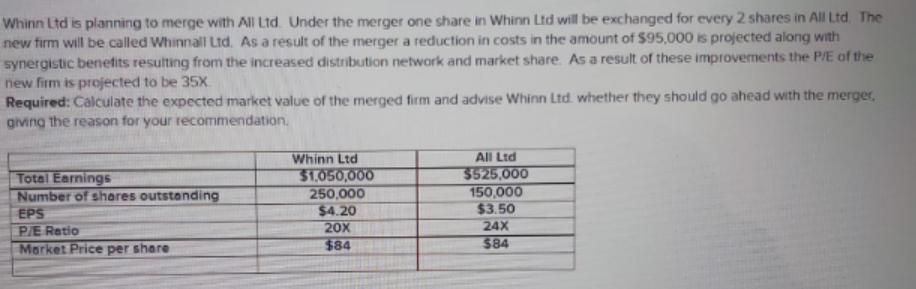

Whinn Ltd is planning to merge with All Ltd. Under the merger one share in Whinn Ltd will be exchanged for every 2 shares in All Ltd. The new firm will be called Whinnall Ltd. As a result of the merger a reduction in costs in the amount of $95,000 is projected along with synergistic benefits resulting from the increased distribution network and market share. As a result of these improvements the P/E of the new firm is projected to be 35X Required: Calculate the expected market value of the merged firm and advise Whinn Ltd. whether they should go ahead with the merger, giving the reason for your recommendation. Total Earnings Number of shares outstanding EPS P/E Ratio Market Price per share Whinn Ltd $1,050,000 250,000 $4.20 20x $84 All Ltd $525,000 150,000 $3.50 24X $84

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected market value of the merged firm we need to consider the total earnings and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started