Answered step by step

Verified Expert Solution

Question

1 Approved Answer

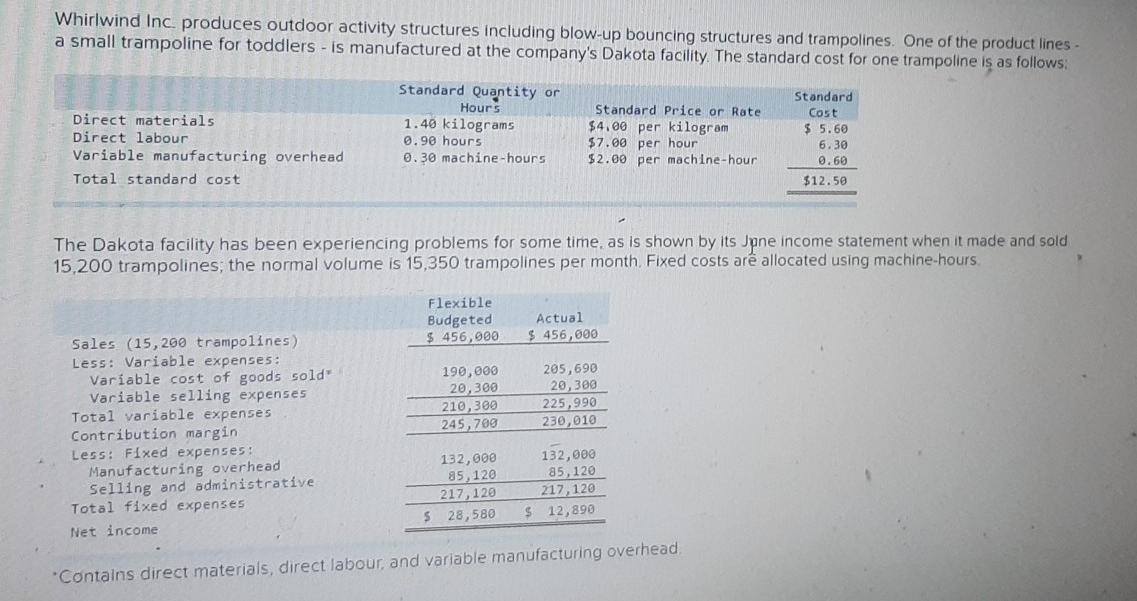

Whirlwind Inc produces outdoor activity structures including blow-up bouncing structures and trampolines. One of the product lines- a small trampoline for toddlers - is

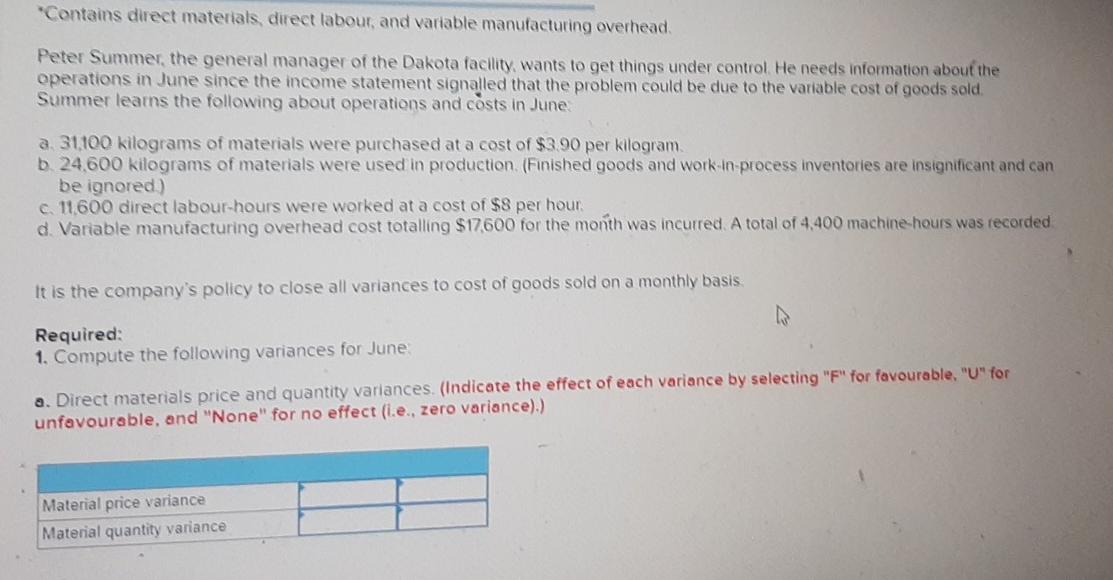

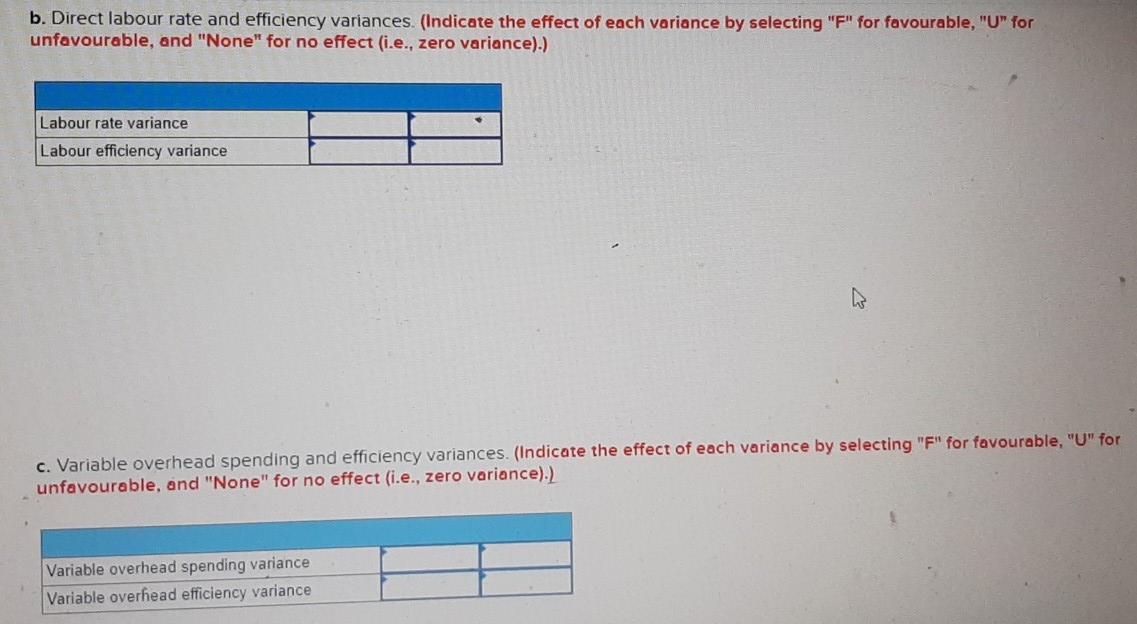

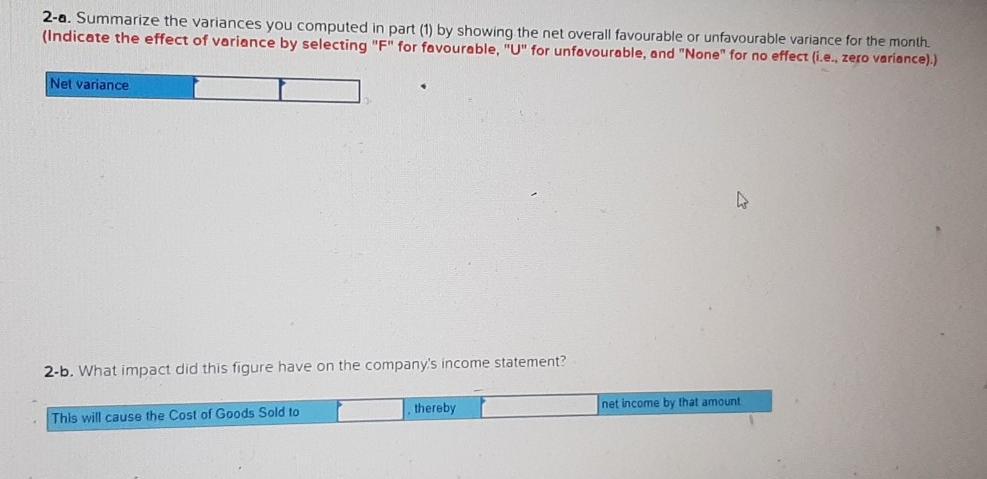

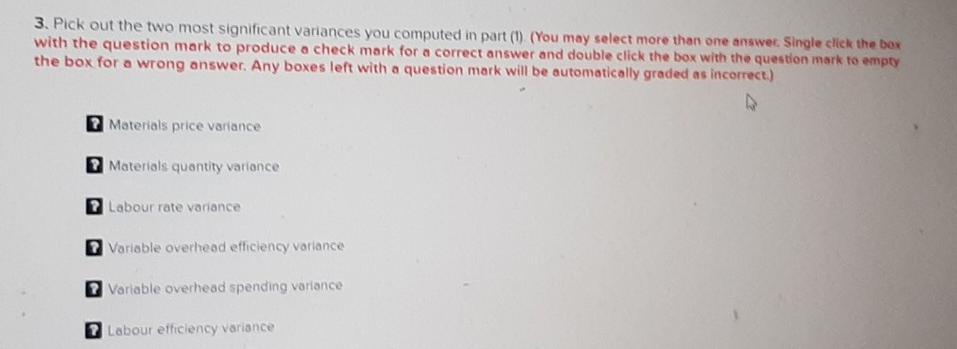

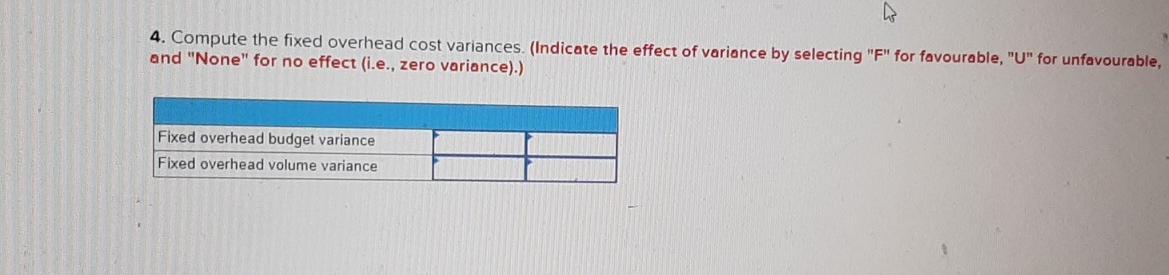

Whirlwind Inc produces outdoor activity structures including blow-up bouncing structures and trampolines. One of the product lines- a small trampoline for toddlers - is manufactured at the company's Dakota facility. The standard cost for one trampoline is as follows: Standard Quantity or Hours 1.40 kilograms 0.90 hours Standard Standard Price or Rate $4.00 per kilogram $7.00 per hour Cost Direct materials $ 5.60 Direct labour 6.30 Variable manufacturing overhead 0.30 machine-hours $2.00 per machine-hour 0.60 Total standard cost $12.50 The Dakota facility has been experiencing problems for some time, as is shown by its Jpne income statement when it made and sold 15,200 trampolines; the normal volume is 15,350 trampolines per month, Fixed costs ar allocated using machine-hours. Flexible Budgeted $ 456,000 Actual $ 456,000 Sales (15,200 trampolines) Less: Variable expenses: Varable cost of goods sold" Variable selling expenses Total varible expenses Contribution margin Less: Fixed expenses: Manufacturing overhead Selling and administrative Total fixed expenses 205,690 190,000 20,300 210,300 245,700 20,300 225,990 230,010 132,000 85,120 217,120 132,000 85,120 217,120 $ 12,890 28,580 Net income "Contains direct materials, direct labour, and variable manufacturing overhead Contains direct materials, direct labour, and variable manufacturing overhead. Peter Summer, the general manager of the Dakota facility, wants to get things under control. He needs information about the operations in June since the income statement signalled that the problem could be due to the variable cost of goods sold. Summer learns the following about operations and costs in June: a. 31,100 kilograms of materials were purchased at a cost of $3.90 per kilogram. b. 24,600 kilograms of materials were used in production. (Finished goods and work-in-process inventories are insignificant and can be ignored.) C. 11,600 direct labour-hours were worked at a cost of $8 per hour. d. Variable manufacturing overhead cost totalling $17,600 for the month was incurred. A total of 4,400 machine-hours was recorded. It is the company's policy to close all variances to cost of goods sold on a monthly basis Required: 1. Compute the following variances for June: a. Direct materials price and quantity variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Material price variance Material quantity variance b. Direct labour rate and efficiency variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Labour rate variance Labour efficiency variance c. Variable overhead spending and efficiency variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Variable overhead spending variance Variable overhead efficiency variance 2-a. Summarize the variances you computed in part (1) by showing the net overall favourable or unfavourable variance for the month (Indicate the effect of variance by selecting "F" for favourable, "U" for unfovourable, and "None" for no effect (i.e., zero variance).) Net variance 2-b. What impact did this figure have on the company's income statement? thereby net income by that amount This will cause the Cost of Goods Sold to 3. Pick out the two most significant variances you computed in part (1) (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Materials price variance Materials quantity variance 7Labour rate variance Variable overhead efficiency variance 2 Variable overhead spending variance 7 Labour efficiency variance 4. Compute the fixed overhead cost variances. (Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Fixed overhead budget variance Fixed overhead volume variance

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 A Materials price variance 3110 Favorable Materials quantity variance 13280 Unfavorable Labor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started