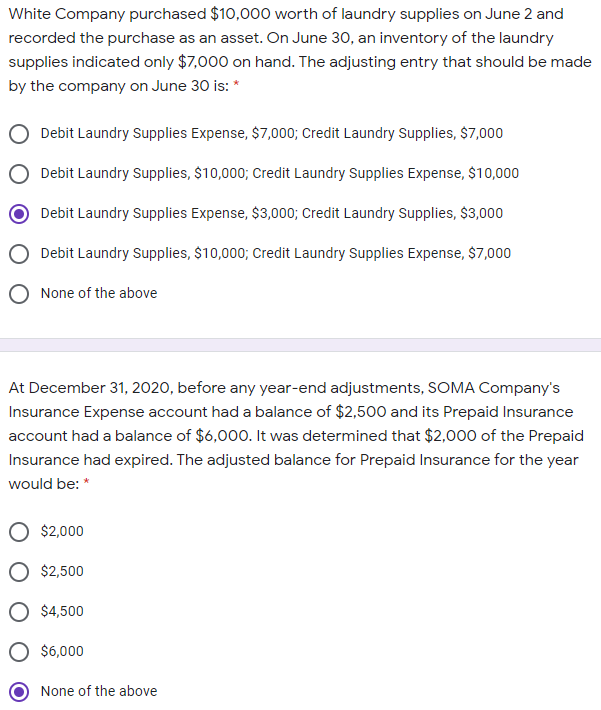

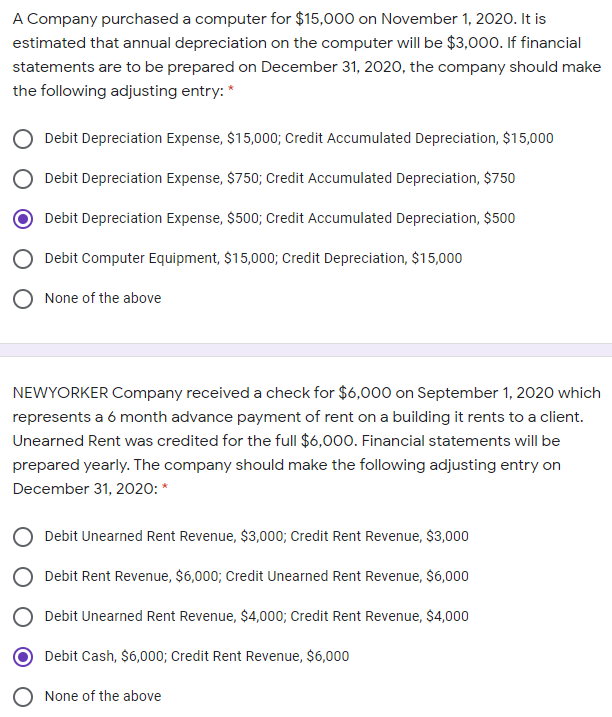

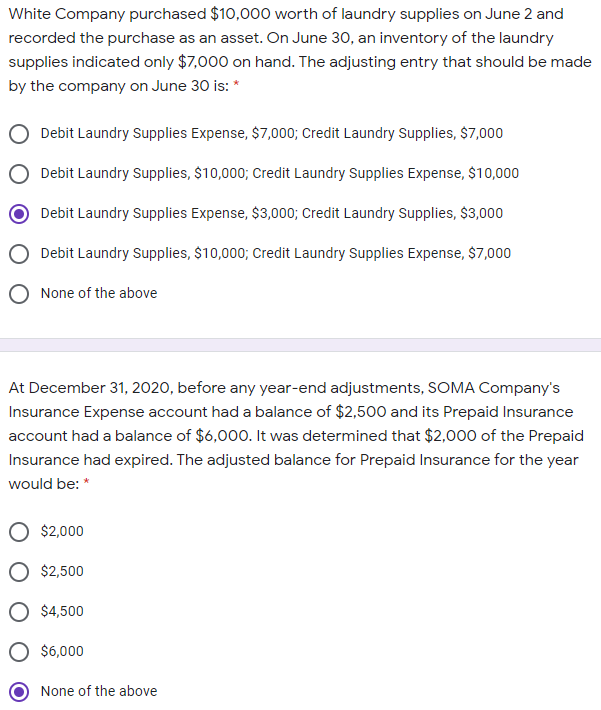

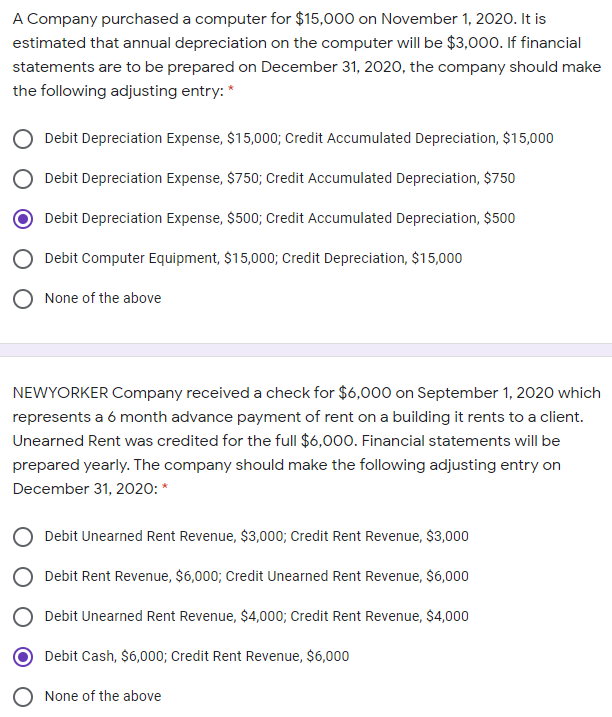

White Company purchased $10,000 worth of laundry supplies on June 2 and recorded the purchase as an asset. On June 30, an inventory of the laundry supplies indicated only $7,000 on hand. The adjusting entry that should be made by the company on June 30 is: * Debit Laundry Supplies Expense, $7,000; Credit Laundry Supplies, $7,000 Debit Laundry Supplies, $10,000; Credit Laundry Supplies Expense, $10,000 Debit Laundry Supplies Expense, $3,000; Credit Laundry Supplies, $3,000 Debit Laundry Supplies, $10,000; Credit Laundry Supplies Expense, $7,000 None of the above At December 31, 2020, before any year-end adjustments, SOMA Company's Insurance Expense account had a balance of $2,500 and its Prepaid Insurance account had a balance of $6,000. It was determined that $2,000 of the Prepaid Insurance had expired. The adjusted balance for Prepaid Insurance for the year would be: * $2,000 $2,500 $4,500 $6,000 None of the above A Company purchased a computer for $15,000 on November 1, 2020. It is estimated that annual depreciation on the computer will be $3,000. If financial statements are to be prepared on December 31, 2020, the company should make the following adjusting entry:* Debit Depreciation Expense, $15,000; Credit Accumulated Depreciation, $15,000 Debit Depreciation Expense, $750; Credit Accumulated Depreciation, $750 Debit Depreciation Expense, $500; Credit Accumulated Depreciation, $500 Debit Computer Equipment, $15,000; Credit Depreciation, $15,000 None of the above NEWYORKER Company received a check for $6,000 on September 1, 2020 which represents a 6 month advance payment of rent on a building it rents to a client. Unearned Rent was credited for the full $6,000. Financial statements will be prepared yearly. The company should make the following adjusting entry on December 31, 2020:* Debit Unearned Rent Revenue, $3,000; Credit Rent Revenue, $3,000 O Debit Rent Revenue, $6,000; Credit Unearned Rent Revenue, $6,000 Debit Unearned Rent Revenue, $4,000; Credit Rent Revenue, $4,000 Debit Cash, $6,000; Credit Rent Revenue, $6,000 None of the above