Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Who receives any survivor benefits payable under the annuity upon the death of the contract owner/annuitant? A) Executor B) Beneficiary C) Annuitant D) Contract owner

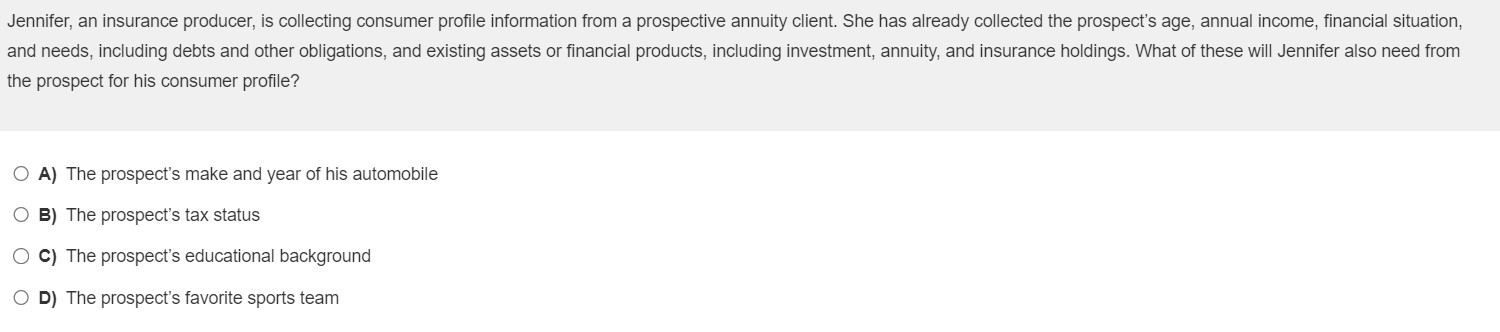

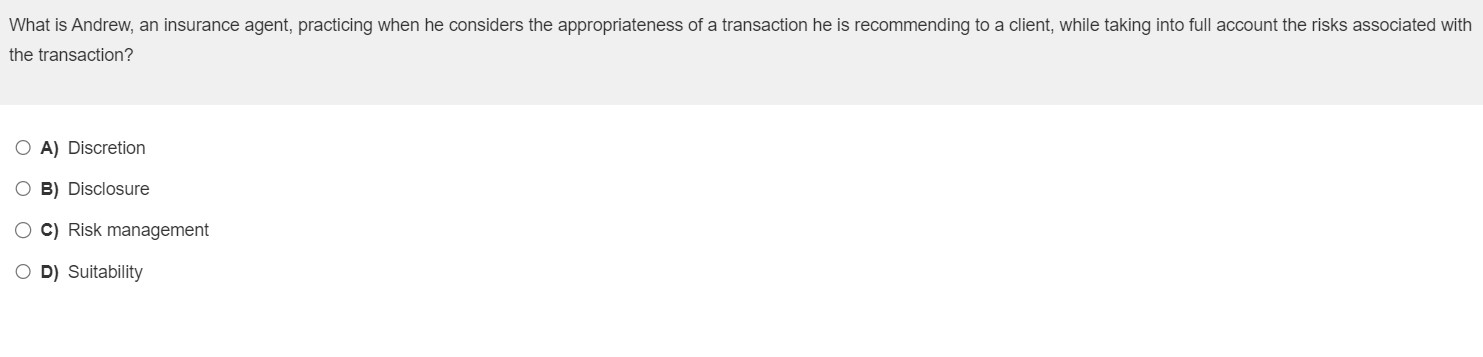

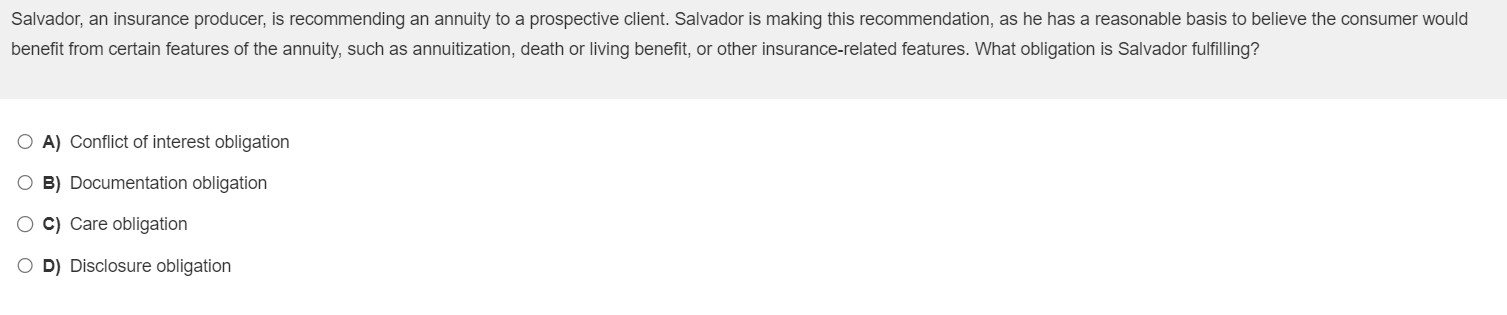

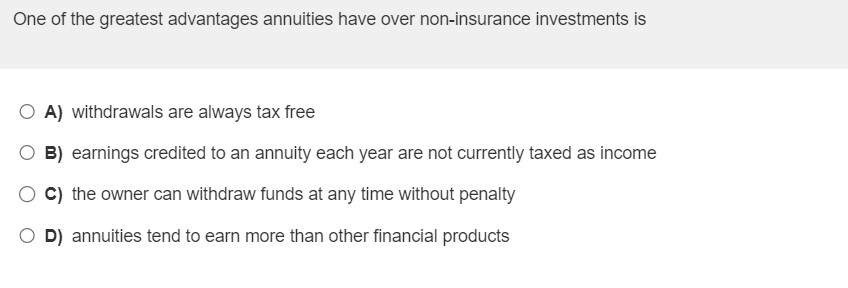

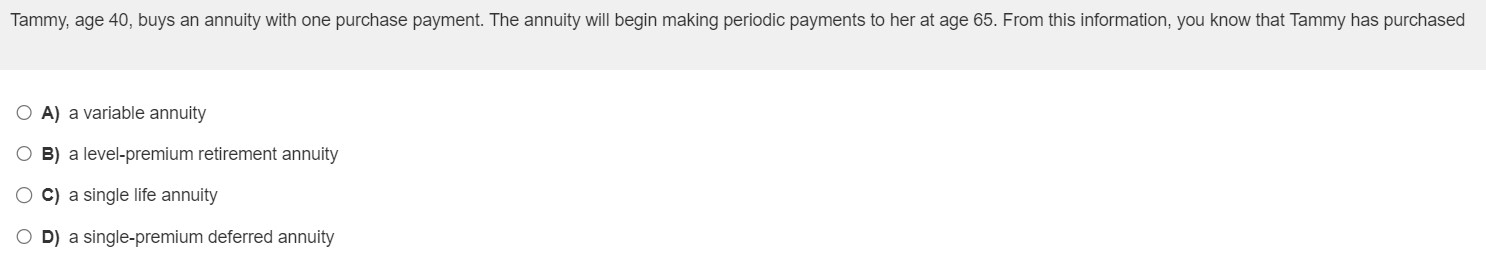

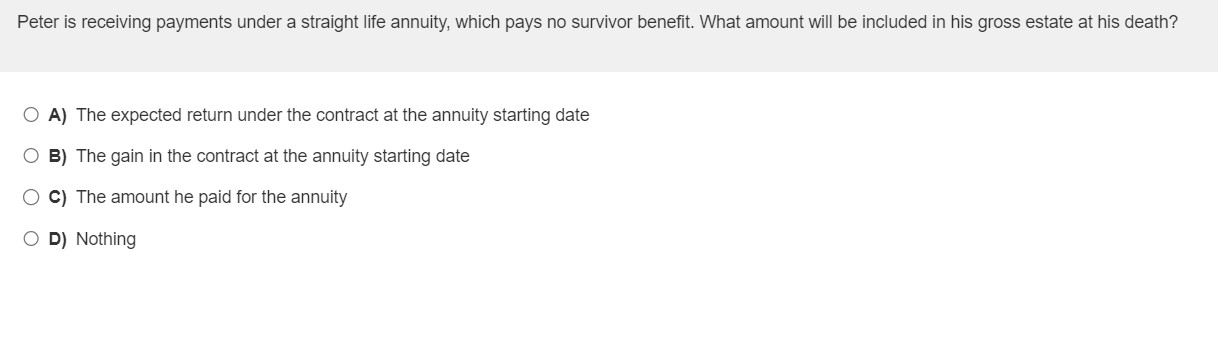

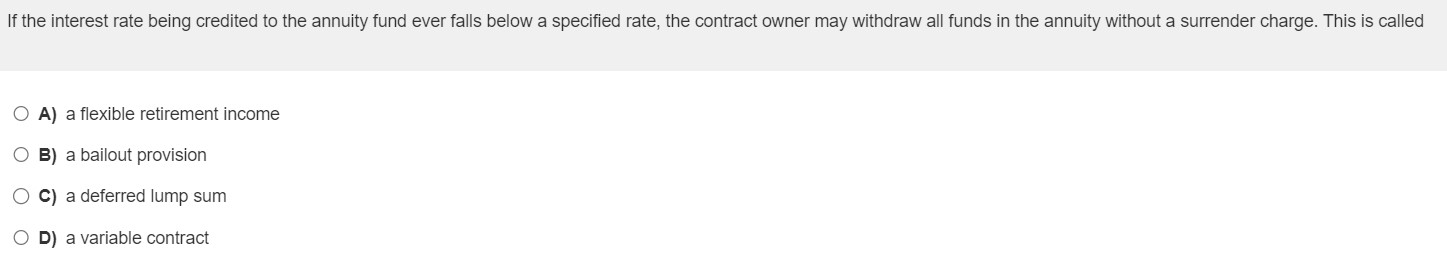

Who receives any survivor benefits payable under the annuity upon the death of the contract owner/annuitant? A) Executor B) Beneficiary C) Annuitant D) Contract owner Which of the following individuals has a need that an annuity is uniquely suited to meet? A) John is an entrepreneur who wants to reduce the taxes his business pays. B) Helen is a working mother who wants to provide for her children in case she dies prematurely. C) Carol has just retired and wants to assure that her funds will last as long as she lives. D) Al, who is elderly and wealthy, is concerned about the disposition of his estate. Jonah wants to purchase an annuity. He doesn't want to risk losing any of his principal, but he would like to earn more than the minimum guaranteed rate of interest. In fact, he would like to earn market-based earnings. Given these considerations, which of the following would you recommend to Jonah? A) Purchase a fixed annuity B) Purchase an immediate annuity C) Purchase an indexed annuity D) Purchase a joint-and-survivor annuity Jennifer, an insurance producer, is collecting consumer profile information from a prospective annuity client. She has already collected the prospect's age, annual income, financial situation, and needs, including debts and other obligations, and existing assets or financial products, including investment, annuity, and insurance holdings. What of these will Jennifer also need from the prospect for his consumer profile? A) The prospect's make and year of his automobile B) The prospect's tax status C) The prospect's educational background D) The prospect's favorite sports team What is Andrew, an insurance agent, practicing when he considers the appropriateness of a transaction he is recommending to a client, while taking into full account the risks associated with the transaction? A) Discretion B) Disclosure C) Risk management D) Suitability Salvador, an insurance producer, is recommending an annuity to a prospective client. Salvador is making this recommendation, as he has a reasonable basis to believe the consumer would benefit from certain features of the annuity, such as annuitization, death or living benefit, or other insurance-related features. What obligation is Salvador fulfilling? A) Conflict of interest obligation B) Documentation obligation C) Care obligation D) Disclosure obligation One of the greatest advantages annuities have over non-insurance investments is A) withdrawals are always tax free B) earnings credited to an annuity each year are not currently taxed as income C) the owner can withdraw funds at any time without penalty D) annuities tend to earn more than other financial products You have explained the various types of annuities to your client, including differences between fixed and variable contracts; immediate and deferred annuities; and single, fixed, or flexible premiums. Your client believes she has a good understanding about annuities based on your discussions. You have your doubts when your client tells you she wants a A) single-premium deferred annuity B) single-premium immediate annuity C) flexible-premium deferred annuity D) flexible-premium immediate annuity Kevin, an insurance agent, advises an individual consumer in such a way that it results in the purchase or exchange of an annuity. What is Kevin's advice called? A) Consultation B) Advisement C) Recommendation D) Direction An insurance agent's recommendation regarding the purchase of an annuity A) may include consideration of the agent's financial needs B) must be reasonable under all the circumstances of the client actually known to the agent at the time of the recommendation C) must be based on the agent's intuition concerning the purchaser's future financial needs D) may be contrary to the client's financial needs Sharon, an insurance producer, is about to recommend an annuity to a prospective client. Sharon has communicated the basis for this recommendation to the client. What obligation is Sharon attempting to fulfill? A) Care obligation B) Documentation obligation C) Disclosure obligation D) Conflict of interest obligation Jack and Jill have an annuity that covers them both. As long as Jack lives, they will receive 100% payments. After Jack's death, Jill will receive 75% of the payment amount. This kind of annuity is A) a joint-and-survivor annuity B) a double annuity C) an immediate annuity D) a single life annuity Two years after she annuitized her annuity funds under a life and 10 -year certain payout structure, Marie died. The funds remaining in her contract are A) reduced to $0 B) paid to her named beneficiary C) paid to her estate D) forfeited to the insurer Raymond is an insurance agent who sells annuities. He meets with Lisa to discuss the purchase of an annuity. Raymond is required to make a reasonable effort to obtain all of the following information from Lisa EXCEPT A) financial objectives B) assets and income information C) liquidity needs D) medical history John is the owner of an annuity that is in the accumulation phase. Jean is named as beneficiary. If John dies, the value of the annuity will A) not be included in his gross estate B) be taxed to John's estate as a capital gain C) be paid to Jean D) be kept by the company that issued the contract Tammy, age 40 , buys an annuity with one purchase payment. The annuity will begin making periodic payments to her at age 65 . From this information, you know that Tammy has purchased A) a variable annuity B) a level-premium retirement annuity C) a single life annuity D) a single-premium deferred annuity Peter is receiving payments under a straight life annuity, which pays no survivor benefit. What amount will be included in his gross estate at his death? A) The expected return under the contract at the annuity starting date B) The gain in the contract at the annuity starting date C) The amount he paid for the annuity D) Nothing If the interest rate being credited to the annuity fund ever falls below a specified rate, the contract owner may withdraw all funds in the annuity without a surrender charge. This is called A) a flexible retirement income B) a bailout provision C) a deferred lump sum D) a variable contract

Who receives any survivor benefits payable under the annuity upon the death of the contract owner/annuitant? A) Executor B) Beneficiary C) Annuitant D) Contract owner Which of the following individuals has a need that an annuity is uniquely suited to meet? A) John is an entrepreneur who wants to reduce the taxes his business pays. B) Helen is a working mother who wants to provide for her children in case she dies prematurely. C) Carol has just retired and wants to assure that her funds will last as long as she lives. D) Al, who is elderly and wealthy, is concerned about the disposition of his estate. Jonah wants to purchase an annuity. He doesn't want to risk losing any of his principal, but he would like to earn more than the minimum guaranteed rate of interest. In fact, he would like to earn market-based earnings. Given these considerations, which of the following would you recommend to Jonah? A) Purchase a fixed annuity B) Purchase an immediate annuity C) Purchase an indexed annuity D) Purchase a joint-and-survivor annuity Jennifer, an insurance producer, is collecting consumer profile information from a prospective annuity client. She has already collected the prospect's age, annual income, financial situation, and needs, including debts and other obligations, and existing assets or financial products, including investment, annuity, and insurance holdings. What of these will Jennifer also need from the prospect for his consumer profile? A) The prospect's make and year of his automobile B) The prospect's tax status C) The prospect's educational background D) The prospect's favorite sports team What is Andrew, an insurance agent, practicing when he considers the appropriateness of a transaction he is recommending to a client, while taking into full account the risks associated with the transaction? A) Discretion B) Disclosure C) Risk management D) Suitability Salvador, an insurance producer, is recommending an annuity to a prospective client. Salvador is making this recommendation, as he has a reasonable basis to believe the consumer would benefit from certain features of the annuity, such as annuitization, death or living benefit, or other insurance-related features. What obligation is Salvador fulfilling? A) Conflict of interest obligation B) Documentation obligation C) Care obligation D) Disclosure obligation One of the greatest advantages annuities have over non-insurance investments is A) withdrawals are always tax free B) earnings credited to an annuity each year are not currently taxed as income C) the owner can withdraw funds at any time without penalty D) annuities tend to earn more than other financial products You have explained the various types of annuities to your client, including differences between fixed and variable contracts; immediate and deferred annuities; and single, fixed, or flexible premiums. Your client believes she has a good understanding about annuities based on your discussions. You have your doubts when your client tells you she wants a A) single-premium deferred annuity B) single-premium immediate annuity C) flexible-premium deferred annuity D) flexible-premium immediate annuity Kevin, an insurance agent, advises an individual consumer in such a way that it results in the purchase or exchange of an annuity. What is Kevin's advice called? A) Consultation B) Advisement C) Recommendation D) Direction An insurance agent's recommendation regarding the purchase of an annuity A) may include consideration of the agent's financial needs B) must be reasonable under all the circumstances of the client actually known to the agent at the time of the recommendation C) must be based on the agent's intuition concerning the purchaser's future financial needs D) may be contrary to the client's financial needs Sharon, an insurance producer, is about to recommend an annuity to a prospective client. Sharon has communicated the basis for this recommendation to the client. What obligation is Sharon attempting to fulfill? A) Care obligation B) Documentation obligation C) Disclosure obligation D) Conflict of interest obligation Jack and Jill have an annuity that covers them both. As long as Jack lives, they will receive 100% payments. After Jack's death, Jill will receive 75% of the payment amount. This kind of annuity is A) a joint-and-survivor annuity B) a double annuity C) an immediate annuity D) a single life annuity Two years after she annuitized her annuity funds under a life and 10 -year certain payout structure, Marie died. The funds remaining in her contract are A) reduced to $0 B) paid to her named beneficiary C) paid to her estate D) forfeited to the insurer Raymond is an insurance agent who sells annuities. He meets with Lisa to discuss the purchase of an annuity. Raymond is required to make a reasonable effort to obtain all of the following information from Lisa EXCEPT A) financial objectives B) assets and income information C) liquidity needs D) medical history John is the owner of an annuity that is in the accumulation phase. Jean is named as beneficiary. If John dies, the value of the annuity will A) not be included in his gross estate B) be taxed to John's estate as a capital gain C) be paid to Jean D) be kept by the company that issued the contract Tammy, age 40 , buys an annuity with one purchase payment. The annuity will begin making periodic payments to her at age 65 . From this information, you know that Tammy has purchased A) a variable annuity B) a level-premium retirement annuity C) a single life annuity D) a single-premium deferred annuity Peter is receiving payments under a straight life annuity, which pays no survivor benefit. What amount will be included in his gross estate at his death? A) The expected return under the contract at the annuity starting date B) The gain in the contract at the annuity starting date C) The amount he paid for the annuity D) Nothing If the interest rate being credited to the annuity fund ever falls below a specified rate, the contract owner may withdraw all funds in the annuity without a surrender charge. This is called A) a flexible retirement income B) a bailout provision C) a deferred lump sum D) a variable contract Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started