Answered step by step

Verified Expert Solution

Question

1 Approved Answer

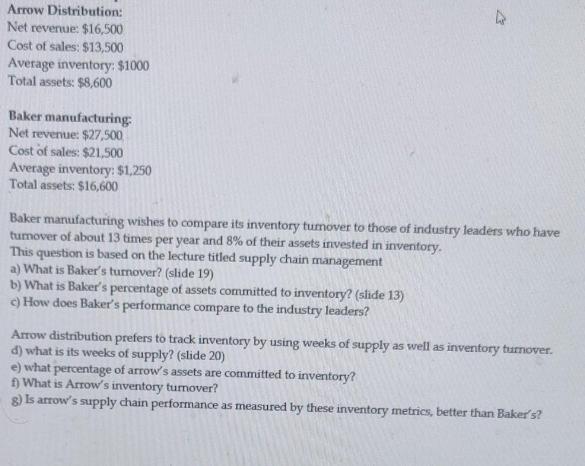

Arrow Distribution: Net revenue: $16,500 Cost of sales: $13,500 Average inventory: $1000 Total assets: $8,600 Baker manufacturing Net revenue: $27,500 Cost of sales: $21,500

Arrow Distribution: Net revenue: $16,500 Cost of sales: $13,500 Average inventory: $1000 Total assets: $8,600 Baker manufacturing Net revenue: $27,500 Cost of sales: $21,500 Average inventory: $1,250 Total assets: $16,600 Baker manufacturing wishes to compare its inventory tumover to those of industry leaders who have turnover of about 13 times per year and 8% of their assets invested in inventory. This question is based on the lecture titled supply chain management a) What is Baker's turnover? (slide 19) b) What is Baker's percentage of assets committed to inventory? (slide 13) c) How does Baker's performance compare to the industry leaders? Arrow distribution prefers to track inventory by using weeks of supply as well as inventory turnover. d) what is its weeks of supply? (slide 20) e) what percentage of arrow's assets are committed to inventory? f) What is Arrow's inventory turnover? g) Is arrow's supply chain performance as measured by these inventory metrics, better than Baker's?

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions lets calculate the relevant metrics for Baker Manufacturing and Arrow Distribution a Bakers turnover inventory turnover is ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started