Why is option 2 and 3 correct ?

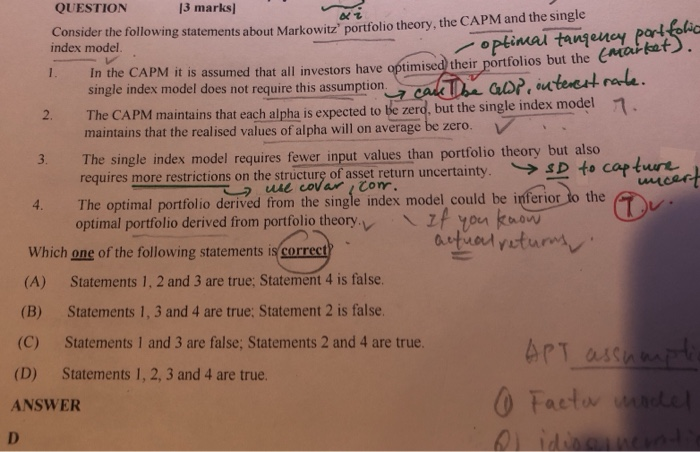

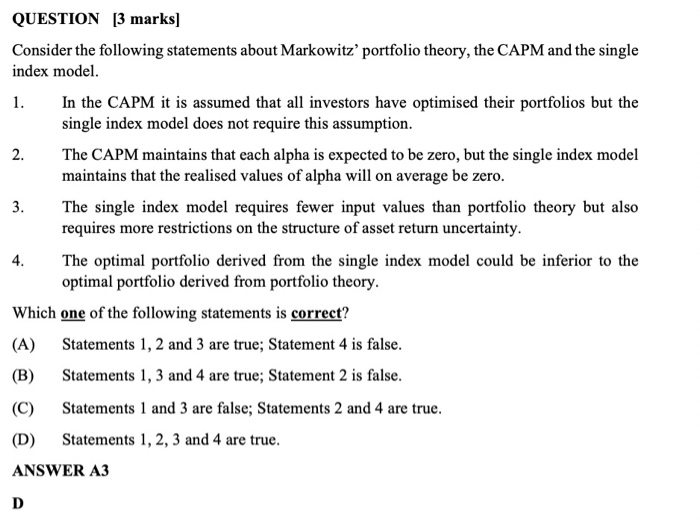

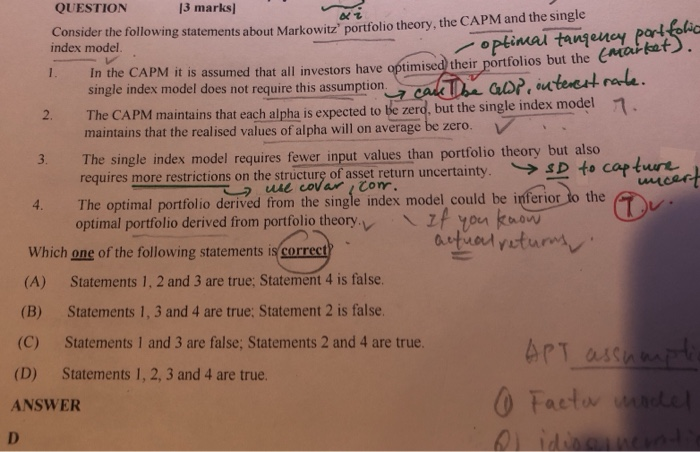

ot In the CAPM it is assumed that all investors have optimised their portfolios but the Market. QUESTION 13 marks Consider the following statements about Markowitz' portfolio theory, the CAPM and the single index model 1. optimal tangency partfolics y can be Gop, interest rake. single index model does not require this assumption 2. The CAPM maintains that each alpha is expected to be zero, but the single index model 7. maintains that the realised values of alpha will on average be zero. 3. The single index model requires fewer input values than portfolio theory but also requires more restrictions on the structure of asset return uncertainty. SD to capture use covar, com. mcert 4. The optimal portfolio derived from the single index model could be inferior to the optimal portfolio derived from portfolio theory. If you know Which one of the following statements is correct actual retums Statements 1, 2 and 3 are true; Statement 4 is false. (B) Statements 1, 3 and 4 are true: Statement 2 is false. (C) Statements 1 and 3 are false; Statements 2 and 4 are true. (D) Statements 1, 2, 3 and 4 are true. ANSWER o Factor model D a (A) APT assumption QUESTION [3 marks] Consider the following statements about Markowitz' portfolio theory, the CAPM and the single index model. 1. In the CAPM it is assumed that all investors have optimised their portfolios but the single index model does not require this assumption. 2. The CAPM maintains that each alpha is expected to be zero, but the single index model maintains that the realised values of alpha will on average be zero. 3. The single index model requires fewer input values than portfolio theory but also requires more restrictions on the structure of asset return uncertainty. 4. The optimal portfolio derived from the single index model could be inferior to the optimal portfolio derived from portfolio theory. Which one of the following statements is correct? (A) Statements 1, 2 and 3 are true; Statement 4 is false. (B) Statements 1, 3 and 4 are true; Statement 2 is false. (C) Statements 1 and 3 are false; Statements 2 and 4 are true. (D) Statements 1, 2, 3 and 4 are true. ANSWER A3 D