Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why is this called deferred tax liability instead of deferred tax asset? Alvis Corporation reports pretax accounting income of $400,000, but due to a single

Why is this called deferred tax liability instead of deferred tax asset?

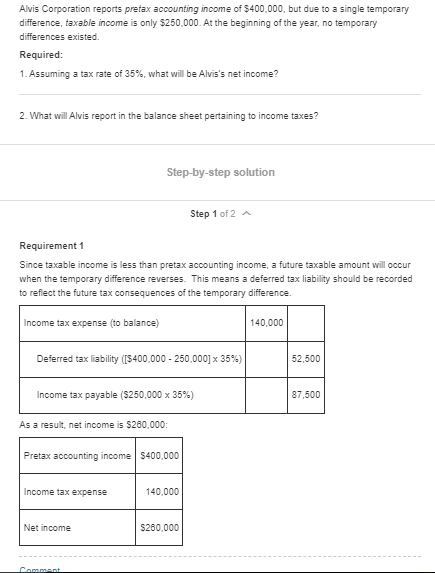

Alvis Corporation reports pretax accounting income of $400,000, but due to a single temporary difference, taxable income is only $250.000. At the beginning of the year, no temporary differences existed Required: 1. Assuming a tax rate of 35%, what will be Alvis's net income? 2. What will Alvis report in the balance sheet pertaining to income taxes? Step-by-step solution Step 1 of 2 A Requirement 1 Since taxable income is less than pretax accounting income, a future taxable amount will occur when the temporary difference reverses. This means a deferred tax liability should be recorded to reflect the future tax consequences of the temporary difference Income tax expense (to balance) 140,000 Deferred tax liability ([5400,000 - 250.000] x 359) 52.500 Income tax payable ($250,000 x 35%) 87,500 As a result, net income is $260.000: Pretax accounting income $400,000 Income tax expense 140.000 Net income $260.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started