Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why might an investor prefer to invest indirectly rather than directly? Why might an investor prefer to invest directly rather than indirectly? Based on Exhibit

Why might an investor prefer to invest indirectly rather than directly?

- Why might an investor prefer to invest directly rather than indirectly?

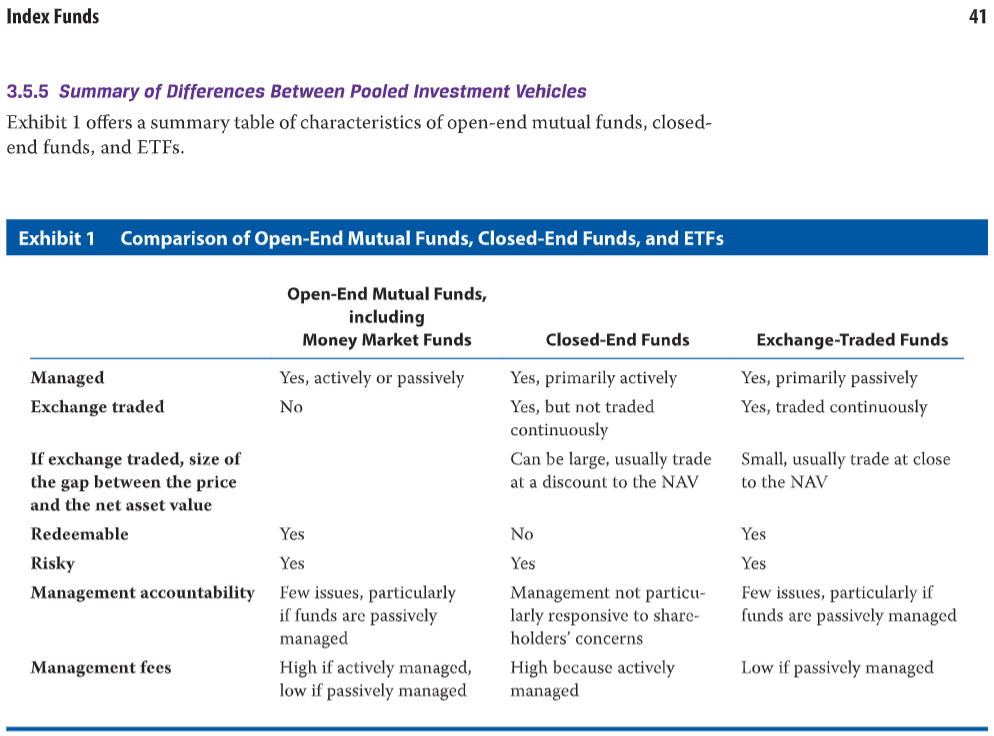

- Based on Exhibit 1 (shown in the picture below), why do you thinkexchange-traded fundsareexploding in popularityamong investors?

(Answer each point in separate paragraphs so I can understand what each point is.)

Index Funds 3.5.5 Summary of Differences Between Pooled Investment Vehicles Exhibit 1 offers a summary table of characteristics of open-end mutual funds, closed- end funds, and ETFs. Exhibit 1 Comparison of Open-End Mutual Funds, Closed-End Funds, and ETFs Managed Exchange traded If exchange traded, size of the gap between the price and the net asset value Redeemable Risky Management accountability Management fees Open-End Mutual Funds, including Money Market Funds Yes, actively or passively No Yes Yes Few issues, particularly if funds are passively managed High if actively managed, low if passively managed Closed-End Funds Yes, primarily actively Yes, but not traded continuously Can be large, usually trade at a discount to the NAV No Yes Management not particu- larly responsive to share- holders' concerns High because actively managed Exchange-Traded Funds Yes, primarily passively Yes, traded continuously Small, usually trade at close. to the NAV Yes Yes Few issues, particularly if funds are passively managed Low if passively managed 41

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Investing Indirectly Investors might prefer to invest indirectly for various reasons 1 Diversification Indirect investment such as through mutual funds or exchangetraded funds ETFs provides instant di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started