Question: Why NEC has no debt in its capital structure L. L L NOTES ON CAPITAL STRUCTURE POLICY: : The Debt Policy Puzzle (Abridged) First, historically,

Why NEC has no debt in its capital structure

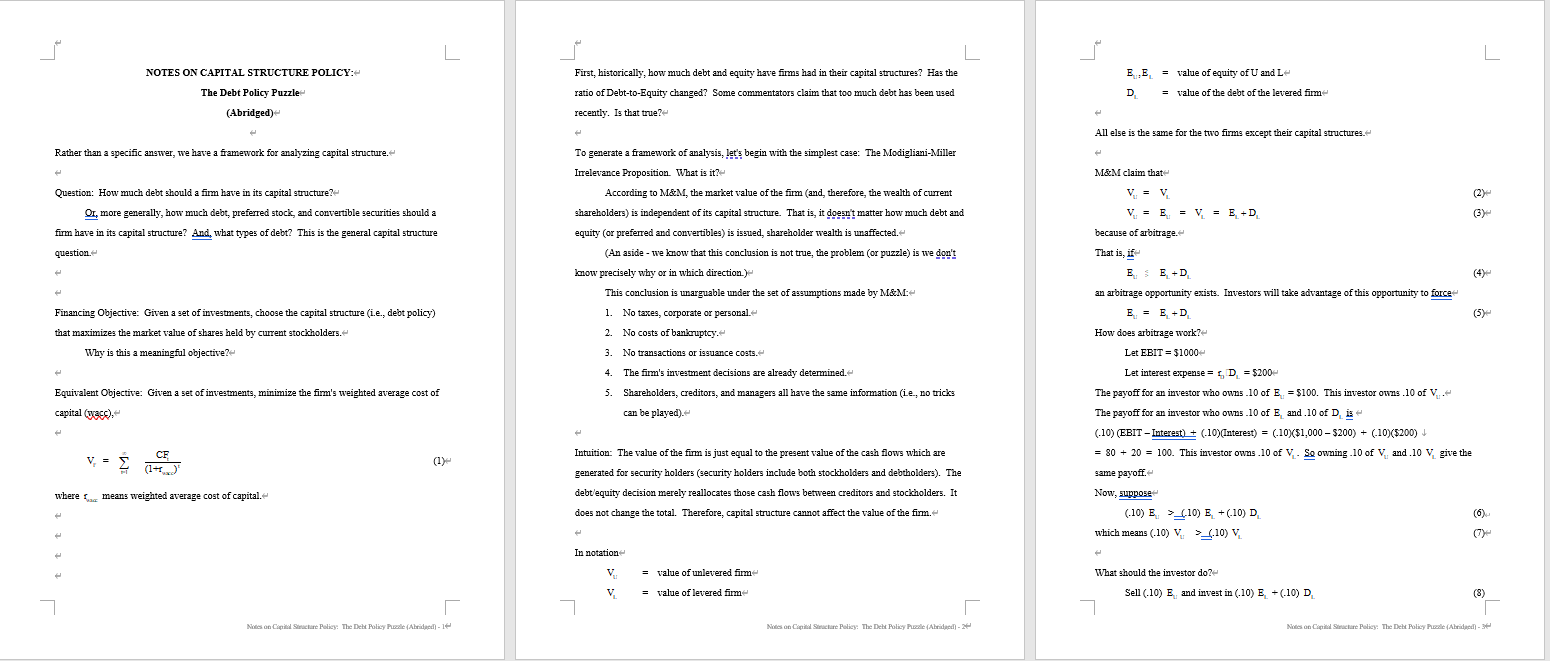

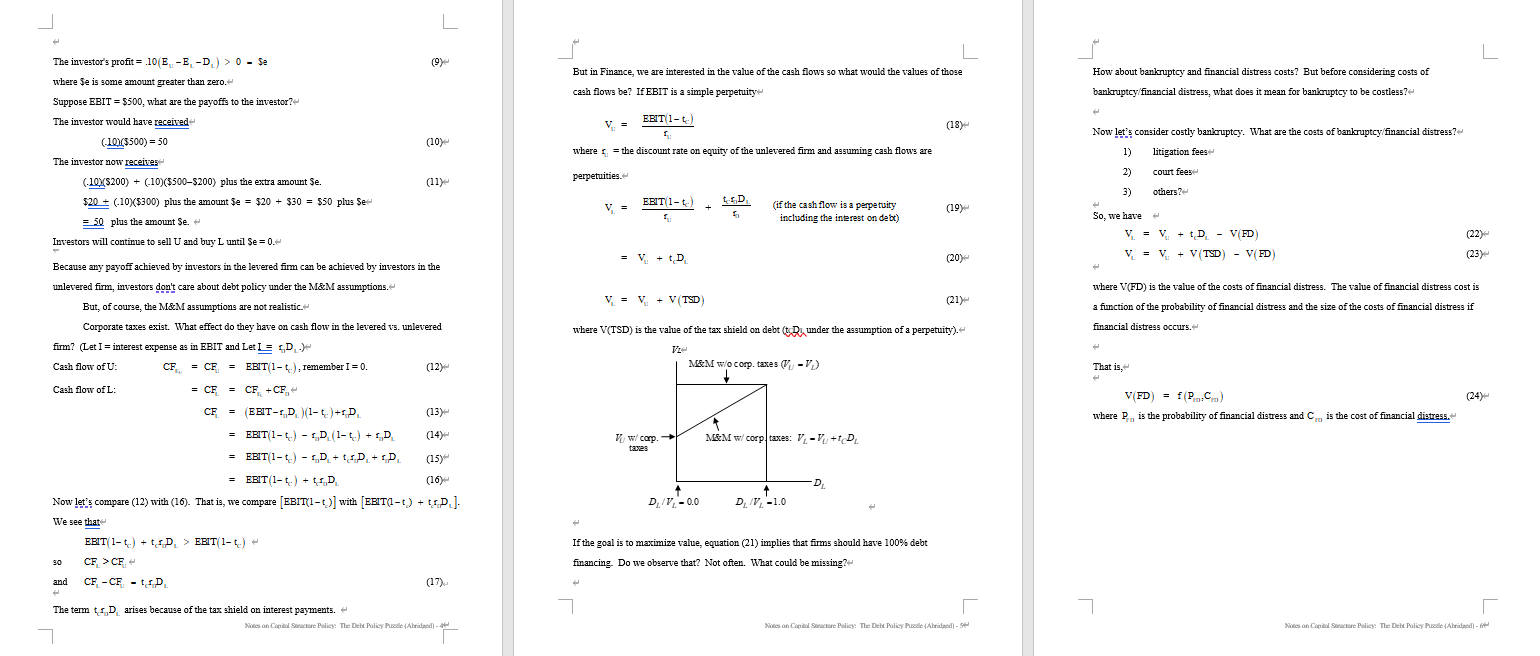

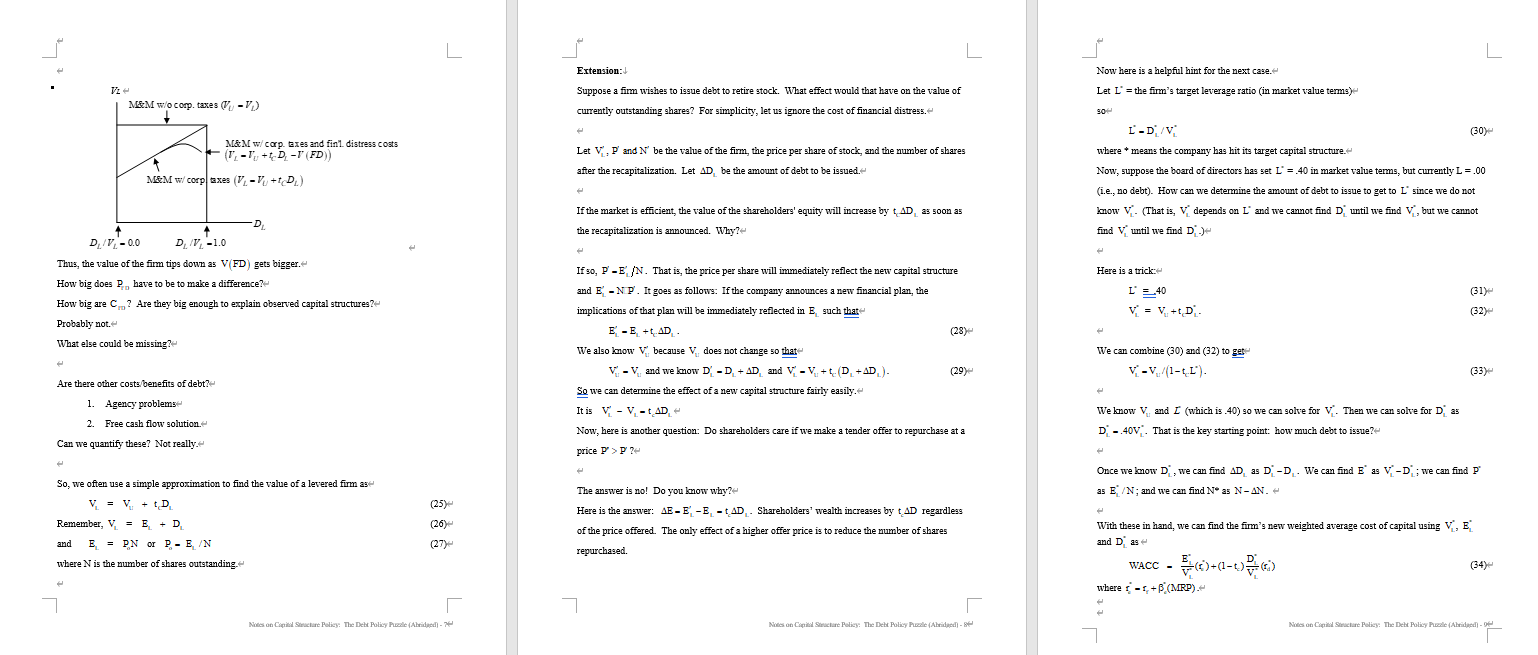

L. L L NOTES ON CAPITAL STRUCTURE POLICY: : The Debt Policy Puzzle (Abridged) First, historically, how much debt and equity have fims had in their capital structures? Has the ratio of Debt-to-Equity changed? Some commentators claim that too much debt has been used ? recently. Is that true? ? EE = value of equity of U and L D = value of the debt of the levered firm All else is the same for the two firms except their capital structures. Rather than a specific answer, we have a framework for analyzing capital structure. M&M claim that (2) (3) Question: How much debt should a firm have in its capital structure? Or, more generally, how much debt, preferred stock, and convertible securities should a firm have in its capital structure? And what types of debt? This is the general capital structure question. To generate a framework of analysis, let's begin with the simplest case: The Modigliani-Miller Irrelevance Proposition. What is it? According to M&M, the market value of the firm (and, therefore, the wealth of current shareholders) is independent of its capital structure. That is, it doesn't matter how much debt and equity (or preferred and convertibles) is issued, shareholder wealth is unaffected. (An aside - we know that this conclusion is not true, the problem (or puzzle) is we don't lonow precisely why or in which direction. This conclusion is unarguable under the set of assumptions made by M&M:- 1. No taxes, corporate or personal. V = V V = E= V = E +D. because of arbitrage. That is, if EE+D an arbitrage opportunity exists. Investors will take advantage of this opportunity to force E = E +D E . How does arbitrage work? Let EBIT = $1000- (5) Financing Objective: Given a set of investments, choose the capital structure (i.e., debt policy) that maximizes the market value of shares held by current stockholders. Why is this a meaningful objective? 2. No costs of bankruptcy. 3. No transactions or issuance costs. 4. Equivalent Objective: Given a set of investments, minimize the firm's weighted average cost of capital (wa). The firm's investment decisions are already determined. 5. Shareholders, creditors, and managers all have the same information (ie., no tricks can be played). - (1) Intuition: The value of the firm is just equal to the present value of the cash flows which are generated for security holders (security holders include both stockholders and debtholders). The debt'equity decision merely reallocates those cash flows between creditors and stockholders. It does not change the total. Therefore, capital structure cannot affect the value of the firm. Let interest expense = L, D = $200 The payoff for an investor who owns 10 of E = $100. This investor owns 10 of V.. The payoff for an investor who owns 10 of E, and 10 of Dis (-10) (EBIT - Interest) + (-10)(Interest) = (-10%($1,000 - $200) + (-10)($200) = 30 + 20 = 100. This investor owns 10 of V. So owning 10 of Vand .10 V. give the same payoff. Now, suppose (10) E, >1.10) E +(-10) D. (6) which means (10) V >4.10) V. where a means weighted average cost of capital. In notation = value of unlevered fimm = value of levered firm V. 7 What should the investor do? Sell (-10) E and invest in (10) E (10) D. (8) Notes on Sinclare Policy: The Del Polacy Pole (Al- Notes on Sinclare Policy: The Del Polacy Pole (Ali-10 Notes on Sinclare Policy: The Del Polacy Pole (Al-2 L L (9) But in Finance, we are interested in the value of the cash flows 90 what would the values of those cash flows be? If EBIT is a simple perpetuity How about bankruptcy and financial distress costs? But before considering costs of bankruptcy/financial distress, what does it mean for bankruptcy to be costless? The investor's profit= .10(E-E.-D.) >0 - Se where Se is some amount greater than zero. Suppose EBIT = $500, what are the payoffs to the investor? The investor would have received (-10X5500) = 30 EBIT 1- (18) (10) where = the discount rate on equity of the unlevered firm and assuming cash flows are Now let's consider costly bankruptcy. What are the costs of bankruptcy/financial distress? 1) litigation fees 2) court fees The investor now receives (11) perpetuities. 3) others? LED (-10X5200) + (-10)(5500-5200) plus the extra amount $e. $20 + (.10X($300) plus the amount $e = $20 + $30 = $50 plus se = 50 plus the amount Se. Investors will continue to sell U and buy L until Se=0.- EBIT 1-te) fu + (if the cash flow is a perpetuity ( including the interest on debt) (19) So, we have V = V + D - V(FD) V = V + VTSD) - VFD V = V + V (TSD V) (22) (23) = V+ D (20) V = V + V (TSD) (21) where V(FD) is the value of the costs of financial distress. The value of financial distress cost is a function of the probability of financial distress and the size of the costs of financial distress if financial distress occurs. where V(TSD) is the value of the tax shield on debt Du under the assumption of a perpetuity). Vz M&M w/o corp. taxes V-V) That is, V(FD) = f(PC) where is the probability of financial distress and C. is the cost of financial distress. Because any payoff achieved by investors in the levered firm can be achieved by investors in the unlevered firm, investors don't care about debt policy under the M&M assumptions. But, of course, the M&M assumptions are not realistic Corporate taxes exist. What effect do they have on cash flow in the levered vs. unlevered firm? (Let I = interest expense as in EBIT and Let I SD- Cash flow of U: CF = CF. = EBIT 1-t.), remember I = 0. (12) Cash flow of L: = CF = CF +CF, CF = = (EBIT-D.)1-t.)+1P. (13) = EBIT1-t.) -LD (1-t.) + D. = EBIT 1- ) - 2D + 3D +D (15) = EBIT 1-t.) + LED (16) Now let's compare (12) with (16). That is, we compare (EBIT(1-t)] with (EBITI-t) + top.]. We see that EBIT 1-t.) + ED > EBIT 1-t) CF > CF CF - CF - VID (17) wlcorp. taxes M&M w/corp taxes: V-V + D. D DIV-0.0 + DV-1.0 If the goal is to maximize value, equation (21) implies that fimms should have 100% debt financing. Do we observe that? Not often. What could be missing? 90 and T 1 The term D. arises because of the tax shield on interest payments. Notes on Sinclare Policy: The Del Polacy Pole (Ald Notes on Cap Schare Policy: The Debt Policy e Abridad) - Notes on a Saclare Policy: The Debt Policy Pale Abridged) - L L L Extension: Now here is a helpful hint for the next case. Let L' = the firm's target leverage ratio in market value terms) M&M w/o corp. taxes V-V) Suppose a fim wishes to issue debt to retire stock. What effect would that have on the value of currently outstanding shares? For simplicity, let us ignore the cost of financial distress. 90 M&M w/carp. Exes and fini distress costs T',-1, D.-T (FD) Let V. P and N' be the value of the firm, the price per share of stock, and the number of shares after the recapitalization. Let AD be the amount of debt to be issued. M&M w/corp sxes V-V + D) L-DV (30) where * means the company has hit its target capital structure. Now, suppose the board of directors has set L = 40 in market value terms, but currently L = .00 (1.e., no debt). How can we determine the amount of debt to issue to get to L since we do not know - (That is, depends on L' and we cannot find D until we find V, but we cannot find V until we find D.) If the market is efficient, the value of the shareholders' equity will increase by AD as soon as the recapitalization is announced. Why? Here is a trick D DIV-0.0 DV-1.0 Thus, the value of the firm tips down as V(FD) gets bigger. How big does P. have to be to make a difference? How big are C.? Are they big enough to explain observed capital structures? Probably not What else could be missing? (31) L' =.40 V = V +D If 30, P-E/N. That is, the price per share will immediately reflect the new capital structure and E-NP. It goes as follows: If the company announces a new financial plan, the implications of that plan will be immediately reflected in E such that E-E + LAD We also know because V does not change so that V-V and we know D-D + AD and V-V +D+AD). So we can determine the effect of a new capital structure fairly easily. It is V-V. - AD- Now, here is another question: Do shareholders care if we make a tender offer to repurchase at a price PP? We can combine (30) and (32) to get V-V/1-L). (33) Are there other costs benefits of debt? 1. Agency problems 2. Free cash flow solution- We know V, and I (which is 40) so we can solve for V. Then we can solve for Das D. -40V. That is the key starting point: how much debt to issue? Can we quantify these? Not really Once we know D, we can find AD as D-D . We can find E as V-D ; we can find P as E/N; and we can find N as N-AN. So, we often use a simple approximation to find the value of a levered firm as- V = V+ t D Remember, V = E + D. and E = PN or P- EN where N is the number of shares outstanding (25) ( (26) The answer is no! Do you know why? Here is the answer: AE-E-E - TAD - Shareholders' wealth increases by t AD regardless of the price offered. The only effect of a higher offer price is to reduce the number of shares repurchased. With these in hand, we can find the firm's new weighted average cost of capital using V, E and Das WACC - (+(1-2) 2 where - F,+B (MRP). Notes on Cap Schar Policy: The Debt Policy Pie (Alided) - Notes on Capital Sociare Policy: The Del Policy Pele (Alded- Notes on Capital Saclare Policy: The Del Policy Pal (Arded - L. A Further Extension Now let's go a bit further. Let's assume that management and the board of directors wish to execute the transaction by issuing debt to achieve L' = 40 and to buy back shares at a price that is a 25% premium relative to the market price today. Let the offer price be p such that P" = 1.25P. What will happen to the stock price when the buy back decision is announced? If the debt to be issued is D, then the number of shares to be repurchased will be AN-D/P and the number of shares that will be outstanding after the transaction will be N-AN-N-(D"/P)-N" What will the total market value of the firm be?- V-V +D+ and V-E +D E-V-D- P-EN. L. L L NOTES ON CAPITAL STRUCTURE POLICY: : The Debt Policy Puzzle (Abridged) First, historically, how much debt and equity have fims had in their capital structures? Has the ratio of Debt-to-Equity changed? Some commentators claim that too much debt has been used ? recently. Is that true? ? EE = value of equity of U and L D = value of the debt of the levered firm All else is the same for the two firms except their capital structures. Rather than a specific answer, we have a framework for analyzing capital structure. M&M claim that (2) (3) Question: How much debt should a firm have in its capital structure? Or, more generally, how much debt, preferred stock, and convertible securities should a firm have in its capital structure? And what types of debt? This is the general capital structure question. To generate a framework of analysis, let's begin with the simplest case: The Modigliani-Miller Irrelevance Proposition. What is it? According to M&M, the market value of the firm (and, therefore, the wealth of current shareholders) is independent of its capital structure. That is, it doesn't matter how much debt and equity (or preferred and convertibles) is issued, shareholder wealth is unaffected. (An aside - we know that this conclusion is not true, the problem (or puzzle) is we don't lonow precisely why or in which direction. This conclusion is unarguable under the set of assumptions made by M&M:- 1. No taxes, corporate or personal. V = V V = E= V = E +D. because of arbitrage. That is, if EE+D an arbitrage opportunity exists. Investors will take advantage of this opportunity to force E = E +D E . How does arbitrage work? Let EBIT = $1000- (5) Financing Objective: Given a set of investments, choose the capital structure (i.e., debt policy) that maximizes the market value of shares held by current stockholders. Why is this a meaningful objective? 2. No costs of bankruptcy. 3. No transactions or issuance costs. 4. Equivalent Objective: Given a set of investments, minimize the firm's weighted average cost of capital (wa). The firm's investment decisions are already determined. 5. Shareholders, creditors, and managers all have the same information (ie., no tricks can be played). - (1) Intuition: The value of the firm is just equal to the present value of the cash flows which are generated for security holders (security holders include both stockholders and debtholders). The debt'equity decision merely reallocates those cash flows between creditors and stockholders. It does not change the total. Therefore, capital structure cannot affect the value of the firm. Let interest expense = L, D = $200 The payoff for an investor who owns 10 of E = $100. This investor owns 10 of V.. The payoff for an investor who owns 10 of E, and 10 of Dis (-10) (EBIT - Interest) + (-10)(Interest) = (-10%($1,000 - $200) + (-10)($200) = 30 + 20 = 100. This investor owns 10 of V. So owning 10 of Vand .10 V. give the same payoff. Now, suppose (10) E, >1.10) E +(-10) D. (6) which means (10) V >4.10) V. where a means weighted average cost of capital. In notation = value of unlevered fimm = value of levered firm V. 7 What should the investor do? Sell (-10) E and invest in (10) E (10) D. (8) Notes on Sinclare Policy: The Del Polacy Pole (Al- Notes on Sinclare Policy: The Del Polacy Pole (Ali-10 Notes on Sinclare Policy: The Del Polacy Pole (Al-2 L L (9) But in Finance, we are interested in the value of the cash flows 90 what would the values of those cash flows be? If EBIT is a simple perpetuity How about bankruptcy and financial distress costs? But before considering costs of bankruptcy/financial distress, what does it mean for bankruptcy to be costless? The investor's profit= .10(E-E.-D.) >0 - Se where Se is some amount greater than zero. Suppose EBIT = $500, what are the payoffs to the investor? The investor would have received (-10X5500) = 30 EBIT 1- (18) (10) where = the discount rate on equity of the unlevered firm and assuming cash flows are Now let's consider costly bankruptcy. What are the costs of bankruptcy/financial distress? 1) litigation fees 2) court fees The investor now receives (11) perpetuities. 3) others? LED (-10X5200) + (-10)(5500-5200) plus the extra amount $e. $20 + (.10X($300) plus the amount $e = $20 + $30 = $50 plus se = 50 plus the amount Se. Investors will continue to sell U and buy L until Se=0.- EBIT 1-te) fu + (if the cash flow is a perpetuity ( including the interest on debt) (19) So, we have V = V + D - V(FD) V = V + VTSD) - VFD V = V + V (TSD V) (22) (23) = V+ D (20) V = V + V (TSD) (21) where V(FD) is the value of the costs of financial distress. The value of financial distress cost is a function of the probability of financial distress and the size of the costs of financial distress if financial distress occurs. where V(TSD) is the value of the tax shield on debt Du under the assumption of a perpetuity). Vz M&M w/o corp. taxes V-V) That is, V(FD) = f(PC) where is the probability of financial distress and C. is the cost of financial distress. Because any payoff achieved by investors in the levered firm can be achieved by investors in the unlevered firm, investors don't care about debt policy under the M&M assumptions. But, of course, the M&M assumptions are not realistic Corporate taxes exist. What effect do they have on cash flow in the levered vs. unlevered firm? (Let I = interest expense as in EBIT and Let I SD- Cash flow of U: CF = CF. = EBIT 1-t.), remember I = 0. (12) Cash flow of L: = CF = CF +CF, CF = = (EBIT-D.)1-t.)+1P. (13) = EBIT1-t.) -LD (1-t.) + D. = EBIT 1- ) - 2D + 3D +D (15) = EBIT 1-t.) + LED (16) Now let's compare (12) with (16). That is, we compare (EBIT(1-t)] with (EBITI-t) + top.]. We see that EBIT 1-t.) + ED > EBIT 1-t) CF > CF CF - CF - VID (17) wlcorp. taxes M&M w/corp taxes: V-V + D. D DIV-0.0 + DV-1.0 If the goal is to maximize value, equation (21) implies that fimms should have 100% debt financing. Do we observe that? Not often. What could be missing? 90 and T 1 The term D. arises because of the tax shield on interest payments. Notes on Sinclare Policy: The Del Polacy Pole (Ald Notes on Cap Schare Policy: The Debt Policy e Abridad) - Notes on a Saclare Policy: The Debt Policy Pale Abridged) - L L L Extension: Now here is a helpful hint for the next case. Let L' = the firm's target leverage ratio in market value terms) M&M w/o corp. taxes V-V) Suppose a fim wishes to issue debt to retire stock. What effect would that have on the value of currently outstanding shares? For simplicity, let us ignore the cost of financial distress. 90 M&M w/carp. Exes and fini distress costs T',-1, D.-T (FD) Let V. P and N' be the value of the firm, the price per share of stock, and the number of shares after the recapitalization. Let AD be the amount of debt to be issued. M&M w/corp sxes V-V + D) L-DV (30) where * means the company has hit its target capital structure. Now, suppose the board of directors has set L = 40 in market value terms, but currently L = .00 (1.e., no debt). How can we determine the amount of debt to issue to get to L since we do not know - (That is, depends on L' and we cannot find D until we find V, but we cannot find V until we find D.) If the market is efficient, the value of the shareholders' equity will increase by AD as soon as the recapitalization is announced. Why? Here is a trick D DIV-0.0 DV-1.0 Thus, the value of the firm tips down as V(FD) gets bigger. How big does P. have to be to make a difference? How big are C.? Are they big enough to explain observed capital structures? Probably not What else could be missing? (31) L' =.40 V = V +D If 30, P-E/N. That is, the price per share will immediately reflect the new capital structure and E-NP. It goes as follows: If the company announces a new financial plan, the implications of that plan will be immediately reflected in E such that E-E + LAD We also know because V does not change so that V-V and we know D-D + AD and V-V +D+AD). So we can determine the effect of a new capital structure fairly easily. It is V-V. - AD- Now, here is another question: Do shareholders care if we make a tender offer to repurchase at a price PP? We can combine (30) and (32) to get V-V/1-L). (33) Are there other costs benefits of debt? 1. Agency problems 2. Free cash flow solution- We know V, and I (which is 40) so we can solve for V. Then we can solve for Das D. -40V. That is the key starting point: how much debt to issue? Can we quantify these? Not really Once we know D, we can find AD as D-D . We can find E as V-D ; we can find P as E/N; and we can find N as N-AN. So, we often use a simple approximation to find the value of a levered firm as- V = V+ t D Remember, V = E + D. and E = PN or P- EN where N is the number of shares outstanding (25) ( (26) The answer is no! Do you know why? Here is the answer: AE-E-E - TAD - Shareholders' wealth increases by t AD regardless of the price offered. The only effect of a higher offer price is to reduce the number of shares repurchased. With these in hand, we can find the firm's new weighted average cost of capital using V, E and Das WACC - (+(1-2) 2 where - F,+B (MRP). Notes on Cap Schar Policy: The Debt Policy Pie (Alided) - Notes on Capital Sociare Policy: The Del Policy Pele (Alded- Notes on Capital Saclare Policy: The Del Policy Pal (Arded - L. A Further Extension Now let's go a bit further. Let's assume that management and the board of directors wish to execute the transaction by issuing debt to achieve L' = 40 and to buy back shares at a price that is a 25% premium relative to the market price today. Let the offer price be p such that P" = 1.25P. What will happen to the stock price when the buy back decision is announced? If the debt to be issued is D, then the number of shares to be repurchased will be AN-D/P and the number of shares that will be outstanding after the transaction will be N-AN-N-(D"/P)-N" What will the total market value of the firm be?- V-V +D+ and V-E +D E-V-D- P-EN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts