Answered step by step

Verified Expert Solution

Question

1 Approved Answer

why professor gave me a homework that he didn't teach me 3. Calculating Project NPV Down Under Boomerang, Inc. is considering a new three-year expansion

why professor gave me a homework that he didn't teach me

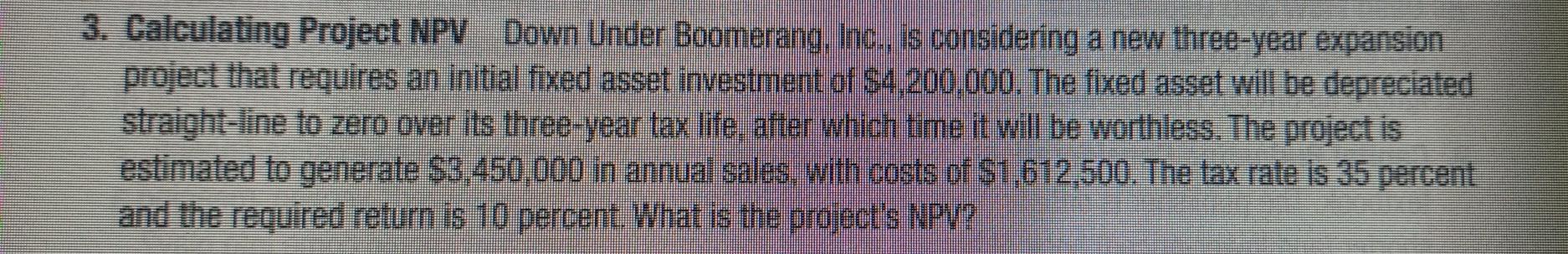

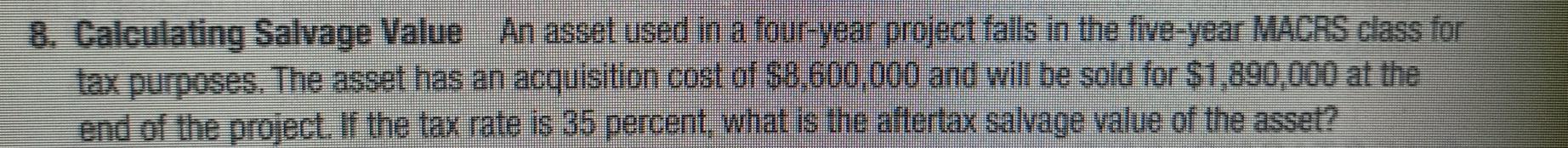

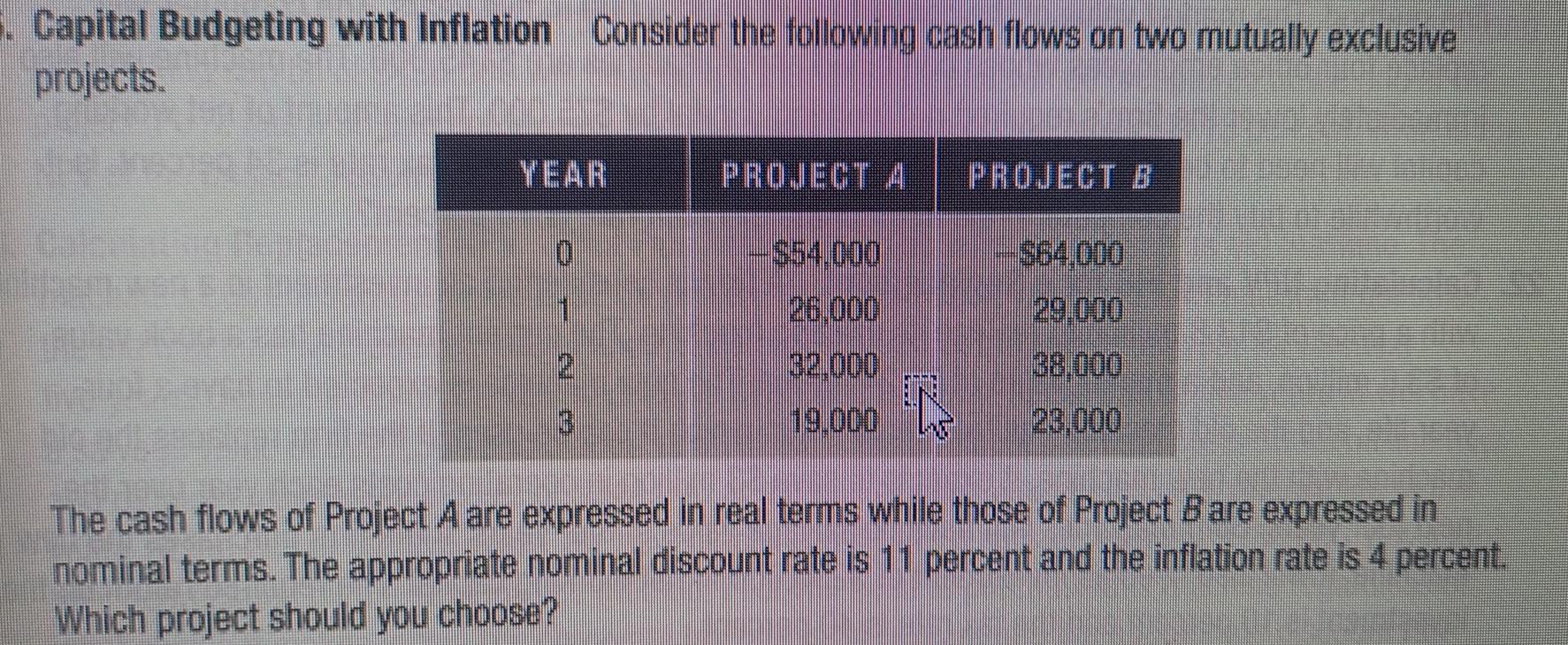

3. Calculating Project NPV Down Under Boomerang, Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $4,200.000. The fixed asset will be depreciated straight-line to zero over its three-year tax life after which time it will be worthless. The project is estimated to generate $3.450,000 in annual sales. With costs of $1.612.500. The tax rate is 35 percent and the required return is 10 percent. What is the project's NPM? 8. Calculating Salvage Value An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $8.600.000 and will be sold for $1.890,000 at the end of the project. If the tax rate is 35 percent, what is the aftertax salvage value of the asset? 5. Capital Budgeting with Inflation Consider the following cash flows on two mutually exclusive projects. PROJECT PROJECT B $64.000 29.01:00 38.000 19.000 23.000 The cash flows of Project A are expressed in real terms while those of Project Bare expressed in nominal terms. The appropriate nominal discount rate is 11 percent and the inflation rate is 4 percent. Which project should you chooseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started