Answered step by step

Verified Expert Solution

Question

1 Approved Answer

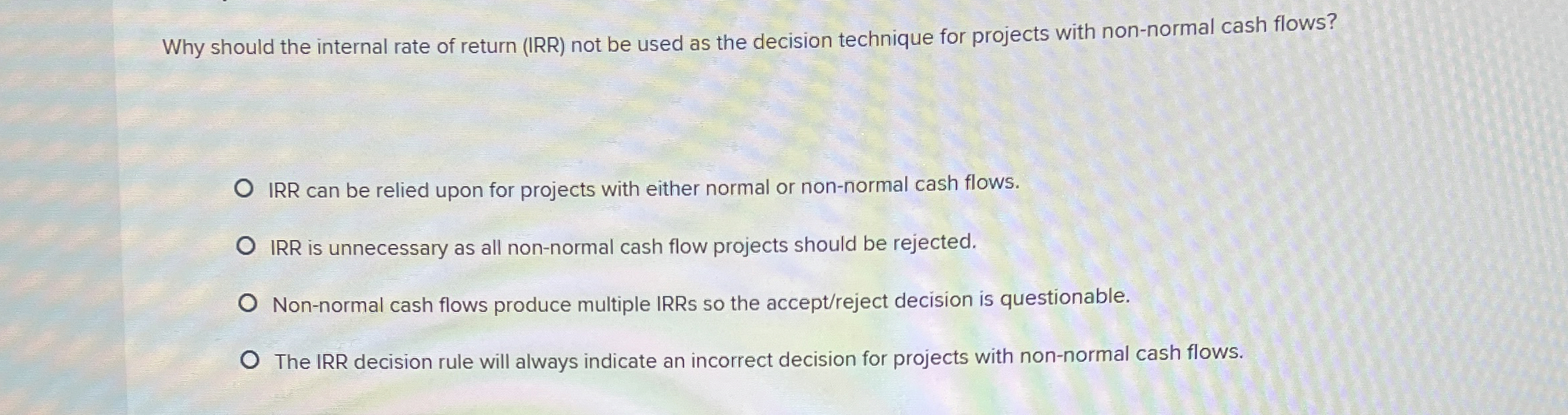

Why should the internal rate of return ( IRR ) not be used as the decision technique for projects with non - normal cash flows?

Why should the internal rate of return IRR not be used as the decision technique for projects with nonnormal cash flows?

IRR can be relied upon for projects with either normal or nonnormal cash flows.

IRR is unnecessary as all nonnormal cash flow projects should be rejected.

Nonnormal cash flows produce multiple IRRs so the acceptreject decision is questionable.

The IRR decision rule will always indicate an incorrect decision for projects with nonnormal cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started