Answered step by step

Verified Expert Solution

Question

1 Approved Answer

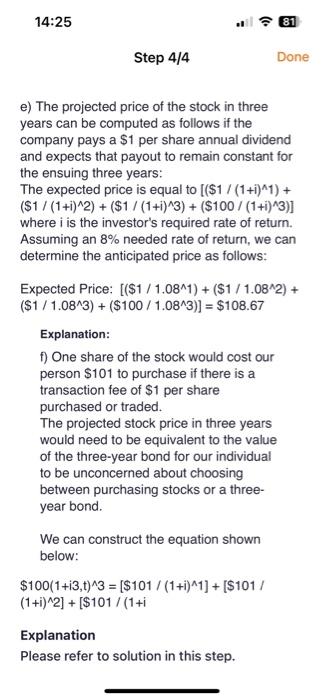

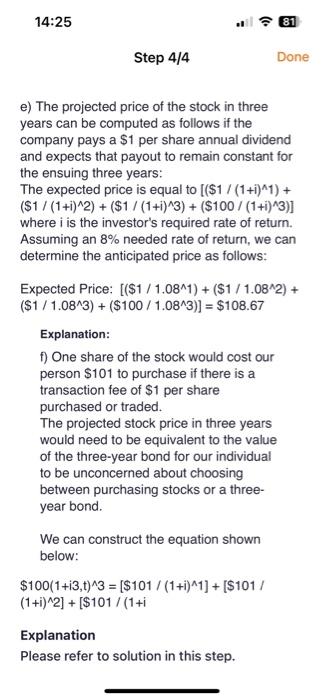

Why the necessary rate of return of 8% was considered Step 4/4 Done e) The projected price of the stock in three years can be

Why the necessary rate of return of 8% was considered

Step 4/4 Done e) The projected price of the stock in three years can be computed as follows if the company pays a $1 per share annual dividend and expects that payout to remain constant for the ensuing three years: The expected price is equal to [($1/(1+i)1)+ ($1/(1+i)2)+($1/(1+i)3)+($100/(1+i)3)] where i is the investor's required rate of return. Assuming an 8% needed rate of return, we can determine the anticipated price as follows: Expected Price: [($1/1.081)+($1/1.082)+ ($1/1.083)+($100/1.083)]=$108.67 Explanation: f) One share of the stock would cost our person $101 to purchase if there is a transaction fee of $1 per share purchased or traded. The projected stock price in three years would need to be equivalent to the value of the three-year bond for our individual to be unconcerned about choosing between purchasing stocks or a threeyear bond. We can construct the equation shown below: $100(1+i3,t)3=[$101/(1+i)1]+[$101/(1+i)2]+[$101/(1+i Explanation Please refer to solution in this step

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started