why we calculate TAX here before the SALAVGE value and in the second quetion we dont .. How do I know if I should calculate in the end with SAVAGE VALUE (see the red signal)

second

here we didnt calculate the Tax in the end 6th line with NWC as we did with the first question

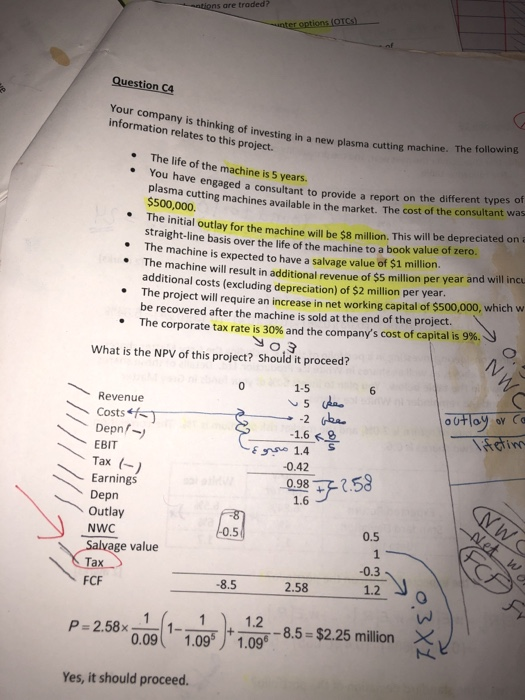

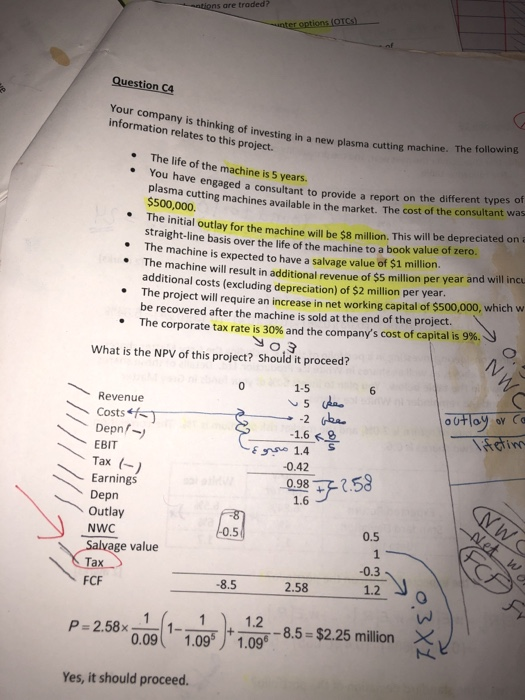

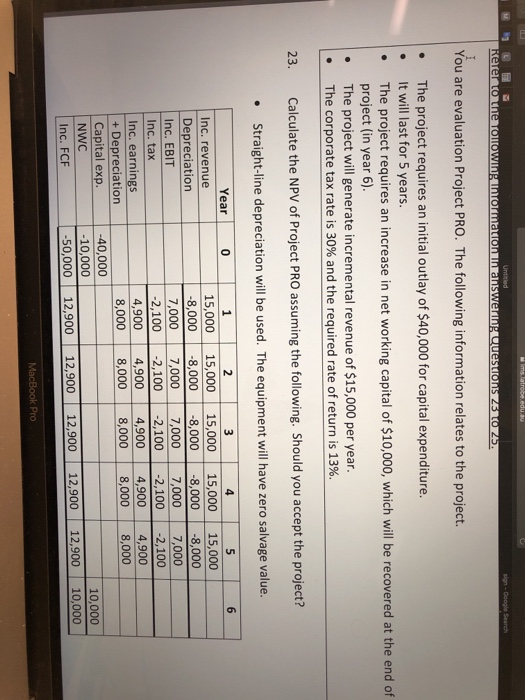

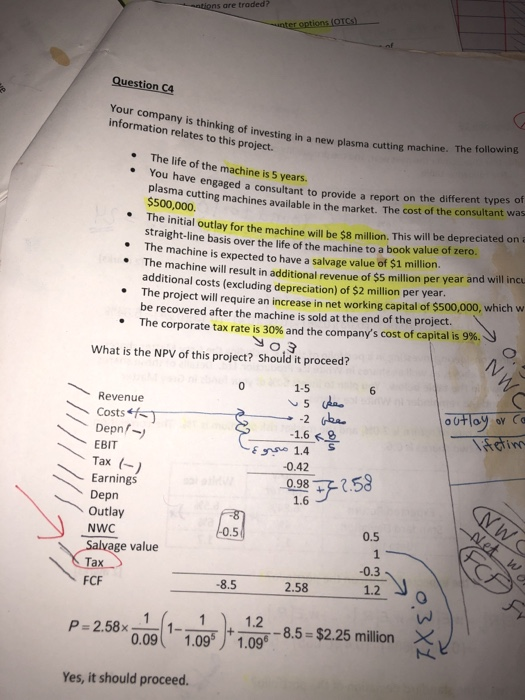

sations oare traded? nter options (OTCs) Question C4 Your company is thinking of investing in a new plasma cutting machine. The following information relates to this project. The life of the machine is 5 years. You have engaged a consultant to provide a report on the different types of plasma cutting machines available in the market. The cost of the consultant was $500,000. The initial outlay for the machine will be $8 million. This will be depreciated on a straight-line basis over the life of the machine to a book value of zero. The machine is expected to have a salvage value of $1 million. The machine will result in additional revenue of $5 million per year and will incu additional costs (excluding depreciation) of $2 million per year. The project will require an increase in net working capital of $500,000, which w be recovered after the machine is sold at the end of the project. The corporate tax rate is 30 % and the company's cost of capital is 9%. What is the NPV of this project? Should it proceed? 6 0 1-5 5 a a Revenue OCtloy iidin oY Ca Costs f Depn/ -2 -1.6 Ese 1.4 -0.42 EBIT Tax () Earnings Depn Outlay 0.98 F.59 MWC Net w 1.6 0.5 0.5 NWC 1 Salvage value -0.3 Tax 1.2 -8.5 2.58 FCF 1.2 - 8.5 = $2.25 million 1.09 1 1- P 2.58x 1.09s 0.09 Yes, it should proceed FC o3X! Ims latrobe.edu.au L Rerer to the rorowig inrormaTION IN answering Questions 23 o 25. M Untirled sign-Google Search You are evaluation Project PRO. The following information relates to the project The project requires It will last for 5 years. The project requires an increase in net working capital of $10,000, which will be recovered at the end of project (in year 6) The project will generate incremental revenue of $15,000 per year. The corporate tax rate is 30 % and the required rate of return is 13% an initial outlay of $40,000 for capital expenditure. . . 23. Calculate the NPV of Project PRO assuming the following. Should you accept the project? Straight-line depreciation will be used. The equipment will have zero salvage value. Year 0 1 2 3 4 6 15,000 15,000 -8,000 7,000 -2,100 4,900 8,000 15,000 -8,000 7,000 Inc. revenue 15,000 15,000 -8,000 -8,000 -8,000 Depreciation Inc. EBIT 7,000 -2,100 4,900 8,000 7,000 -2,100 7,000 -2,100 Inc. tax -2,100 Inc. earnings Depreciation Capital exp. 4,900 8,000 4,900 8,000 4,900 8,000 -40,000 10,000 -10,000 -50,000 NWC Inc. FCF 12,900 12,900 12,900 12,900 12,900 10,000 MacBook Pro