Question

Wicker Company manufactures a single product and uses a process costing system. The product goes through two sequential departments, A and B. Information relating to

a.Raw materials were issued for use in production: department A, $851’000; and department B, 629’000.

b.Direct Labor costs were incurred: department A, $330’000; and department B, $270’000.

c.Manufacturing overhead cost was applied to products: department A, $665’000; and department B, $405’000. d.Products that were complete as to processing in department A were transferred to department B, $1’850’000. e.Products that were complete as to processing in department B were transferred to Finished Goods, $3’200’000.

Required:

•Prepare journal entries to record items (a) through (e) above.

•Post Journal entries from (1) to T-accounts. The balance in department A’s WIP account on April 1 was $150’000; the

balance in the department B’s WIP account was $70’000. After posting entries to the T accounts, find the ending balance in

each department’s WIP account.

•Prepare a production report for department A for April. The following additional information is available regarding production

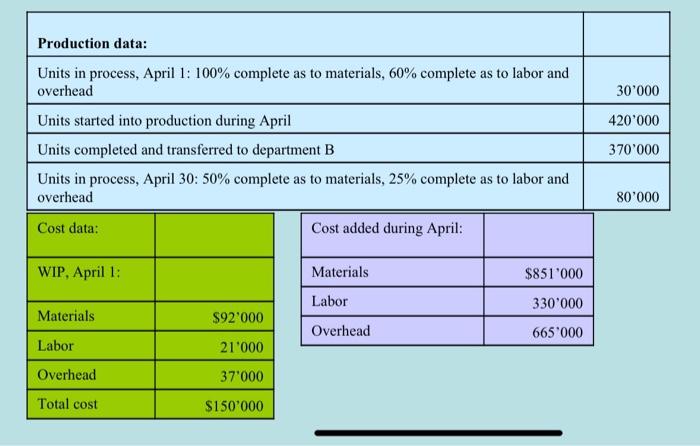

in department A during April:

Production data: Units in process, April 1: 100% complete as to materials, 60% complete as to labor and overhead Units started into production during April Units completed and transferred to department B Units in process, April 30: 50% complete as to materials, 25% complete as to labor and overhead Cost data: WIP, April 1: Materials Labor Overhead Total cost $92'000 21'000 37'000 $150'000 Cost added during April: Materials Labor Overhead $851'000 330'000 665'000 30'000 420'000 370'000 80'000

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries a Raw Materials Issued for Use in Production Department A Debit Raw Materials Inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started