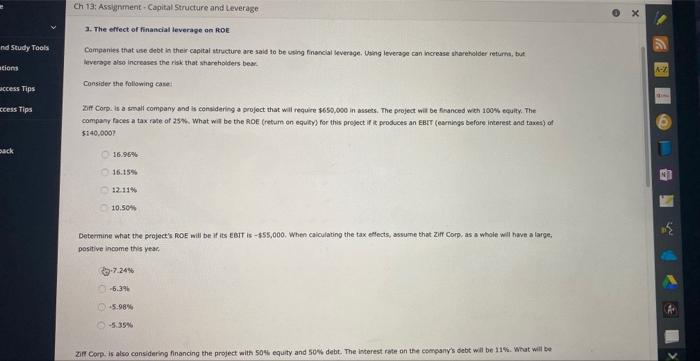

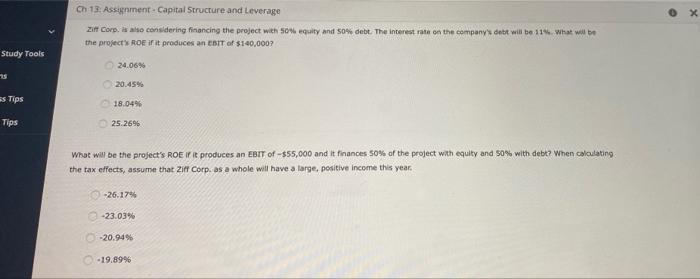

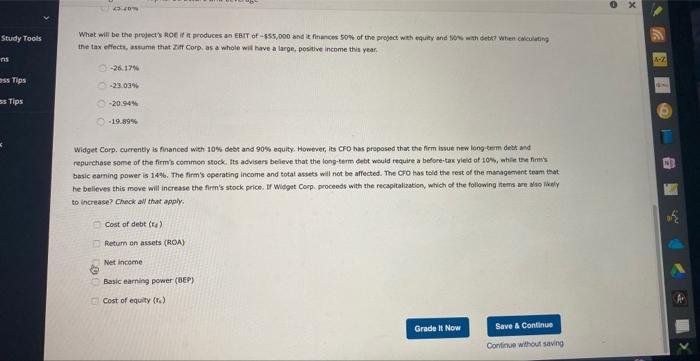

Wif Corp. is a smal company and is fonsidering a project that wil require $650,050 in assees. The project wis be Franced with 100% equity. The company faces a tax rate of 25%. What wit be the ROE (return en equify for this project if it produces an EBT { eankas before interest and taxes) of 5 \$4 4.0507? 16.96% 16.15 2.11% 10.50m Determine what the grojectis focE will be if its evit is 555,000. Whes caiculating the tax eamects, assume that Ziff Corp, as a whole will have a large, pasitive income this yeac +724% 6.376 i5. 98% 5.3506 Ziff corp, as also considering financing the project with 50 w equity and 50% debt. The interest rate ea the company' 6mt will be i1 is. What will be the project? ROE if it produces an EDit of $140,000 ? 24.06% 20.45% 18.0498 25.26% What will be the project's ROE If it produces an EBTT of 555,000 and it finances 5046 of the project with equity and 50% with debt? When caloulating: the tax effects, assume that ziff Corp. as a whole will have a large, positive income this year. 26.17%23.03%20.94%19.89%196 the tax effect., assumn that Zir Corp, as a whole wit have a large, positive income thin year. .23.03% 2094m 19.8995 Widget Corp. cuerently is flanced with 10% debt and 90% equity. Howerec, its cro has preposed that the firm issue new long-tem debt and repurchase some of the firm's common stock. ths advisers believe that the long-term debt wauld require a before-tas vieid of tom, whie the finsts basic caming power is 14%. The firm's coerating income and totat assees wil not be affected. The Cro has toid the rest of the management team that he bellewes this move will increase the firm's stock price. If Wisget Corp. proceeds with the recapitalization, which of the foldwing rems are also likely to increase? check ail that apply, Cost of debt (d) Retum en assets (ROA) Net inceme Basic earring power (0EP} Cost of equity {rk} Wif Corp. is a smal company and is fonsidering a project that wil require $650,050 in assees. The project wis be Franced with 100% equity. The company faces a tax rate of 25%. What wit be the ROE (return en equify for this project if it produces an EBT { eankas before interest and taxes) of 5 \$4 4.0507? 16.96% 16.15 2.11% 10.50m Determine what the grojectis focE will be if its evit is 555,000. Whes caiculating the tax eamects, assume that Ziff Corp, as a whole will have a large, pasitive income this yeac +724% 6.376 i5. 98% 5.3506 Ziff corp, as also considering financing the project with 50 w equity and 50% debt. The interest rate ea the company' 6mt will be i1 is. What will be the project? ROE if it produces an EDit of $140,000 ? 24.06% 20.45% 18.0498 25.26% What will be the project's ROE If it produces an EBTT of 555,000 and it finances 5046 of the project with equity and 50% with debt? When caloulating: the tax effects, assume that ziff Corp. as a whole will have a large, positive income this year. 26.17%23.03%20.94%19.89%196 the tax effect., assumn that Zir Corp, as a whole wit have a large, positive income thin year. .23.03% 2094m 19.8995 Widget Corp. cuerently is flanced with 10% debt and 90% equity. Howerec, its cro has preposed that the firm issue new long-tem debt and repurchase some of the firm's common stock. ths advisers believe that the long-term debt wauld require a before-tas vieid of tom, whie the finsts basic caming power is 14%. The firm's coerating income and totat assees wil not be affected. The Cro has toid the rest of the management team that he bellewes this move will increase the firm's stock price. If Wisget Corp. proceeds with the recapitalization, which of the foldwing rems are also likely to increase? check ail that apply, Cost of debt (d) Retum en assets (ROA) Net inceme Basic earring power (0EP} Cost of equity {rk}