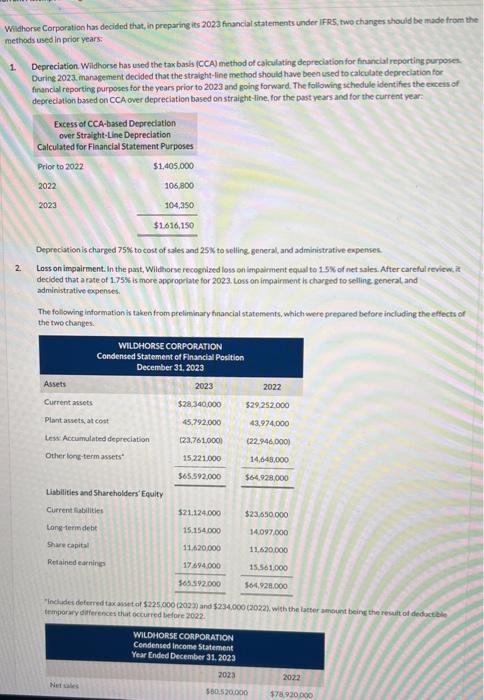

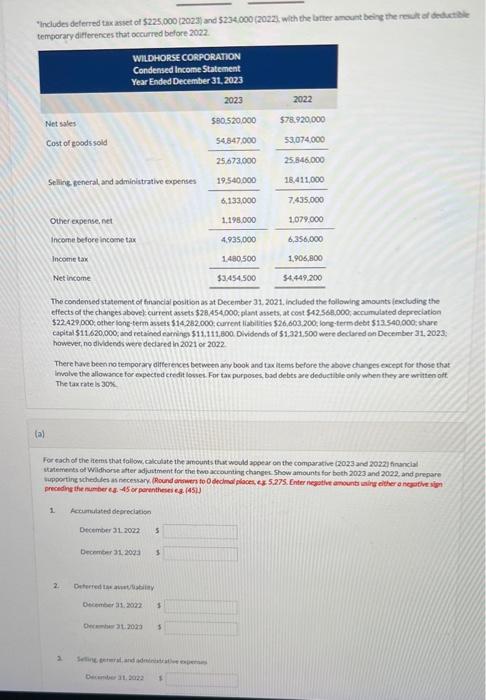

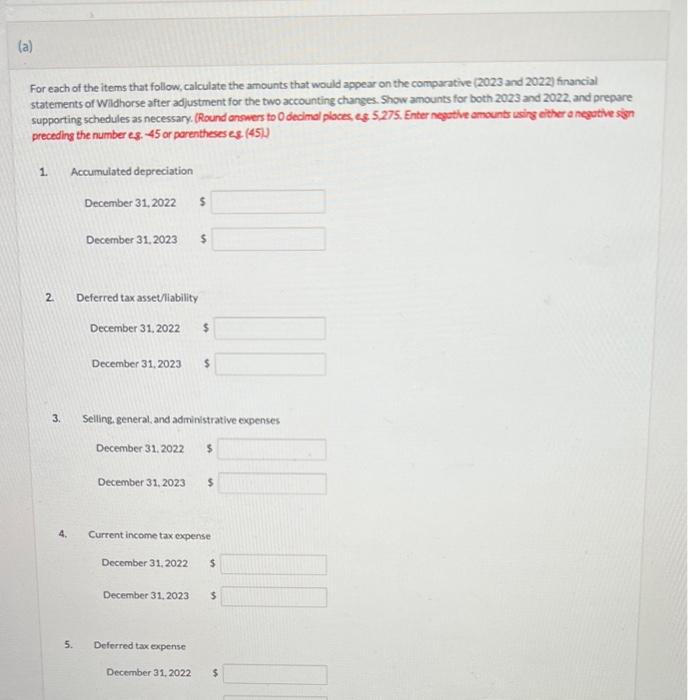

Wikhorse Corporation has decided that, in preparingits 2023 financlai statements under IFR5, two changes should be made from the methods used in prior years: 1. Depreciation. Wildorse has used the tax bash (CCA) method of calculating depreciation for firuncial reporting ourposes. During 2023 . management decided that the stralght-line method should have been used to calculate depreclation for financial reporting purposes for the years prior to 2023 and going forward. The following schedule identifies the exceis of depreclation based on CCA over depreciation based on straight-line, for the past yearsand for the current year: Depreciationis charged 75% to cost of sales and 25K to selling general, and administrative expensec. 2. Loss on impairment: In the past, Wildhorve recognized loss on lenpairment equal to 15 s. of net sales. After careful tevicw. it decided that a rate of 175 is is more appropriate for 2023 . Loss on impairment is charged to selling general and administrathe egenses. The following information is taken from preliminary fnancial statements, which were prepared before including the effects of the twochanges. "Inelides defered tax ash tof $225,000(2027) and $234,000(2022) with the lacter aentunt being the resuit of deduce temporary ditferences that occurred before 2022. "Induden deferred tax asset of 5225,000 (2023) and 5234,000/2023, with the butre amount beine the rest af desketile? temsorary differences that occiried before 2027 The condensed statement of tirancial position as at December 31. 2021. included the following amounts iexcluding the effects of the changes abevek current asvets $28.454,000, plant assets, at cont $42568,000, acnumulated depreciation $22,429,000, ofber long-term asvets 514,262,000, current liabilities 526,603.200, lors-term debt 513340,000 ;hare capital 511.620,000, and retained earni2s $11,111,600 Didends of 51.321,500 were dectured on December 31,2023 : however, no dhidendi were dedared in 2021 or 2022 There have been no temporary olfterences berweenampbook and tax liems before the above changer except for these that involve the allowance for espected credit losses. For tax purposes bid debts are deduct itle only when they are written olt. The tax rote 1530s (b) For each of the atems phat follow, calculate the amounts thac would yppear on the comparative (2023 and 20221 finuncial uatemitnts of Wildhorse atter adjutiment for the twe acrounting chanets. Show amounti for both 2023 and 2022 . and prepare preceding the nimber es -45 or perentheiei es. (45i) 1. Acomitates deoreciation Dectemer 312022 Decomerer 31.2093 3 2. Deteried tucainetatiay owienter 31. 2082 i 1 For each of the items that follow, calculate the amounts that would appear on the comparative (2023 and 2022) financial. statements of Wilhorse after ad)ustment for the two accounting changes. Show amounts for both 2023 and 2022 , and prepare supporting schedules as necessary. (Round onowers to 0 decimal places, es 5,275 . Enter negetive amountr usirg either a negutive sign preceding the number es. 45 or parentheses es. (45). 1. 2. Deferred tax assetliability December 31, 2022 December 31,2023 3. Seling general, and adiministrative expenses December 31.2022 5 December 31,2023 $ 4. Current income tax expense December 31,2022 December 31,2023 $