Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wild Rides manufactures snowboards. John Gallagher, the CEO, is trying to decide whether to adopt a lean her, the CEO, is trying to d production

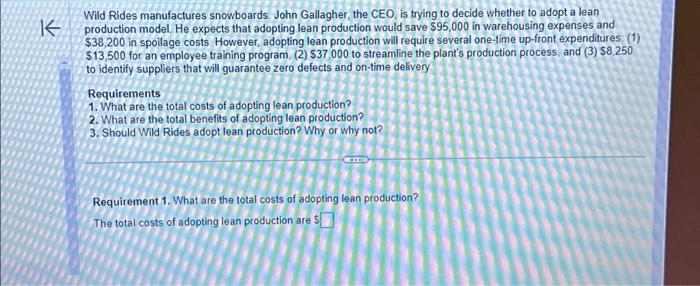

Wild Rides manufactures snowboards. John Gallagher, the CEO, is trying to decide whether to adopt a lean her, the CEO, is trying to d production model. He expects that adopting lean production would save $95,000 in warehousing expenses and $38,200 in spoilage costs However, adopting lean production will require several one-time up-front expenditures: (1) $13,500 for an employee training program, (2) $37,000 to streamline the plant's production process, and (3) $8,250 to identify suppliers that will guarantee zero defects and on-time delivery. Requirements 1. What are the total costs of adopting lean production? 2. What are the total benefits of adopting lean production? 3. Should Wild Rides adopt lean production? Why or why not? Requirement 1. What are the total costs of adopting lean production? The total costs of adopting lean production are S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started