Question

Wildhorse Clark opened Wildhorse's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 5 18 31 Wildhorse invested $19.800

Wildhorse Clark opened Wildhorse's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 5 18 31

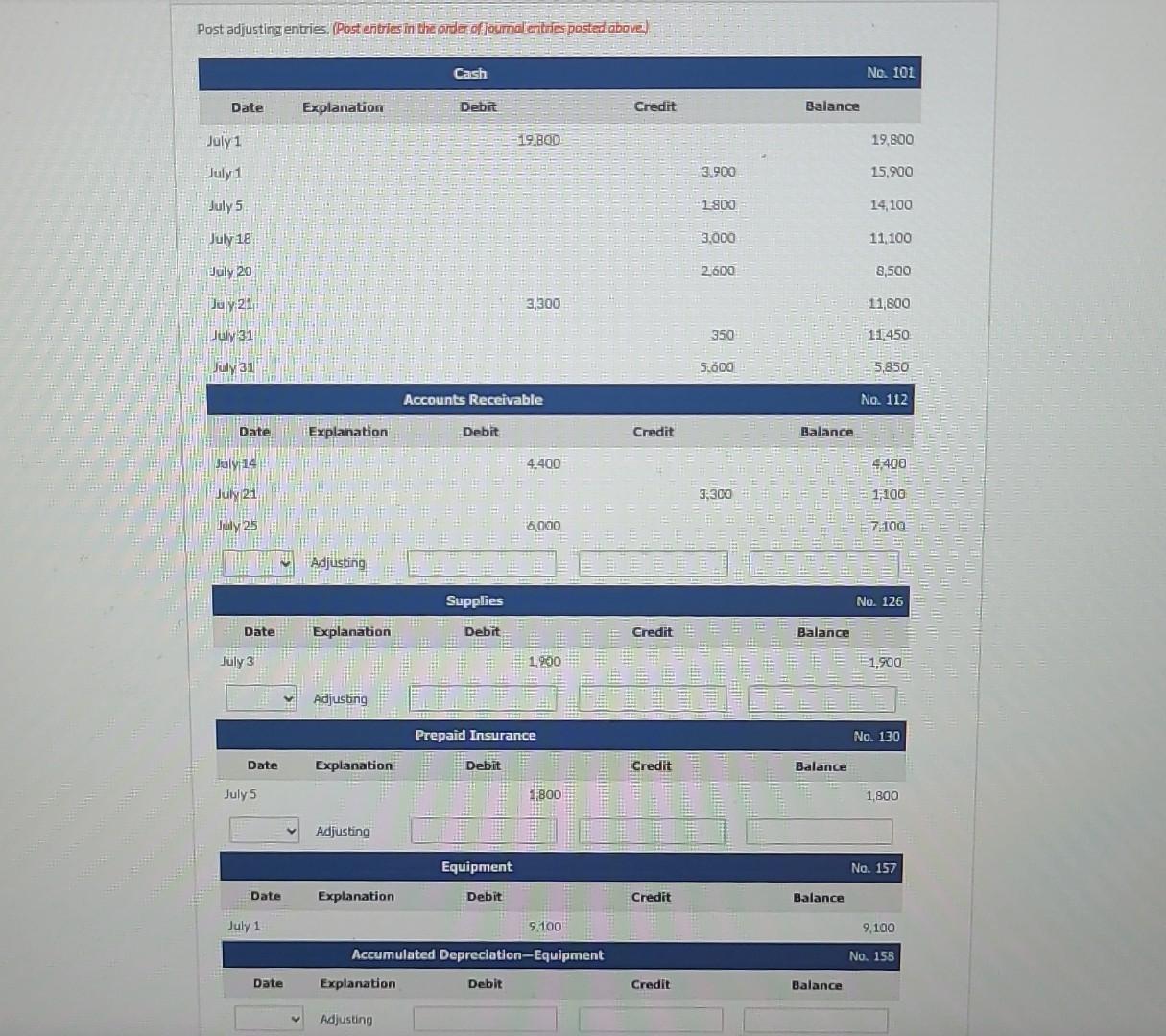

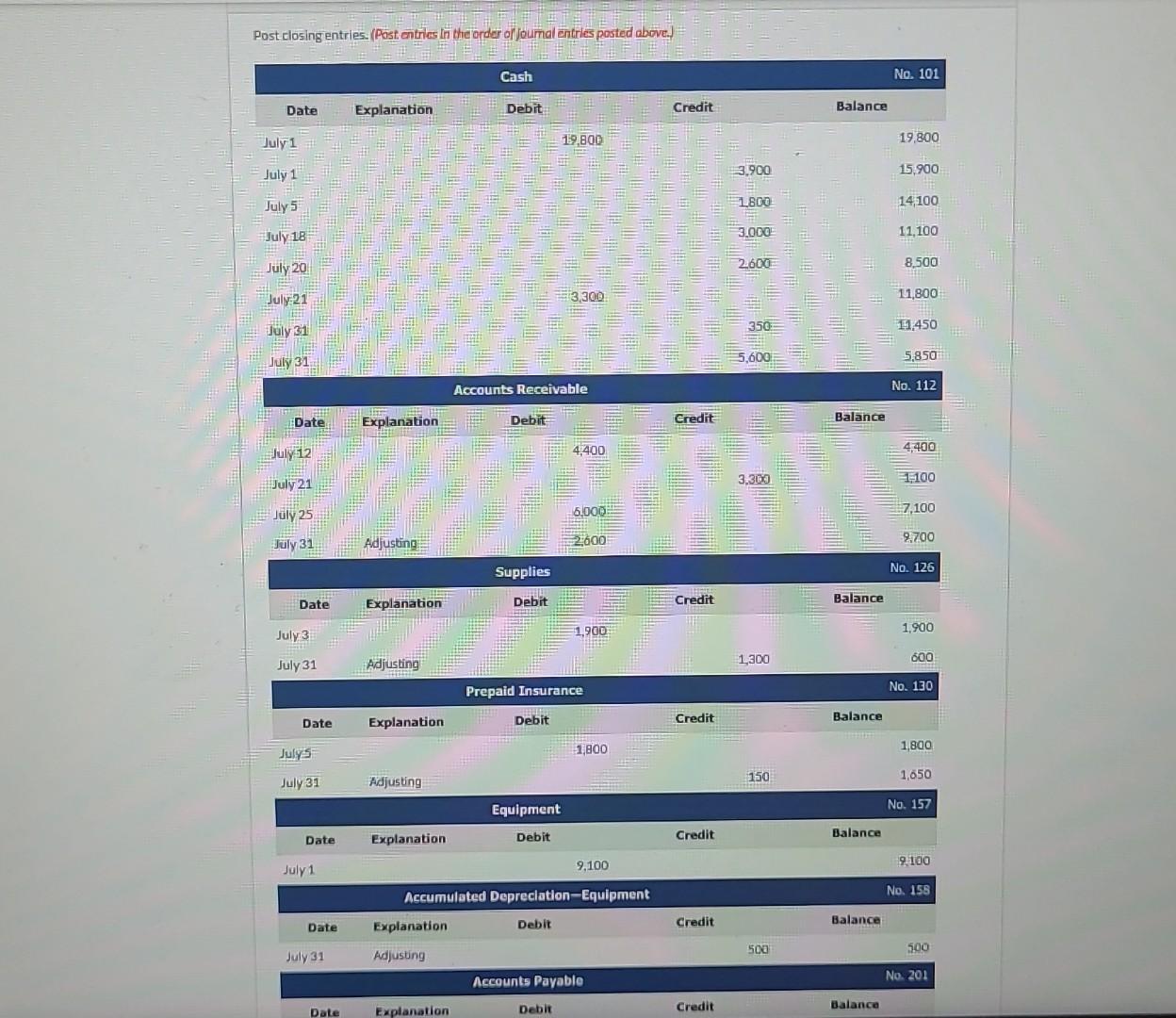

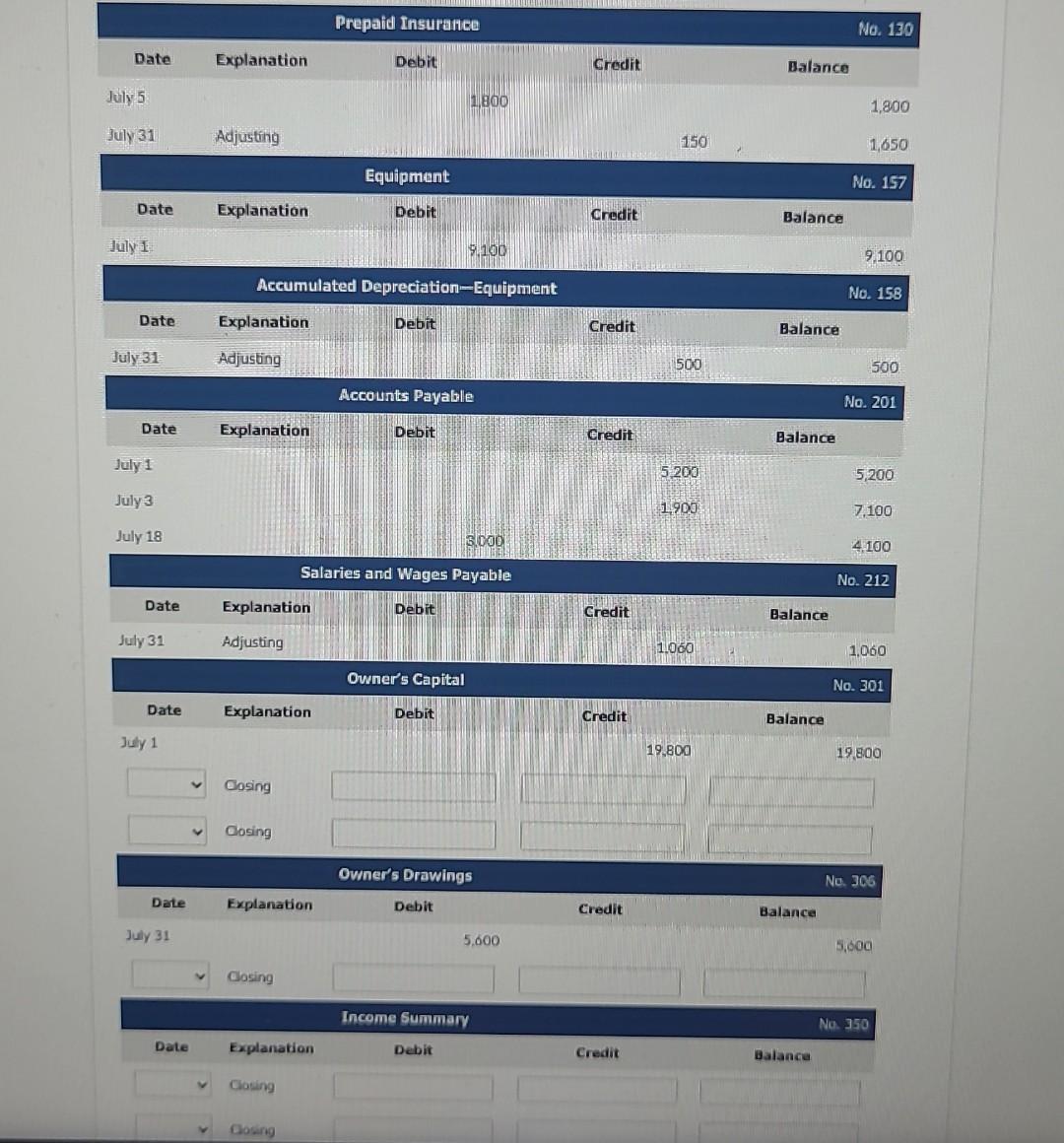

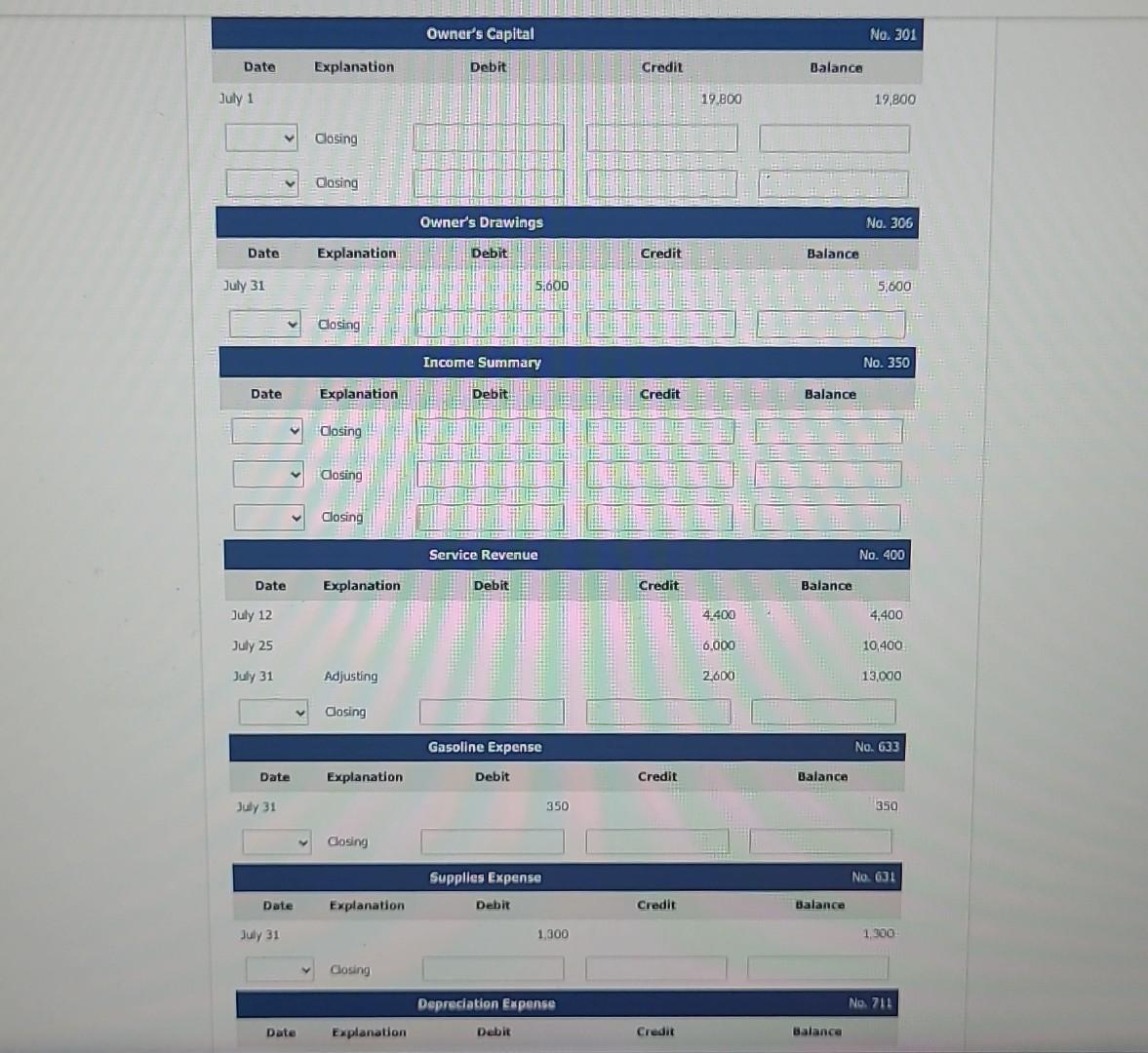

Wildhorse invested $19.800 cash in the business. Purchased used truck for $9,100, paying $3,900 cash and the balance on account. Purchased cleaning supplies for $1,900 on account. Paid $1,800 cash on a 1-year insurance policy effective July 1. Billed customers $4.400 for cleaning services. Paid $1,000 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. Paid $2,600 cash for employee salaries. Collected $3,300 cash from customers billed on July 12. Billed customers $6,000 for cleaning services. Paid $350 for the monthly gasoline bill for the truck. Withdraw $5,600 cash for personal use.

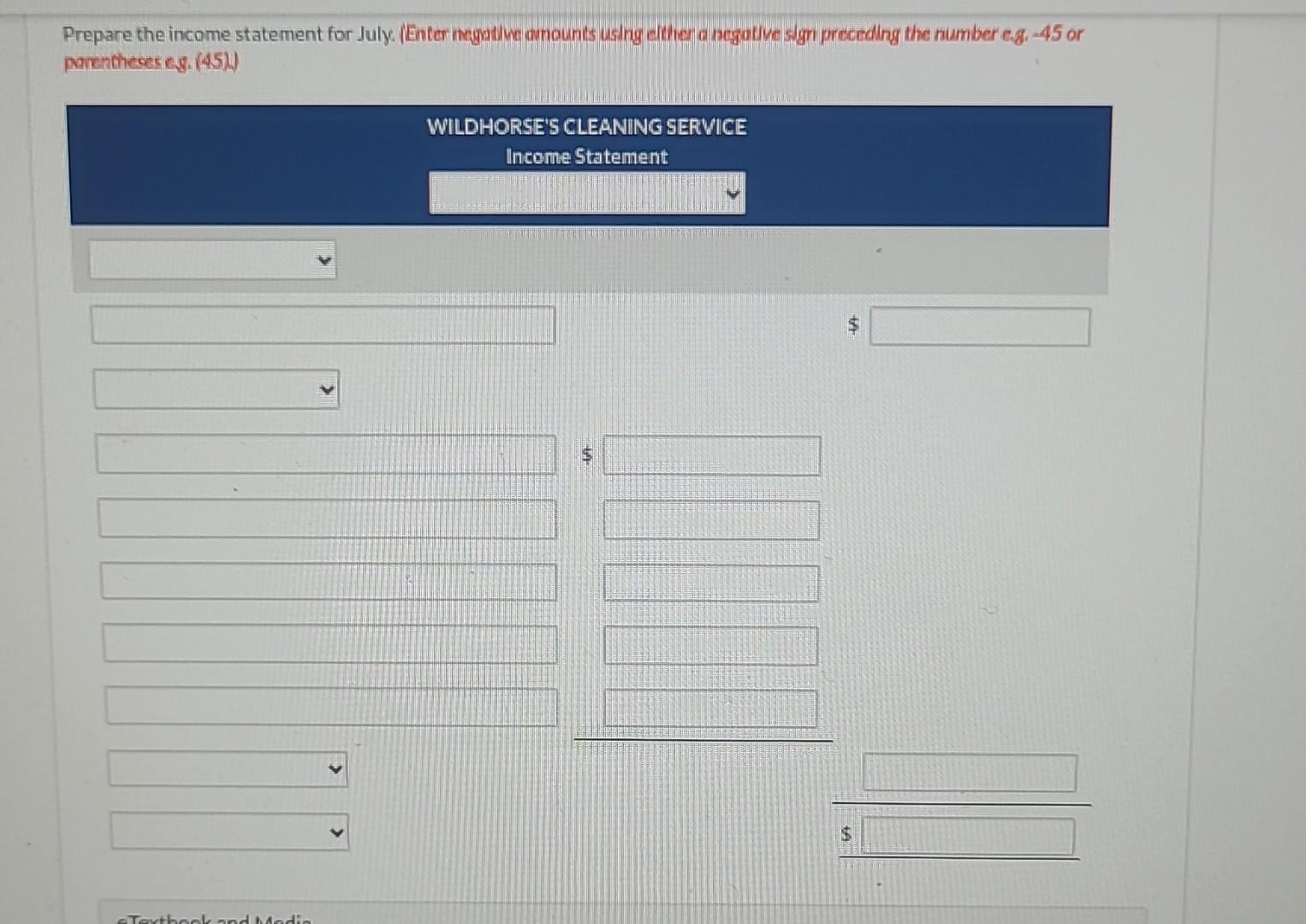

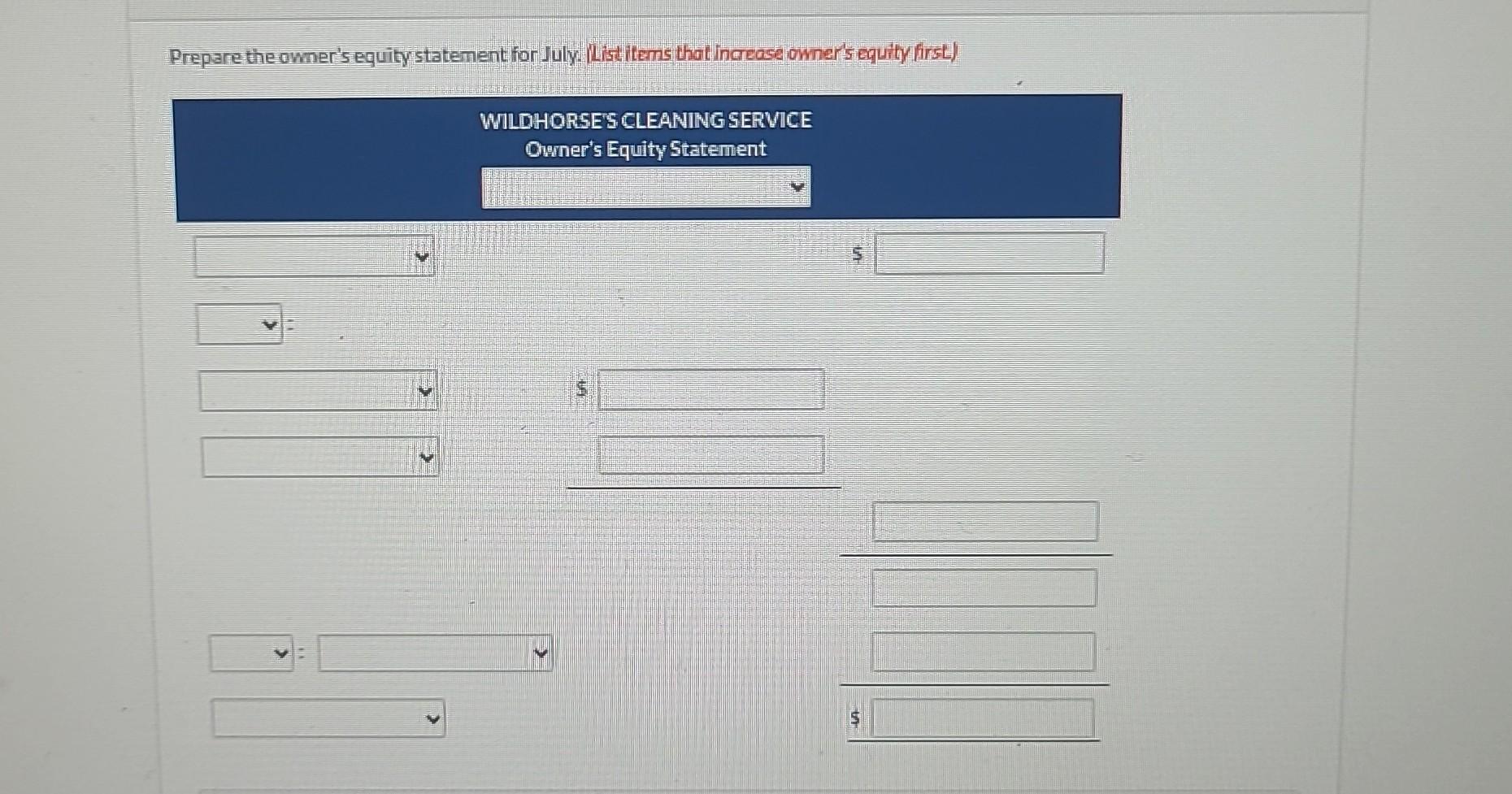

prepare an income statement,owners equity statement,balance sheet

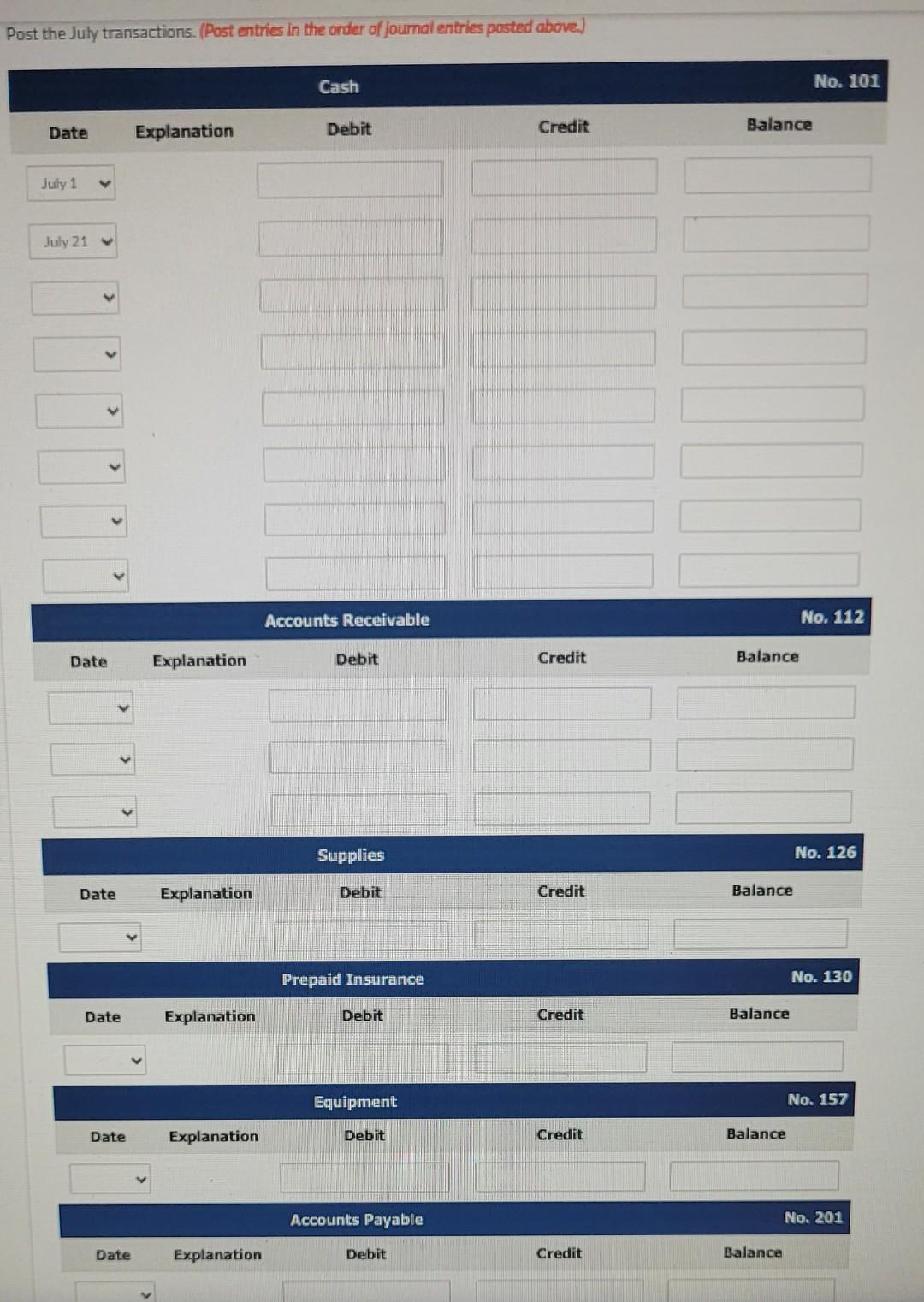

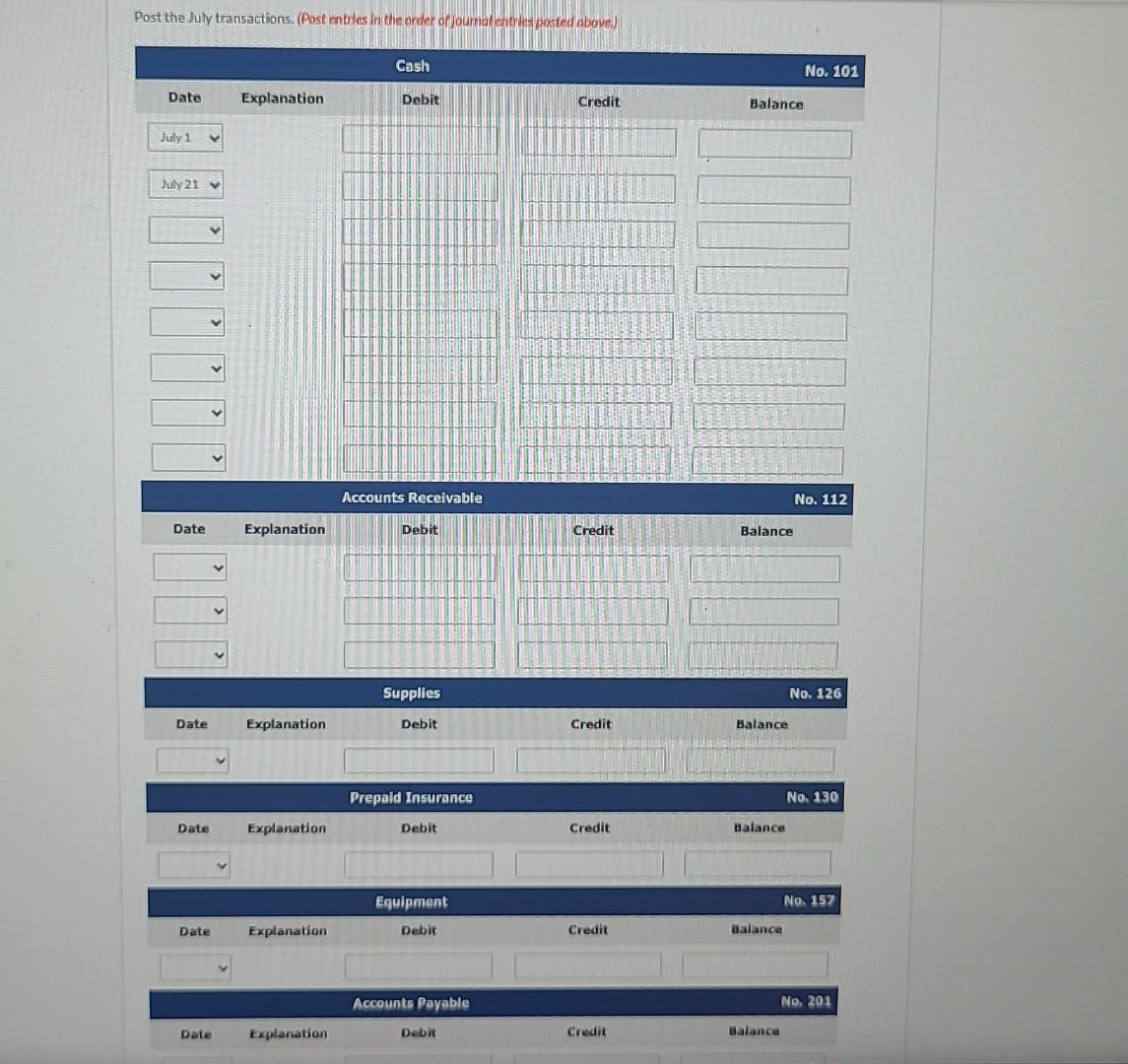

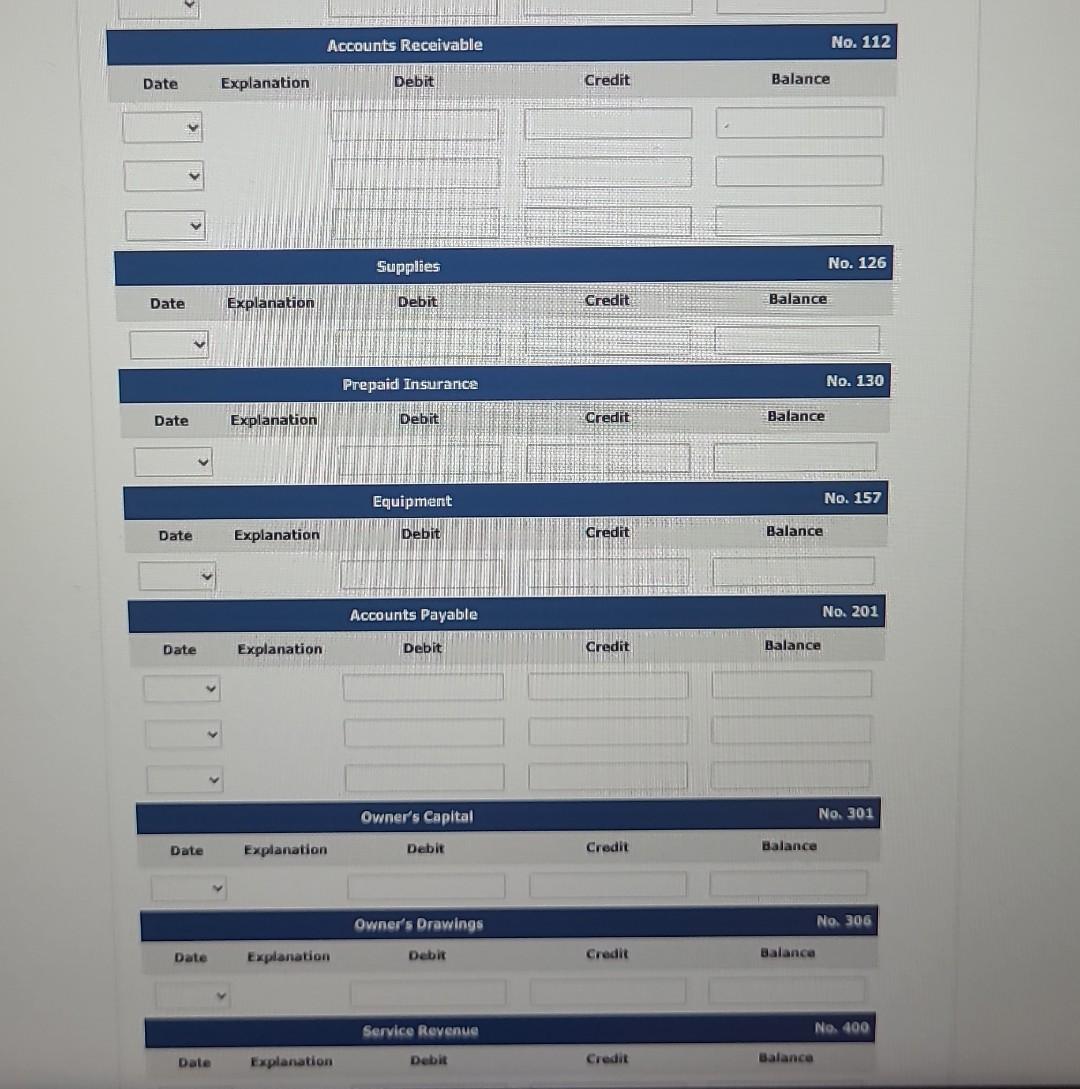

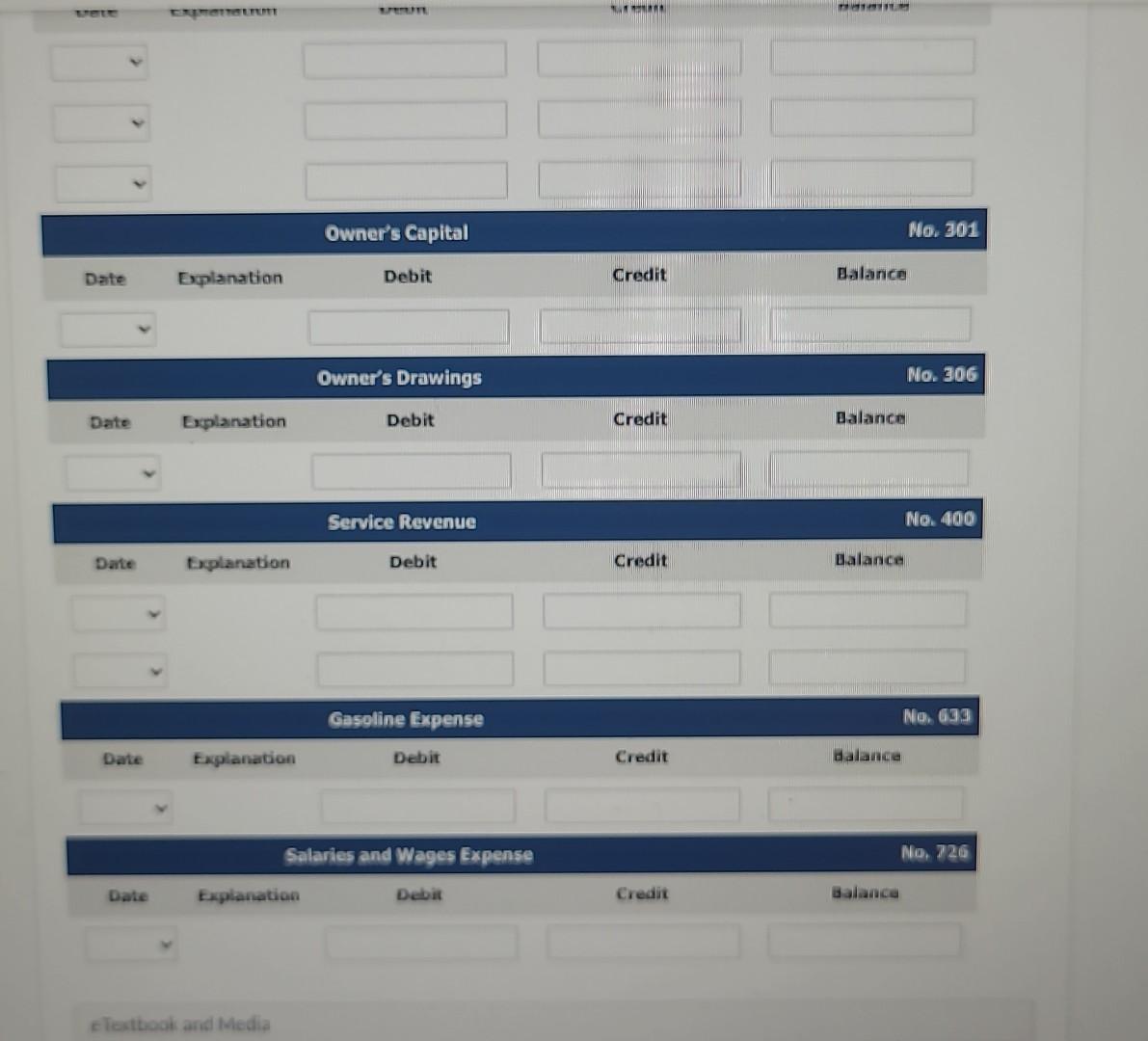

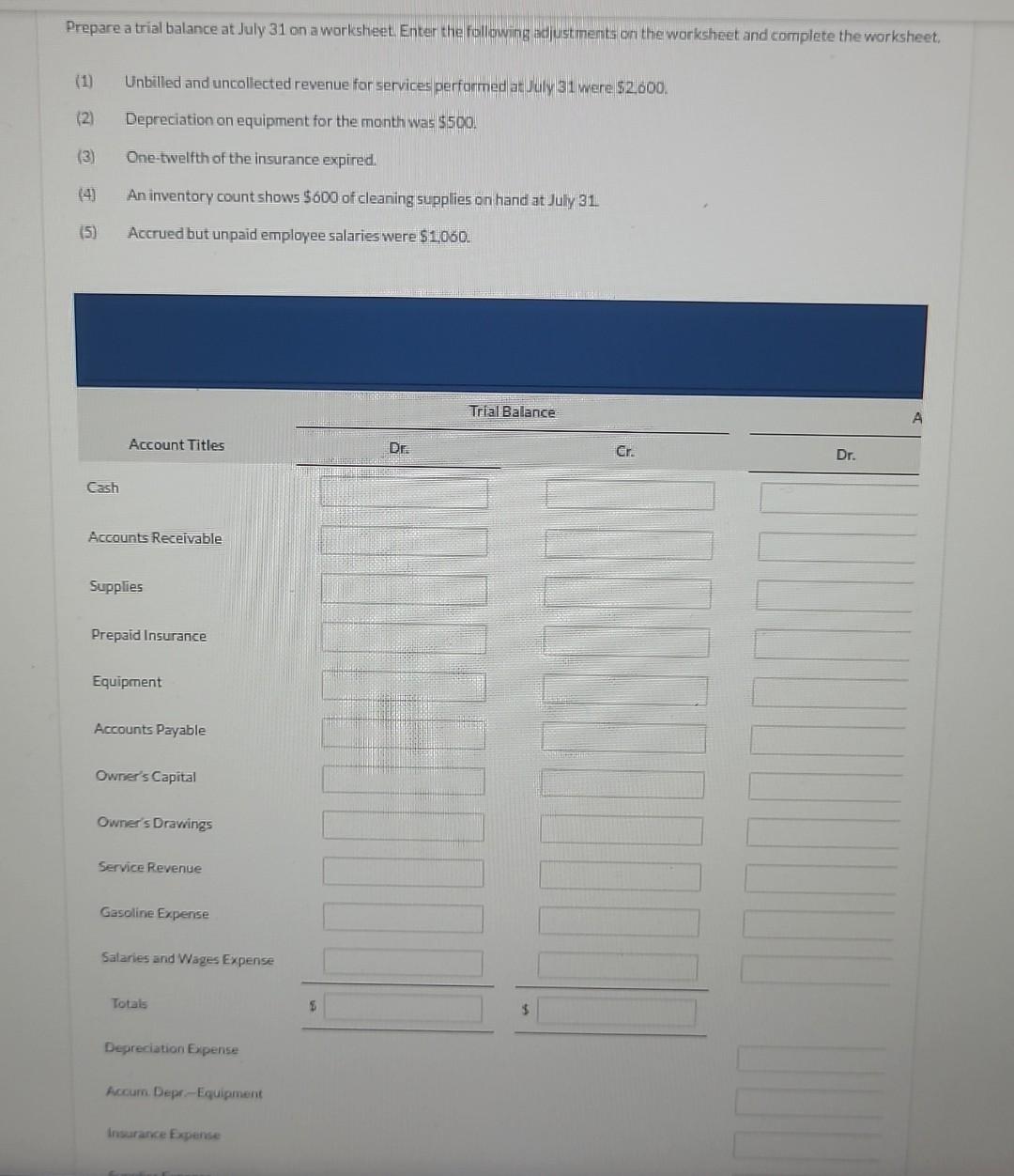

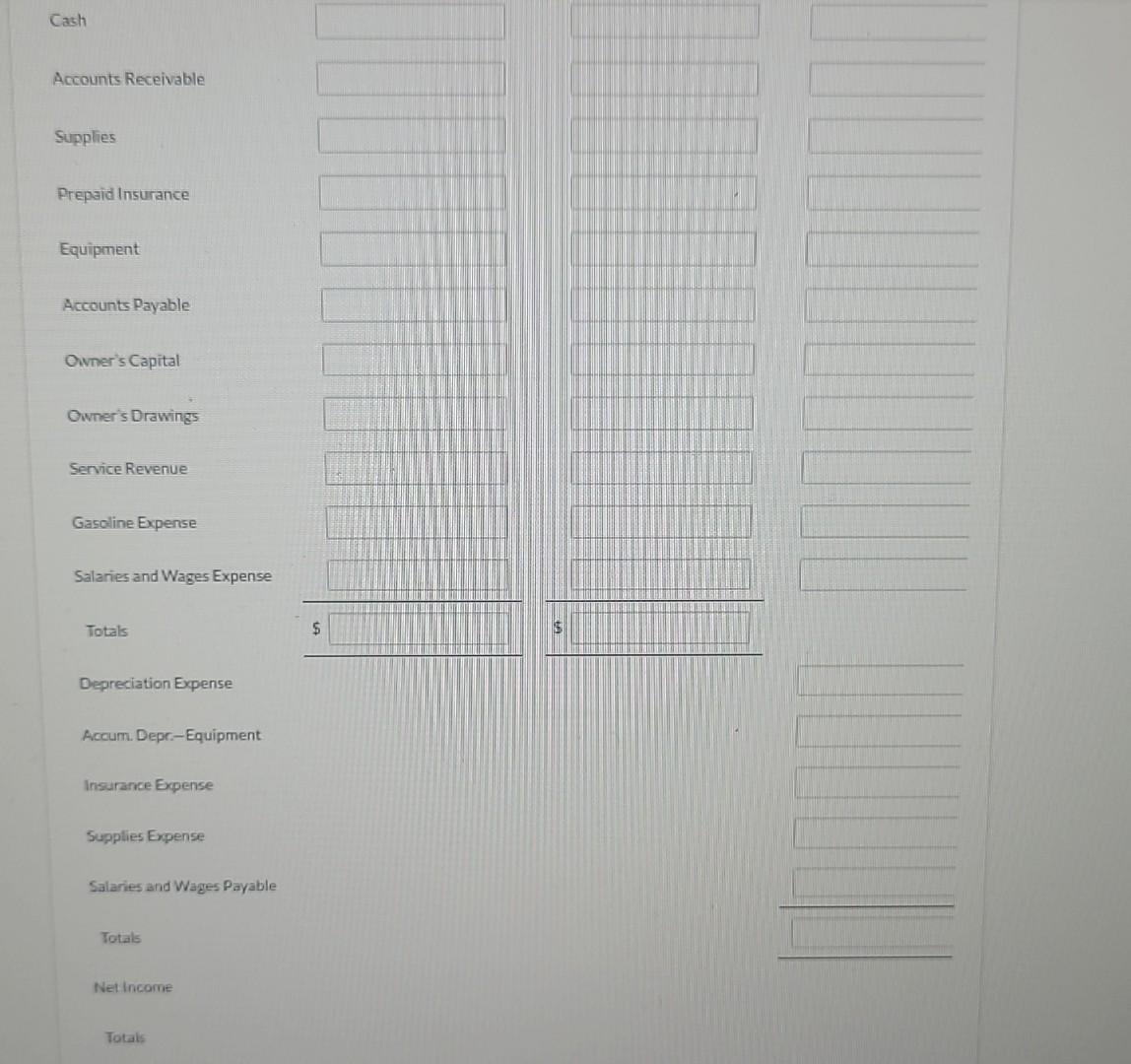

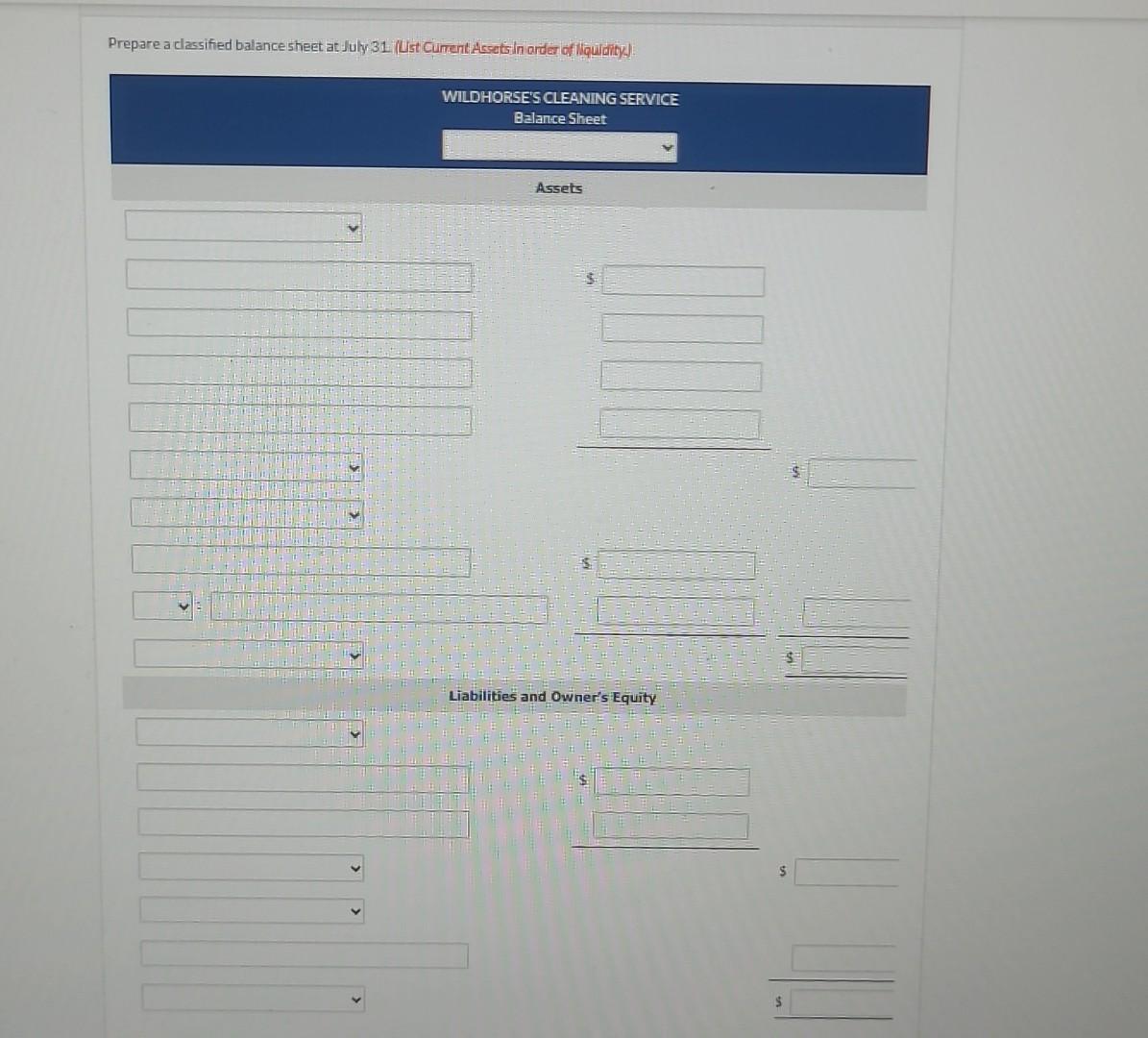

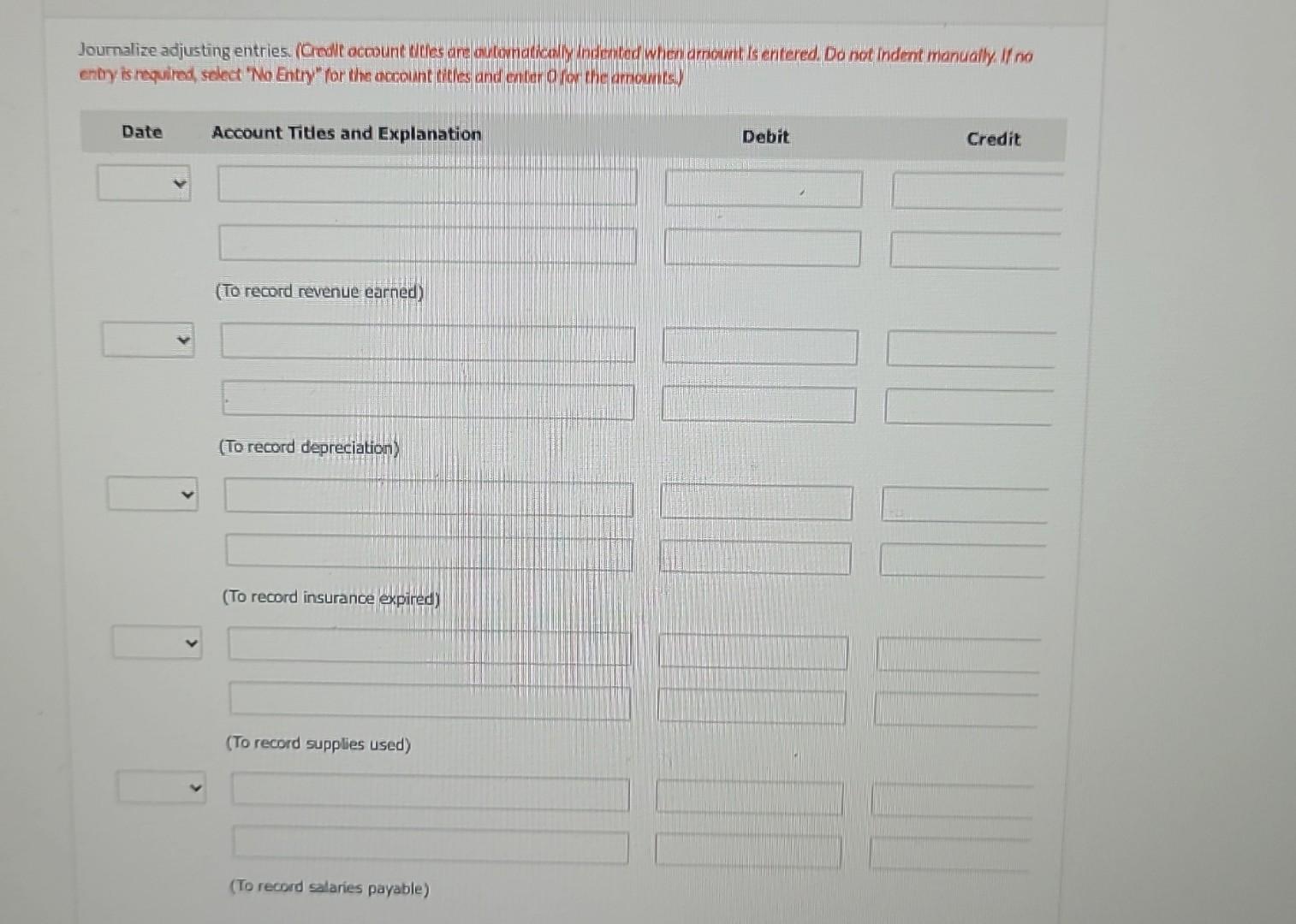

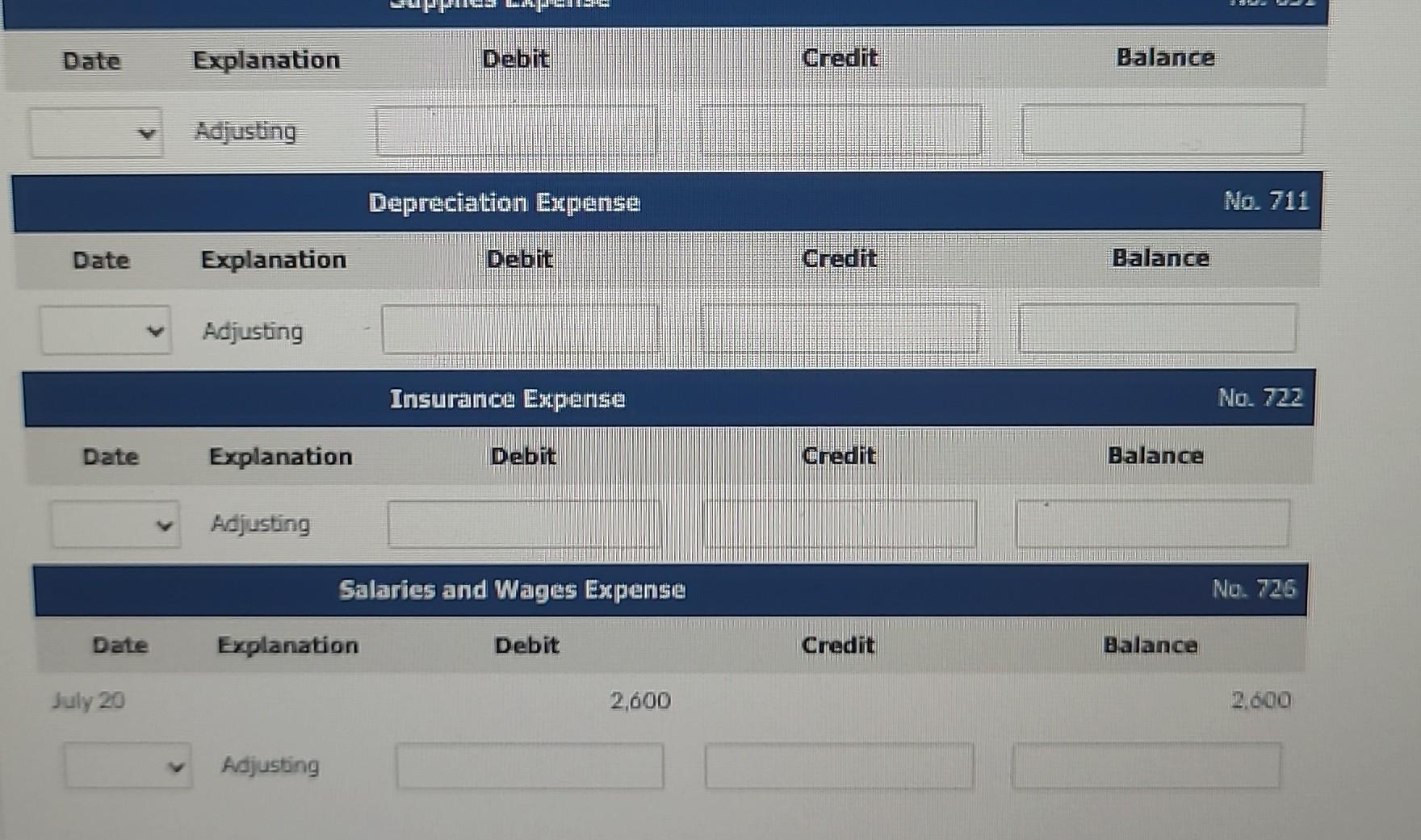

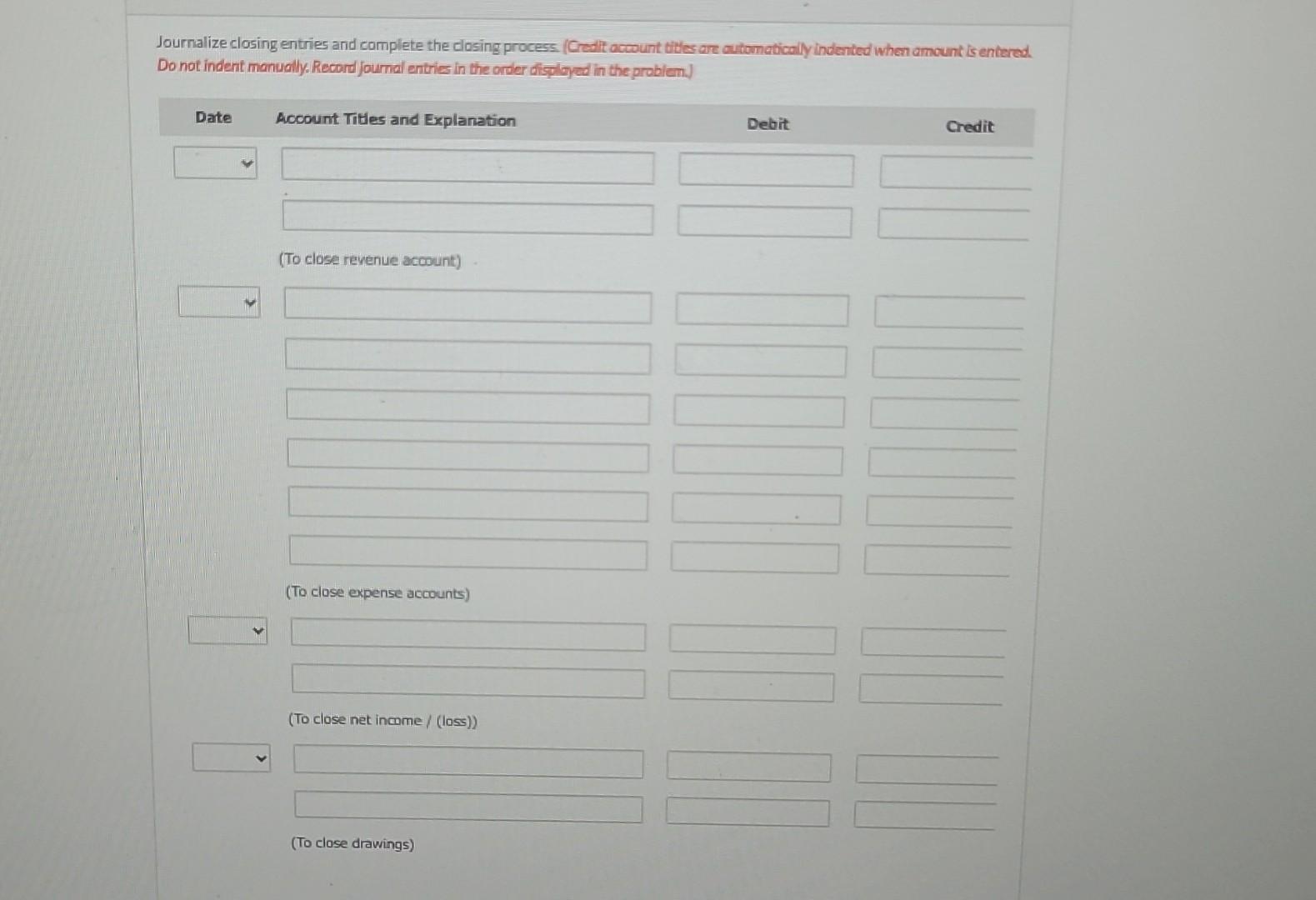

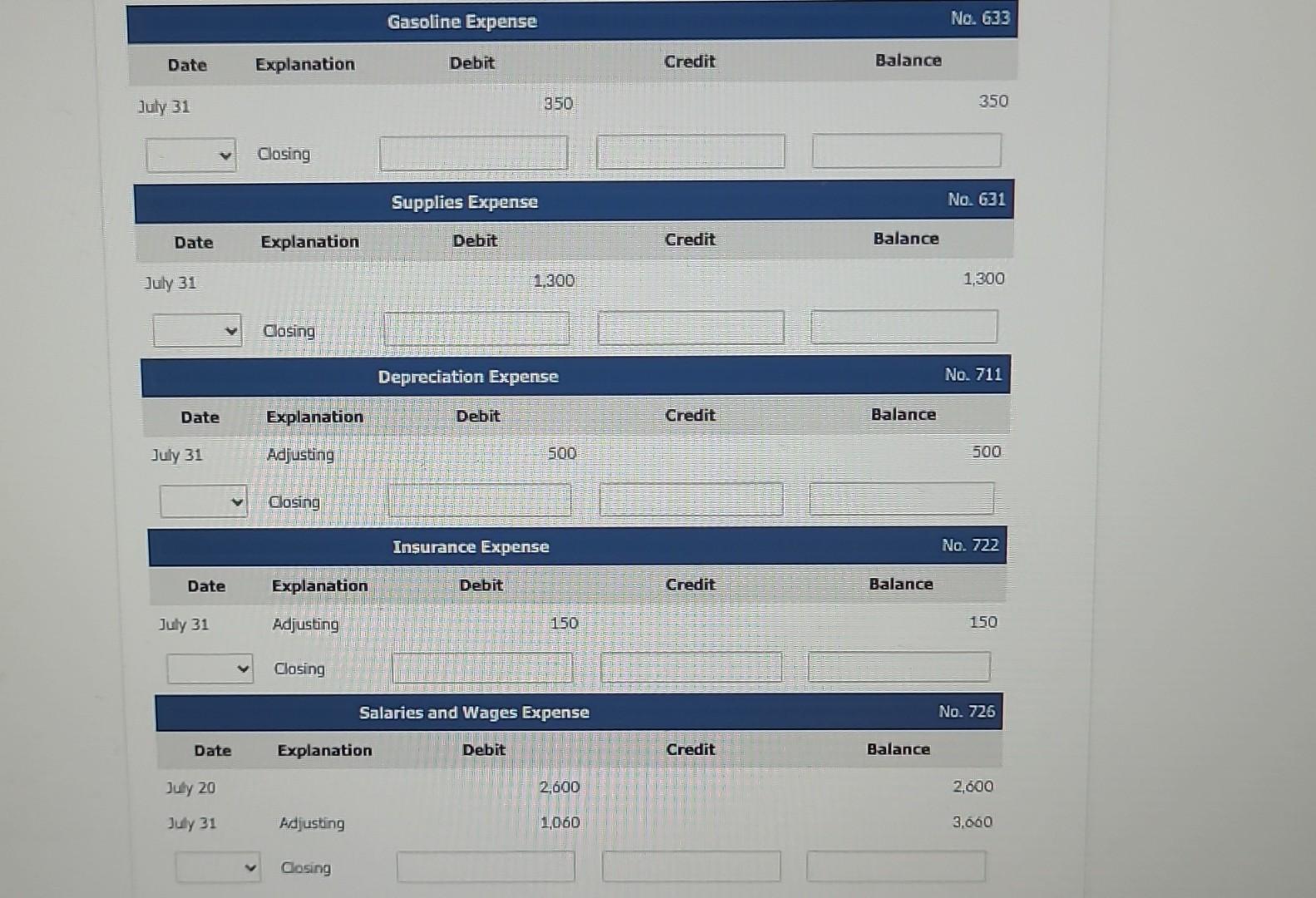

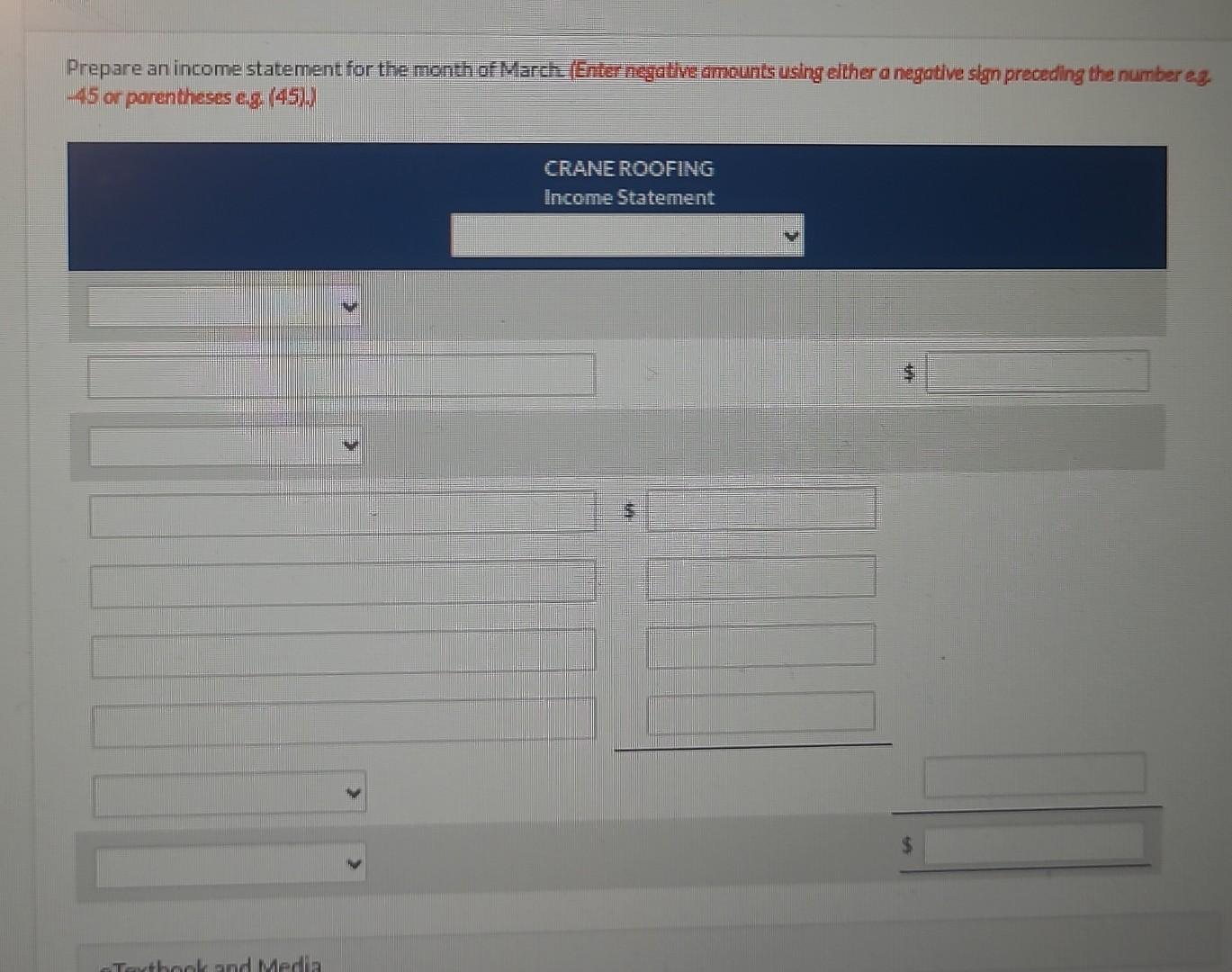

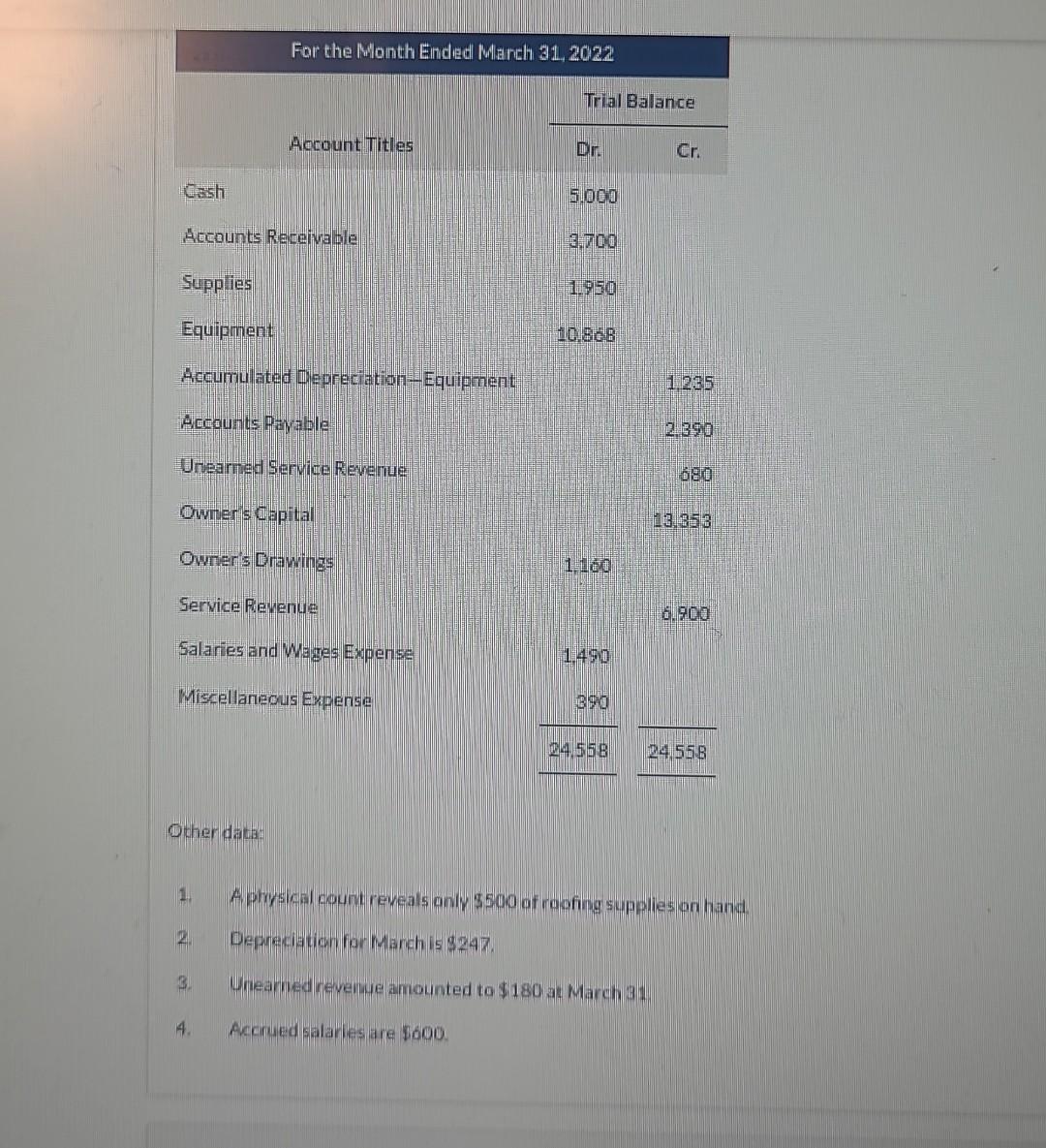

Post the July transactions. (Post entries in the order of joumal entries posted above.) Post the July transactions. (Post entries in the order of Jourmal chowht posted above.) clestboak and Media Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected revenue for services performed at July 31 mera $2,000. (2) Depreciation on equipment for the month was $500. (3) One-twelfth of the insurance expired. (4) An inventory count shows $600 of cleaning supplies on hand at July 31 (5) Accrued but unpaid employee salaries were $1060 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Ovner's Capital Owner's Drawings Service Revenue Gasoline Expense Salaries and Wages Expense Totals Depreciation Expense Accum. Depr-Equipment Insurarre Expense Supplies Expense Salaries and Wages Payable Totals Net incame Totaks Prepare the income statement for July. (Enter ingatlme announts using eliker a negative sigm preceding the number eg. 45 or Prepare the owner's equity statement for July (Listitems that incease owner's equity first) Prepare a classified balance sheet at July 31 (Ust Cumment Assatis in ardar of liquiditith): WILDHORSE'S CLEANING SERVICE Balance Sheet Assets 3 Liabilities and Owner's Equity 3 Journalize adjusting entries. (Credlt ocount vities are aulomaticoly indented when arnomt is entered. Do not indent manually. If no enory is required, select "No Entry" for the account tites and entiar o for the arnounts. Post adjusting entries, (Post entries in bhe ordar of joumalentinesposted above). Adjusting Adjusting Journalize closing entries and complete the closing process. (Credlit acwunt tibles are automatically indented when amount is entered. Do nat indent manually. Record journal entries in the order displayed in the problam.) Post closing entries. (Post entries in the order of jourmal entries posted above.) Qosing \begin{tabular}{|ccc|c|} \hline & Income Summary & & No. 350 \\ \hline Date Explanation & Debit & Credit & Balanca \end{tabular} Closing Cosing Prepare an income statement for the month of March (Enter negatue amounts using elther a negative sign preceding the number eg. Other data: 1. A pirysical pount reveals anly $500 of roofing supplies on hand. 2. Depreciation for March is $247. 3. Uiearnedrevenue amounted to $180 at March 32. 4. Accrued salaries are $600. Post the July transactions. (Post entries in the order of joumal entries posted above.) Post the July transactions. (Post entries in the order of Jourmal chowht posted above.) clestboak and Media Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected revenue for services performed at July 31 mera $2,000. (2) Depreciation on equipment for the month was $500. (3) One-twelfth of the insurance expired. (4) An inventory count shows $600 of cleaning supplies on hand at July 31 (5) Accrued but unpaid employee salaries were $1060 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Ovner's Capital Owner's Drawings Service Revenue Gasoline Expense Salaries and Wages Expense Totals Depreciation Expense Accum. Depr-Equipment Insurarre Expense Supplies Expense Salaries and Wages Payable Totals Net incame Totaks Prepare the income statement for July. (Enter ingatlme announts using eliker a negative sigm preceding the number eg. 45 or Prepare the owner's equity statement for July (Listitems that incease owner's equity first) Prepare a classified balance sheet at July 31 (Ust Cumment Assatis in ardar of liquiditith): WILDHORSE'S CLEANING SERVICE Balance Sheet Assets 3 Liabilities and Owner's Equity 3 Journalize adjusting entries. (Credlt ocount vities are aulomaticoly indented when arnomt is entered. Do not indent manually. If no enory is required, select "No Entry" for the account tites and entiar o for the arnounts. Post adjusting entries, (Post entries in bhe ordar of joumalentinesposted above). Adjusting Adjusting Journalize closing entries and complete the closing process. (Credlit acwunt tibles are automatically indented when amount is entered. Do nat indent manually. Record journal entries in the order displayed in the problam.) Post closing entries. (Post entries in the order of jourmal entries posted above.) Qosing \begin{tabular}{|ccc|c|} \hline & Income Summary & & No. 350 \\ \hline Date Explanation & Debit & Credit & Balanca \end{tabular} Closing Cosing Prepare an income statement for the month of March (Enter negatue amounts using elther a negative sign preceding the number eg. Other data: 1. A pirysical pount reveals anly $500 of roofing supplies on hand. 2. Depreciation for March is $247. 3. Uiearnedrevenue amounted to $180 at March 32. 4. Accrued salaries are $600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started