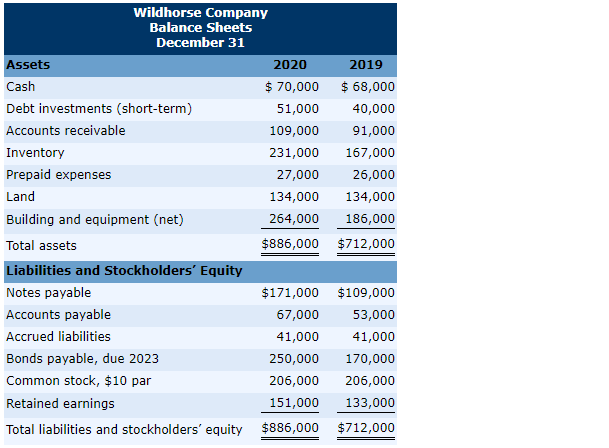

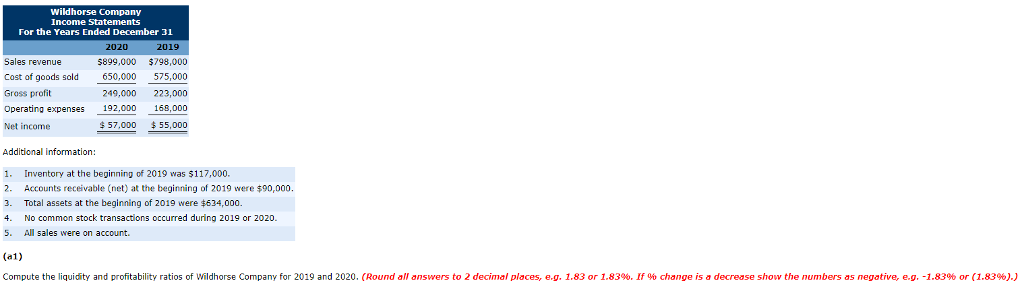

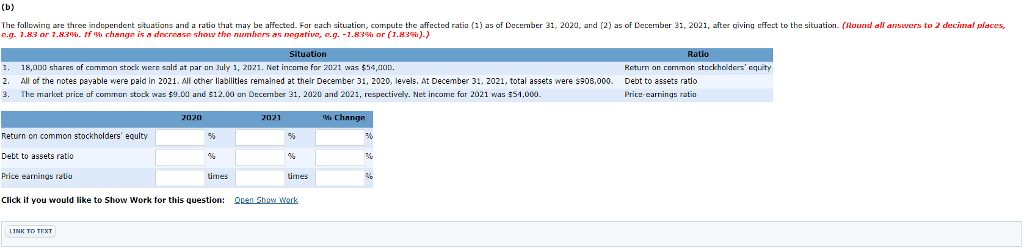

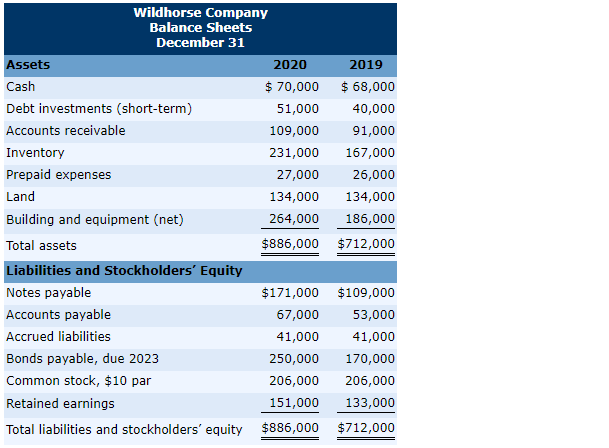

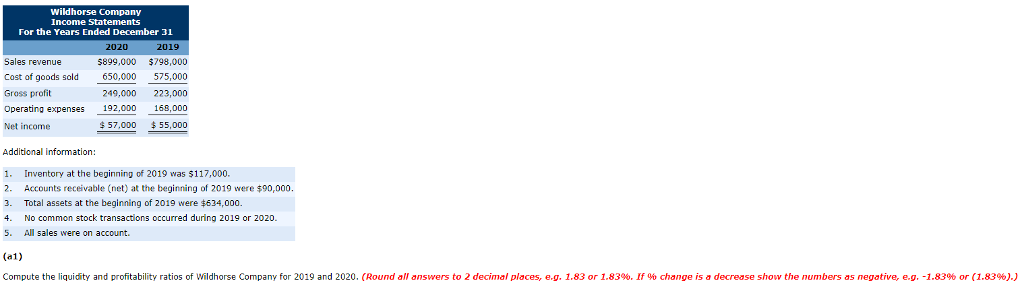

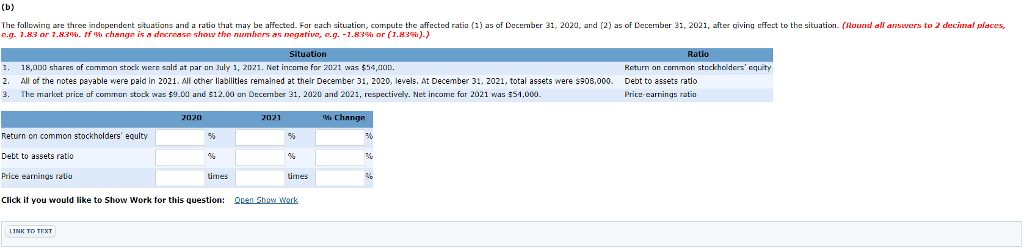

Wildhorse Company Balance Sheets December 31 Assets Cash Debt investments (short-term) Accounts receivable Inventory Prepaid expenses Land Building and equipment (net) Total assets 2020 2019 $70,000 68,000 40,000 91,000 231,000 167,000 26,000 134,000 134,000 264,000 186,000 $886,000 $712,000 51,000 109,000 27,000 $171,000 $109,000 53,000 41,000 250,000 170,000 206,000 206,000 151,000 133,000 Total liabilities and stockholders' equity $886,000 $712,000 abilities and Stockholders' Equity Notes payable Accounts payable Accrued liabilities Bonds payable, due 2023 Common stock, $10 par Retained earnings 67,000 41,000 Wildhorse Company Income StatementsS For the Years Ended December 31 2020 2019 Sales revenue Cost of goods sold Gross profit Operating expenses Net income $899,000 $798,000 575,000 650,000 249,000 223,000 192,000 57,000 55,000 168,000 Additional information: 1. Inventory at the beginning of 2019 was $117,000 2. Accounts receivable (net) at the beginning of 2019 were $90,000. 3. Total assets at the beginning of 2019 were $634,000. 4. No common stock transactions occurred during 2019 or 2020. 5. All sales were on account (a1) Compute the liqu dity and profitability ratios of Wildhorse Company for 2019 and 2020 Round all answers to 2 decemal places, eg. 1.83 or 1.83% If % change is a decrease show the numbers as negative, eg, 1.83% or 1.83% The following are hree ndependent situations and ratio hat may be affe ed far each situation, compute the affected ratio eg. 1.83 or 1 83%. If % change is a decrease show the namhers as negative, e.g.-1.83% or ( 1.83%).) 1 as of December 31, 2020 and 2) as of December 31, 2021, a er g 1ng e ect to the situation. Rourn ll nswers to 2 dec mal alaces 1. 18,0DD shares af comman stock were sald at par an July 1, 2021. Net income for 2121 was $54,op. 2. All ofthe notes payable were paid in 2021. All other liabilities remained at their December 31, 2020, levels. At December 31, 2021, total assets were s908,000. 3. The market price of common stock was $9.00 and $12.00 an Decenber 31, 2020 and 2021, respectively. Net income for 2021 was $51,000 Return on common stockholders cquity Debt to assets ratio Price-earnings r ratio Return on common stockholders equity Debt to assets ratio Price earnings ratio Click it you would like to Show Work for this question: times times