Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wildhorse Ltd. purchased land and constructed a service station, at a total cost of $468000. On January 2,2022 , when construction was completed, Wildhorse sold

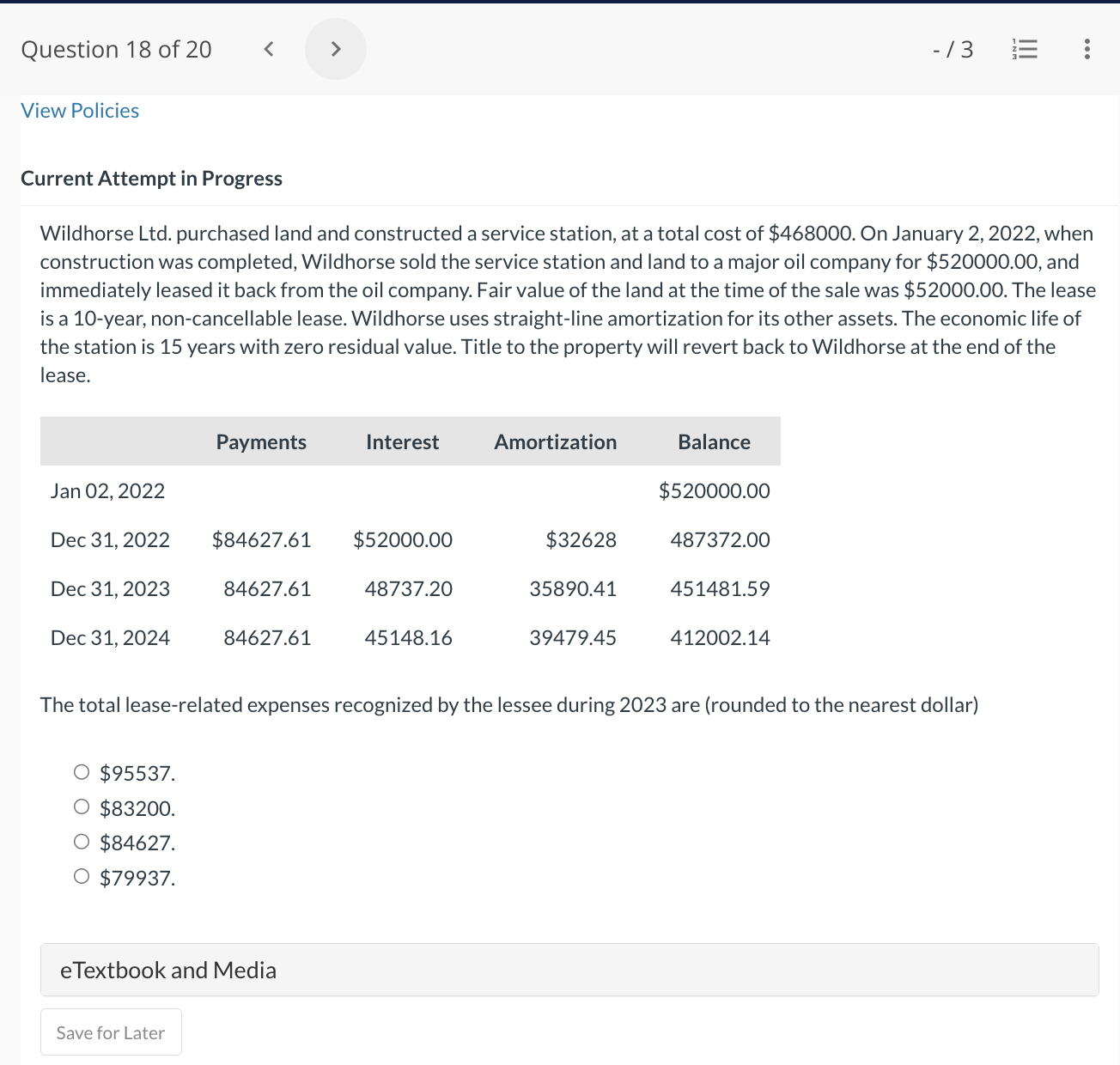

Wildhorse Ltd. purchased land and constructed a service station, at a total cost of $468000. On January 2,2022 , when construction was completed, Wildhorse sold the service station and land to a major oil company for $520000.00, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $52000.00. The lease is a 10-year, non-cancellable lease. Wildhorse uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Wildhorse at the end of the lease. The total lease-related expenses recognized by the lessee during 2023 are (rounded to the nearest dollar) $95537. $83200. $84627. $79937. eTextbook and Media

Wildhorse Ltd. purchased land and constructed a service station, at a total cost of $468000. On January 2,2022 , when construction was completed, Wildhorse sold the service station and land to a major oil company for $520000.00, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $52000.00. The lease is a 10-year, non-cancellable lease. Wildhorse uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Wildhorse at the end of the lease. The total lease-related expenses recognized by the lessee during 2023 are (rounded to the nearest dollar) $95537. $83200. $84627. $79937. eTextbook and Media Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started