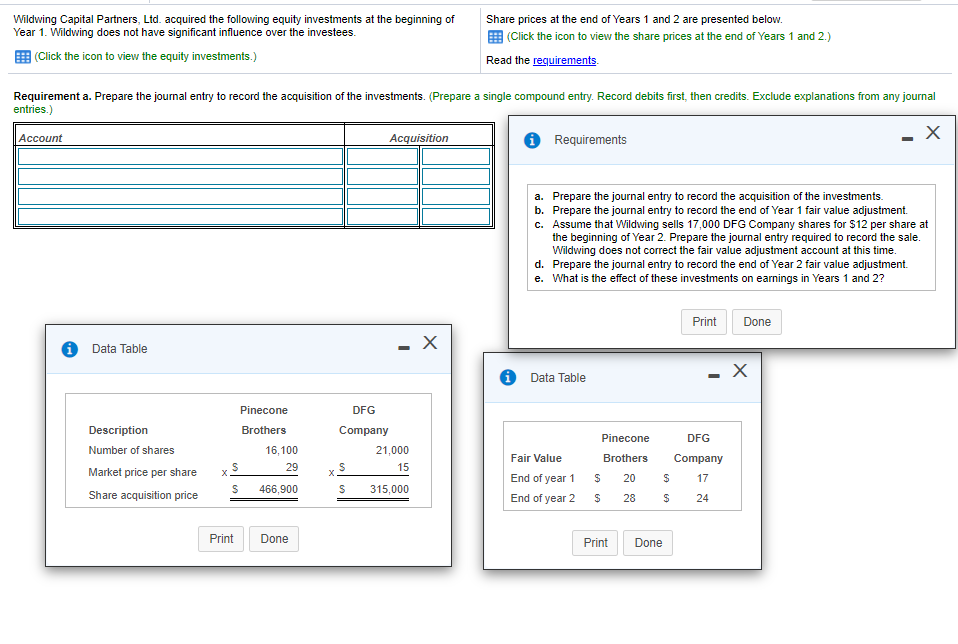

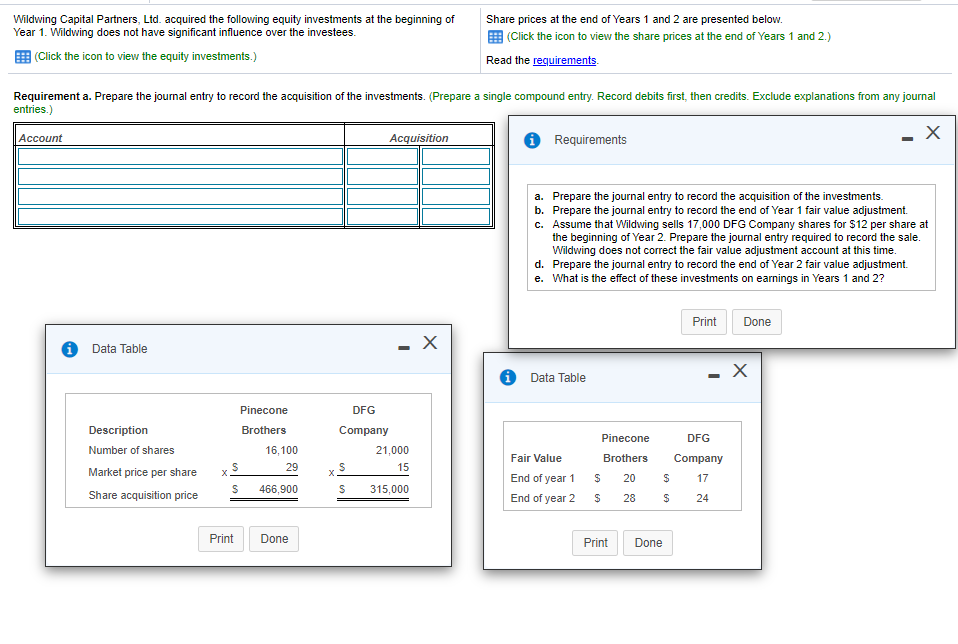

Wildwing Capital Partners, Ltd. acquired the following equity investments at the beginning of Year 1. Wildwing does not have significant influence over the investees. (Click the icon to view the equity investments.) Share prices at the end of Years 1 and 2 are presented below. (Click the icon to view the share prices at the end of Years 1 and 2.) Read the requirements Requirement a. Prepare the journal entry to record the acquisition of the investments. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) Acquisition Requirements x Account - a. Prepare the journal entry to record the acquisition of the investments. b. Prepare the journal entry to record the end of Year 1 fair value adjustment. c. Assume that Wildwing sells 17,000 DFG Company shares for $12 per share at the beginning of Year 2. Prepare the journal entry required to record the sale. Wildwing does not correct the fair value adjustment account at this time. d. Prepare the journal entry to record the end of Year 2 fair value adjustment. e. What is the effect of these investments on earnings in Years 1 and 2? Print Done i Data Table -X Data Table - X Pinecone Brothers Pinecone Description Number of shares Market price per share Share acquisition price 16,100 29 DFG Company 21,000 s 15 X s 315,000 DFG Company $ 17 Fair Value Brothers End of year 1 $ 20 End of year 2 $ 28 S $ 466,900 $ 24 Print Done Print Done Wildwing Capital Partners, Ltd. acquired the following equity investments at the beginning of Year 1. Wildwing does not have significant influence over the investees. (Click the icon to view the equity investments.) Share prices at the end of Years 1 and 2 are presented below. (Click the icon to view the share prices at the end of Years 1 and 2.) Read the requirements Requirement a. Prepare the journal entry to record the acquisition of the investments. (Prepare a single compound entry. Record debits first, then credits. Exclude explanations from any journal entries.) Acquisition Requirements x Account - a. Prepare the journal entry to record the acquisition of the investments. b. Prepare the journal entry to record the end of Year 1 fair value adjustment. c. Assume that Wildwing sells 17,000 DFG Company shares for $12 per share at the beginning of Year 2. Prepare the journal entry required to record the sale. Wildwing does not correct the fair value adjustment account at this time. d. Prepare the journal entry to record the end of Year 2 fair value adjustment. e. What is the effect of these investments on earnings in Years 1 and 2? Print Done i Data Table -X Data Table - X Pinecone Brothers Pinecone Description Number of shares Market price per share Share acquisition price 16,100 29 DFG Company 21,000 s 15 X s 315,000 DFG Company $ 17 Fair Value Brothers End of year 1 $ 20 End of year 2 $ 28 S $ 466,900 $ 24 Print Done Print Done