Question

Wiley 22 - If you're not able to answer each question. Please skip entirely. Thank you. 1) ____________________________________________________ 2) Barnes Company reports the following operating

Wiley 22 - If you're not able to answer each question. Please skip entirely. Thank you.

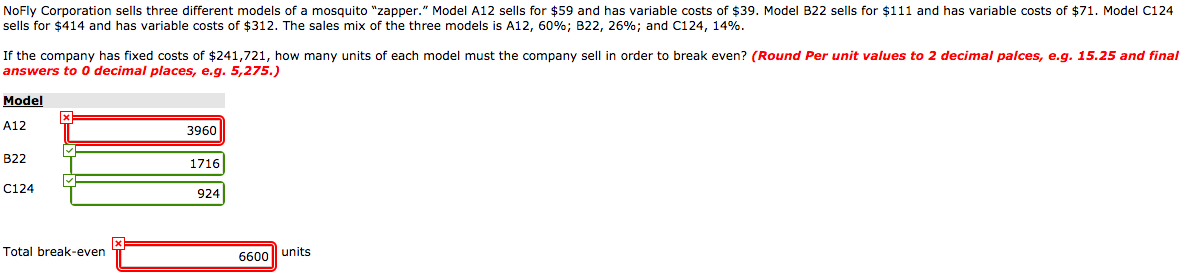

1)  ____________________________________________________

____________________________________________________

2) Barnes Company reports the following operating results for the month of August: sales $300,000 (units 5,000); variable costs $223,000; and fixed costs $70,800. Management is considering the following independent courses of action to increase net income. Compute the net income to be earned under each alternative.

_____________________________________________________________

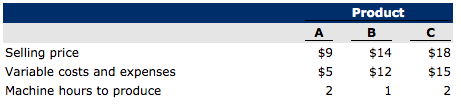

3) Mars Company manufactures and sells three products. Relevant per unit data concerning each product are given below.

_____________________________________________________________________________

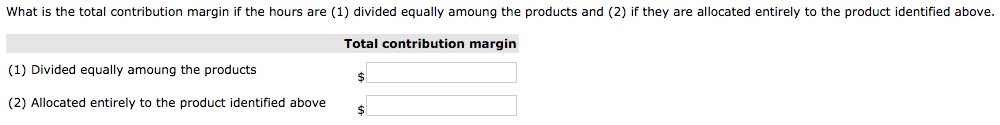

4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started